-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: MN Fed Kashkari Remains Hawkish

- MNI INTERVIEW: Fed Likely Overtightened-Ex-Boston Fed's Fuhrer

- MNI INTERVIEW: Labor Hoarding Improves Odds Of US Soft Landing

- MNI INTERVIEW: Germany Faces 10-15Y Labour Shortfall -Wise Man

- MNI US DATA: Core Durable Goods Orders See A Small Beat On Net

US

FED: The Federal Reserve has probably already gone too far in raising interest rates but officials could still hike further because they have set a low bar for doing so, former Boston Fed research director Jeff Fuhrer told MNI.

Fuhrer said the economy and the job market are likely to suffer from the Fed’s excessive tightening, which neglects the fact that inflation is already headed in the right direction.

- “The pause was better than an additional tightening, that’s the good news, but it’s not what we needed. I think it’s fair to say that up to date, cumulatively, they’ve overdone it a bit,” he said in the latest episode of MNI’s FedSpeak Podcast. Fuhrer said the inflation trend is highly encouraging.

- "I think the underlying rate of inflation today is around 2.5-3% and I think it’s going down for both the PCE and the CPI. That means inflation is going to continue to decline gradually from where it is," he said. (See MNI POLICY: Softer Trend Inflation Boosts Case For Fed Pause). For more see MNI Policy main wire at 1340ET.

US: Employers who are loath to jettison workers after going to great lengths to hire and train them during the pandemic raises the chances the U.S. labor market can cool and wage growth moderate without a spike in unemployment, Kansas City Fed economist Elior Cohen told MNI.

- Post-Covid labor shortages have limited the effect of monetary policy on the labor market and raised the chance of a soft landing, even as employers increasingly expect demand for their goods and services to weaken, he said in an interview.

- "As long as conditions remain, where you have those labor shortages and employers are still in need of those additional hands, they would be very reluctant to get rid of workers," Cohen said. "This is expected to keep unemployment rates at a very steady level."

- The Fed last week significantly upgraded its view of how the labor market will handle higher interest rates, marking down the expected rise in joblessness to just 4.1% next year versus the 4.5% peak seen in the June projections. It also said growth will be better than earlier expected and core inflation fall a tad faster.

EUROPE

GERMANY: Germany’s labour shortages could persist for more than a decade, a leading government advisor told MNI, as it grapples with a demographic crisis that threatens to raise the cost of social spending and make the country less attractive to workers and companies.

- Martin Werding, a member of the five-person German Council of Economic Experts, also said the GCEE would downgrade its growth projections for this year in November’s annual report, bringing its outlook in line with recent Bundesbank and Eurosystem assessments.

- While he agreed with Vice Chancellor Robert Habeck’s recent remark that it could take five years to get the economy back on track, Werding said structural issues could prove no less damaging, with the coalition government making little progress in addressing expected shortfalls in both workers and their social insurance contributions. For more see MNI Policy main wire at 0907ET.

US TSYS Brief Post-Auction Support, Fed Speak Remains Hawkish, Strong 5Y Sale

- Treasury futures weaker, near late session lows after bounce on strong 5Y note auction (4.659% vs. 4.672% WI) proved short lived. Dec'23 10Y futures through technical support to 107-15.5 (-20), puts focus on 107-05+ 1.382 proj of the Jul 18 - Aug 4 - Aug 10 price swing.

- Curves bear steepening again, 3M10Y +8.096 to -87.514, 2Y10Y +6.767 at -52.175 (steepest since mid-May 2023).

- Rates actually extended highs after Core durable goods orders came out stronger than expected in August preliminary data, rising 0.9% M/M (cons 0.1) but with the gloss taken off by a sizeable downward revision to -0.4% M/M (initial 0.1) in July.

- Little (or perhaps a delayed) reaction to MN Fed President Kashkari making the rounds again this morning (CNN, CNBC), reprising higher for long stance if inflation persists: "holding rates through 2024" (despite dots showing a cut next year).

