-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI ASIA OPEN: Modest Headline Risk Buoyed Tsys

- MNI POLICY: Market Inflation Signals Mainly Noise, BOE Finds

- MNI INTERVIEW: ECB Should Be Cautious In Reducing Liquidity

- MNI Macro Developments Since Jun FOMC: Labor - payrolls misses

- MNI Macro Developments Since Jun FOMC: Labor - stronger wage growth

US

FED: The single payrolls report for June was the opposite of May’s, with nonfarm payrolls growth seeing its first miss in fifteen months along with a return of downward revisions.

- Market reaction was however limited by both AHE growth and hours worked coming in stronger than expected, whilst the unemployment rate was on the low side of expectations albeit partly offset by the U6 underemployment rate rising on a strong increase in those working part-time for economic reasons.

- Specifically, nonfarm payrolls increased 209k (cons 230K) in June with a hefty two-month downward revision of -110k. It left a three-month average at 244k following a 247k that had previously been 283k.

- Further adding to the downside surprise was a larger miss for private sector payrolls at 149k (cons 200k) after a -98k two-month revision. Both are the softest rates since Dec’20 but clearly still far stronger than the long-run sustainable ~100k previously touted by Chair Powell.

- The gap on the month came from government jobs again rising by more than expected at 60k vs the implied consensus of ~25k, with government payrolls just recently overtaking accommodation to leave the latter as the sector with the largest outright losses still to make up from pre-pandemic levels.

- In the separate household survey, the unemployment rate fell from 3.65% to 3.57%, which whilst as expected at a rounded level did push back against a non-trivial number of analysts forecasting 3.7%.

- It moved back closer to April’s multi-decade low of 3.39% rather than in the direction of the median FOMC projection of 4.1% for 4Q23, itself revised down from 4.5% at the March round.

- The decline came as household employment bounced 273k after last month’s -310k, against a backdrop of the labor force increasing 130k in each of the last two months.

- However, the U6 underemployment rate offered a more dovish take, rising 0.2pts to 6.9% for its highest since August from a notable 452k increase in the number of part-time workers for economic reasons, the sharpest since Aug’19 when looking outside of two months of the pandemic.

EUROPE

BOE: Bank Of England research has cast doubt on the reliability of shorter-term market-based measures of inflation expectations often cited by policymakers as factors in their interest-rate-setting deliberations.

- Some 80-90% of price variations in the shorter end of the fast-growing UK inflation swaps market are driven by changes in liquidity rather than by perceptions of economic fundamentals , with hedge funds major players, according to ongoing research using transaction-level regulatory data by the BOE’s Robert Czech and BOE- and LSE-affiliated Ricardo Reis and Sitong Ding.

- Monetary Policy Committee members Catherine Mann and Dave Ramsden, among others, have referred to inflation swap prices in commentary on whether monetary policy is delivering price stability, but the research suggests that extracting an inflation expectations signal from the shorter end of the market is fraught with risk. For more see MNI Policy main wire at 0847ET.

ECB: The European Central Bank should avoid any hasty moves to reduce excessive banking system liquidity after its operational framework review reports back at the end of the year, its former Market Operations Chief Francesco Papadia told MNI.

- Calls from Bank for International Settlements Monetary and Economics Head Claudio Borio for a rapid return to the corridor system in place before the global financial crisis are misplaced, Papadia said in an interview, pointing to difficulties faced by the Federal Reserve in running down reserves in 2019.

- “Currently the prospect of reducing liquidity back to a balanced situation is far away. Five years is my wild guess, but my sense is it’s too early to start thinking about that and there is no urgency because one can’t say the current system has any big problems,” he said. For more see MNI Policy main wire at 0645ET.

US TSYS Markets Roundup

- Scant data to wrap up the week, Bbg US economic survey for July this morning: showed the US economy will expand 1.5% in 2023, 0.6% in 2024 and 1.9% in 2025, according to a survey conducted by Bloomberg News.

- Data picks up slightly with S&P Global PMIs. Fed speakers remain in blackout ahead next Wednesday's policy announcement.

- Friday's focus was largely on headline risk: sources pointed to Russia grain deal headline "RUSSIA FLOATS PLAN TO SUPPLY AFRICA GRAIN WITHOUT UKRAINE" FT. Treasury futures extended gains after the open, amid surge of buying in front month 10Y futures, TYU3 marks 112-13.5 high (+9) before retracing/finishing the day at 112-06.5 on modest overall volume under 900k. Curves held flatter profiles 2s10s -1.665 at -100.927, off session low of -104.021.

