-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Reversing Late 2022 Curve Steepening

EXECUTIVE SUMMARY

US

FED: A few things to watch in the December FOMC minutes (released Wednesday at 1400ET.

- Expect the minutes to emphasize Powell's message that "we have more work to do", with participants putting greater focus on "how long do we remain restrictive", and "not so important how fast we go".

- Markets interpreted Powell's press conference comments mostly dovishly, especially on a possible 25bp hike in February vs Dec's 50bp. One area of focus in the minutes will be the degree to which participants anticipated a further step-down, and what inflation/job conditions would allow that to happen.

- Recall at the meeting: the Dot Plot was more hawkish than most had expected in terms of the terminal rate (5.00-5.25% in 2023, with an upward skew in the distribution). The minutes could flesh out some of the participants' thinking on how long rates need to be held at a "sufficiently restrictive" level.

- By the same token, of interest will be whether and to what degree the minutes push back against market pricing for rate cuts (Powell said they "weren't considering" cuts), and whether there was any concern about the ongoing easing of financial conditions via market expectations.

- Look for more color on the discussion around the inflation outlook, and in particular Powell's comment "overwhelmingly FOMC participants believe that inflation risks are to the upside so I can't tell you confidently that we won't move up our estimate of the peak rate again at the next SEP."

- Ahead of Friday's payrolls - which is the only employment report between the Dec FOMC and the Feb 1 decision - discussion re labor market tightness will be in focus, with Powell emphasizing a cooler jobs market being required to reduce services inflation.

- Powell said in the press conference "we do see a very, very strong labor market, one where we haven't seen much softening."

- With basically no change made to the December statement, it would be interesting to see if there was any movement among doves to more firmly signal that they anticipated a pause in the hike cycle would be coming soon (vs maintaining the guidance for "ongoing" hikes).

US TSYS: Rates Paring Early Gains, Heavy Rate Lock Hedging

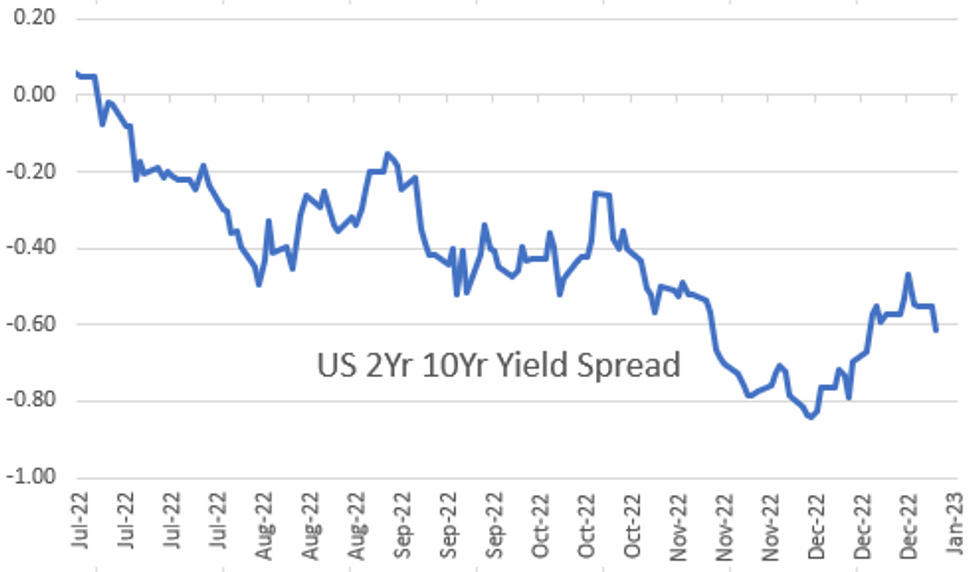

Tsys hold firmer by the close, but well off first-half highs, yield curves bull-flattening on wide ranges (2s10s -6.060 at -61.783; -64.324L, -50.971H)).

- Tsys broke narrow range in late overnight trade, largely tracking German bunds, particularly after latest German CPI reading for Dec: below exp (-0.8% MoM vs. -0.6% est, 8.6% YoY vs. 9.0% est).

- FI support eased after US S&P Global manufacturing PMI was unrevised in the final December reading at 46.2, leaving it down from 47.7 in Nov and the lowest since May'20.

- Coming ahead of tomorrow's ISM manufacturing survey, the confirmed decline in the PMI goes against the sizeable bounce in last week's MNI Chicago PMI from 37.2 to 44.9 (albeit clearly from weaker levels).

- Heavy corporate bond issuance helped keep rate rally in check amid rate lock hedging vs more than $30B debt issuance across the curve.

