-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: PPI Miss Keeps Yr End Policy Pivot Alive

EXECUTIVE SUMMARY

US

FED: The U.S. jobless rate should peak at 4.5% next year when interest rates are at their highest before retreating again, resulting in a soft landing for the economy, Federal Reserve Bank of Philadelphia President Patrick Harker said Tuesday.

- He also reiterated that rate hikes will slow in "upcoming months" and the FOMC is likely to hold rates at a restrictive stance for a while starting next year to let tighter monetary policy work its way through the economy.

- By 2024, the unemployment should fall to 4%, "which suggests that, even as we tighten monetary policy, labor markets will stay quite healthy," he said in remarks prepared for the Global Interdependence Center. For more see MNI Policy main wire at 0900ET.

- In an essay titled “On Long and Variable Lags in Monetary Policy,” Bostic says a large body of research suggests it can take 18 months to two years or more for tighter monetary policy to materially affect inflation but pointed out another school of thought indicates the lags may be shorter.

- "Still, monetary policy unquestionably works with a lag," he said. "So, we at the FOMC calibrate policy today knowing we won’t see its full impact on inflation for months. In those circumstances, we must look to economic signals other than inflation as guideposts along our path."

US TSYS: Risk Off on Stray Missile Induced Volatility

Tsys firmer, back near early session highs after second half risk-off driven volatility. Risk-off early in second half after unconfirmed reports of "stray" missile strike in Poland near Ukraine border. Tsys bounced as risk-off action ensued amid sporadic headlines and calls for security council meetings in Poland and Hungary. Pentagon officials are aware of the reports but can't corroborate.

- Tsys surged higher this morning after lower than forecasted PPI (MoM +0.2% vs. 0.4% est; YoY +8.0% vs. +8.3% est) saw Tsys extend early rally past last Thursday's post-CPI levels.

- BLS: The index for final demand goods moved up 0.6 percent in October, the largest advance since a 2.2-percent rise in June. Most of the October increase can be traced to a 2.7 percent jump in prices for final demand energy.

- FI support cooled after Philly Fed Harker, Fed Gov Cook and lastly Atlanta Fed Bostic offered cautionary opinions/outlooks: Harker: doesn't like to "base policy on a couple headline number", yet sees the Fed "going on hold some point next year". Cook: HAVE TO BE CAREFUL HOW MONETARY POLICY IS WIELDED, Bbg. Bostic: sees "glimmers of hope" that inflation is cooling, but expects more hikes as tighter money has not yet constrained business activity enough to seriously dent inflation.

- Year end pivot/hike step-down gains traction: Fed funds implied hike for Dec'22 at 50.9bp, Feb'23 cumulative 85.7bp to 4.70%, terminal funds rate 4.9% in May'23/Jun'23 (5.08% pre-CPI).

OVERNIGHT DATA

- US OCT FINAL DEMAND PPI +0.2%, EX FOOD, ENERGY +0.0%

- US OCT FINAL DEMAND PPI EX FOOD, ENERGY, TRADE SERVICES +0.2%

- US OCT FINAL DEMAND PPI Y/Y +8.0%, EX FOOD, ENERGY Y/Y +6.7%

- US OCT PPI: FOOD +0.5%; ENERGY +2.7%

- US OCT PPI: GOODS +0.6%; SERVICES -0.1%; TRADE SERVICES -0.5%

- US NY FED EMPIRE STATE MFG INDEX 4.5 NOV

- US NY FED EMPIRE MFG NEW ORDERS -3.3 NOV

- US NY FED EMPIRE MFG EMPLOYMENT INDEX 12.2 NOV

- US NY FED EMPIRE MFG PRICES PAID INDEX 50.5 NOV

- US REDBOOK: NOV STORE SALES +7.2% V YR AGO MO

- US REDBOOK: STORE SALES +6.8% WK ENDED NOV 12 V YR AGO WK

- CANADIAN SEP MANUFACTURING SALES +0.0% MOM

- CANADA SEP FACTORY INVENTORIES +1.3%; INVENTORY-SALES RATIO 1.73

- CANADA SEP WHOLESALE SALES +0.1%; EX-AUTOS -0.1%

- SEP WHOLESALE INVENTORIES +1.2%: STATISTICS CANADA

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 93.2 points (0.28%) at 33634.52

