-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA OPEN: Hawkish Pause, Stocks Rally

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed Set For Hawkish Pause On Turmoil-English

- MNI INTERVIEW: Fed Pause Would Undermine Credibility - Plosser

- MNI: Treasury's Yellen - Banking System Sound Despite Turmoil

- MNI POLICY: ECB Dissenters Looked For Hold, Not Smaller Hike

- MNI BRIEF: ECB Hikes 50Bps, But Says Uncertainty Now Elevated

- MNI BRIEF: More Ground To Cover If Uncertainty Eases-Lagarde

- MNI INTERVIEW: No Fast BOE Cuts If Inflation Slides-OBR's Miles

US TSYS: Risk-On Gains Momentum

- Front month Treasury futures remain under pressure after the bell, near session lows as risk-on sentiment tied to a $30B rescue package for First Republic Bank from 11 banks helped equity index futures climbed to highs for the week (ESM3 at 3997.25, nearing firm resistance of 4031.46, 50-day EMA.

- Front month Treasury futures has 30Y Bonds down 105 at 130-17 (30Y yield 3.7065%), 10Y notes -27 at 114-09 (10Y yield 3.5733%) above initial support of 113-08.5 (March 15 low).

- As a result of the tone change in risk, short end rates are gradually unwinding the week's rate-cut (25bp) expectations from July out to November now, while the May Fed terminal rate has climbed to 4.915%.

- Focus turns to Friday's data with Industrial Production, Capacity Utilization, Leading Index and University of Michigan Sentiment on tap.

- US Tsys have rescheduled today's $60B 4W, $50B 8W bill auctions to 1000ET Friday after technical difficulties prevented today's sale at 1130ET.

US

FED: The Federal Reserve is most likely to take a break in its interest rate increases at its March meeting because of the turmoil in global financial markets that has resulted from troubles at U.S. regional banks and worries about Credit Suisse, William English, a former director of the Fed's division of monetary affairs, told MNI.

- "Things are moving very quickly and we could all feel better by the middle of next week," he said. "But particularly with the spill over to Europe yesterday and the problems with Credit Suisse, it seems like we're going to be in an uncertain period for a while and given that I would have thought the Committee would likely choose to take no action and emphasize it's going to wait and see."

- The ECB's 50 basis point rate hike does give the Fed some room to raise rates by 25 basis points next week if it wants but even if policymakers opt to do so, they will reveal a cautious, wait-and-see posture to future rate increases.

- It gives them "a little bit of scope to tighten without feeling like they're doing something that would have bigger effects than they like," he said, still leaning in the direction of a pause next Wednesday to assess the situation and gather more information. For more see MNMI Policy main wire at 1408ET.

FED: The Federal Reserve would risk undermining its inflation-fighting credibility and raising doubts about the effectiveness of its latest banking sector intervention if it paused interest rate hikes this month while inflation is still far too high, former Philadelphia Fed President Charles Plosser told MNI.

- The Fed has repeatedly stated it could separate financial stability measures from interest rate policy and a rate pause would suggest the Fed lacks confidence in its own new lending facility aimed at helping alleviate pressures on the banking sector.

- “Given the distinction they make between financial stability policy and monetary policy, I think it would be a mistake to send a signal to actually not do anything in March,” Plosser said in an interview. “That would immediately transmit to the markets that the Fed can be swayed from fighting inflation at the drop of a hat and that would be a very dangerous thing to do because it would undermine their own commitment.”

- “They may only want to do 25 basis points and not 50 out of an abundance of caution,” he added. For more see MNMI Policy main wire at 1045ET.

- "I can reassure the members of the Committee that our banking system remains sound, and that Americans can feel confident that their deposits will be there when they need them. This week’s actions demonstrate our resolute commitment to ensure that depositors’ savings remain safe," Yellen said in prepared testimony to the U.S. Senate Committee on Finance. The hearing is intended to focus on President Biden's fiscal year 2024 budget.

EUROPE

ECB: Around four Governing Council members argued against the European Central Bank’s decision to raise rates by 50 basis points on Thursday, with all of the dissenters preferring no hike at all rather than a smaller 25-basis-point move, MNI understands.

- Overall, support for the 50bp hike was strong. While there was agreement on more neutral guidance for future policy, all policymakers around the table accepted the need to get inflation down considerably from current levels, though some had a more hawkish outlook than others, MNI also understands.

