-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI ASIA OPEN: Inflation Spikes and Rate Hikes

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed's Daly Downplays Chances Of 50 BP Rate Hike

- MNI INTERVIEW2: QT Should Be Background Not Surgical Tool-Daly

- BULLARD FAVORS FIRST HALF-POINT U.S. RATE INCREASE SINCE 2000, Bbg

- FED'S BULLARD FAVORS 100 BPS INTEREST-RATE INCREASES BY JULY 1, Bbg

US

FED: San Francisco Federal Reserve President Mary Daly told MNI Thursday interest rates will almost certainly rise beginning in March followed by at least two more hikes this year, but downplayed the need for a half-point increase at the upcoming meeting despite another stronger-than-expected reading on inflation.

- “My own view is that March is the live meeting when we would raise interest rates for the first time, and I could imagine raising at subsequent meetings as well, but I just want to see the data,” she said in a phone interview.

- “While I'm able to say a modal outlook of three rate increases and balance sheet reduction starting later this year, you know, I could easily imagine myself saying that more is needed,” she said, adding the uncertain economy makes it harder to give firm projections. Fore more see MNI Policy main wire at 1456ET.

- “We know it's an important tool but it is a background tool,” Daly said in a phone interview. The Fed could raise rates three time this year and start slimming the balance sheet, she said.

- “Reducing the balance sheet, that's just less clear the impact it directly has on financial markets, how much does it tighten them," Daly said. "And so fiddling with it in a surgical way is not optimal when you're thinking about trying to achieve this soft landing with the economy.”

- The last time the Fed wound down in 2017, officials allowed assets to run off at USD10 billion a month, increasing the pace to USD50 billion a month over the course of a year. Atlanta Fed President Raphael Bostic has come out as the most hawkish, calling for a monthly reduction of USD100 billion. Fed officials are coalescing around a gradualist, highly telegraphed approach to reducing its USD8.7 trillion balance sheet, ex-officials and staffers have told MNI.

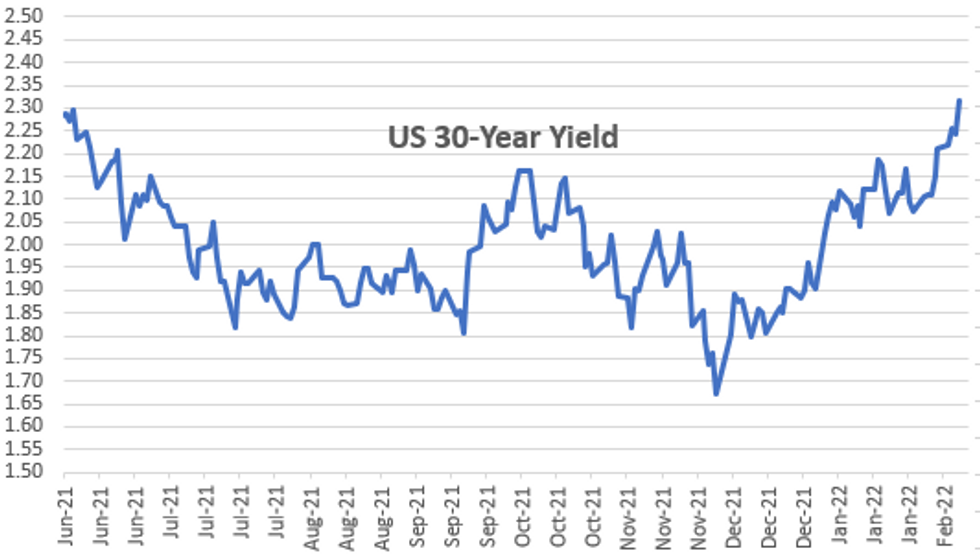

US TSYS: Hot CPI and Hawkish Pivot From StL Fed Bullard

Tsy yields surged back to mid-May levels (30YY 2.3436%) after Jan CPI came out higher than estimates at 0.6% Thu, yield curves bear flattened (2s10s slipped below 43.0, finishing around 43.8 -13.4; 7s10s inverted) while equities fell below 4500.0 after climbing back above 50-day EMA of4564.03 around midday.

