-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI ASIA OPEN - FOMC See Need to Enhance QE Guidance "Fairly Soon"

EXECUTIVE SUMMARY:

- FED MINUTES: SHOULD ENHANCE QE GUIDANCE FAIRLY SOON

- UK OBR FORECASTS UK ECONOMY SHRINKING 11.3% IN 2020

- CHINA TO PUSH CNY USE IN INDUSTRIAL RELOCATION

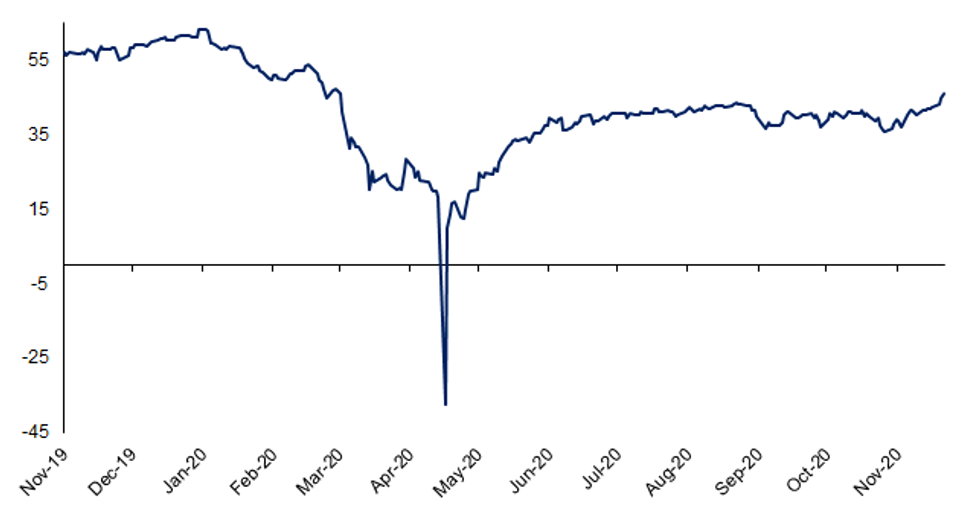

WTI crude futures hit new multi-month high

US:

FED: FOMC May Want To Enhance Guidance On QE 'Fairly Soon,' Minutes Say

Many Fed policymakers at the November FOMC meeting said they would want to enhance guidance on QE "fairly soon," with most favoring tying asset purchases to economic outcomes, the minutes of the meeting said Wednesday.

Would be appropriate to keep buying Treasuries and agency MBS "at least at the current pace" over "coming months."

- "Many participants judged that the Committee might want to enhance its guidance for asset purchases fairly soon."

- "Most participants favored moving to qualitative outcome-based guidance for asset purchases that links the horizon over which the Committee anticipates it would be conducting asset purchases to economic conditions."

- "A few participants were hesitant to make changes in the near term to the guidance for asset purchases and pointed to considerable uncertainty about the economic outlook and the appropriate use of balance sheet policies given that uncertainty."

- "the Committee could provide more accommodation, if appropriate, by increasing the pace of purchases or by shifting its Treasury purchases to those with a longer maturity without increasing the size of its purchases. Alternatively, the Committee could provide more accommodation, if appropriate, by conducting purchases of the same pace and composition over a longer horizon."

- Most officials said guidance "should imply that increases in the Committee's securities holdings would taper and cease sometime before the Committee would begin to raise the target range for the federal funds rate."

Fed's Main Street Ceasing Purchases In December (MNI)

The Boston Fed on Wednesday signaled it will not be able to process Main Street program loans in time submitted beyond mid-December.

The Main Street Lending Program, jointly run with the Treasury Department, will likely not be able to process loans submitted after Dec. 14 to meet the year-end termination of the program, according to the Boston Fed, which administers the program. Former Fed officials have told MNI the facility could be reopened and expanded if ex-Federal Reserve Chair Janet Yellen were to be confirmed as Treasury secretary.

Lenders not yet registered with Main Street should initiate registration on or before Dec. 4, the central bank said, and it will stop issuing commitment letters as of Dec. 23.