- S&P E-Mini Future up 36.75 points (0.93%) at 4003.5

- Nasdaq up 174.9 points (1.6%) at 11373.58

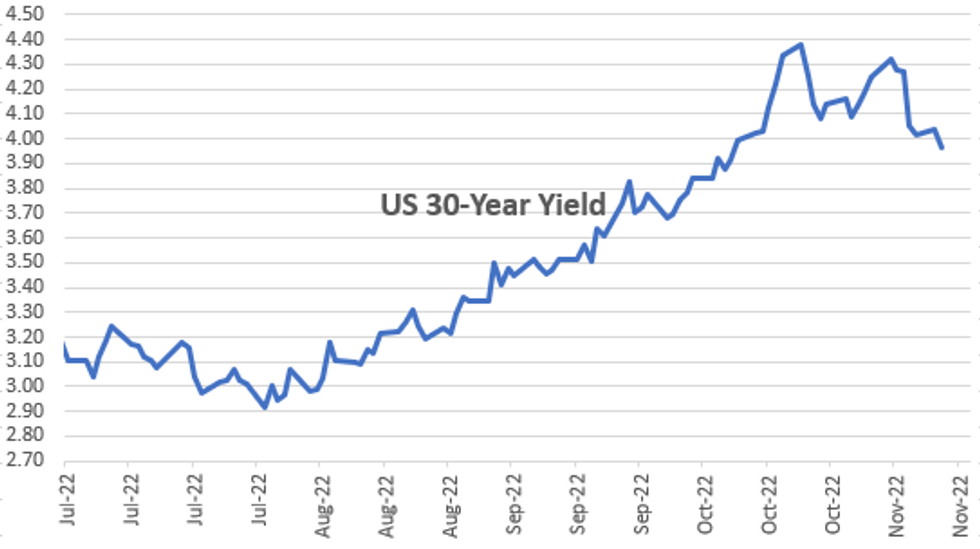

- US 10-Yr yield is down 6.5 bps at 3.7882%

- US Dec 10Y are up 16/32 at 112-20

- EURUSD up 0.0037 (0.36%) at 1.0364

- USDJPY down 0.85 (-0.61%) at 139.03

- WTI Crude Oil (front-month) up $0.92 (1.07%) at $86.79

- Gold is up $8.4 (0.47%) at $1779.91

- EuroStoxx 50 up 27.58 points (0.71%) at 3915.09

- FTSE 100 down 15.73 points (-0.21%) at 7369.44

- German DAX up 65.21 points (0.46%) at 14378.51

- French CAC 40 up 32.49 points (0.49%) at 6641.66

US TSY FUTURES CLOSE

- 3M10Y -12.267, -44.125 (L: -46.98 / H: -31.887)

- 2Y10Y -3.172, -57.315 (L: -59.41 / H: -52.058)

- 2Y30Y -3.821, -39.716 (L: -41.26 / H: -32.643)

- 5Y30Y +0.487, 4.776 (L: 2.797 / H: 9.624)

- Current futures levels:

- Dec 2Y up 2.625/32 at 102-13.75 (L: 102-10.625 / H: 102-15.875)

- Dec 5Y up 11/32 at 108-01 (L: 107-20.25 / H: 108-08.75)

- Dec 10Y up 16/32 at 112-20 (L: 112-00.5 / H: 112-31.5)

- Dec 30Y up 1-02/32 at 124-23 (L: 123-16 / H: 125-03)

- Dec Ultra 30Y up 2-0/32 at 132-08 (L: 130-06 / H: 132-14)

US 10YR FUTURE TECH: (Z2) 50-Day EMA Cracking

- RES 4: 115-14+ 50.0% retracement of the Aug 2 - Oct 21 downleg

- RES 3: 114-17 High Sep 20

- RES 2: 113-30 High Oct 4 and a key resistance

- RES 1: 112-31+ High Nov 15

- PRICE: 112-17 @ 1500ET Nov 15

- SUP 1: 111-03+/109-10+ 20-day EMA / Low Nov 04

- SUP 2: 108-26+ Low Oct 21 and the bear trigger

- SUP 3: 108-06+ Low Oct 2007 (cont)

