-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Global Financial Stability Concern Abounds

EXECUTIVE SUMMARY

US

FED: The Federal Reserve might need to raise interest rates even more than it indicated at its September meeting because inflation pressures coming from an overheating economy are likely to prove stubborn, former IMF chief economist Olivier Blanchard told MNI.

- The FOMC projected rates rising to a median 4.6% next year in its latest Summary of Economic Projections as inflation remains stuck near 40-year highs.

- “There’s a very good chance that they have to do more than they have said, that we see rates go up maybe to 5% or more,” Blanchard, a senior fellow at the Peterson Institute for International Economics, said in the latest episode of MNI’s FedSpeak podcast. For more see MNI Policy main wire at 1433ET

FED: The Federal Reserve's current interest rate setting is not yet restrictive and will need to continue to move up so that real interest rates move into positive territory and then remain there for some time, Cleveland President Loretta Mester said Tuesday.

- "Despite some moderation on the demand side of the economy and nascent signs of improvement in supply side conditions, there has been no progress on inflation," she said at an Economic Club of New York luncheon. "The month-to-month changes in the inflation measures have shown no real decline, so we cannot even say inflation has peaked yet, let alone that it is on a sustainable downward path to 2 percent."

IMF: The global economy will feel like a recession in many nations next year as growth slows and inflation remains elevated, with central banks required to raise interest rates while governments must largely stand back to avoid adding to price pressures, the IMF said Tuesday.

- "More than a third of the global economy will contract this year or next, while the three largest economies—the United States, the European Union, and China—will continue to stall. In short, the worst is yet to come, and for many people 2023 will feel like a recession," the fund's Economic Counsellor Pierre-Olivier Gourinchas wrote in an updated World Economic Outlook.

- The global 2023 inflation forecast of 6.5% is up 0.8pp from the Fund's July estimate and 1.7pp from its April projection. For more see MNI Policy main wire at 0905ET

EUROPE

G7: The communique following this week’s meeting in Washington of G7 finance ministers and central bank governors is likely to repeat a long-standing commitment to market-determined exchange rates, European Union and UK officials told MNI.

- While one of the EU officials said there was a chance the U.S. could be persuaded to add an expression of concern over dollar strength, he stressed that this, if it were to be included, would fall short of a signal of intervention, for which there is little support in the G7, including in Brussels.

- However the official noted the restrained U.S. reaction to recent yen-buying by the Bank of Japan, which while falling short of an endorsement stressed that Washington understood the reasons for the move aimed at reducing heightened exchange rate volatility. For more see MNI Policy main wire at 1034ET

BOE Bailey Doubles Down On Pension Fund Ultimatum

- Speaking in Washington, BOE Governor Bailey says the message to pension funds is that "you've got three days left" reinforcing that the current intervention in markets is temporary and that "we will be out" by the end of the week.

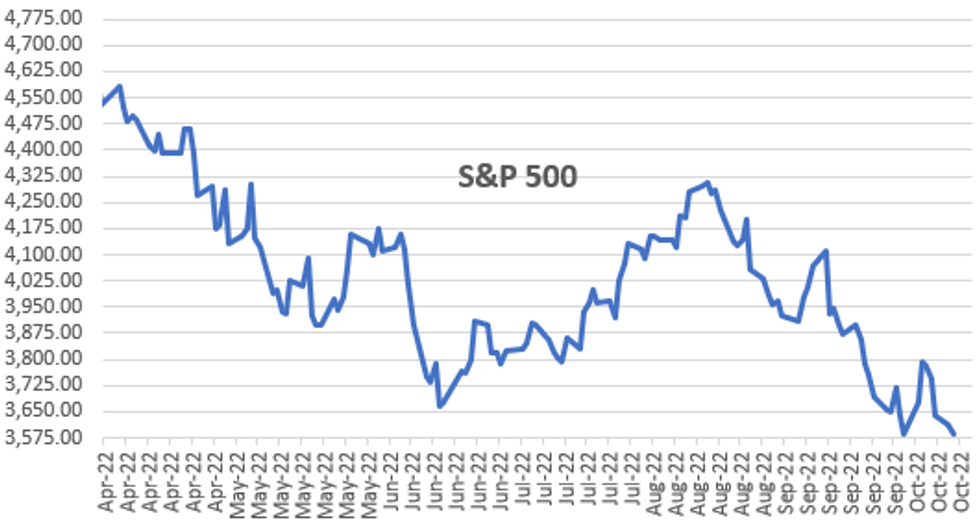

- It confirms what the Bank has already said in market notices both today and yesterday but goes against apparent market hopes of further intervention with risk assets selling off on the back of it - S&P e-mini fall 1% on the headlines to back at levels as the US first came in this morning and USD firms on the flip side.