- Cross asset summary: Greenback near highs (DXY +.426 at 106.657), Gold weaker (-24.5 at 1876.15), crude broadly higher (WTI +3.40 at 93.79) and stocks bounced after Senate Leader McConnell headlines re: avoiding a Govt shutdown: DJIA is down DJIA is down 56.82 points (-0.17%) at 33564.46, S&P E-Mini Future down 0.25 points (-0.01%) at 4315.25, Nasdaq up 27.7 points (0.2%) at 13092.47.

- Thursday focus: Weekly Claims, GDP, PCE, Fed Speakers inclding Chairman Powell, 7Y Note Sale.

OVERNIGHT DATA

- US PRELIM AUG. DURABLE GOODS ORDERS RISE 0.2% M/M; EST. -0.5%

- US PRELIM AUG. DURABLE GOODS EX-TRANS RISE 0.4% M/M; EST. +0.2%

US DATA: Core durable goods orders were stronger than expected in August preliminary data, rising 0.9% M/M (cons 0.1) but with the gloss taken off by a sizeable downward revision to -0.4% M/M (initial 0.1) in July.

- It leaves the 3M/3M trend rate at just 0.4% annualized, particularly tepid considering it’s a nominal measure, although as we’ve regularly pointed out it still holds up well compared to various manufacturing surveys having been firmly in contractionary territory for many months now.

- Core shipments meanwhile also surprised higher at 0.7% M/M (cons 0.0) after an unrevised -0.3% M/M. Its 3M/3M run has been more resilient at 1.5% annualized.

- US MBA: MARKET COMPOSITE -1.3% SA THRU SEP 22 WK

- US MBA: REFIS -1% SA; PURCH INDEX -2% SA THRU SEP 22 WK

- US MBA: UNADJ PURCHASE INDEX -27% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 7.41% VS 7.31% PREV

MARKETS SNAPSHOT

- Key late session market levels:

- DJIA down 28.55 points (-0.08%) at 33583.74

- S&P E-Mini Future up 5.5 points (0.13%) at 4320

- Nasdaq up 56.1 points (0.4%) at 13117.9

- US 10-Yr yield is up 7.6 bps at 4.6116%

- US Dec 10-Yr futures are down 13.5/32 at 107-22

- EURUSD down 0.0059 (-0.56%) at 1.0512

- USDJPY up 0.49 (0.33%) at 149.56

- WTI Crude Oil (front-month) up $3.39 (3.75%) at $93.77

- Gold is down $23.57 (-1.24%) at $1877.15

- European bourses closing levels:

- EuroStoxx 50 up 2.5 points (0.06%) at 4131.68

- FTSE 100 down 32.5 points (-0.43%) at 7593.22

- German DAX down 38.42 points (-0.25%) at 15217.45

- French CAC 40 down 2.23 points (-0.03%) at 7071.79

US TREASURY FUTURES CLOSE

- 3M10Y +8.151, -87.459 (L: -100.723 / H: -84.52)

- 2Y10Y +6.773, -52.169 (L: -60.12 / H: -51.56)

- 2Y30Y +4.411, -40.37 (L: -46.524 / H: -39.561)

- 5Y30Y -2.5, 4.293 (L: 1.758 / H: 7.061)

- Current futures levels:

- Dec 2-Yr futures down 3.25/32 at 101-5.875 (L: 101-04.375 / H: 101-11.125)

- Dec 5-Yr futures down 8.75/32 at 104-31.25 (L: 104-27.25 / H: 105-14.5)

- Dec 10-Yr futures down 13.5/32 at 107-22 (L: 107-15.5 / H: 108-17)

- Dec 30-Yr futures down 25/32 at 113-19 (L: 113-11 / H: 115-15)

- Dec Ultra futures down 21/32 at 118-11 (L: 118-05 / H: 120-13)

US 10Y FUTURE TECHS (Z3) Bear Trend Remains Intact

- RES 4: 111-12+ High Sep 1 key resistance

- RES 3: 110-17 50-day EMA

- RES 2: 110-07+ High Sep14

- RES 1: 109-03/109-13 Low Sep 13 / 20-day EMA

- PRICE: 107-29 @ 15:55 BST Sep 27

- SUP 1: 107-26.5 Low Sep 27

- SUP 2: 107.23 1.236 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 3: 107-05+ 1.382 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 4: 106-23 1.50 proj of the Jul 18 - Aug 4 - Aug 10 price swing

Treasuries maintain a softer tone and the contract traded lower Tuesday. Last week’s move down resulted in a breach of 109-03, the Sep 13 / 19 low, confirming a resumption of the current downtrend. Moving average studies remain in a bear mode position and this highlights a clear downtrend. The focus is on 108-00 and 107-23, the 1.236 projection of the Jul 18 - Aug 4 - Aug 10 price swing. Firm resistance is at 109-13, the 20-day EMA.