- One-Two Punch: The "hot" CPI got "higher/faster" rate hike ball rolling early but hawkish pivot from StL Fed Bullard hammered the point home.

- In a Bbg interview -- ahead the 30Y auction to boot -- Fed Bullard green-lighted a 50bp hike in March (but defers to Powell on move) and potential for inter-meeting hikes in light of the pick-up in inflation. (Remember, Bullard stated a 50bp hike "didn't help us" a week ago).

- Of note, 2YY currently at 1.5827% well above where 10YY started the year (1.5360%).

- Not kind to Bond auction: Tys whipsawed after $23B 30Y auction tail (912810TD0), Bond sale tailed on 2.340% high yield vs. 2.327% WI; 2.30x bid-to-cover vs. 2.35x last month (2.29x 5-month average).

- Counterpoint: MNI INTERVIEW: Fed's Daly Downplays Chances Of 50 BP Rate Hike, interview AFTER CPI. Still on tap: Richmond Fed Barkin (hawk) this evening at 1900ET.

- Heavy volumes, real-vol spiked, heavy Eurodlr and Treasury option volumes chasing renewed rate hike pricing (as much as 150bp by year end).

- After the bell, 2-Yr yield is up 24.5bps at 1.6092%, 5-Yr is up 14.6bps at 1.9624%, 10-Yr is up 10.4bps at 2.0451%, and 30-Yr is up 8.2bps at 2.3272%.

OVERNIGHT DATA

US JAN CPI 0.6%, CORE 0.6%; CPI Y/Y 7.5%, CORE Y/Y 6.0%

US JAN ENERGY PRICES 0.9%

US JAN OWNERS' EQUIVALENT RENT PRICES 0.4%

US JOBLESS CLAIMS -16K TO 223K IN FEB 05 WK

US PREV JOBLESS CLAIMS REVISED TO 239K IN JAN 29 WK

US CONTINUING CLAIMS +0.000M to 1.621M IN JAN 29 WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 526.47 points (-1.47%) at 35241.59

- S&P E-Mini Future down 89 points (-1.94%) at 4488.25

- Nasdaq down 304.7 points (-2.1%) at 14185.64

- US 10-Yr yield is up 10.9 bps at 2.0503%

- US Mar 10Y are down 37/32 at 125-19

- EURUSD down 0 (0%) at 1.1425

- USDJPY up 0.57 (0.49%) at 116.1

- WTI Crude Oil (front-month) up $0.35 (0.39%) at $89.99

- Gold is down $6.75 (-0.37%) at $1826.58

European bourses closing levels:

- EuroStoxx 50 down 7.02 points (-0.17%) at 4197.07

- FTSE 100 up 28.98 points (0.38%) at 7672.4

- French CAC 40 down 29.33 points (-0.41%) at 7101.55

US TSYS FUTURES CLOSE

- 3M10Y -3.512, 161.724 (L: 158.894 / H: 169.004)

- 2Y10Y -13.784, 43.528 (L: 41.224 / H: 59.526)

- 2Y30Y -16.496, 71.156 (L: 68.968 / H: 90.071)

- 5Y30Y -6.906, 35.572 (L: 34.527 / H: 44.078)

- Current futures levels:

- Mar 2Y down 16.75/32 at 107-15.5 (L: 107-13.75 / H: 108-01)

- Mar 5Y down 28.5/32 at 117-11.75 (L: 117-08.5 / H: 118-10.75)

- Mar 10Y down 1-4.5/32 at 125-19.5 (L: 125-17.5 / H: 126-26)

- Mar 30Y down 1-31/32 at 151-10 (L: 151-02 / H: 153-11)

- Mar Ultra 30Y down 3-10/32 at 180-27 (L: 180-10 / H: 184-17)

US 10Y FUTURES TECHS: (H2) Continuation Trend Extends Lower

- RES 4: 129-14 High Jan 5

- RES 3: 128-24 50-day EMA

- RES 2: 128-22+ High Jan 24

- RES 1: 127-01/24 High Feb 7 / High Feb 4

- PRICE: 125-30+ @ 16:32 GMT Feb 10

- SUP 1: 125-28+ Low Feb 09

- SUP 2: 125-26+ 1.618 proj of the Jan 13 - 19 - 24 price swing

- SUP 3: 125-06+ Low 30 May 2019

- SUP 4: 124-22+ 2.0% 10-dma envelope

Treasuries solidified the bearish trend condition Thursday, diving through nearby support layered between 126-01 and 125-10+. This put the contract at a fresh cycle low. Thursday’s price action marks an extension of the continuation pattern, reinforcing bearish conditions. Having cleared 126-10+ and 126-01, focus turns lower to 125-26+ for the next key level.

