-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Industrial Profits Up 11.0% In December

MNI: China CFETS Yuan Index Down 0.45% In Week of Jan 24

MNI: PBOC Sets Yuan Parity Lower At 7.1698 Mon; -1.06% Y/

MNI ASIA OPEN: Late Fed Speakers Still on Tap

- MNI INTERVIEW: Reserve Scarcity Yet To Materialize - Fed Econ

- MNI: BOC Balancing Risk Of Over-Tightening, CPI Target In Sight

- MNI Initial Jobless Claims Healthier Than Expected, Potential Seasonality Factor

US TSY Rates Shrug Off Lower Than Expected Weekly Claims

- Treasury futures are drifting near late session highs after the bell, Dec'23 10Y futures currently at 109-31.5 (+9.5) are back near Wednesday's pre-ISM Services data highs. Curves bear steepening with long end rates lagging, 2Y10Y at -69.524 +4.755.

- Treasury futures had sold off after Initial Jobless Claims comes out lower than expected (216k, 234k est), Continuing Claims added to the healthier than expected data, falling to 1679k (cons 1719k) from a downward revised 1719k (initial 1725k). It falls back below the 2019 average, tying with mid-July levels having last been lower in January.

- Meanwhile, Unit Labor Costs higher than expected at 2.2% vs. 1.9% est, Nonfarm Productivity near in-line at 3.5% vs. 3.4% est.

- Market participation has been relatively thin, however, as evidenced by a rebound in German bunds this morning that carried over into US markets at midmorning.

- Fed speak resumes this afternoon, the StL Fed will hold a forum on the search for bank president at 1400ET. NY Fed Williams partaking in a Bbg moderated market discussion at 1530ET, Atl Fed Bostic economic outlook, livestreamed at 1545ET, Fed Gov Bowman on future of money at 1655ET.

- This evening, Atlanta Fed Bostic speaks about economic mobility at 1900ET, while Dallas Fed Logan discusses policy at Southern Methodist University (text, no Q&A) at 1905ET.

US

FED: The Federal Reserve has room to keep running down its balance sheet because signs of reserve scarcity have yet to materialize in money markets, but officials may still have to end quantitative tightening earlier due to liquidity constraints, St. Louis Fed senior economist Amalia Estenssoro told MNI.

- "Balance sheet normalization processes as practiced today are complex because there are several moving parts. Deciding when to fade the policy is not trivial," she said in response to emailed questions. Asked whether she's seeing any money-market pressures suggesting the lowest comfortable level of reserves is closer than previously thought: "Not at all at the moment."

- Fed officials have said there is a high bar to adjust quantitative tightening but there will be reassessments of the optimal level of reserves. Banking regulations and desired liquidity could push up the level of reserves where constraints begin to force money-market rates higher. For more see MNI Policy main wire at 1141ET.

CANADA

BOC: Bank of Canada Governor Tiff Macklem on Thursday restored more balanced language about the risks of over- and under-tightening and said restoring inflation to the 2% target is within sight, adding a dovish note to Wednesday's hawkish interest rate hold.

- Inflation progress has been slow and Macklem reiterated he's prepared to hike again if needed because of the risk that CPI becomes stuck above target. The Governor also rejected talk of raising the inflation target while noting the next five-year agreement with the government is due in 2026 and always requires careful study, comments made in a week where the Finance Minister said she would use all available tools to help ease the cost of living.

- "With past interest rate increases still working their way through the economy, monetary policy may be sufficiently restrictive to restore price stability. However, Governing Council is concerned about the persistence of underlying inflation," Macklem said in the text of a speech from Calgary. For more see MNI Policy main wire at 1355ET.

OVERNIGHT DATA

- US JOBLESS CLAIMS -13K TO 216K IN SEP 02 WK

- US PREV JOBLESS CLAIMS REVISED TO 229K IN AUG 26 WK

- US CONTINUING CLAIMS -0.040M to 1.679M IN AUG 26 WK

- Initial jobless claims were notably lower than expected in the week to Sep 2, falling to 216k (cons 233k) after a fractionally upward revised 229k (initial 228k).

- The four-week average also sees a sizeable drop to 229k (-9k) for its lowest since late July and before that March.

- It appears there could have been a favorable seasonal adjustment effect, with the NSA data falling 3k to 190k but with the seasonal factors possibly distorted by a sharp increase back in 2017.

- Ohio is also at play, returning to more typical levels as non-seasonally adjusted claims fell for the third week running from particularly elevated levels.

- Continuing claims added to the healthier than expected data, falling to 1679k (cons 1719k) from a downward revised 1719k (initial 1725k). It falls back below the 2019 average, tying with mid-July levels having last been lower in January.

- US Q2 REV NONFARM PRODUCTIVITY +3.5%; Y/Y +1.3%

- US Q2 UNIT LABOR COSTS +2.2%; Y/Y +2.5%

- Nonfarm productivity was revised lower in Q2 but by less than expected, printing a still strong 3.5% jump (cons 3.4, initial 3.7) as it bounced from -1.2% in Q1.