SOFR FUTURES CLOSE

- Dec 23 -0.015 at 94.525

- Mar 24 -0.035 at 94.575

- Jun 24 -0.040 at 94.750

- Sep 24 -0.050 at 950

- Red Pack (Dec 24-Sep 25) -0.07 to -0.055

- Green Pack (Dec 25-Sep 26) -0.065 to -0.06

- Blue Pack (Dec 26-Sep 27) -0.065 to -0.06

- Gold Pack (Dec 27-Sep 28) -0.06 to -0.055

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00235 to 5.31608 (-0.00143/wk)

- 3M +0.00450 to 5.39008 (-0.00973/wk)

- 6M +0.00422 to 5.46749 (-0.01206/wk)

- 12M +0.00936 to 5.46909 (-0.01654/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $96B

- Daily Overnight Bank Funding Rate: 5.32% volume: $260B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.561T

- Broad General Collateral Rate (BGCR): 5.30%, $568B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $555B

- (rate, volume levels reflect prior session)

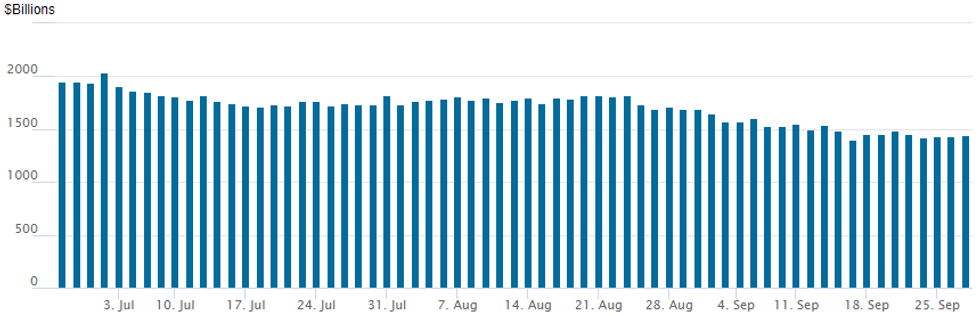

FED REVERSE REPO OPERATION

Repo operation up to 1,442.805B w/100 counterparties, compared to $1,438.301B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

$2.5B Glencore 3Pt, $1.4B Panama 2Pt Launched

Still waiting for supra-sovereigns Guatemala

- Date $MM Issuer (Priced *, Launch #)

- 09/27 $2.5B #Glencore $750M 5Y +155, $750M 7Y +180, $1B 10Y +195

- 09/27 $1.4B #Republic of Panama $1B +12Y +235, $400M 2054 Tap 7.45%

- 09/27 $600M #Western Midstream 5Y +170

- 09/27 $500M *World Bank (IBRD) 7Y SOFR+46

- 09/27 $500M #Pilgrims Pride WNG +10Y +250

- 09/27 $Benchmark NBN Co 5Y +108, 10Y +143

- 09/27 $Benchmark Guatemala 9Y 7.1%a

EGBs-GILTS CASH CLOSE: German Long-End Yields Hit Post-2011 Highs

European core yields closed on the highs Wednesday after an afternoon selloff in sympathy with US Treasuries.

- The bellies of the German and UK curves underperformed, with Bobl yields at a post-March high.

- 10Y and 30Y German yields started the day constructively but after a sell-off in the last 2 hours of trade alongside Tsys (but with no particular catalyst) closed at a new post-2011 high. UK rates sold off but in contrast the curve move was more of a bear flattening motion.