EUROZONE:

Italy's 5-Star May Approve EU's ESM Reform (MNI)

Italy's parliament is likely to finally vote to approve a long-delayed overhaul of the European Stability Mechanism in the next few weeks as the Five-Star Movement which has held it up drops its opposition, sources in the populist group and the Italian government told MNI.

Rule Of Law Fudge May End EU Budget Standoff (MNI)

The deadlock over the European Union's 2021-27 budget and Covid recovery programmes could potentially be broken by an addition to the agreement making clear that requirements for Poland and Hungary to uphold the rule of law in order to qualify for EU funds will only be enforced in extreme situations, an EU source told MNI.

Growing Risks Could Test Bank Resilience: ECB FSR (MNI)

Risks are building across the eurozone's corporate sector as the pandemic evolves which could test the resilience of regional banks in the future, the European Central Bank's latest Stability Review notes. The extensive policy measures are helping euro area corporates and households to cope with Covid-19 fallout, but risks can arise "either from a premature end to measures or from prolonged support," the report says.

UK:

UK Needs 1% Plus GDP Fiscal Consolidation: OBR (MNI)

The UK needs a fiscal consolidation of more than 1% of GDP just to match day-to-day receipts and spending, the Office for Budget Responsibility said in its detailed fiscal forecasts published Wednesday. The deficit this fiscal year is set to be 19% of GDP and the OBR said that while borrowing falls to 3.9% of GDP by 2025-26 "even on the loosest conventional definition of balancing the books, a fiscal adjustment of 27 billion ... (just over 1 per cent of GDP) would be required to match day-to-day spending to receipts by the end of the five-year forecast period."

The Office for Budget Responsibility forecasts UK GDP will fall by 11.3% in 2020 and rise 5.5% in 2021. UK borrowing will be 19% of GDP in the 2020/21 fiscal year, or GBP394 billion, decreasing to GBP164 bn in 2021-22, GBP105 bn in 2022-23 and then to hold steady at around GBP100 bn, or 4% of GDP. Underlying debt, which strips out the BOE purchases, is estimated at 91.9% of GDP this year. Chancellor Rishi Sunak is presenting the forecasts to parliament.

ASIA:

China To Push Yuan Use In Industrial Relocation (MNI)

China should prioritize the use of the yuan as its industries relocate to other countries and play an active role in adopting new global rules, an official from the People's Bank of China told the Caijing Annual Conference 2021 Wednesday.

DATA:

US OCT PERSONAL INCOME -0.7%; NOM PCE +0.5%

- OCT CORE PCE PRICE INDEX +0.0%; +1.4% Y/Y

US OCT NEW HOME SALES -0.3% TO 0.999M SAAR

US OCT ADVANCE INTL TRADE BALANCE -$80.3B VS SEP -$79.4B

US Q3 GDP +33.1%

US JOBLESS CLAIMS +30K TO 778K IN NOV 21 WK

- CONTINUING CLAIMS -0.299M TO 6.071M IN NOV 14 WK

US SEP DURABLE GDS NEW ORDERS REV TO +2.1%

FOREX: NOK on Top as Crude Rally Extends

The near 30% rally in crude oil prices across November continues to lend support to commodity-tied currencies, with NOK outperforming again Wednesday. This keeps USD/NOK on track to test the early September lows of 8.6570, which would be the lowest rate since mid-2019.

The greenback came under some fix-related selling pressure despite starting the US session well. This kept a lid on the greenback, which underperformed all others in G10.

Brexit negotiations clearly remain fractious, with no signs of a deal emerging as yet. Markets continue to price for a favourable outcome in the talks that continue this week, raising interest in a suggestion from the Irish PM, who suggested a deal could be agreed on a "staged" basis in an attempt to find common ground. GBP/USD, while stronger, failed to reach new weekly highs.