- A stronger rise in wages meant unit labor cost growth was revised higher by more than from productivity alone, printing 2.2% annualized (cons 1.9, initial 1.6) in less of a moderation from the 3.3% in Q1 than first thought.

- CANADIAN JUL BUILDING PERMITS -1.5% MOM

- CANADA RESIDENTIAL BUILDING PERMITS +5.4%; NON-RESIDENTIAL -11.5%

MARKETS SNAPSHOT

Key late session levels:- DJIA up 57.06 points (0.17%) at 34501.1

- S&P E-Mini Future down 14.5 points (-0.32%) at 4457.25

- Nasdaq down 112.6 points (-0.8%) at 13760.54

- US 10-Yr yield is down 2.2 bps at 4.2579%

- US Dec 10-Yr futures are up 9/32 at 109-31

- EURUSD down 0.0032 (-0.3%) at 1.0696

- USDJPY down 0.48 (-0.33%) at 147.18

- WTI Crude Oil (front-month) down $0.61 (-0.7%) at $86.93

- Gold is up $4 (0.21%) at $1920.51

- EuroStoxx 50 down 17.24 points (-0.41%) at 4221.02

- FTSE 100 up 15.58 points (0.21%) at 7441.72

- German DAX down 22.71 points (-0.14%) at 15718.66

- French CAC 40 up 2.01 points (0.03%) at 7196.1

US TREASURY FUTURES CLOSE

- 3M10Y +0.321, -120.736 (L: -123.598 / H: -117.537)

- 2Y10Y +4.556, -69.723 (L: -74.112 / H: -68.907)

- 2Y30Y +6.543, -60.211 (L: -67.088 / H: -59.712)

- 5Y30Y +4.223, -2.901 (L: -8.247 / H: -2.901)

- Current futures levels:

- Dec 2-Yr futures up 4.875/32 at 101-22.125 (L: 101-16.375 / H: 101-22.375)

- Dec 5-Yr futures up 8.75/32 at 106-10 (L: 105-31.75 / H: 106-10.25)

- Dec 10-Yr futures up 9.5/32 at 109-31.5 (L: 109-19 / H: 110-00.5)

- Dec 30-Yr futures up 4/32 at 119-10 (L: 118-26 / H: 119-13)

- Dec Ultra futures steady at at 126-9 (L: 125-25 / H: 126-16)

US 10Y FUTURE TECHS (Z3) Bear Threat Remains Present

- RES 4: 112-24+ High Jul 27

- RES 3: 112-14 High Aug 10 and a key short-term resistance

- RES 2: 112-00 Round number resistance

- RES 1: 110-17/111-12+ 20-day EMA / High Sep 1

- PRICE: 109-27+ @ 12:00 BST Sep 7

- SUP 1: 109-19+ Low Sep 6

- SUP 2: 109-18+/09+ Low Aug 25 / 22 and the bear trigger

- SUP 3: 108-20 1.000 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 4: 107.23 1.236 proj of the Jul 18 - Aug 4 - Aug 10 price swing

Treasury prices traded lower again Wednesday and a bear threat remains present. The latest move lower highlights a potential short-term reversal and 111-12+ marks a key short-term resistance, the Sep 1 high. The medium-term trend direction is down and moving average studies reinforce this theme. An extension lower would signal scope for 109-09+, Aug 22 low and a bear trigger. A break of this level would strengthen a bearish theme.

SOFR FUTURES CLOSE

- Sep 23 +0.003 at 94.583

- Dec 23 +0.015 at 94.560

- Mar 24 +0.045 at 94.720

- Jun 24 +0.070 at 94.995

- Red Pack (Sep 24-Jun 25) +0.095 to +0.105

- Green Pack (Sep 25-Jun 26) +0.045 to +0.080

- Blue Pack (Sep 26-Jun 27) +0.030 to +0.040

- Gold Pack (Sep 27-Jun 28) +0.015 to +0.020

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00249 to 5.32933 (+.00046/wk)

- 3M +0.01326 to 5.41099 (+0.00869/wk)

- 6M +0.02329 to 5.47601 (+0.02277/wk)

- 12M +0.04377 to 5.43272 (+0.06406/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $100B

- Daily Overnight Bank Funding Rate: 5.32% volume: $250B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.391T

- Broad General Collateral Rate (BGCR): 5.30%, $552B

- Tri-Party General Collateral Rate (TGCR): 5.29%, $543B

- (rate, volume levels reflect prior session)

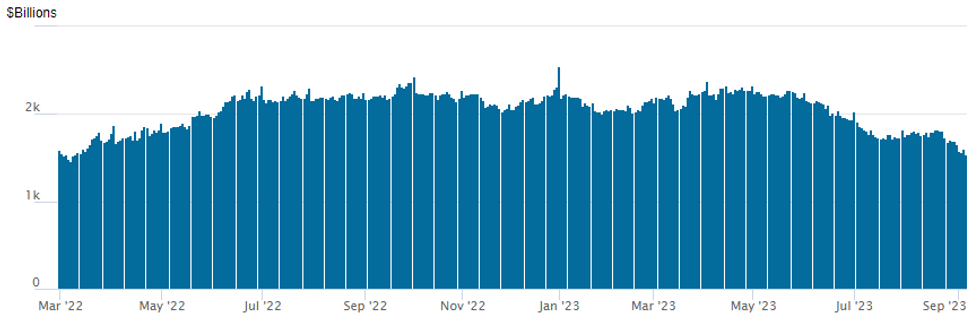

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation falls to new low of $1,535.289B (last seen early March 2022) w/97 counterparties, compared to $1,606.244B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $3B ESM Priced, $2B Gilead Launched

Thursday's supply pushes early September corporate debt issuance over $65B, well above early estimates of $50B for the week.