US EURODOLLAR FUTURES CLOSE

- Mar 22 -0.155 at 99.260

- Jun 22 -0.275 at 98.680

- Sep 22 -0.360 at 98.275

- Dec 22 -0.370 at 97.960

- Red Pack (Mar 23-Dec 23) -0.365 to -0.22

- Green Pack (Mar 24-Dec 24) -0.17 to -0.085

- Blue Pack (Mar 25-Dec 25) -0.08 to -0.075

- Gold Pack (Mar 26-Dec 26) -0.08 to -0.07

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00014 at 0.07757% (+0.00057/wk)

- 1 Month +0.00100 to 0.12371% (+0.00842/wk)

- 3 Month +0.01743 to 0.39486% (+0.05586/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.02986 to 0.66443% (+0.10900/wk)

- 1 Year +0.03086 to 1.12457% (+0.12557/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07% volume: $266B

- Secured Overnight Financing Rate (SOFR): 0.04%, $911B

- Broad General Collateral Rate (BGCR): 0.05%, $350B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $343B

- (rate, volume levels reflect prior session)

- Tsy 7Y-10Y, $3.201B accepted vs. $8.064B submitted

- Next updated schedule will be released Friday, Feb 11 at 1500ET

FED Reverse Repo Operation, Receding

NY Fed reverse repo usage falls to $1,634.146B w/ 76 counterparties vs. $1,653.153B yesterday -- remains well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: Issuers Remain Absent Post CPI

No new issuance as yet Thursday, issuers still plying sidelines after pulling back going into this morning's Jan CPI data.

- Date $MM Issuer (Priced *, Launch #)

- 02/10 $1.6B NCL $1B 5NC2, $600M 7NC investor calls

- At least $14.45B Priced Wednesday

- 02/09 $3.5B *Union Pacific $1.25B 10Y +90, $500M 20Y +107, $1.25B 31Y +125, $500M 50Y +160

- 02/09 $2.5B *Aptiv $700M 3NC1 +80, $800M 10Y +135, $1B 30Y +190

- 02/09 $1.5B *Starbucks $500M 2NC1 FRN/SOFR+42, $1B 10Y +110

- 02/09 $1.25B *Japan Bank for Int'l Cooperation (JBIC) 7Y SFOR+45

- 02/09 $1.05B *Nationwide Building Soc $750M 6NC5 +117, $300M 6NC5 SOFR+129

- 02/09 $1B *ANZ New Zealand $500M 3Y +57, $500M 3Y FRN/SOFR+60

- 02/09 $800M *EBRD 7Y SOFR+30

- 02/09 $500M *Boardwalk Pipelines WNG 10Y +168

- 02/09 $500M *Harley Davidson 5Y +130

- 02/09 $700M *Kookmin Bank $400M 3Y +60, $300M 5Y +70

- 02/09 $550M *China Development Bank 5Y +33

- Smaller but notable US$ issuance from Bank of China foreign branches:

- 02/09 $300M *Bank of China Hungarian Branch 2Y +30

- 02/09 $300M *Bank of China Johannesburg Branch 3Y +35

EGBs-GILTS CASH CLOSE: Renewed Weakness On US CPI

Gilts underperformed Bunds Thursday, with the 10Y segment weakest on both curves as markets digested yet another hawkish inflation surprise.

- The global focal point of the session was the US January inflation report, and it delivered a sizeable upside surprise vs expectations that reversed modest earlier FI gains.

- Periphery spreads also widened noticeably as the CPI report triggered renewed central bank tightening speculation; BTPs and GGBs traded at their widest to Bunds since mid-2020.