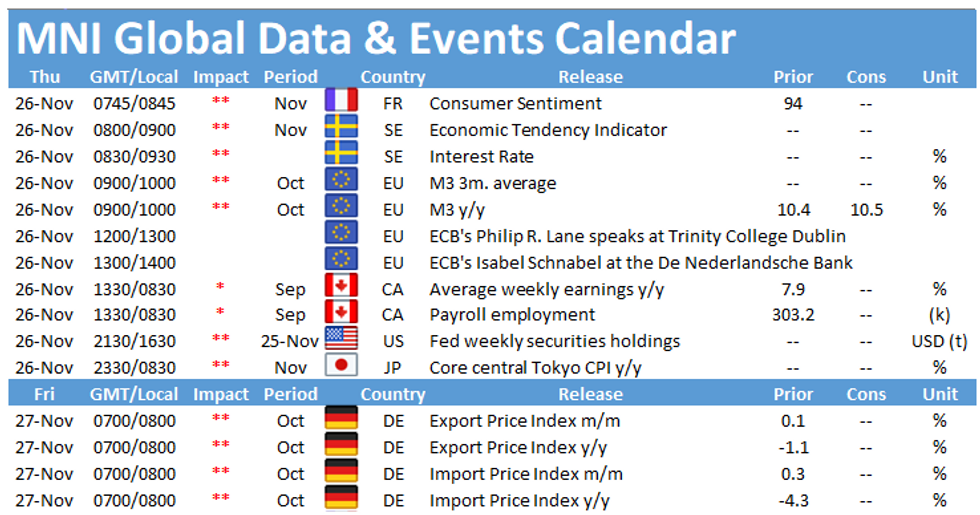

Tier one data releases are few and far between Thursday, with US markets close for the Thanksgiving holidays. ECB's Schnabel & Lane and BoC's Macklem & Wilkins are due to speak.

US TSYS SUMMARY: Strength Amid Mixed Data, Slightly Dovish Fed Minutes

A heavy pre-Thanksgiving data slate proved mixed, and did nothing to reverse steady strength in Treasuries throughout the session. FOMC Minutes gave enough of a taste of potential action at forthcoming meetings (at least on guidance) to nudge the curve flatter ahead of the holiday.

- Curve trading mixed: 2-Yr yield is down 0.2bps at 0.1583%, 5-Yr is down 1.3bps at 0.3829%, 10-Yr is down 1.6bps at 0.8635%, and 30-Yr is down 0.9bps at 1.596%.

- Dec 10-Yr futures (TY) up 4/32 at 138-12 (L: 138-04 / H: 138-15)

- Tsys ticked higher after the 0830ET release of jobless claims (weak) and durable goods (strong), then again to session highs after personal income (mixed) and home sales (strong) data released at 1000ET.

- FOMC November minutes were initially digested bullish for Tsys, with some discussion of asset purchases pointing toward outcome-based guidance on asset purchases favored by participants, with guidance coming "fairly soon" enough to help reverse earlier curve steepening though only slightly.

- Overall though it was the steady weakness in equities (from Tue's jump), not the data, that Tsys most closely tracked. The next set of data is not until next week (starting with MNI Chicago PMI).

- Thursday sees a bond market holiday, with Friday a half-day.

EGBs-GILTS CASH CLOSE: UK Linkers And BTPs Make Moves

Bunds and Gilts opened Wednesday on the back foot following Tuesday's surge in risk appetite but yields fell over the session and finished not far from the lows.

- The morning's move to new record lows for Italian 10-Yr yields faded over the day however, with BTP spreads ultimately widening. The afternoon's big move was in Gilt linkers which rallied sharply following the announcement that the UK RPI review would not come into effect until 2030.

- In contrast w the US holiday, a reasonably active Thursday in Europe ahead: data including French and German consumer confidence, with the Swedish Riksbank decision eyed. ECB's Lane and Schnabel speak, while the October ECB meeting's accounts are published. No issuance though.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 0.7bps at -0.75%, 5-Yr is down 1bps at -0.755%, 10-Yr is down 0.5bps at -0.568%, and 30-Yr is down 0.7bps at -0.156%.

- UK: The 2-Yr yield is down 0.7bps at -0.025%, 5-Yr is down 0.9bps at 0.015%, 10-Yr is down 1.2bps at 0.318%, and 30-Yr is down 2bps at 0.881%.

- Italian BTP spread up 0.8bps at 118.3bps

- Spanish bond spread unchanged at 63.7bps

- Portuguese PGB spread down 0.7bps at 58.9bps

- Greek bond spread up 2.2bps at 125.5bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.