-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Powell Provides Nothing New, Election Dragging On

EXECUTIVE SUMMARY:

- Fed Chair Powell reveals little in post-decision press conference

- November FOMC little more than a placeholder for December

- Release time of Summary of Economic Projections only notable 'surprise'

- Vote counting for Presidential election drags into third day

Figure 1: USD Index falling for third session

MNI POLICY: Fed Leaves Rates, QE on Hold

The Federal Reserve left official interest rates near zero Thursday and maintained the pace of its bond buying to support an economy still grappling with the Covid-19 pandemic.

"Economic activity and employment have continued to recover but remain well below their levels at the beginning of the year," the Federal Open Market Committee said in its policy statement, a change from September's description of activity and employment as having "picked up."

Policymakers left the federal funds rate in a range of zero to 0.25%, while pledging to keep buying USD80 billion in US Treasury bonds and USD40 billion in mortgage-backed securities per month.Officials said financial conditions "remain accommodative" after stating they had "improved" back in September.

The Fed again vowed to "increase its holdings of Treasury securities and agency mortgage-backed securities at least at the current pace" over coming months, though it offered no further guidance in terms of what criteria it might use to raise or reduce the pace of bond buys

MNI REALITY CHECK: Strong US Oct Job Gains, But Pace Slowing

U.S. payrolls growth continued to taper in October, with strength in goods-producing sectors offset by prolonged weakness in some service sectors, recruiters and industry experts told MNI. Surging daily Covid-19 case counts across the nation also drove some unemployed workers away from the market, potentially slowing the jobs recovery even further.

MNI POLICY: Symmetrical Target Easier To Understand - Weidmann

An explicitly symmetrical inflation target would be easier to understand than the European Central Bank's current wording, Bundesbank president Jens Weidmann said on Thursday, in remarks which come as the ECB is set to review its monetary policy strategy.

Monetary policymakers "cannot control inflation right down to the decimal point, let alone in a certain month or quarter," he told an OMFIF Virtual Panel, "but flexibility could also be achieved through design features other than a target band. In particular, the existing medium-term orientation provides a high degree of flexibility."

MNI BRIEF: Sunak Extends Furlough Scheme To March 2021

UK Chancellor of the Exchequer Rishi Sunak announced Thursday that he was extending the furlough scheme, which provides those still employed but not working, with up to 80% of their earnings, subject to a cap, through to next March. The scheme originally ended, after tapering, in October, before being extended until Dec 2 to cover the current England-wide lockdown.

MNI BRIEF: EC Ups 2020 EZ Growth Forecasts, Cuts 2021 Outlook

The European Commission has raised its Euro Area 2020 full year growth forecast to -7.8% in the Autumn projection round: https://ec.europa.eu/commission/presscorner/detail..., up from the -8.7% forecast in the Summer, with growth in 2021 now seen recovering by 4.2% (6.1%) and 3.0% in 2022. Inflation is seen at 0.3% for the whole of this year, before recovering to 1.1% through 2021 and 1.3% in 2022. Unemployment in the single currency block is now forecast to rise to 8.3 in 2020, increase to 9.4% in 2021 and then dip to 8.9% in 2022.

US TSYS SUMMARY: Fed: See You In December

The FOMC spoke about asset purchases at today's meeting but did little else, with the statement largely unchanged and Powell holding his cards close to his chest. With no expectations of any moves at this meeting, with the December FOMC eyed instead, Treasuries were unchanged throughout the Fed decision/press conference.

- That meant that Treasuries held on to losses incurred earlier in the session, with the curve mixed.

- Yields hit lows in the overnight session only to rebound over the course of the day as it became clearer we'd have an election resolution soon (Biden >90% odds of winning based on bookmakers' odds).

- Equities continued to gain throughout the day, S&P eminis >2%, dollar ~1% weaker.

- Albeit a pretty sizeable 7bps range for 10Y Tsys on the day. Futures volume strong by most standards (TYZ0s ~1.57mn contracts traded by 1600ET) but then again, slower than Wed's election-driven 2.88mn.

- The 2-Yr yield is up 0.2bps at 0.1467%, 5-Yr is up 0.3bps at 0.3307%, 10-Yr is up 0.8bps at 0.7713%, and 30-Yr is down 0.5bps at 1.5357%. Dec 10-Yr futures (TY) down 2/32 at 138-29.5 (L: 138-24.5 / H: 139-08.5)

- With the FOMC and Refunding out of the way (neither offering any surprises), the election result remains the biggest event risk - though of course nonfarm payrolls will be keenly watched Friday.