- The ECB decided to hike its key suite of rates by 50 bps, taking the benchmark deposit facility rate to 3.0% -- a cumulative 350 bps above the lowest level seen during the global pandemic.

ECB: The European Central Bank pressed ahead with an expected 50bp deposit rate hike Thursday, but did not offer any form of guidance as to future policy and instead reasserted the importance of adopting a data-dependent, meeting-by-meeting approach, with the Governing Council monitoring current market tensions closely in the wake of the SVB collapse and recent event with Credit Suisse.

- Europe's banking system is resilient, but the ECB "stands ready" and is "fully equipped to provide liquidity support to the euro area financial system if needed and to preserve the smooth transmission of monetary policy," it said.

- ECB staff projections show inflation averaging 5.3% in 2023, 2.9% in 2024 and 2.1% in 2025. Core inflation expected to average 4.6% in 2023, 2.5% in 2024 and 2.2% in 2025.

- Moving forward, policy will be determined by its assessment of "the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission," Lagarde said, pointing to the statement.

- But, she added, "'if our baseline was to persist, as the (financial sector) uncertainty reduces we know we have a lot more ground to cover, but it’s a big caveat."

UK

BOE: The Bank of England is likely to keep rates near their peak for some time and not respond with rapid rate large cuts if inflation undershoots the 2% target for a lengthy period as assumed by the official fiscal forecaster in its March Budget projections, top Office for Budget Responsibility official and former BOE Monetary Policy Committee member David Miles told MNI.

- The OBR's projections showed CPI inflation dropping from 6.3% in 2023 to 0.9% in 2024, and then to just 0.1% in 2025 and 0.5% in 2026 based on a market rate path for Bank Rate to rise from its current 4.0% to a short-lived peak of 4.3% in Q3 2023 followed by a gradual drift down to around 3.0% by around the end of the forecast horizon in 2028. Miles rejected the interpretation that the prolonged inflation undershoot foreseen means the market curve is in the wrong place.

- "You could look at the forecast of inflation which for a fairly long period, a couple of years, undershoots the Bank of England target and you might say 'well, wouldn't the Bank of England be cutting rates aggressively then?’” he said. For more see MNI Policy main wire at 0837ET.

OVERNIGHT DATA

- US JOBLESS CLAIMS -20K TO 192K IN MAR 11 WK

- US PREV JOBLESS CLAIMS REVISED TO 212K IN MAR 04 WK

- US CONTINUING CLAIMS -0.029M to 1.684M IN MAR 04 WK

- US FEB HOUSING STARTS 1.450M; PERMITS 1.524M

- US JAN STARTS REVISED TO 1.321M; PERMITS 1.339M

- US FEB HOUSING COMPLETIONS 1.557M; JAN 1.388M (REV)

- US FEB IMPORT PRICES -0.1%

- US FEB EXPORT PRICES +0.2%; NON-AG +0.1%; AGRICULTURE +1.0%

- MNI: US MAR PHILADELPHIA FED MFG INDEX -23.2

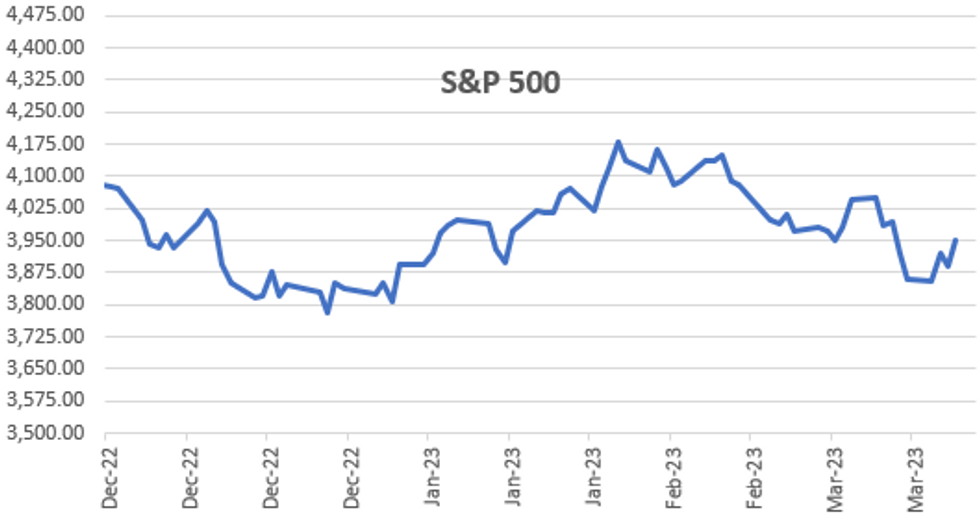

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 320.48 points (1.01%) at 32192.38

