-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Implied Hikes Point to 25Bp Move From FOMC

EXECUTIVE SUMMARY

US

US: High inflation remains Americans' top concern and has kept sentiment at historically low levels despite continued expectations for a strong labor market, the head of the University of Michigan's Survey of Consumers told MNI.

- "The overriding message is that consumer sentiment has deteriorated since February and this drop completely happened prior to the financial turmoil and prior to SVB," said Joanne Hsu in a phone interview Friday. "It dropped on the basis of the persistence of high prices, of inflation … consumers aren't really responding yet to the banking crisis, but it remains to be seen in the weeks ahead whether it's something that will influence them."

- The University of Michigan's preliminary March reading on the overall index of consumer sentiment came in at 63.4, down 5.4 on the month. The perception of current conditions fell to 66.4, the lowest since December at 59.4, and the expected index fell 4.9 to 61.5.

- "That slowdown in inflation just is not as fast as people would like and that is contributing to these deteriorating views across the board," Hsu said. For more, see MNI Policy main wire at 1334ET.

FED: The FOMC's interest rate projections next week are likely headed higher despite market expectations for 75 bps of rate cuts this year after the failure of two midsize banks, former Atlanta Fed President Dennis Lockhart told MNI.

- It is unlikely the Summary of Economic Projections will signal significant concern that the collapse of Silicon Valley Bank and Signature Bank will lead to a severe downturn, though some officials could incorporate higher chances of a recession into their individual forecasts, Lockhart said in an interview.

- "The projections overall are going to look past the circumstances of this week and reflect an assumption that stability is restored," Lockhart said. "The question remains: what are they going to do about inflation? Although year-end is nine months away, a lower median rate for end-2023 would be surprising considering the persistence of inflation." (See: MNI INTERVIEW: Inflation Proves More Persistent - Fed's Garriga) For more see MNI Policy main wire at 0605ET.

- The claim by European Central Bank President Christine Lagarde after Thursday’s 50-basis-point interest rate hike that there is no trade-off between monetary policy and financial stability was a standard denial for someone in her position, Papadia, currently senior fellow at the Bruegel thinktank in Brussels, said in an interview.

- “Draghi used to say that, Yellen used to say that when she was at the Fed, and Lagarde says that now. It’s not true, but it’s the only thing they can say,” Papadia said, when asked about Lagarde’s comments. (See MNI ECB WATCH: Rates Up 50Bps With 'Ground To Cover' - Lagarde)

- “What she said yesterday that liquidity support would deal with financial stability, interest rates for inflation, is true but only up to a point,” he said. “If it comes to a really serious crisis - as in the GFC - then you also have to use interest rates and then you may get into a dilemma. Yes, you can do separation, in a mild situation like the current one, but if it gets serious then you do not have this luxury.” For more see MNI Policy main wire at 1158ET.

US: The White House has released a statement in which President Joe Biden in the wake of the SVB and Signature Bank collapses, calls on Congress to make it easier to punish bank executives for mismanagement and claw back compensation.

- 'The President is calling on Congress to:Expand the FDIC’s authority to claw back compensation – including gains from stock sales – from executives at failed banks like Silicon Valley Bank and Signature Bank'

- Also calls on Congress to bar such execs from working in banking sector again: "Under existing law, the FDIC can bar executives from holding jobs at other banks if they engage in “willful or continuing disregard for the safety and soundness” of their bank. Congress should strengthen this tool by lowering the legal standard for imposing this prohibition when a bank is put into FDIC receivership."

- Biden faces major political risks from the current upheaval in the banking sector. While the FDIC Deposit Insurance Fund is paid out by premiums paid by banks, there is a risk - exacerbated by GOP rhetoric - that these banks are being 'bailed out' at taxpayers' expense. The banking bailouts of the Global Financial Crisis caused a major public backlash against mainstream politicians and contributed to rising populism, with statements such as Biden's today attempting to put clear blue water between his administration and those failed banks.