- Projected rate hike expectations gained slightly: July 26 FOMC is 96% w/ implied rate of +24bp to 5.318%. September cumulative of +28.2bp at 5.36%, November cumulative of 33.2bp at 5.409%, and December cumulative of 28.8bp at 5.365%. Fed terminal holding at 5.405% in Nov'23.

OVERNIGHT DATA

Scant data Friday followed by S&P Global PMI measures next Monday:

- US Data/Speaker Calendar (prior, estimate)

- Jul-21 0900 Bloomberg July United States Economic Survey: The US economy will expand 1.5% in 2023, 0.6% in 2024 and 1.9% in 2025, according to a survey conducted by Bloomberg News.

- Jul-24 0830 Chicago Fed Nat Activity Index (-0.15, --)

- Jul-24 0945 S&P Global US Manufacturing PMI (46.3, 46.1)

- Jul-24 0945 S&P Global US Services PMI (54.4, 54.1)

- Jul-24 0945 S&P Global US Composite PMI (53.2, --)

- Jul-24 1130 US Tsy $65B 13W, $58B 26W Bill auctions

- Jul-24 1300 ZUS Tsy $42B 2Y Note auction, (91282CHN4)

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 88.82 points (0.25%) at 35315.46

- S&P E-Mini Future up 12.75 points (0.28%) at 4578.5

- Nasdaq up 23.9 points (0.2%) at 14087.06

- US 10-Yr yield is down 2.1 bps at 3.829%

- US Sep 10-Yr futures are up 4/32 at 112-8.5

- EURUSD down 0.0002 (-0.02%) at 1.1127

- USDJPY up 1.7 (1.21%) at 141.77

- Gold is down $6.21 (-0.32%) at $1963.29

- EuroStoxx 50 up 17.68 points (0.4%) at 4391.41

- FTSE 100 up 17.68 points (0.23%) at 7663.73

- German DAX down 27 points (-0.17%) at 16177.22

- French CAC 40 up 47.86 points (0.65%) at 7432.77

US TREASURY FUTURES CLOSE

- 3M10Y -2.416, -158.753 (L: -162.527 / H: -156.72)

- 2Y10Y -1.989, -101.251 (L: -104.021 / H: -97.943)

- 2Y30Y -0.958, -94.413 (L: -98.182 / H: -92.207)

- 5Y30Y +0.832, -18.856 (L: -21.786 / H: -18.484)

- Current futures levels:

- Sep 2-Yr futures steady at at 101-23.25 (L: 101-21.25 / H: 101-24.25)

- Sep 5-Yr futures up 1.5/32 at 107-9 (L: 107-05 / H: 107-11.5)

- Sep 10-Yr futures up 4.5/32 at 112-9 (L: 112-02 / H: 112-13.5)

- Sep 30-Yr futures up 8/32 at 126-14 (L: 126-04 / H: 126-30)

- Sep Ultra futures up 9/32 at 134-31 (L: 134-20 / H: 135-20)

US 10Y FUTURE TECHS: (U3) Further Slippage Could Confirm Reversal

- RES 4: 114-06+ High Jun 6

- RES 3: 114-00 High Jun 13

- RES 2: 113-08 High Jul 18

- RES 1: 113-07+ 50-day EMA and a key resistance point

- PRICE: 112-04 @ 10:36 BST Jul 21

- SUP 1: 112-00 Low Jul 20

- SUP 2: 111-03+/110-05 Low Jul 11 / 6 and the bear trigger

- SUP 3: 110-00 Low Nov 9 2022 (cont)

- SUP 4: 109-14 Low Nov 8 2022 (cont)

Prices turned lower Thursday, erasing the entirety of the mid-week rally and showing through the first notable retracement support at 112-16+. The pullback concludes the run higher off the July low, however may be corrective at these levels, rather than a full reversal. This raises the importance of 111-22+ on an intraday basis. A close below here would signal scope for further losses toward 111-09+ (CPI day low) and the bear trigger further out at 110-05. The key resistance area remains 113-07+ to 113-15, the 50-day EMA and 50-dma respectively.

SOFR FUTURES CLOSE

- Sep 23 +0.005 at 94.595

- Dec 23 +0.010 at 94.650

- Mar 24 -0.015 at 94.910

- Jun 24 -0.025 at 95.270

- Red Pack (Sep 24-Jun 25) -0.025 to -0.005

- Green Pack (Sep 25-Jun 26) steadysteady0 to +0.005

- Blue Pack (Sep 26-Jun 27) +0.010 to +0.015

- Gold Pack (Sep 27-Jun 28) +0.020 to +0.025

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00665 to 5.29799 (+.06805/wk)

- 3M +0.00564 to 5.35121 (+.04132/wk)

- 6M +0.01583 to 5.42843 (+.05289/wk)