- S&P E-Mini Future up 63.25 points (1.61%) at 3988.5

- Nasdaq up 264.1 points (2.3%) at 11698.53

- US 10-Yr yield is up 11.9 bps at 3.5733%

- US Jun 10-Yr futures are down 29/32 at 114-7

- EURUSD up 0.0038 (0.36%) at 1.0615

- USDJPY up 0.08 (0.06%) at 133.5

- WTI Crude Oil (front-month) up $0.69 (1.02%) at $68.28

- Gold is up $0.63 (0.03%) at $1919.22

- EuroStoxx 50 up 82.06 points (2.03%) at 4116.98

- FTSE 100 up 65.58 points (0.89%) at 7410.03

- German DAX up 231.84 points (1.57%) at 14967.1

- French CAC 40 up 140.01 points (2.03%) at 7025.72

US TREASURY FUTURES CLOSE

- 3M10Y +12.995, -112.624 (L: -136.535 / H: -111.587)

- 2Y10Y -12.9, -56.992 (L: -72.311 / H: -40.198)

- 2Y30Y -18.785, -44.058 (L: -57.639 / H: -22.143)

- 5Y30Y -12.044, -3.176 (L: -4.005 / H: 13.489)

- Current futures levels:

- Jun 2-Yr futures down 11/32 at 103-5.875 (L: 103-01.375 / H: 103-27.625)

- Jun 5-Yr futures down 25.5/32 at 108-30.5 (L: 108-29.5 / H: 110-09.25)

- Jun 10-Yr futures down 30.5/32 at 114-5.5 (L: 114-05 / H: 116-01)

- Jun 30-Yr futures down 1-04/32 at 130-18 (L: 130-15 / H: 133-16)

- Jun Ultra futures down 1-10/32 at 140-31 (L: 140-24 / H: 144-29)

US 10YR FUTURE TECHS: Outlook Is Bullish, Despite Fade Off High

- RES 4: 116-28+ High Jan 19 and key resistance

- RES 3: 116-08 High Feb 2

- RES 2: 116-00 Round number resistance

- RES 1: 115-31 High Mar 15

- PRICE: 114-11 @ 17:06 GMT Mar 16

- SUP 1: 113-08+ Low Mar 15

- SUP 2: 113-05 50-day EMA

- SUP 3: 112-21 Low Mar 13

- SUP 4: 112-09+ 20-day EMA

Treasury futures continue to trade in a volatile manner and the contract recovered convincingly from Wednesday’s intraday low of 113-08+. The rally took out Monday’s high of 115-13 with little effort to confirm an extension of the recent impulsive bull cycle and open the 116-00 handle next. Price remains below yesterday’s high. Key support to watch is 113-05, the 50-day EMA. A clear break would be seen as a bearish development.

EURODOLLAR FUTURES CLOSE

- Jun 23 -0.240 at 94.875

- Sep 23 -0.385 at 95.340

- Dec 23 -0.310 at 95.560

- Mar 24 -0.180 at 95.870

- Red Pack (Jun 24-Mar 25) -0.10 to -0.07

- Green Pack (Jun 25-Mar 26) -0.095 to -0.06

- Blue Pack (Jun 26-Mar 27) -0.105 to -0.10

- Gold Pack (Jun 27-Mar 28) -0.10 to -0.025

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00885 to 4.55086% (-0.00628/wk)

- 1M +0.05286 to 4.76143% (-0.03714/wk)

- 3M +0.05543 to 4.96257% (-0.17557/wk)*/**

- 6M +0.09829 to 4.93229% (-0.49600/wk)

- 12M +0.10100 to 4.82943% (-0.90871/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $89B

- Daily Overnight Bank Funding Rate: 4.57% volume: $262B

- Secured Overnight Financing Rate (SOFR): 4.58%, $1.252T

- Broad General Collateral Rate (BGCR): 4.55%, $484B

- Tri-Party General Collateral Rate (TGCR): 4.55%, $474B

- (rate, volume levels reflect prior session)

