-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Personal Income Focus Ahead Next Week's FOMC

EXECUTIVE SUMMARY

US

US DATA: U.S. GDP growth decelerated in the fourth quarter to 2.9% but was still three-tenths higher than Wall Street expected, boosted by increases in manufacturing inventories and consumer spending on services and auto, the Bureau of Economic Analysis reported Thursday.

- Personal consumption expenditures rose 2.1% in the quarter, slowing from 2.3% in the third quarter, contributing roughly 1.5pp to overall GDP. Final sales to domestic purchasers, a measure of demand, slowed to 0.8% from 1.5% in the third quarter. A rise in manufacturing inventories as supply chain bottlenecks eased contributed another 1.5pp. Housing investment fell 26.7%, about the same as a 27.1% decline in the third quarter.

EUROPE

ECB: Eurozone core inflation will rise in coming months as dearer energy feeds through into basic products but there are no signs of a wage price spiral despite labour shortages, leading European small business association SMEunited told MNI.

- Negotiated wage increases have been around 7% to 9% across the eurozone, though Belgian firms may lose competitiveness as pay increases there reach 11%, SMEunited’s head of economic and fiscal policy Gerhard Huemer said in an interview, in which he noted that labour shortages can also have an impact, sometimes pushing wage costs higher than negotiated levels. Wages and core inflation will be crucial considerations for the European Central Bank as it weighs future interest rate increases. (See MNI SOURCES: ECB Doves Eye Smaller Hikes As Inflation Falls). For more see MNI Policy main wire at 0706ET.

US TSYS: Late Market Roundup: Yields Higher Ahead Fri's Personal Income

Tsys have another whip-saw session, weaker across the board after the bell (30YY 3.6207% +.0270) to near mid-range for the session, yield curves flatter after spending much of the day steeper (2s10s -1.022 at -69.981). Robust volumes on two-way trade (TYH3>1.1m).

- Tsys extend lows (30YY taps3.662% high) before bouncing slightly after Q4 GDP climbs 2.9% (annual rate) - higher than estimated 2.6%, The real GDP beat for the Q4 advance was much less flattering in the details, heavily boosted by changes in inventories swinging from -1.2 to +1.5pps. Weekly claims lower than exp at 186k vs. 205k est, Core Durables beat and New Home Sales stabilized.

- Tsys pared losses after strong $35B 7Y note auction (91282CGJ4) breaking string of three consecutive tails w/ 3.517% high yield vs. 3.537% WI; 2.69x bid-to-cover vs. 2.45x last month. Also of note - January was clean-sweep for Tsy coupon/bond auctions, every one trading through this month.

- Fed funds implied hike for Feb'23 at 26.4bp, Mar'23 cumulative 46.9bp to 4.798%, May'23 56.8bp to 4.897%, terminal at 4.895% in Jun'23.

- Focus turns to Friday's personal income (+0.1% vs. +0.4%) and spending (-0.3% vs. +0.1%) release, last component ahead next week Wed's FOMC policy annc.

OVERNIGHT DATA

- US Q4 GDP +2.9%: The real GDP beat for the Q4 advance (2.9% vs cons 2.6%) was much less flattering in the details, heavily boosted by changes in inventories swinging from -1.2 to +1.5pps.

- Personal consumption confounded expectations of an acceleration as it eased from 2.3% to 2.1% (cons 2.9%) whilst the drag from private investment intensified from -0.6pps to -1.2pps, its largest since the pandemic - all seasonally adjusted annualized.

- The investment hit came as non-residential investment almost paused after a strong Q3 whilst residential investment saw more of the same heavy declines (on its own dragging -1.3pps from quarterly GDP growth).