- 12M +0.05230 to 5.36150 (+.10749/wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $111B

- Daily Overnight Bank Funding Rate: 5.07% volume: $272B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.460T

- Broad General Collateral Rate (BGCR): 5.03%, $589B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $579B

- (rate, volume levels reflect prior session)

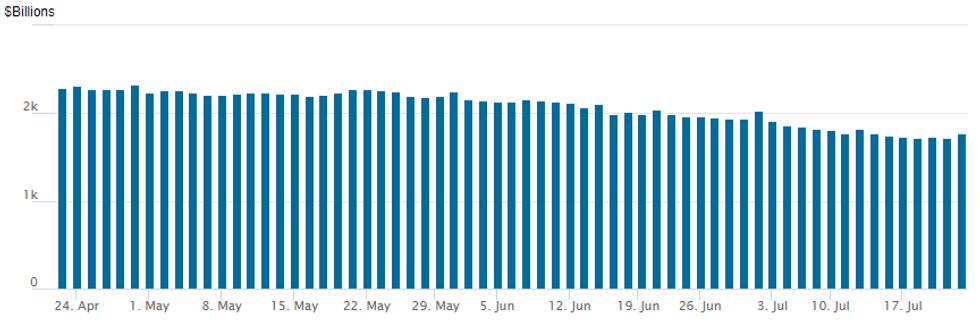

FED Reverse Repo Operation

NY Federal Reserve/MNI

The latest operation rebounds to $1,770.752B, w/99 counterparties, compared to $1,721.001B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

EGBs-GILTS CASH CLOSE: Bull Steeper Ahead Of Next Week's Data / ECB Hike

Core European FI ended a volatile week on a stronger note, with bull steepening in both the UK and German curves.

- German and UK 2Y yields fell 3+bp each as central bank hike prospects faded slightly (ECB terminal dipped 1bp, BoE 3bp).

- Any hawkish impact from stronger-than-expected UK retail sales faded quickly, with more global focus on potential dovishness from the BoJ at its meeting next week after multiple sources pieces suggested unchanged policy.

- Periphery bonds closed mixed, with Spanish yields seemingly unaffected by upcoming elections Sunday (MNI's preview is here).

- Beyond that, attention will swiftly be on Monday's flash PMI readings, then on the ECB decision Thursday and flash French/Spanish/German inflation Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3bps at 3.093%, 5-Yr is down 1.7bps at 2.554%, 10-Yr is down 2.1bps at 2.469%, and 30-Yr is down 1.6bps at 2.488%.

- UK: The 2-Yr yield is down 3.9bps at 4.955%, 5-Yr is down 1.4bps at 4.371%, 10-Yr is up 0.3bps at 4.28%, and 30-Yr is up 1.7bps at 4.429%.

- Italian BTP spread down 1bps at 160.9bps / Spanish up 1.2bps at 100.9bps

FOREX: Focus On USDJPY Recovery Ahead of Fed & BOJ Next Week

- Broad JPY weakness was the key theme across major currency markets on Friday. Concurrent BoJ sources reports raising expectations that the BoJ's yield curve control programme will be unchanged at next Friday's decision substantially weighed on the Yen. Both Bloomberg and Reuters cited sources in reporting that the board were leaning toward no change in approach, countering recent building speculation that a policy switch would be imminent.

- USDJPY (+1.12%) rallied solidly on the headlines, rising well through the recent highs to trade at the best levels since July 10th, briefly peaking at 141.96. JPY implied vols are well bid, with the one-week contract now capturing the BoJ decision and crossing 16 points to trade at the best levels since March.

- Weakness for Antipodean FX was also notable with both NZD and AUD rivalling the Yen as the weakest performers across G10. NZDUSD looks set to extend its losing streak to six trading sessions as the greenback continues to recover. Notably, the pair has now erased the entirety of the post US CPI inspired rally and now sits back below the 50 day exponential moving average, which intersected today around the 0.6200 handle.

- The main focus next week will be on the Fed meeting/decision. The FOMC is firmly expected to hike by 25 basis points and maintain its tightening bias at the July meeting. Chair Powell is likely to suggest that a follow-up hike is possible at the next meeting in September, but will emphasize that no decision has yet been made, and will depend on the substantial inflation and jobs data in the interim. Both the ECB and BOJ decisions will follow the FOMC.

- Over the weekend, attention will be on the Spanish parliamentary election before Monday’s release of European and US flash PMIs kick off the data docket.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/07/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 24/07/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 24/07/2023 | 0700/0900 | ** |  | ES | PPI |

| 24/07/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 24/07/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 24/07/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 24/07/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 24/07/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 24/07/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 24/07/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 24/07/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/07/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/07/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/07/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/07/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 24/07/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.