- Peripheral spreads widened amid anxiety over the Italian government's deficit forecasts due to be released after the cash close, and a broader risk-off move (equities down once again).

- Data was 2nd tier, with Euro money supply contracting more quickly than expected in August, while German and French consumer confidence was a little soft but basically in line. ECB's Elderson told MNI that policy rates have not necessarily peaked.

- MNI hosts an event with BoE's Hauser Thursday morning; we also get appearances by ECB's Holzmann and BoE's Greene.

- The September flash inflation round unofficially begins at 0630UK time Thursday with Germany's North Rhine Westphalia setting the tone for the rest of the prints through Friday morning, including Spain and the German national number Thursday. Our preview is here (PDF).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.3bps at 3.244%, 5-Yr is up 4.1bps at 2.812%, 10-Yr is up 3.5bps at 2.843%, and 30-Yr is up 2.9bps at 3.033%.

- UK: The 2-Yr yield is up 6.6bps at 4.874%, 5-Yr is up 7.4bps at 4.472%, 10-Yr is up 3.2bps at 4.358%, and 30-Yr is down 1.2bps at 4.793%.

- Italian BTP spread up 1.1bps at 194.5bps / Greek up 3.3bps at 153.3bps

FOREX Single Currency Continues to Spiral, EUR/USD Downtrend Cemented

- The single currency was the poorest performing currency in G10 Wednesday, sliding against all others to retain the solid downtrend in EUR/USD. The pair traded to a fresh cycle low of 1.0509, to extend the recent clearance of 1.0632.

- Sights are on 1.0484 next, the Jan 6 low. Moves in the EUR come ahead of the September preliminary CPI estimate due on Friday, at which markets expected headline inflation to dip below 5.0% for the first time since late 2021.

- NOK sits at the other end of the table, with the strength in oil markets remaining the primary driver. The prompt WTI crude spread rallied to its highest in over a year, lending further support to oil-tied currencies and putting the NOK at the top of the table. EURNOK is has breached the 11.40-11.60 range that has contained the pair since mid-August, meaning the 200-day EMA at 11.2735 provides the next key support. The NOK bid also allows NOKSEK to retrace yesterday's downtick, with the cross rising by ~0.7% today.

- The medium-term uptrend across the greenback continues to dominate, with concerns surrounding a possible US government shutdown at top of mind. Fed's Kashkari spoke to say that near-term economic risks from a shutdown could force the Fed to "do less" on policy than might otherwise be the case, leaving markets watching politics and Capitol Hill for any further developments. Fed's Powell hosts a town hall with educators on Thursday, at which the Q&A will be watched for any comments on policy.

- Focus Thursday turns to regional German CPI data, ahead of a national print expected to show inflation at 4.5% for the Y/Y EU harmonized release. From the US, weekly jobless claims and the tertiary read for Q2 GDP also cross.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/09/2023 | 0130/1130 | ** |  | AU | Retail Trade |

| 28/09/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 28/09/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 28/09/2023 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/09/2023 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/09/2023 | 0800/1000 | *** |  | DE | Baden Wuerttemberg CPI |

| 28/09/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/09/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 28/09/2023 | 0900/1100 | ** |  | IT | PPI |

| 28/09/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/09/2023 | 0930/1030 |  | UK | BoE's Hauser Speaks at MNI | |

| 28/09/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/09/2023 | 1230/0830 | *** |  | US | Jobless Claims |

| 28/09/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 28/09/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 28/09/2023 | 1230/0830 | *** |  | US | GDP |

| 28/09/2023 | 1300/0900 |  | US | Chicago Fed's Austan Goolsbee | |

| 28/09/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 28/09/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 28/09/2023 | 1445/1545 |  | UK | BOE's Greene speaks on panel | |

| 28/09/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 28/09/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 28/09/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 28/09/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/09/2023 | 1700/1300 |  | US | Fed Governor Lisa Cook | |

| 28/09/2023 | 1900/1500 | *** |  | MX | Mexico Interest Rate |

| 28/09/2023 | 2000/1600 |  | US | Fed Chair Jerome Powell | |

| 28/09/2023 | 2300/1900 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.