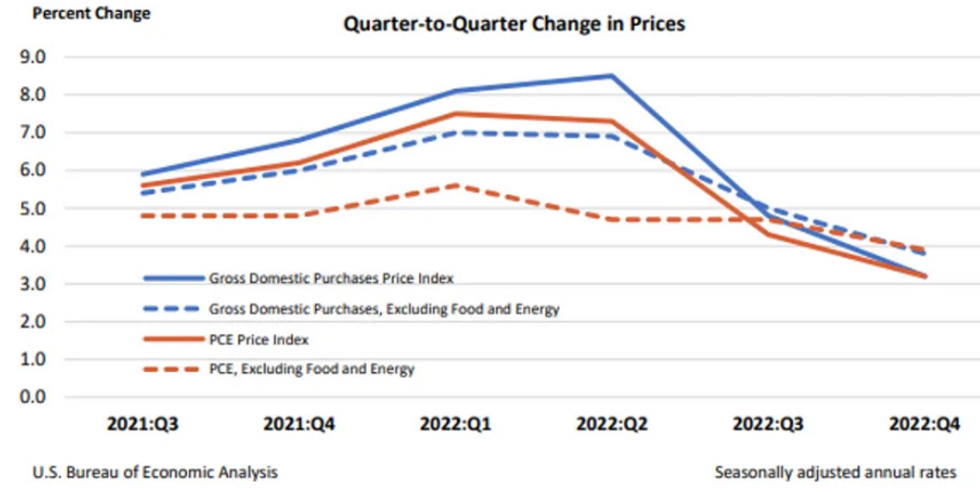

- Tallying them up and final sales to domestic purchasers (aka final domestic demand) slowed from 1.5% to 0.8% annualized, whilst the private version of this measure of 0.2% annualized was the softest since the pandemic.* On the price side, core PCE was exactly in line with expectations at 3.9% annualized.

- US 4Q CORE PCE PRICE INDEX RISES AT A 3.9% ANNUAL RATE

- US 4Q GDP PRICE INDEX RISES AT A 3.5% ANNUAL RATE; EST. 3.2%

- US NOV DURABLE GDS NEW ORDERS REV TO -1.7%

- US DEC NONDEF CAP GDS ORDERS EX-AIR -0.2% V NOV +0.0%

- US JOBLESS CLAIMS -6K TO 186K IN JAN 21 WK

- US PREV JOBLESS CLAIMS REVISED TO 192K IN JAN 14 WK

- US CONTINUING CLAIMS +0.020M to 1.675M IN JAN 14 WK

- US DEC NEW HOME SALES +2.3% TO 0.616M SAAR

- US NOV NEW HOME SALES REVISED TO 0.602M SAAR

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 153.64 points (0.46%) at 33891.44

- S&P E-Mini Future up 33.75 points (0.84%) at 4065.25

- Nasdaq up 161.4 points (1.4%) at 11473.13

- US 10-Yr yield is up 4.8 bps at 3.4892%

- US Mar 10-Yr futures are down 9.5/32 at 114-27

- EURUSD down 0.0025 (-0.23%) at 1.0891

- USDJPY up 0.65 (0.5%) at 130.24

- WTI Crude Oil (front-month) up $1.03 (1.29%) at $81.18

- Gold is down $15.08 (-0.77%) at $1930.96

- EuroStoxx 50 up 25.87 points (0.62%) at 4173.98

- FTSE 100 up 16.24 points (0.21%) at 7761.11

- German DAX up 51.21 points (0.34%) at 15132.85

- French CAC 40 up 52.11 points (0.74%) at 7095.99

US TSY FUTURES CLOSE

- 3M10Y +5.855, -117.971 (L: -126.161 / H: -115.651)

- 2Y10Y -0.795, -69.754 (L: -70.981 / H: -65.854)

- 2Y30Y -2.848, -56.596 (L: -57.448 / H: -50.241)

- 5Y30Y -1.709, 2.78 (L: 2.697 / H: 8.205)

- Current futures levels:

- Mar 2-Yr futures down 3/32 at 102-28.375 (L: 102-27.625 / H: 103-00.125)

- Mar 5-Yr futures down 7/32 at 109-14.25 (L: 109-11.25 / H: 109-23.75)

- Mar 10-Yr futures down 10/32 at 114-26.5 (L: 114-21.5 / H: 115-09)

- Mar 30-Yr futures down 12/32 at 130-14 (L: 130-00 / H: 131-08)

- Mar Ultra futures down 3/32 at 142-18 (L: 141-19 / H: 143-14)

US 10YR FUTURE TECHS: (H3) Recent Pullback Considered Corrective

- RES 4: 117-17+ 1.00 proj of the Nov 3 - Dec 13 - Dec 30 price swing

- RES 3: 117-06+ 2.0% 10-dma env

- RES 2: 117-00 High Sep 8 2022

- RES 1: 115-21/116-08 High Jan 20 / 19 and the bull trigger

- PRICE: 114-30 @ 1430ET Jan 26

- SUP 1: 114-16/14/13+ 20-day EMA / Low Jan 24

- SUP 2: 114-09+ Low Jan 17 and a key support

- SUP 3: 113-26+ Low Jan 10

- SUP 4: 112-18+ Low Jan 5

Key resistance in Treasury futures is 116-08, the Jan 19 high. The latest pullback is considered corrective and the M/T trend condition is bullish. Moving average studies are in a bull mode position and a positive price sequence of higher highs and higher lows remains intact. On the continuation chart, the 200-dma has recently been pierced. A clear break would reinforce conditions. Key support is 114-09+, Jan 17 low. A break would concern bulls.