- SUP 4: 107.16+ 3.0% 10-dma envelope

Short-term trend conditions in Treasuries remain bullish following last week’s gains. Resistance at 111-31, the Oct 27 high, has been cleared and the contract has pierced the 50-day EMA, at 112-12+. The clear break of this EMA would strengthen the case for short-term bulls and open 113-30, the Oct 4 high and a key resistance. On the downside, key support has been defined at 108-26+, the Oct 21 low. Initial support lies at 111-03+, the 20-day EMA.

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.008 at 94.993

- Mar 23 +0.035 at 94.825

- Jun 23 +0.030 at 94.815

- Sep 23 +0.040 at 95.080

- Red Pack (Dec 23-Sep 24) +0.080 to +0.175

- Green Pack (Dec 24-Sep 25) +0.105 to +0.160

- Blue Pack (Dec 25-Sep 26) +0.070 to +0.090

- Gold Pack (Dec 26-Sep 27) +0.070 to +0.080

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00500 to 3.81357% (-0.00129/wk)

- 1M +0.01700 to 3.90357% (+0.02828/wk)

- 3M +0.00585 to 4.64971% (+0.04357/wk) * / **

- 6M -0.01886 to 5.08500% (+0.00100/wk)

- 12M -0.02343 to 5.46014% (+0.00885/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.64971% on 11/10/22

- Daily Effective Fed Funds Rate: 3.83% volume: $99B

- Daily Overnight Bank Funding Rate: 3.82% volume: $284B

- Secured Overnight Financing Rate (SOFR): 3.79%, $1.041T

- Broad General Collateral Rate (BGCR): 3.75%, $429B

- Tri-Party General Collateral Rate (TGCR): 3.75%, $405B

- (rate, volume levels reflect prior session)

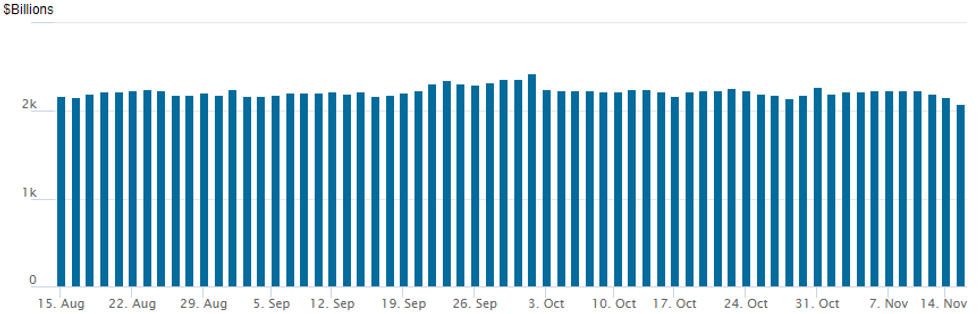

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,086.574B w/ 99 counterparties vs. $2,200.586B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

$6B Philip Morris 5Pt Jumbo Launched

Larger than anticipated Philip Morris 5pt jumbo contributed to dip in rates earlier in second half.- Date $MM Issuer (Priced *, Launch #)

- 11/15 $6B #Philip Morris $1B 2Y +85, $750M 3Y +95, $1.5B 5Y +135, $1.25B 7Y +180, $1.5B 10Y +200

- 11/15 $1.5B #Santander UK 4NC3 +265

- 11/15 $1.5B *BNG Bank 1.5Y SOFR+18

- 11/15 $1.5B United Rentals 7NC3, 6.125% a

- 11/15 $800M *CAF 3Y SOFR+125

- 11/15 $800M #Texas Instruments $300M 2Y +35, $500M +5Y +70

- 11/15 $750M #Oneok 10Y +230

- 11/15 $Benchmark BNY Mellon MNC2 +85

- Expected to issue Wednesday:

- 11/15 $1B Kommuninvest 2Y SOFR +18a

EGBs-GILTS CASH CLOSE: BTPs Outperform

Yields fell sharply across the German and UK curves Tuesday, but periphery EGBs outperformed as the risk rally continued.