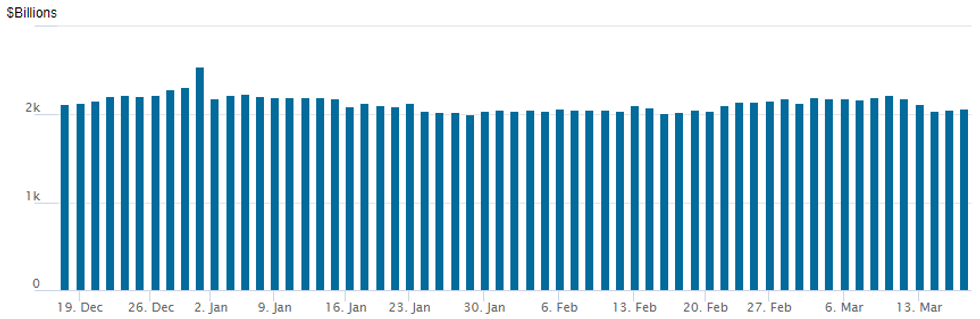

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,066.319B w/ 103 counterparties vs. prior session's $2,.055.823B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE

No new corporate bond issuance so far this week, several interested parties remain sidelined due to market volatility tied to banking stocks sell-off.

EGBs-GILTS CASH CLOSE: Bear Flattening On ECB 50bp Hike And Bank Relief

The UK and German curves bear flattened Thursday and periphery EGB spreads tightened as the ECB delivered a 50bp hike and concerns over US and European banks dissipated somewhat.

- Yields initially rose on overnight news that Credit Suisse was strengthening its liquidity position.

- With a better-than-even probability of 25bp or a hold priced in going into the ECB decision vs a 50bp hike, the half-point raise surprised to the upside.

- But the overall takeaway was slightly more dovish, with the ECB shying away from providing guidance on further hikes.

- MNI Sources reported afterward that all of the four or so dissenters preferred no hike at all rather than a smaller 25bp move.

- EGB yields fell through Lagarde's press conference and bottomed for the day as it wrapped up, then rose on diminished banking sector panic with major US institutions reportedly propping up troubled First Republic Bank.

- An appearance by ECB's Simkus features early Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 19.9bps at 2.608%, 5-Yr is up 18.1bps at 2.318%, 10-Yr is up 16bps at 2.29%, and 30-Yr is up 16.7bps at 2.312%.

- UK: The 2-Yr yield is up 12.3bps at 3.415%, 5-Yr is up 12.8bps at 3.342%, 10-Yr is up 10.4bps at 3.425%, and 30-Yr is up 9.8bps at 3.853%.

- Italian BTP spread down 8.3bps at 189.8bps / Greek down 9.9bps at 200.3bps

FOREX: Late Equity Surge Underpins Cross/JPY Recovery

- Optimism across global markets rose in the latter half of Thursday trade on diminished banking sector panic with major US institutions reportedly propping up troubled First Republic Bank. The news supported a punchy recovery for Cross/JPY which had come under extended pressure in earlier trade.

- For USDJPY, fresh lows for the week were printed at 131.72, largely in the lead up to and the immediate aftermath of the ECB decision. EURJPY also tracked through Wednesday’s worst levels to trade as low as 139.13. However, as the dust settled on the ECB’s 50bp hike and fresh news underpinned a significant recovery for First Republic shares and major indices alike, the Japanese yen came under consistent pressure with USDJPY rising back to unchanged on the session around 133.50 as we approach the APAC crossover.

- With the focus on the volatile yen, EURUSD traded in a fairly narrow range despite the ECB decision and press conference outcomes being blurred in recent sessions by the Credit Suisse situation. Some early selling pressure on the lack of forward guidance for May was swiftly absorbed and the pair returned back north of the 1.06 handle for much of the session.

- In emerging markets, the sensitive Mexican peso reacted very favourably to the latest developments. USDMXN, after briefly trading to fresh weekly highs at 19.1792 has slipped all the way back to 18.77 as of writing with the peso partially clawing back the steep losses incurred since late last week. 18.4707, the 20-day EMA, is the first support to watch.

- On Friday, Final Eurozone CPI readings will cross before US industrial production and Uni Mich consumer sentiment and inflation expectations cap off the week. Focus then turns to the March FOMC meeting next Wednesday.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/03/2023 | 0700/0800 | ** |  | SE | Unemployment |

| 17/03/2023 | 0930/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 17/03/2023 | 1000/1100 | *** |  | EU | HICP (f) |

| 17/03/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/03/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 17/03/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 17/03/2023 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.