- Date $MM Issuer (Priced *, Launch #)

- 09/07 $3B *European Stability Mechanism (ESM) 3Y SOFR+28

- 09/07 $2B #Gilead $1B 10Y +100, $1B 30Y +120

- 09/07 $1.25B #Swedish Export Credit 3Y SOFR+41

- 09/07 $750M #Standard & Poor's Financial 10Y +100

- 09/07 $500M #Lennox WNG 5Y +112.5

- 09/07 $850M #Nordson $350M 5Y +122, $500M 10Y +157

- 09/07 $Benchmark Slovenia 10Y bond investor calls

EGBs-GILTS CASH CLOSE: Gilts Outperform Again With BoE Hikes Priced Out

Gilts outperform Bunds for a second consecutive session Thursday, with notable bull steepening in the UK curve as BoE hikes continued to be priced out.

- Following on from this week's BoE commentary which is seen relatively dovish, unexpectedly low BoE Decision Maker survey inflation expectations helped peak Bank Rate expectations dip nearly 10 basis points on the day, boosting the UK short-end.

- For the second consecutive session, European instruments weakened in afternoon trade alongside stronger-than-expected US data (jobless claims, unit labour costs), but the move didn't last.

- German yields fell in parallel fashion across most of the curve, with little change in ECB pricing.

- Periphery EGB spreads tightened modestly.

- Per the usual pre-meeting quiet period, no ECB speakers are scheduled between now and next Thursday's decision.

- After generally soft/dovish eurozone data Thursday (poor German industrial production and a downward revision to Q2 eurozone GDP), Friday brings final German inflation and multiple industrial production prints. No UK data of note.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.8bps at 3.084%, 5-Yr is down 4.4bps at 2.615%, 10-Yr is down 3.9bps at 2.614%, and 30-Yr is down 2.8bps at 2.745%.

- UK: The 2-Yr yield is down 10.2bps at 5.137%, 5-Yr is down 9.4bps at 4.716%, 10-Yr is down 7.9bps at 4.454%, and 30-Yr is down 7.8bps at 4.706%.

- Italian BTP spread down 2.2bps at 172.8bps / Spanish down 1.6bps at 103.5bps

FOREX USD Index Consolidates Gains, EURJPY Declines 0.60%

- The USD index has edged higher once more on Thursday, broadly consolidating the week’s solid advance and remaining in the medium-term uptrend drawn off the mid-July lows. Underperformance for major equity benchmarks has continued to underpin the resilient greenback.

- EURUSD has edged lower in sympathy, printing back below the 1.0700 handle for the first time since early June, narrowing the gap with 1.0635, the May 31 low and a key support. An additional headwind for the single currency may have been the weaker than expected revision of Q2 Eurozone GDP which came in at 0.1% Q/q, two tenths below the surveyed estimate.

- Of note, the Japanese Yen has outperformed modestly, with markets clearly still heeding the verbal intervention from both Matsuno and Kanda earlier in the week. Additionally, lower front-end yields in the US are easing the most recent downward pressure on the Yen.

- As such, EURJPY has fallen 0.6%, touching pullback lows of 157.36 in the process. The recent pullback is considered corrective, and the trend outlook remains bullish. Key support to watch is the 50-day EMA - at 156.72. A clear breach of this EMA would undermine the uptrend and highlight a possible short-term reversal.

- The Canadian dollar is one of the worst performers following the BOC decision yesterday and ahead of the August employment data on Friday with expectations for a further drift higher in the u/e rate but only a limited moderation in wage growth. An idiosyncratic pop higher in late trade to 1.3695 narrows in on cluster resistance at 1.3719 (1.0% 10-dma envelope) followed by 1.3722 (trendline resistance drawn from Oct 13, 2022 high).

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/09/2023 | 2300/1900 |  | US | Atlanta Fed's Raphael Bostic | |

| 07/09/2023 | 2305/1905 |  | US | Dallas Fed's Lorie Logan | |

| 08/09/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 08/09/2023 | 0600/0800 | ** |  | SE | Private Sector Production |

| 08/09/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 08/09/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 08/09/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 08/09/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/09/2023 | 1300/0900 |  | US | Fed Vice Chair Michael Barr | |

| 08/09/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/09/2023 | 1500/1100 |  | US | San Francisco Fed's Mary Daly | |

| 08/09/2023 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.