-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - RBA Holds, Communication Turns Slightly Dovish

MNI China Daily Summary: Tuesday, December 10

MNI ASIA OPEN: Fund Managers Buying Bonds/Cover Shorts

- MNI BOC WATCH: Another Hawkish Hold Seen As Economy Slows

- MNI DATA: Chicago Fed National Activity Surprisingly Firmed In September

US TSYS 10Y Yields Reject 5% High, Fund Managers Buy Bonds

- Unwinding weekend short hedges centered on Israel-Hamas and BoJ sources triggered cheapening in Asia hours after 10Y yield climbed above 5% for the first time since Sep'07 earlier to 5.0187% high.

- Early block buy of +8,237 TYZ3 105-23 (buy through 105-22 post-time offer at 0839:08ET, DV01 $536,000) contributed to the early support followed by the long end after Pershing Square fund manager/CEO Bill Ackman tweeted he had covered shorts in Tsys in light of "too much risk in the world to remain short."

- Reuters reported asset manager Vanguard is bullish on longer-dated Treasuries after this year's brutal selloff, betting that the Federal Reserve is at the end of its rate hiking cycle and that the economy will slow next year.

- Short end SOFR futures remained weak (SFRU3-SFRM4 down 0.0025-0.020) despite Bill Gross announced buying of SOFR futures amid "INDICATIONS THAT US ECONOMY IS SLOWING SIGNIFICANTLY" Bbg.

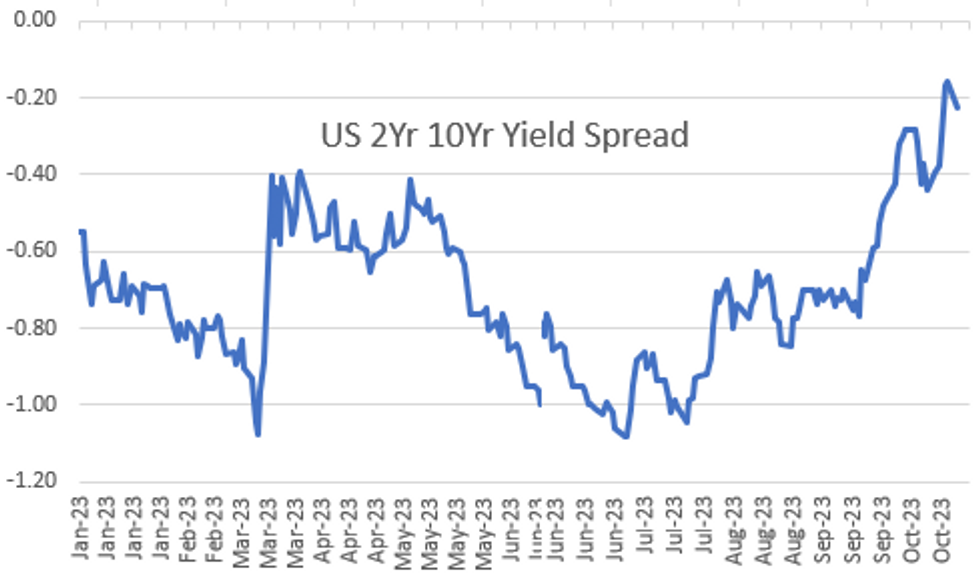

- As a result, Treasury yield curves rejected mid-2022 highs, finished the session broadly flatter: 3M10Y -5.840 at -61.602 vs. -45.127 high, 2Y10Y -5.282 at -21.655 vs. -11.024 high.

- Projected rate hikes remained static into early 2024: November holding at 1.6%, w/ implied rate change of +.4bp to 5.333%, December cumulative of 5.7bp at 5.386%, January 2024 cumulative 9.4bp at 5.423%, while March 2024 slips to 5.3bp at 5.381%. Fed terminal at 5.438% in Jan'24. Fed terminal at 5.425% in Feb'24.

CANADA

BOC: Bank of Canada Governor Tiff Macklem is widely expected to hold the country's lending rate for a second meeting Wednesday, judging the highest rate since 2001 is finally putting the brakes on an overheated economy while likely warning the BOC could still tighten further if inflation appears stuck above target.

- Nineteen of 20 economists surveyed by MNI say the target rate will remain 5% in the decision at 10am EST, with a handful closing bets on a hike after last week's CPI report showed price gains slowing to 3.8%. In other signs of softening activity, second-quarter GDP slipped 0.2% and unemployment has risen in recent months as record immigration boosts labor supply.

- BOC officials, like their global counterparts, will likely keep hawkish language in their statement Wednesday even amid a rise in global bond yields, which help the inflation fight for now but could easily turn the other way if bondholders return to their earlier pattern of aggressively betting on cuts. Macklem told reporters at IMF meetings earlier this month higher yields are no substitute for any needed policy action, and suggested the Middle East conflict so far was more a source of volatility rather than something throwing Canada's economy off track. For more see MNI Policy main wire at 0947ET.