US EURODOLLAR FUTURES CLOSE

- Mar 23 +0.005 at 95.005

- Jun 23 -0.015 at 94.920

- Sep 23 -0.035 at 95.020

- Dec 23 -0.040 at 95.355

- Red Pack (Mar 24-Dec 24) -0.07 to -0.055

- Green Pack (Mar 25-Dec 25) -0.06 to -0.05

- Blue Pack (Mar 26-Dec 26) -0.05 to -0.045

- Gold Pack (Mar 27-Dec 27) -0.045 to -0.03

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00343 to 4.30457% (-0.000057/wk)

- 1M +0.03000 to 4.54729% (+0.02401/wk)

- 3M -0.01214 to 4.80243% (-0.01314/wk)*/**

- 6M -0.00600 to 5.10229% (+0.00029/wk)

- 12M -0.03843 to 5.30086% (-0.04643/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $111B

- Daily Overnight Bank Funding Rate: 4.32% volume: $292B

- Secured Overnight Financing Rate (SOFR): 4.31%, $1.157T

- Broad General Collateral Rate (BGCR): 4.27%, $467B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $445B

- (rate, volume levels reflect prior session)

FED Reverse Repo Operation

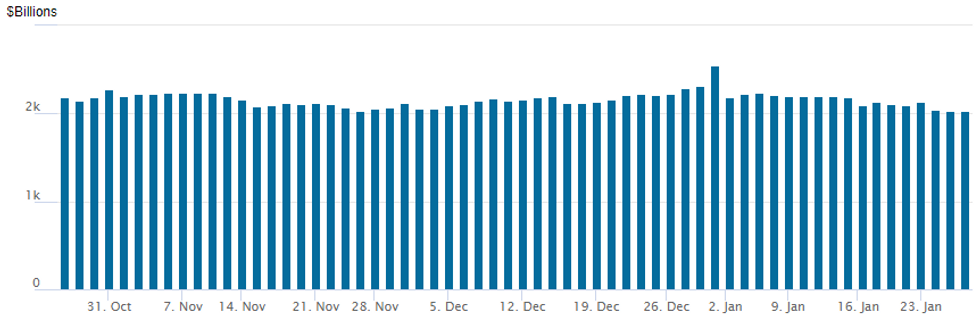

NY Fed reverse repo usage recedes to $2,024.069B w/ 97 counterparties vs. prior session's $2,031.561B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $3.65B USB 2Pt Launched

$5.4B to price Thursday

- Date $MM Issuer (Priced *, Launch #)

- 01/26 $3.65B #USB $1.65B 6NC5 +103, $3B 11NC10 +133

- 01/26 $1.25B #Kinder Morgan 10Y +175

- 01/26 $500M #Norfolk Southern 10Y +100

- 01/26 $2.75B Mauser Packaging 3.5NC1.5 investor calls

FOREX: Mixed Currency Performance Across G10 Following US Growth Data

- The US GDP beat for the Q4 advance (2.9% vs cons 2.6%) provided an initial spike for the greenback on Wednesday. However, with the details of the report much less flattening, and core PCE coming in exactly in line with expectations at 3.9% annualized, the initial USD strength almost immediately reversed course.

- Most major pairs traded back to pre-data levels as market participants digested the data, which appears very unlikely to move the needle for next week's Fed decision.

- With that said, the USD index looks set to post a quarter percent gains approaching the APAC crossover, with the data doing enough to halt the greenback slide that culminated in the DXY printing fresh trend lows at 101.50 during today’s session.

- Both CAD and CNH are topping the G10 leaderboard, with roughly half a percent gains amid the moderate advances for major equity indices. Perhaps reflecting a similar narrative, the Japanese Yen is one of the worst performers, with USDJPY consolidating back above the 130 handle.

- The pair made a new weekly low of 129.03 overnight before bouncing impressively both ahead of and post the US data. The USDJPY trend outlook remains bearish for now and resistance at 131.58, the Jan 18 high, remains intact.

- Friday’s docket is highlighted by US Core PCE Price index data, as well as personal income/spending, pending home sales and university of Michigan sentiment data.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/01/2023 | 0030/1130 | ** |  | AU | Trade price indexes |

| 27/01/2023 | 0700/0800 | ** |  | SE | Unemployment |

| 27/01/2023 | 0700/0800 | ** |  | SE | Retail Sales |

| 27/01/2023 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 27/01/2023 | 0800/0900 | *** |  | ES | GDP (p) |

| 27/01/2023 | 0900/1000 | ** |  | EU | M3 |

| 27/01/2023 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 27/01/2023 | 1500/1000 | ** |  | US | NAR pending home sales |

| 27/01/2023 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 27/01/2023 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.