- Bunds and Gilts strengthened for most of the morning session, cresting in the early afternoon after a soft US producer prices print added further fuel to the "peak inflation" narrative.

- While that rally partially reversed, yields closed at around late-morning levels.

- The short end outperformed on both curves: ECB terminal rate pricing (2.90%) dipped a few bp; BoE steady at 4.90%.

- 10Y BTP spreads hit another fresh post-July low below 200bp as stocks continued to gain and the dollar weakened.

- Attention after the cash close turns to ECB's Elderson and Holzmann.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 4.6bps at 2.17%, 5-Yr is down 1.6bps at 2.066%, 10-Yr is down 3.9bps at 2.108%, and 30-Yr is down 5.1bps at 2.052%.

- UK: The 2-Yr yield is down 5.8bps at 3.101%, 5-Yr is down 4.5bps at 3.314%, 10-Yr is down 7.3bps at 3.295%, and 30-Yr is down 2.6bps at 3.471%.

- Italian BTP spread down 8.5bps at 194.9bps / Spanish down 3.6bps at 101.6bps

FOREX: Volatile Session Amid US Data, Late Russian Missile Reports

- Currency markets traded in volatile fashion on Tuesday, with the greenback initially extending its most recent weakness before sharply reversing in late US trade.

- Strength in equity markets was weighing on the greenback overnight with the USD index extending the most recent weakness following the US inflation data last week. A set of weaker producer price data from the US exacerbated this dollar weakness with the USD index extending its four-day decline to 5.1%.

- Likely profit taking after moves appeared stretched on an intra-day basis prompted some moderation with the greenback edging higher throughout the US trading session. This greenback recovery, however, gained significant traction amid headlines that Russian missiles had strayed into Poland from Ukraine, potentially causing two deaths.

- The greenback firmed across the board with EURUSD briefly trading back below 1.03 handle with a considerable turnaround from the post-PPI highs of 1.0479 earlier in the session. 1.0272/0163 Low Nov 14 / 11 are the immediate points of support before more significant support at 1.0094, High Oct 27.

- As markets await details of the event and an emergency meeting in Poland, risk sentiment has stabilised and the USD has slipped back into negative territory approaching the APAC crossover.

- Overall strength in equity markets continues to underpin the likes of AUD and NZD as well as Cable, that have all risen over 1% on Tuesday. Underpeforming on the day are the Swiss Franc and Chinese Yuan, remaining close to unchanged on the day.

- Australian Wage Price Index will be published overnight before UK and Canadian CPI data on Wednesday. US retail sales report for October highlights the US data docket.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/11/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 16/11/2022 | 0700/0700 | *** |  | UK | Producer Prices |

| 16/11/2022 | 0900/1000 | *** |  | IT | HICP (f) |

| 16/11/2022 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 16/11/2022 | 0930/0930 | * |  | UK | ONS House Price Index |

| 16/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 16/11/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 16/11/2022 | - |  | ID | G20 Summit in Indonesia | |

| 16/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 16/11/2022 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 16/11/2022 | 1330/0830 | *** |  | CA | CPI |

| 16/11/2022 | 1330/0830 | *** |  | US | Retail Sales |

| 16/11/2022 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 16/11/2022 | 1415/0915 | *** |  | US | Industrial Production |

| 16/11/2022 | 1415/1415 |  | UK | BOE Treasury Select Committee hearing on Nov Monetary Policy Report | |

| 16/11/2022 | 1450/0950 |  | US | New York Fed's John Williams | |

| 16/11/2022 | 1500/1000 | * |  | US | Business Inventories |

| 16/11/2022 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 16/11/2022 | 1500/1600 |  | EU | ECB Lagarde Speech at European School Frankfurt Anniversary | |

| 16/11/2022 | 1500/1600 |  | EU | ECB Panetta at ABI's Executive Committee Meeting | |

| 16/11/2022 | 1500/1000 |  | US | Fed Vice chair for Supervision Michael Barr | |

| 16/11/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 16/11/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 16/11/2022 | 1935/1435 |  | US | Fed Governor Christopher Waller | |

| 16/11/2022 | 2100/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.