US TSYS: Late Roundup: Short End Extends Session Highs

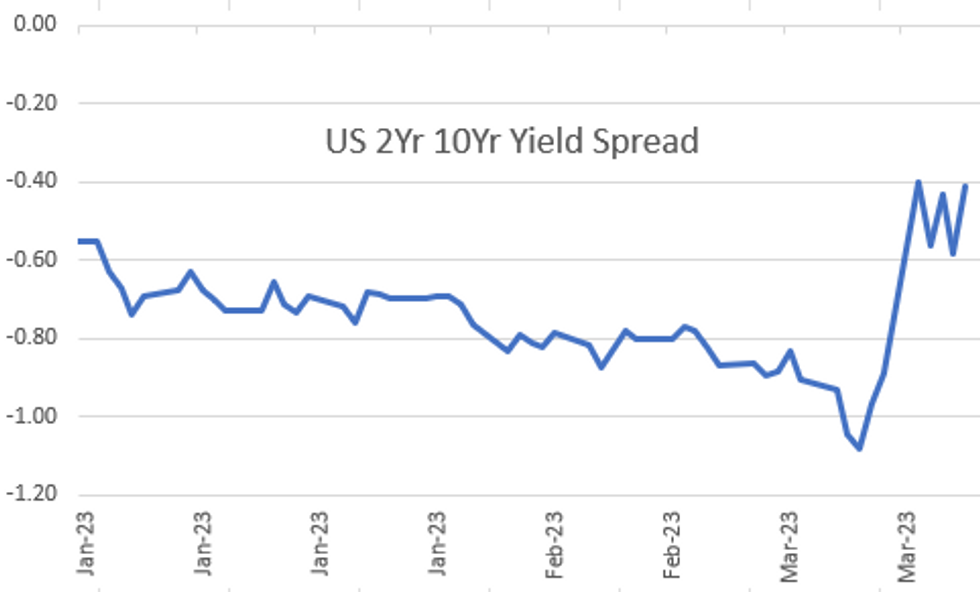

- Yield curves are bull steepening (2s10s -46.511 high) with front end Treasury futures extending session highs late trade while bonds hold to session range over last few hours. Front month 2Y futures tapped 103-24.38 (+17.5) before receding to 103-22.5 last few minutes, 2Y yield falls to 3.8520% low.

- Timing of move coincided with headlines that four European banks (including SocGen and Deutsche Bank) have put curbs on trades with Credit Suisse. Not as proactive or positive as receiving a liquidity backstop from SNB, but markets may perceive ringfence move to prevent contagion as systemically positive.

- In the meantime, Short end futures implied rate hikes have drifted back near midweek highs: Fed funds implied hike for Mar'23 at 16.0bp (-3.0bp from this morning), May'23 cumulative 22.1bp (-13bp) to 4.798%, Jun'23 2.7bp (-21.7bp) to 4.608%.

- Implied cut for Jul'23 at -26.3bp to 4.318%, Sep'23 cumulative of -44.5 to 4.323%; peak Fed terminal rate has fallen to 4.795% for May'23 vs. 4.920% earlier.

- Next week outlook, no economic data Monday, while the Tsy will auction bills late morning. FOMC kicks off first of two day FOMC meeting on Tuesday.

OVERNIGHT DATA

- US FEB INDUSTRIAL PROD +0.0%; CAP UTIL 78.0%

- US JAN IP REV TO +0.3%; CAP UTIL REV 78.0%

- US FEB MFG OUTPUT +0.1%

- MICHIGAN YEAR-AHEAD INFLATION EXPECTATIONS AT 3.8% VS 4.1%

- MICHIGAN CONSUMER SENTIMENT INDEX DROPS BY MOST SINCE JUNE ‘21

- MICHIGAN 5-10 YEAR INFLATION EXPECTATIONS FELL TO 2.8% VS 2.9%

- MARCH MICHIGAN CURRENT CONDITIONS INDEX AT 66.4 AFTER 70.7

- US FEB. INDEX OF LEADING ECONOMIC INDICATORS FALLS 0.3%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 409.39 points (-1.27%) at 31836.78

