-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Projected Yr End Rate Cut Recedes

- MNI INTERVIEW: Atlanta Fed Wage Tracker Shows Deceleration

- MNI BRIEF: US Mulls Regulation of Money-Market, Hedge Funds

- MNI INTERVIEW: EU States To Try To Revive China Investment Deal

- MNI DATA: Surprise Further, And Solid, Gains For Flash April US PMIs

US

FED: U.S. wage growth continues to cool alongside other signs of normalization in the labor market, a trend that bodes well for returning inflation to 2%, Federal Reserve Bank of Atlanta economist John Robertson said in an interview.

- The three-month moving average of wage growth for the median U.S. earner dipped to 6.1% in January and February from a high of 6.7% last summer, according to the Atlanta Fed Wage Tracker. Robertson downplayed a rebound to 6.4% in March, attributing it to a very low December reading that dropped out of calculations rather than the start of a new upward trend. The wage tracker uses microdata from the Bureau of Labor Statistics' monthly household survey to compare wages of the same person 12 months apart.

- The figures signal a likely further easing in the BLS's employment cost index, the Fed's preferred measure of wages and benefits trends. ECI data for the first quarter is due April 28 just before the FOMC begins deliberations on how much higher rates need to go. (See: MNI INTERVIEW: Fed Close to Done As Credit Tightens-Kroszner) For more see MNI Policy main wire at 0712ET.

US: The Biden administration is moving to make it easier to more closely regulate nonbank financial institutions such as hedge funds and money-market funds, Treasury Secretary Janet Yellen said, proposing a rollback of Trump-era procedures.

- The Financial Stability Oversight Council, a group of top federal regulators, is proposing to change the way it designates nonbanks as systemically important, Yellen said. That label currently only applies to the nations’ largest banks and allows extra oversight from the Federal Reserve. “The existing guidance — issued in 2019 — created inappropriate hurdles as part of the designation process,” she said.

- “We are proposing revisions to certain elements of the Council’s existing guidance that have made it difficult to use its nonbank designation authority,” Yellen said. Regulators voted unanimously for the new framework.

US DATA: The S&P Global US PMI bucked expectations of a decline across the board in the preliminary April report, with services rising from 52.6 to 53.7 (cons 51.5) and manufacturing up from 49.2 to 50.4 (cons 49.0).

- The press release notes the latest composite reading (up from 52.3 to 53.5) is indicative of GDP growth just over 2% annualized, with business activity regaining growth momentum after contracting over the seven months to January.

- For services, it marks the fourth consecutive monthly increase to leave it at the highest since Apr’22, a greater recovery from notably lower levels than that seen in the ISM Services. The upturn in service output was “solid overall, as greater employment and stronger demand supported the increase.”

- “Selling prices increased at a sharper pace, as firms responded to higher cost burdens by passing these through to customers where possible amid more accommodative demand conditions. The rate of inflation accelerated for the third month running and was the quickest since last August.”

EUROPE

EU/CHINA: European Union states are likely to make big efforts to revive the currently stalled EU-China Comprehensive Agreement on Investment in coming months, the vice chair of the European Parliament’s International Trade Committee told MNI.

- “What I hear behind the curtains is a lot of noise in the last month about CAI and I hear that member states when they assemble in the Council will ask for the CAI to be reconsidered,” Iuliu Winkler said.

- Another EU source suggested that the CAI may appear on the agenda of an informal EU foreign ministers’ meeting scheduled for mid-May. France and Germany are said to be keen on pushing ahead with the CAI, although there has also been talk that it could be implemented in a series of smaller deals, which might not require a full ratification procedure by the Parliament.

- The comments follow a recent series of high-level visits to Beijing by the leaders of France, Germany, Spain and the European Commission aimed at stabilising EU-China economic relations despite increasingly hawkish noises and trade measures from Brussels and Washington. For more see MNI Policy main wire at 1015ET.

US TSYS: Strong Flash April US PMIs Take Air Out of Year-End Rate Cut

- Treasury futures reverse early session gains to moderately lower after the S&P Global PMIs for April came out much stronger than expected (MFG 40.4 vs. 49.0; Srvcs 53.7 vs. 51.5; Comp 53.5 vs. 51.2 est).