OVERNIGHT DATA

- The Chicago Fed national activity index increased by more than the median response from the admittedly small sample of analysts in September, at +0.02 (cons -0.14), but after a downward revised -0.22 (initial -0.16).

- The monthly movements remain relatively limited by standards of recent years.

- From the press release: “All four broad categories of indicators used to construct the index increased from August, and two categories made positive contributions in September.”

- Contributions: Production-related indicators contributed +0.03 from -0.10; sales, orders, and inventories -0.01 from -0.06; employment-related indicators +0.01 up slightly from neutral, and personal consumption and housing -0.01 from -0.06.

MARKETS SNAPSHOT

- Key late session market levels

- DJIA down 125.93 points (-0.38%) at 33003.08

- S&P E-Mini Future up 2.5 points (0.06%) at 4252

- Nasdaq up 76.6 points (0.6%) at 13061.52

- US 10-Yr yield is down 6.6 bps at 4.8481%

- US Dec 10-Yr futures are up 12/32 at 106-12

- EURUSD up 0.0071 (0.67%) at 1.0665

- USDJPY down 0.26 (-0.17%) at 149.6

- WTI Crude Oil (front-month) down $2.14 (-2.43%) at $85.91

- Gold is down $7.95 (-0.4%) at $1973.58

- Prior European bourses closing levels:

- EuroStoxx 50 up 17.07 points (0.42%) at 4041.75

- FTSE 100 down 27.31 points (-0.37%) at 7374.83

- German DAX up 2.25 points (0.02%) at 14800.72

- French CAC 40 up 34.25 points (0.5%) at 6850.47

US TREASURY FUTURES CLOSE

- 3M10Y -6.475, -62.237 (L: -64.14 / H: -45.127)

- 2Y10Y -6.131, -22.504 (L: -24.625 / H: -11.024)

- 2Y30Y -7.177, -7.362 (L: -11.042 / H: 4.82)

- 5Y30Y -2.007, 19.372 (L: 16.37 / H: 23.691)

- Current futures levels:

- Dec 2-Yr futures up 0.75/32 at 101-9.25 (L: 101-05.375 / H: 101-10.125)

- Dec 5-Yr futures up 6.5/32 at 104-17.75 (L: 104-00.5 / H: 104-20)

- Dec 10-Yr futures up 12/32 at 106-12 (L: 105-12.5 / H: 106-16)

- Dec 30-Yr futures up 1-10/32 at 109-25 (L: 107-04 / H: 110-08)

- Dec Ultra futures up 1-20/32 at 112-24 (L: 109-15 / H: 113-14)

US 10Y FUTURE TECHS: (Z3) Trades Just Above Recent Lows

- RES 4: 109-20 High Sep 19

- RES 3: 108-23 50-day EMA

- RES 2: 107-08/108-16 20-day EMA / High Oct 12

- RES 1: 106-15+ High Oct 18

- PRICE: 106-09 @ 17:00 BST Oct 23

- SUP 1: 105-10+ Low Oct 19

- SUP 2: 104-25 2.0% 10-dma envelope

- SUP 3: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 4: 104-17+ Low Jul’07

Treasuries came under initial pressure Monday, before a corrective rally spared markets from testing the Oct 19 low at 105-10+. The trend condition remains bearish. Last week’s move lower resulted in a break of key support at 106-03+, the Oct 4 low, confirming a resumption of the downtrend. The move down has exposed the 2.0% 10-dma envelope support of 104-25. Key short-term trend resistance has been defined at 108-16, Oct 12 high. Initial firm resistance is at 107-08, the 20-day EMA.

SOFR FUTURES CLOSE

- Dec 23 -0.015 at 94.560

- Mar 24 -0.025 at 94.640

- Jun 24 -0.015 at 94.860

- Sep 24 +0.020 at 95.140

- Red Pack (Dec 24-Sep 25) +0.045 to +0.080

- Green Pack (Dec 25-Sep 26) +0.085 to +0.095

- Blue Pack (Dec 26-Sep 27) +0.085 to +0.090

- Gold Pack (Dec 27-Sep 28) +0.085 to +0.085

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00721 to 5.32444 (-0.00368 total last wk)

- 3M -0.02025 to 5.37822 (-0.00436 total last wk)

- 6M -0.03039 to 5.43909 (+0.00540 total last wk)

- 12M -0.05824 to 5.38011 (+0.02130 total last wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $87B

- Daily Overnight Bank Funding Rate: 5.32% volume: $229B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.396T

- Broad General Collateral Rate (BGCR): 5.30%, $560B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $548B

- (rate, volume levels reflect prior session)