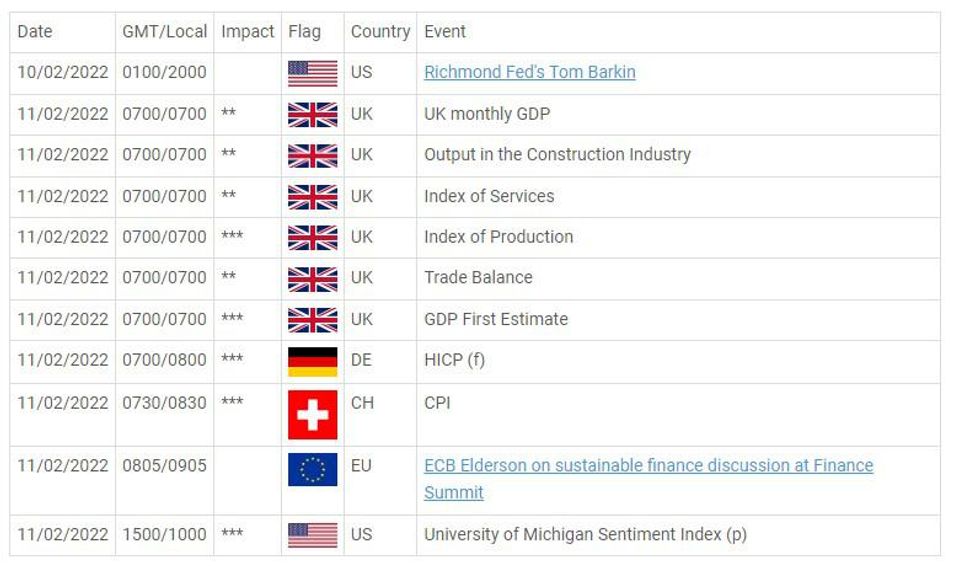

- A quieter calendar Friday, with UK GDP taking focus early.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.8bps at -0.331%, 5-Yr is up 6.3bps at 0.083%, 10-Yr is up 7.2bps at 0.284%, and 30-Yr is up 4.7bps at 0.474%.

- UK: The 2-Yr yield is up 8.1bps at 1.362%, 5-Yr is up 8.8bps at 1.409%, 10-Yr is up 9.4bps at 1.524%, and 30-Yr is up 8.3bps at 1.613%.

- Italian BTP spread up 6.8bps at 160.7bps / Spanish up 3.5bps at 88.7bps

FOREX: Greenback Spike Faded Following Above Estimate US Inflation

- US CPI surprised to the upside once more, illustrating the continued momentum for inflation in the US economy. As such, US yields spiked in a bear flattening move prompting an initial relief rally for the US dollar, that has been struggling over the past two weeks.

- The US dollar index was boosted around 0.5% following the data with EURUSD trading down to 1.1375 and USDJPY breaking above the 1.16 handle to closely match the years highs around 1.1635.

- Despite the downward momentum for US fixed income, renewed optimism for the greenback was short-lived. A very strong dollar reversal ensued, aided by a firm bounce off the lows for major equity indices.

- The DXY fell around 0.85% which translated into EURUSD making fresh highs for the year at 1.1495 and USDJPY falling back below 116.

- In a third major move for the session, Fed Bullard's comments on favouring a 50bp hike in March coupled with entertaining the option of inter-meeting increases sparked an equities selloff with the dollar regaining some poise, DXY now residing close to unchanged for Thursday.

- EURUSD’s resilient price action appears to be confirming a bull flag continuation pattern. Once through the day’s high and pivot resistance at 1.1495, the focus will be on 1.1558, a Fibonacci retracement.

- The Swedish krona was the clear underperformer on Thursday, with gains for EURSEK totalling 2.15% approaching the end of the trading day. Following the riksbank meeting, analysts suggested that set against the increasingly hawkish major central banks, Thursday's Riksbank meeting had erred more on the dovish side than markets had expected.

- Overnight, potential comments from RBA Governor Lowe, due to testify at a virtual hearing before the House of Representatives Standing Committee on Economics. Inflation expectations for New Zealand will also be released before UK publishes growth data at the start of the European session.

Friday Data Calendar

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.