- S&P E-Mini Future down 45.75 points (-1.15%) at 3948.75

- Nasdaq down 87 points (-0.7%) at 11630.62

- US 10-Yr yield is down 18.4 bps at 3.3931%

- US Jun 10-Yr futures are up 52/32 at 115-26

- EURUSD up 0.0064 (0.6%) at 1.0674

- USDJPY down 2.01 (-1.5%) at 131.73

- WTI Crude Oil (front-month) down $2 (-2.93%) at $66.36

- Gold is up $59.83 (3.12%) at $1979.72

- EuroStoxx 50 down 51.99 points (-1.26%) at 4064.99

- FTSE 100 down 74.63 points (-1.01%) at 7335.4

- German DAX down 198.9 points (-1.33%) at 14768.2

- French CAC 40 down 100.32 points (-1.43%) at 6925.4

US TREASURY FUTURES CLOSE

3M10Y +8.996, -106.93 (L: -124.964 / H: -104.364)

2Y10Y +15.051, -43.803 (L: -66.886 / H: -43.617)

2Y30Y +23.822, -22.872 (L: -54.432 / H: -22.872)

5Y30Y +18.055, 13.741 (L: -7.089 / H: 13.741)

Current futures levels:

Jun 2-Yr futures up 19.125/32 at 103-26 (L: 102-31 / H: 103-26.25)

Jun 5-Yr futures up 39.25/32 at 110-6.5 (L: 108-25.25 / H: 110-08.25)

Jun 10-Yr futures up 51.5/32 at 115-25.5 (L: 114-01.5 / H: 115-28.5)

Jun 30-Yr futures up 65/32 at 132-20 (L: 130-10 / H: 133-03)

Jun Ultra futures up 86/32 at 143-21 (L: 140-15 / H: 144-06)

US 10YR FUTURE TECHS: Outlook Remains Bullish

- RES 4: 117-00 61.8% of the Aug - Oct 2022 bear leg (cont)

- RES 3: 116-28+ High Jan 19 and key resistance

- RES 2: 116-08 High Feb 2

- RES 1: 116-01 High Mar 16

- PRICE: 115-18 @ 16:46 GMT Mar 17

- SUP 1: 113-28 38.2% retracement of the rally from Mar 2 (cont)

- SUP 2: 113-06+ 50-day EMA

- SUP 3: 112-27 20-day EMA

- SUP 4: 112-17+ 61.8% retracement of the rally from Mar 2 (cont)

Treasury futures failed to hold on to yesterday’s high of 116-01. Despite the pullback, a bullish short-term outlook remains intact. Key support to watch lies at 113-06+, the 50-day EMA and this level also represent a short-term pivot level. A break of yesterday’s high would open 116-08, the Feb 2 high and 116-28+, the Jan 19 high and a key resistance. On the downside, a clear breach of the 50-day EMA would expose 112-21, the Mar 13 low.

EURODOLLAR FUTURES CLOSE

- Jun 23 +0.235 at 95.120

- Sep 23 +0.340 at 95.695

- Dec 23 +0.330 at 95.905

- Mar 24 +0.310 at 96.180

- Red Pack (Jun 24-Mar 25) +0.325 to +0.355

- Green Pack (Jun 25-Mar 26) +0.215 to +0.290

- Blue Pack (Jun 26-Mar 27) +0.185 to +0.205

- Gold Pack (Jun 27-Mar 28) +0.165 to +0.185

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.01000 to 4.56086% (+0.00372/wk)

- 1M +0.01628 to 4.77771% (-0.02086/wk)

- 3M +0.03586 to 4.99843% (-0.13971/wk)*/**

- 6M +0.12000 to 5.05229% (-0.37600/wk)

- 12M +0.20471 to 5.03414% (-0.70400/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $83B

- Daily Overnight Bank Funding Rate: 4.57% volume: $261B

- Secured Overnight Financing Rate (SOFR): 4.57%, $1.272T

- Broad General Collateral Rate (BGCR): 4.55%, $503B

- Tri-Party General Collateral Rate (TGCR): 4.55%, $491B

- (rate, volume levels reflect prior session)