- Front month 10Y futures hit a pre-data high of 115-00 (3.4977% low yld) before falling to a post-data low of 114-13 (-8; yield rebounding to 3.5776% high) amid renewed selling ahead the weekend.

- Reminder, Fed Gov Cook will discuss economic research at 1600ET before the Federal Reserve enters policy blackout at midnight tonight through May 4.

- From a technical perspective, 10Y futures remain in a short-term downtrend and the recovery since Thursday is considered corrective - for now. The contract has recently traded through the 20- and 50-day EMAs and pierced 114-00. This signals scope for weakness to 113-23, a Fibonacci retracement.

- Fed funds implied hike for May'23 remains largely static at 22bp, Jun'23 +29bp cumulative at 5.118%, while projected rate cuts later in the year receded following this morning's data: Nov'23 cumulative -5.2bp vs. 11bp earlier to 4.776%, Dec'23 cumulative -24.1bp vs. -31bp at 4.776%. Fed Terminal currently at 5.11% in Jul'23.

OVERNIGHTH DATA

- US APR FLASH S&P MANUF PMI 50.4 (FCST 49.0); MAR 49.2

- US APR FLASH S&P SERVICES PMI 53.7 (FCST 51.5); MAR 52.6

- US APR FLASH S&P COMPOSITE PMI 53.5 (FCST 51.2); MAR 52.3

- The press release notes the latest composite reading (up from 52.3 to 53.5) is indicative of GDP growth just over 2% annualized, with business activity regaining growth momentum after contracting over the seven months to January.

CANADA DATA: Retail Sales: Mixed Feb, Weak March Advance. Mixed retail sales figures for Feb, with total sales better than expected at -0.2% M/M (cons and Feb advance of -0.6) after an initial +1.4% M/M in Jan, but sales ex-autos surprisingly falling -0.7% M/M (cons 0.0%) after an initial +0.9%. More notably though, the March advance is reported with a heavy decline of -1.4% M/M.

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 11.47 points (0.03%) at 33795.53

- S&P E-Mini Future up 3 points (0.07%) at 4155.5

- Nasdaq up 16.7 points (0.1%) at 12074.72

- US 10-Yr yield is up 4 bps at 3.5718%

- US Jun 10-Yr futures are down 6/32 at 114-15

- EURUSD up 0.0007 (0.06%) at 1.0977

- USDJPY down 0.03 (-0.02%) at 134.21

- Gold is down $26.08 (-1.3%) at $1978.88

- EuroStoxx 50 up 23.73 points (0.54%) at 4408.59

- FTSE 100 up 11.52 points (0.15%) at 7914.13

- German DAX up 85.69 points (0.54%) at 15881.66

- French CAC 40 up 38.29 points (0.51%) at 7577

US TREASURY FUTURES CLOSE

- 3M10Y +1.426, -154.855 (L: -164.438 / H: -153.037)

- 2Y10Y -0.76, -62.235 (L: -63.402 / H: -57.719)

- 2Y30Y -1.007, -41.652 (L: -42.882 / H: -35.633)

- 5Y30Y -0.273, 10.928 (L: 10.035 / H: 14.227)

- Current futures levels:

- Jun 2-Yr futures down 1.125/32 at 102-30.625 (L: 102-29.875 / H: 103-04.5)

- Jun 5-Yr futures down 3/32 at 109-7 (L: 109-05.25 / H: 109-19)

- Jun 10-Yr futures down 6/32 at 114-15 (L: 114-13 / H: 115-00)

- Jun 30-Yr futures down 14/32 at 129-28 (L: 129-24 / H: 130-30)

- Jun Ultra futures down 21/32 at 139-0 (L: 138-28 / H: 140-14)