FOREX: Fed's Powell Divulges Few New Details

Powell revealed relatively little at his post-FOMC decision press conference, with markets relatively unmoved following the release. This month's meeting was always regarded as a placeholder for December, with the only newsworthy item being the change in release timings for the Summary of Economic Projections, which now come alongside the FOMC statement instead of being part of the minutes release.

In currencies, the USD fell further, narrowing the gap with the late October low for the USD index. USD implied vols remain in freefall, with with AUD/USD, USD/JPY, USD/CHF 3m vols all hitting the lowest since July. The drop in EUR/USD 3m Butterfly also reflects somewhat calmer outlook for USD -despite the contract capturing December's ECB meeting where they'll likely 'recalibrate' policy (ECB on Dec12th, FOMC on Dec16th).

USD was the weakest, NOK, AUD and NZD the strongest in G10.

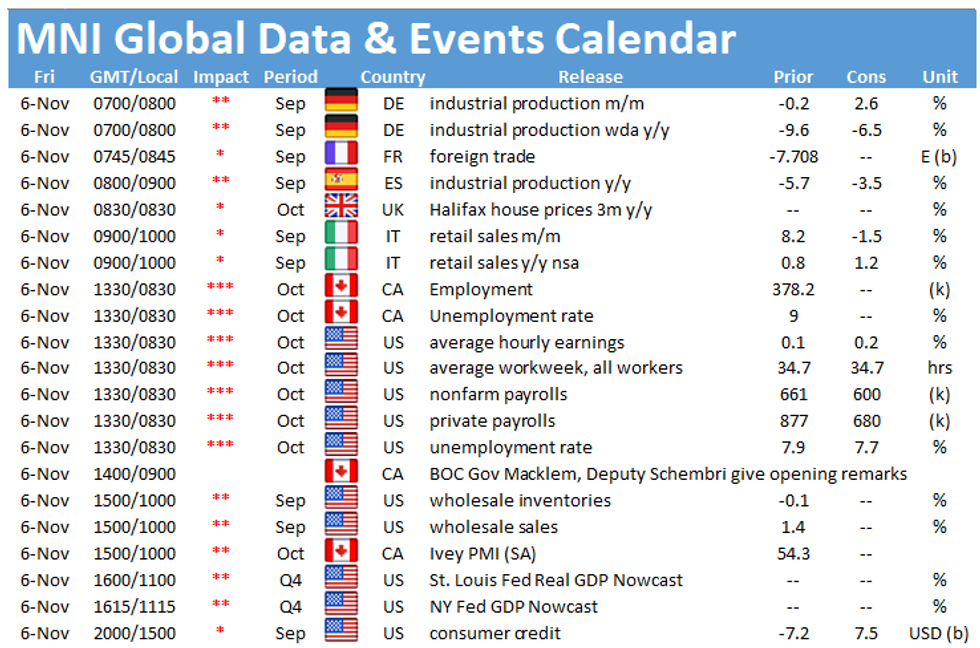

Focus Friday turns to the October Nonfarm Payrolls release. The US are expected to have added 585k jobs across the month, dragging the unemployment rate lower by a further 0.3 ppts. The RBA monetary policy statement, the Canadian jobs and further US election updates are also on the docket.

EGBs-GILTS CASH CLOSE: Gilt Rally Reverses

The core FI rally reversed, particularly in Gilts, after the BoE's GBP150bn QE announcement which exceeded the GBP100bn consensus estimate, and Chancellor Sunak's announcement of an extension of the furlough scheme until March. The UK curve bear steepened on the day. Peripheries have outperformed in what has been a risk-on session. Attention after hours is on the US Fed decision.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 0.9bps at -0.784%, 5-Yr is up 0.5bps at -0.812%, 10-Yr is up 0.1bps at -0.637%, and 30-Yr is up 0.4bps at -0.227%.

- UK: The 2-Yr yield is up 2.6bps at -0.047%, 5-Yr is up 2.2bps at -0.051%, 10-Yr is up 2.7bps at 0.234%, and 30-Yr is up 3.7bps at 0.801%.

- Italian BTP spread down 2bps at 130.5bps

- Spanish bond spread down 0.2bps at 72.8bps

- Portuguese PGB spread up 1bps at 71.3bps

- Greek bond spread down 2.5bps at 146.9bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.