- Other Bloomberg headlines

- *BOE'S BAILEY: LEVERAGE IN NON-BANK WORLD A `SLIPPERY' CONCEPT

- *BOE'S BAILEY: STRUCTURAL ISSUE PREVENTED TARGETED INTERVENTION

- *BOE'S BAILEY: SERIOUS RISK TO FINANCIAL STABILITY IN UK

US TSYS: BOE Bailey Busts Rally

Tsys pared gains along with equities in late Tuesday trade after BoE Gov Bailey, speaking in DC, warned of "serious risk to financial stability in the UK".

- Bailey also doubled down on message to pension funds is that "you've got three days left" reinforcing that the current intervention in markets is temporary and that "we will be out" by the end of the week.

- Other market watchers suggested the late reversal is do to factors outside the gilt market than actually from the market participants this is directly impacting based on the day's low take-up in purchase operations.

- Tsys had rallied overnight after the BoE Linkers will now be eligible in the daily gilt purchase operations for the remainder of this week: up to GBP5bln linkers will be eligible for purchase (14:15-14:45BST) and GBP5bln of long conventional (15:15-15:45BST - an hour later than previous operations). Corporate bonds sales scheduled for today and tomorrow "will not take place".

- Focus turns to Wednesday's Sep FOMC minutes release at 1400ET, CPI Thursday at 0830ET.

- Currently, the 2-Yr yield is down 0.4bps at 4.3037%, 5-Yr is up 1.1bps at 4.1528%, 10-Yr is up 4.3bps at 3.9245%, and 30-Yr is up 5.3bps at 3.8943%.

OVERNIGHT DATA

- US REDBOOK: OCT STORE SALES +8.3% V YR AGO MO

- US REDBOOK: STORE SALES +8.3% WK ENDED OCT 08 V YR AGO WK

- NFIB Small Business Optimism reported 92.1

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 48.22 points (0.17%) at 29251.98

- S&P E-Mini Future down 25.25 points (-0.7%) at 3600.5

- Nasdaq down 126 points (-1.2%) at 10415.79

- US 10-Yr yield is up 4.3 bps at 3.9245%

- US Dec 10Y are up 7/32 at 111-7.5

- EURUSD up 0.0008 (0.08%) at 0.971

- USDJPY up 0.11 (0.08%) at 145.83

- WTI Crude Oil (front-month) down $2.66 (-2.92%) at $88.47

- Gold is down $2.05 (-0.12%) at $1666.53

- EuroStoxx 50 down 16.53 points (-0.49%) at 3340.35

- FTSE 100 down 74.08 points (-1.06%) at 6885.23

- German DAX down 52.69 points (-0.43%) at 12220.25

- French CAC 40 down 7.35 points (-0.13%) at 5833.2

US TSY FUTURES CLOSE

- 3M10Y -1.121, 49.005 (L: 41.266 / H: 59.086)

- 2Y10Y +5.138, -38.131 (L: -41.355 / H: -33.403)

- 2Y30Y +5.986, -41.255 (L: -47.241 / H: -34.368)

- 5Y30Y +4.307, -26.104 (L: -33.223 / H: -21.537)

- Current futures levels:

- Dec 2Y up 1.875/32 at 102-17 (L: 102-13.75 / H: 102-19.25)

- Dec 5Y up 4/32 at 106-31.5 (L: 106-20.75 / H: 107-08.5)

- Dec 10Y up 6.5/32 at 111-7 (L: 110-21.5 / H: 111-22)

- Dec 30Y up 17/32 at 124-22 (L: 123-23 / H: 125-16)

- Dec Ultra 30Y up 29/32 at 133-26 (L: 132-12 / H: 134-26)

US 10Y FUTURE TECHS: (Z2) Short-Term Gains Considered Corrective

- RES 4: 116-11 50.0% retracement of the Aug 2 - Sep 28 bear leg

- RES 3: 115-04 50-day EMA

- RES 2: 114-31+ 38.2% retracement of the Aug 2 - Sep 28 bear leg

- RES 1: 113-04/30 20-day EMA / High Oct 4 and the bull trigger

- PRICE: 111-16+ @ 19:24 BST Oct 11

- SUP 1: 110-19 Low Sep 28 and the bear trigger

- SUP 2: 110-00 Psychological Support

- SUP 3: 109-23+ Low Nov 30 2007 (cont)

- SUP 4: 108.27+ 3.0% 10-dma envelope

Treasuries remain soft but have found some support today. Short-term gains are considered corrective. The reversal last week from 113-30, Oct 4 high, marks the end of the Sep 28 - Oct 4 correction. MA studies remain in a bear mode position and attention is on the key support and bear trigger at 110-19, Sep 28 low. A break would confirm a resumption of the primary downtrend. Price needs to break above 113-30 to reinstate a short-term bullish theme.