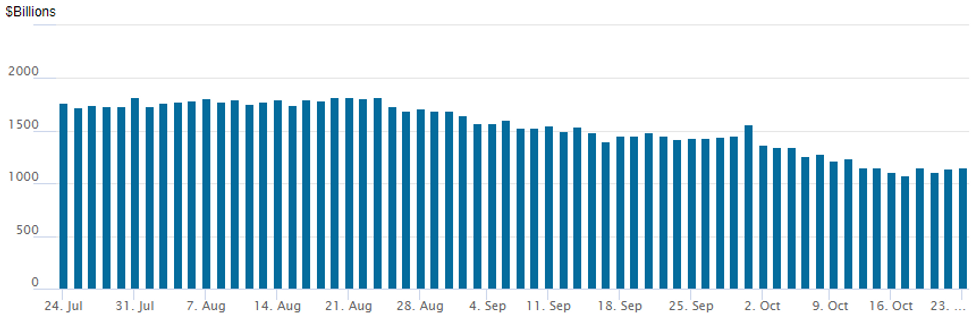

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage climbs to $1,157.976B w/101 counterparties vs. $1,138.756B in the prior session. Compares to last Tuesday's $1,082.399B - the lowest level since mid-September 2021. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $800M Genuine Parts 2Pt Priced

After total $33.25B high-grade corporate debt priced last week, US$ issuance relatively quiet this morning as pending Q4 earnings releases keeps many sidelined.

- Date $MM Issuer (Priced *, Launch #)

- 10/23 $800M *Genuine Parts $425M 5Y +180, $375M 10Y +210

- Expected to issue Tuesday:

- 10/24 $1.5B Borr Drilling 5NC2, 7NC3

- 10/24 $Benchmark IDA 5Y SOFR+45a

EGBs-GILTS CASH CLOSE: BTPs Outperform As Core FI Reverses Higher

An early sell-off Monday fully had reversed by the cash close, with Bunds and Gilts benefiting from a bid in US Treasuries.

- Bunds underperformed Gilts, though an early German bear steepening flipped to flattening as the USD weakened and equities rose alongside a broader move lower in rates. Gilts leaned bull flatter overall (2s30s flatter, 2s10s a little steeper on the day).

- It was difficult to pinpoint a specific reason for the reversals, which accelerated after high-profile market participants (incl Bill Ackman and Bill Gross) expressed the view that the recent US yield rise had gone far enough.

- We note though that our Europe Pi positioning update today showed significant structural shorts across Eurex contracts, with the trade potentially getting overcrowded as yields pushed to fresh multi-year highs.

- BTPs outperformed, with 10Y spreads down 7bp after S&P affirmed the sovereign at BBB; Outlook Stable; Greek spreads were close behind, after attaining investment grade status at S&P Friday.

- Focus Tuesday is on flash October PMIs, with the ECB decision Thursday the clear focus for the week - MNI's preview went out today. The UK's ONS publishes new labour market data Tuesday morning (though won't publish the Jun-Aug LFS data).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.2bps at 3.134%, 5-Yr is down 0.3bps at 2.78%, 10-Yr is down 1.5bps at 2.874%, and 30-Yr is down 2.6bps at 3.068%.

- UK: The 2-Yr yield is down 5.7bps at 4.832%, 5-Yr is down 5.7bps at 4.579%, 10-Yr is down 5.2bps at 4.599%, and 30-Yr is down 6.2bps at 5.049%.

- Italian BTP spread down 7bps at 196.6bps / Greek down 6.6bps at 141.8bps

FOREX Greenback Slides Amid Yields Reversal, EURUSD Back Above 1.0650

- The USD index has dropped over half a percent on Monday with single currency outperformance most notable across G10, prompting EURUSD to rise above 1.0650, fresh one-month highs for the pair. The moves come alongside a strong recovery for US treasuries, with specific outperformance noted in the long-end, and a firm bounce for major equity indices.

- EURUSD has been on a steady grind higher and following the breach of the mid-October highs, the pair is now inching its way above 1.0650 in recent trade. This is considered a bullish development and a confirmed break above the Oct 12 high is required to signal scope for a stronger correction. In the short-term, this places the focus on the 50-day EMA which intersects today at 1.0677, however, further out, 1.0737 and 1.0769 are levels of note.

- In similar vein, the likes of GBP, AUD and NZD are all moving higher in sympathy with the lower yields, while the Swiss franc, Chinese Yuan and Canadian dollar all underperform.

- The lower core yields have placed the JPY moderately on the front foot, with USDJPY once again unable to make any inroads above the 150.00 mark and slowly edging away from that level throughout US trade.

- On Tuesday, we get the October round of flash European PMIs. For the Eurozone, the September composite print saw a small uptick from August but remained in contractionary territory at 47.2. Additionally, the UK’s ONS says it will publish a new series of labour market data using additional sources to produce adjusted levels and rates for employment, unemployment and inactivity.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/10/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 24/10/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 24/10/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 24/10/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 24/10/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 24/10/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 24/10/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 24/10/2023 | 0800/1000 |  | EU | ECB Bank Lending Survey (Q3 2023) | |

| 24/10/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 24/10/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 24/10/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 24/10/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/10/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/10/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/10/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 24/10/2023 | 0900/0500 | * |  | US | Business Inventories |

| 24/10/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 24/10/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 24/10/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 24/10/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/10/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/10/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 24/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 24/10/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.