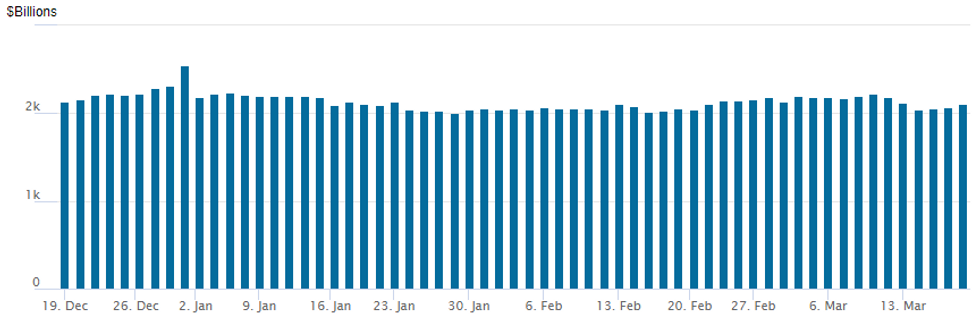

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,106.166B w/ 97 counterparties vs. prior session's $2,.066.319B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE

No new corporate bond issuance so far this week, several interested parties remain sidelined due to market volatility tied to banking stocks sell-off.

EGBs-GILTS CASH CLOSE: Bull Steepening In Pre-Weekend Risk Off Move

European curves bull steepened Friday amid strong gains at the short-end, with central bank hikes continuing to get priced out after the ECB meeting yesterday and ahead of the Fed and BoE decisions next week.

- After a fairly quiet start to the European session, highlighted by ECB hawks eyeing further rate hikes sending EGB yields marginally higher, safe havens began rallying as bank stocks dropped sharply throughout the rest of the day.

- There was no specific trigger, more a resumption of concerns over Credit Suisse and US banks, with angst over possible developments over the weekend. Reuters reported Credit Suisse executives would meet over the weekend to discuss options for the bank's future.

- ECB terminal rate pricing fell back 12bp to 3.20%; a 25bp BoE hike next week is less than 50% priced, with terminal dropping as much as 23bp to 4.17%.

- After initially tightening, periphery EGB spreads widened as equities pulled back.

- With a quiet schedule Monday (ECB Lagarde appearance aside), attention over the weekend will continue to be paid to banking sector risks.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 22bps at 2.388%, 5-Yr is down 22.5bps at 2.093%, 10-Yr is down 18.2bps at 2.108%, and 30-Yr is down 15.5bps at 2.157%.

- UK: The 2-Yr yield is down 17.4bps at 3.241%, 5-Yr is down 17.2bps at 3.17%, 10-Yr is down 14.1bps at 3.284%, and 30-Yr is down 9.7bps at 3.756%.

- Italian BTP spread up 4.8bps at 194.6bps / Spanish up 2.7bps at 112bps

FOREX: Risk-On Through London Close Tilts EUR/USD to New Highs

- Greenback fading following the London close, with price action picking up in EURUSD to put the pair just above earlier session highs. GBP/USD moving similarly, with 1.2177 the next intraday level of note.

- Move lower in the greenback coincides with very modest uptick further off the lows for the e-mini S&P, which is in the process of chewing through the post-cash open losses at pixel time.

- Moves coincide with Credit Suisse headlines on Reuters, who write that Credit Suisse's CFO teams are being called up to work over the weekend, with the teams set to work on scenarios for the bank going forward. This possibly suggests plans are advancing on reparatory measures for the bank - but unclear if that marks the price catalyst here

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/03/2023 | 0700/0800 | ** |  | DE | PPI |

| 20/03/2023 | 0730/0730 |  | UK | DMO to Confirm Gilts on Offer at 4/5 April Auctions | |

| 20/03/2023 | 1000/1100 | * |  | EU | Trade Balance |

| 20/03/2023 | - |  | UK | DMO Quarterly Consultation with GEMMs / Investors | |

| 20/03/2023 | 1400/1500 |  | EU | ECB Lagarde Intro at ECON Hearing | |

| 20/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 20/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 20/03/2023 | 1600/1700 |  | EU | ECB Lagarde Intro as ESRB Chair at ECON |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.