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.005 at 95.135

- Mar 23 +0.030 at 95.080

- Jun 23 +0.050 at 95.130

- Sep 23 +0.065 at 95.250

- Red Pack (Dec 23-Sep 24) +0.015 to +0.060

- Green Pack (Dec 24-Sep 25) steadysteady0 to +0.010

- Blue Pack (Dec 25-Sep 26) +0.020 to +0.040

- Gold Pack (Dec 26-Sep 27) +0.045 to +0.050

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00686 to 3.05943% (-0.00686/wk)

- 1M +0.02886 to 3.34557% (+0.03200/wk)

- 3M +0.02157 to 3.94071% (+0.03200/wk) * / **

- 6M +0.02586 to 4.45329% (+0.06858/wk)

- 12M +0.04843 to 5.09843% (+0.10214/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.94071% on 10/11/22

- Daily Effective Fed Funds Rate: 3.08% volume: $113B

- Daily Overnight Bank Funding Rate: 3.07% volume: $282B

- Secured Overnight Financing Rate (SOFR): 3.05%, $968B

- Broad General Collateral Rate (BGCR): 3.00%, $394B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $371B

- (rate, volume levels reflect prior session)

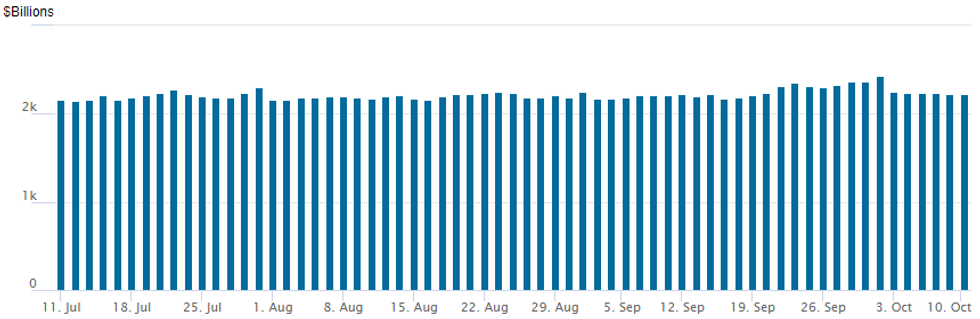

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,222.479B w/ 100 counterparties vs. $2,226.950B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE

Incoming corporate bond issuance should remain muted as Q3 equity earnings kicks off with PepsiCo (PEP) tomorrow before the open, Walgreens Boots (WBA), Dominos (DPZ), Progressive (PGR), Delta (DAL) and Blackrock (BLK) early Wednesday.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/10/2022 | 2350/0850 | * |  | JP | Machinery orders |

| 11/10/2022 | 0000/2000 |  | KR | Bank of Korea policy decision | |

| 12/10/2022 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 12/10/2022 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 12/10/2022 | 0600/0700 | ** |  | UK | Trade Balance |

| 12/10/2022 | 0600/0700 | *** |  | UK | Index of Production |

| 12/10/2022 | 0600/0700 | ** |  | UK | Index of Services |

| 12/10/2022 | 0800/0900 |  | UK | BOE Haskel Keynote Speech at The Productivity Institute | |

| 12/10/2022 | 0900/1100 | ** |  | EU | Industrial Production |

| 12/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 12/10/2022 | 0930/1030 |  | UK | BOE FPC Sept 30 meet minutes | |

| 12/10/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 12/10/2022 | 1135/1235 |  | UK | BOE Pill in Conversation with SCDI | |

| 12/10/2022 | - |  | EU | ECB Lagarde & Panetta IMF/World Bank Annual Meetings | |

| 12/10/2022 | 1230/0830 | *** |  | US | PPI |

| 12/10/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/10/2022 | 1330/1530 |  | EU | ECB Lagarde in Conversation with Tim Adams (IIF) | |

| 12/10/2022 | 1400/1000 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/10/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/10/2022 | 1700/1800 |  | UK | BOE Mann Canadian Association for Economics Webinar | |

| 12/10/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/10/2022 | 1745/1345 |  | US | Fed Vice Chair Michael Barr | |

| 12/10/2022 | 2230/1830 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.