US 10YR FUTURE TECHS: (M3) Corrective Bounce

- RES 4: 117-01+ High Mar 24 and bull trigger

- RES 3: 116-30 High Apr 5 / 6

- RES 2: 116-08 High Apr 12

- RES 1: 114-29/115-23 20-day EMA / High Apr 14

- PRICE: 114-18 @ 1230ET Apr 20

- SUP 1: 113-30+ Low Apr 19

- SUP 2: 113-23 50.0% retracement of the Mar 3 - 24 bull run

- SUP 3: 113-08+ Low Mar 15

- SUP 4: 112-30 61.8% retracement of the Mar 3 - 24 bull run

Treasury futures remain in a short-term downtrend and the latest recovery is considered corrective - for now. The contract has recently traded through the 20- and 50-day EMAs and pierced 114-00. This signals scope for weakness to 113-23, a Fibonacci retracement. On the upside, initial firm resistance to watch is at 114-29, the 20-day EMA. A break of this average is required to ease the current bearish threat.

SOFR FUTURES CLOSE

- Jun 23 -0.005 at 94.910

- Sep 23 -0.025 at 95.120

- Dec 23 -0.025 at 95.480

- Mar 24 -0.020 at 95.945

- Red Pack (Jun 24-Mar 25) -0.015 to -0.005

- Green Pack (Jun 25-Mar 26) -0.03 to -0.015

- Blue Pack (Jun 26-Mar 27) -0.04 to -0.035

- Gold Pack (Jun 27-Mar 28) -0.045 to -0.045

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00622 to 4.97052 (+.07746/wk)

- 3M -0.00285 to 5.06775 (+.08487/wk)

- 6M -0.01130 to 5.08834 (+.14532/wk)

- 12M -0.04554 to 4.88247 (+.19820/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00000 to 4.80671%

- 1M +0.01043 to 5.02043%

- 3M -0.01757 to 5.25514% */**

- 6M -0.03872 to 5.43457%

- 12M -0.05157 to 5.40900%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.26500% on 4/17/23

- Daily Effective Fed Funds Rate: 4.83% volume: $115B

- Daily Overnight Bank Funding Rate: 4.82% volume: $281B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.281T

- Broad General Collateral Rate (BGCR): 4.76%, $527B

- Tri-Party General Collateral Rate (TGCR): 4.76%, $521B

- (rate, volume levels reflect prior session)

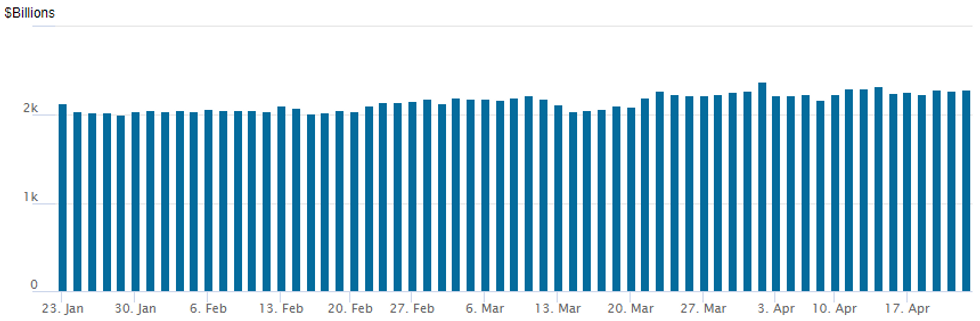

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,290.0239B w/ 105 counterparties, compares to prior $2,277.259B. All-time record high of $2,553.716B reached December 30, 2022; high usage for 2023: $2,375.171B on Friday March 31, 2023

PIPELINE: Foreign/Domestic Names Issue Over $50B Debt on Week

No new corporate bond issuance Friday after $50.45B total priced on the week:

- Date $MM Issuer (Priced *, Launch #)

- 04/21 $Benchmark Hungarian Export-Import Bank 5Y investor calls

- 04/21 $Benchmark Seacor Marine 5Y investor calls

- $2.35B Priced Thursday

- 04/20 $1B *Japan Finance for Municipalities (JFM) 5Y SOFR+81

- 04/20 $1.35B *United Mexican States 30Y +260

- $24.75B Priced Wednesday

- 04/19 $8.5B *Bank of America $3.5B 6NC5 +148, $5B 11NC10 +168*

- 04/19 $7.5B *Morgan Stanley $1.5B 3Y +80, $2.75B 6NC5 +145, $3.25B 11NC10 +165

- 04/19 $4B *Canadian Government Bond 5Y +11

- 04/19 $2.5B *Bank of NY Mellon $1.5B 4NC3 +97, $1B 11NC10 +137

- 04/19 $1.25B *New Development Bank (NEWDEV) 3Y SOFR+125

- 04/19 $1B *Kommuninvest WNG -3Y SOFR+27

EGBs-GILTS CASH CLOSE: Bunds Underperform As Services PMIs Surprise

Gilts outperformed Bunds Friday in a session highlighted by much stronger-than-expected flash Services PMIs offset somewhat by weak Manufacturing readings.

- Overall the hawkish impact from the European PMI readings was short-lived, with a strong reading in the US equivalent required to send Bund yields decisively higher with the German curve bear steepening,

- The UK curve saw some twist flattening, with yield rises possibly restrained by a mixed-to-weak UK retail sales reading.

- In a continuation of this week's ECB speaker theme, de Guindos and Vujcic had no discernible market impact.

- Periphery EGB spreads were little changed on the day, as were ECB / BoE hike prospects.

- We highlighted several sell-side BoE view changes this week following strong CPI/wage data.

- Ratings reviews after hours Friday include Greece, Italy, France, Ireland, and the UK. Focus next week will be on prelim April euro area national PMIs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.6bps at 2.921%, 5-Yr is up 2.9bps at 2.521%, 10-Yr is up 3.6bps at 2.481%, and 30-Yr is up 4.5bps at 2.55%.

- UK: The 2-Yr yield is up 1.5bps at 3.746%, 5-Yr is down 0.8bps at 3.621%, 10-Yr is down 0.9bps at 3.758%, and 30-Yr is down 0.8bps at 4.097%.

- Italian BTP spread up 0.1bps at 187.1bps / Spanish down 0.2bps at 103.9bps

FOREX: Greenback Spikes On US Data, Pares Gains Into The Close

- The USD had been trading on the back foot on Friday before stellar US data prompted a spike to the best levels of the session. Above expectation manufacturing and services PMIs saw the USD index rally the best part of half a percent with a notable uptick for USDJPY. However, the greenback pared these gains into the close and looks set to post a very minor adjustment for the week with expectations for the May FOMC meeting looking set in stone.

- The poorest performers are AUD & NZD across the final session of the week, undoing the late rally across AUD/USD and NZD/USD into the Thursday close. NZD/USD printed down at 0.6127 ahead of the NY crossover following on from the weak NZ CPI data seen early Thursday. This represents the lowest level since early March, narrowing the gap with key support of 0.6085.

- USDCAD has drifted 0.5% higher on Friday, nearing 1.3550 again. The pair has seen a 1.3% advance on the week in a solid reversal of prior oversold conditions. There was limited reaction in the pair to CAD retail sales with a weak March advance release (caveated by a low response rate), but it helps CAD underperform. 1.3582 remains in focus, the 50% retrace of Mar 10-Apr 14 bear leg.

- EURUSD has showed a degree of resilience, hovering just below the 1.10 mark. However, it is worth noting that price action has been limited within Monday’s 90 pip range all week as markets await further tier-one US data and monetary policy decisions from both the Fed and the ECB over the next two weeks.

- The highlight on Monday will be the German IFO Survey: The IFO sentiment index is seen stalling at 93.3 in April, after five consecutive months of improvement. Highlights for the week ahead include advanced US Q1 GDP and German Flash CPI readings. Australian CPI and a BOJ meeting are also on the docket.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/04/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 24/04/2023 | 0900/1100 |  | EU | ECB Panetta Panels Event by Bruegel Think Tank | |

| 24/04/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 24/04/2023 | 1330/1530 |  | EU | ECB Panetta Into at ECON Hearing on Digital Euro | |

| 24/04/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 24/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.