- Focus turns to Dec FOMC minutes release Wed at 1400, APD private employ data (150k est vs. 127k prior) on Thursday and headline NFP data (+200k est vs. +263k prior) Friday at 0830ET.

OVERNIGHT DATA

- US NOV CONSTRUCT SPENDING +0.2%

- US NOV PRIVATE CONSTRUCT SPENDING +0.3%

- US NOV PUBLIC CONSTRUCT SPENDING -0.1%

- US FINAL DEC MANUF. PMI 46.2 (FLSH 46.2); NOV 47.7

- Coming ahead of tomorrow's ISM manufacturing survey, the confirmed decline in the PMI goes against the sizeable bounce in last week's MNI Chicago PMI from 37.2 to 44.9 (albeit clearly from weaker levels).

- Some key points from the press release:

- "The downturn stemmed from weak client demand which drove faster contractions in output and new orders".

- Ahead of Friday's payrolls report "muted domestic and foreign customer demand led to a slower rise in employment. Staffing numbers rose only fractionally as pressure on capacity waned and backlogs of work fell sharply."

- Softer prices: "Lower prices for some inputs such as metals and fuel led to the slowest uptick in cost burdens since July 2020. In an effort to drive sales and pass on cost savings, firms hiked their selling prices at the softest pace for just over two years."

MARKETS SNAPSHOT

Key late session market levels- DJIA down 53.4 points (-0.16%) at 33089.35

- S&P E-Mini Future down 17.75 points (-0.46%) at 3842.5

- Nasdaq down 81.9 points (-0.8%) at 10382.35

- US 10-Yr yield is down 8 bps at 3.7953%

- US Mar 10-Yr futures are up 10/32 at 112-19.5

- EURUSD down 0.0111 (-1.04%) at 1.0556

- USDJPY up 0.12 (0.09%) at 130.93

- WTI Crude Oil (front-month) down $3.15 (-3.92%) at $77.13

- Gold is up $13.18 (0.72%) at $1837.05

- EuroStoxx 50 up 26.2 points (0.68%) at 3882.29

- FTSE 100 up 102.35 points (1.37%) at 7554.09

- German DAX up 112.41 points (0.8%) at 14181.67

- French CAC 40 up 29.32 points (0.44%) at 6623.89

US TSY FUTURES CLOSE

- 3M10Y -5.499, -58.517 (L: -68.078 / H: -56.846)

- 2Y10Y -5.664, -61.387 (L: -64.396 / H: -50.971)

- 2Y30Y -5.135, -52.038 (L: -55.143 / H: -41.702)

- 5Y30Y -1.677, -5.938 (L: -7.689 / H: 2.96)

- Current futures levels:

- Mar 2-Yr futures up 0.375/32 at 102-17.625 (L: 102-16.875 / H: 102-21.875)

- Mar 5-Yr futures up 2.75/32 at 108-0.5 (L: 107-31 / H: 108-12)

- Mar 10-Yr futures up 10.5/32 at 112-20 (L: 112-12.5 / H: 113-03.5)

- Mar 30-Yr futures up 27/32 at 126-6 (L: 125-03 / H: 127-06)

- Mar Ultra futures up 38/32 at 135-16 (L: 133-28 / H: 136-31)

US 10YR FUTURE TECHS: (H3) Short-Term Corrective Bounce

- RES 4: 114-17 76.4% retracement of the Dec 13 - 30 bear leg

- RES 3: 114-01+ High Dec 21

- RES 2: 113-15+ High Dec 23

- RES 1: 113-09+ 20-day EMA

- PRICE: 112-31 @ 15:12 GMT Jan 3

- SUP 1: 112-12+/111-28 Intraday low / Low Dec 30

- SUP 2: 111-27+ 61.8% retracement of the Nov 3 - Dec 13 rally

- SUP 3: 111-01 76.4% retracement of the Nov 3 - Dec 13 rally

- SUP 4: 110-22 Low Nov 10

Treasury futures have recovered from the late December lows and the contract traded firmer Tuesday. The trend condition remains bearish and short-term gains appear to be a correction. Recent weakness through a number of support points suggest scope for a continuation lower near-term. A resumption of weakness would open 111-27+ next, a Fibonacci retracement. On the upside, resistance to watch is at 113-09+, the 20-day EMA.

US EURODOLLAR FUTURES CLOSE

- Mar 23 -0.010 at 94.915

- Jun 23 -0.010 at 94.825

- Sep 23 +0.010 at 94.935

- Dec 23 +0.015 at 95.225

- Red Pack (Mar 24-Dec 24) +0.010 to +0.025

- Green Pack (Mar 25-Dec 25) +0.035 to +0.040

- Blue Pack (Mar 26-Dec 26) +0.035 to +0.050

- Gold Pack (Mar 27-Dec 27) +0.045 to +0.055

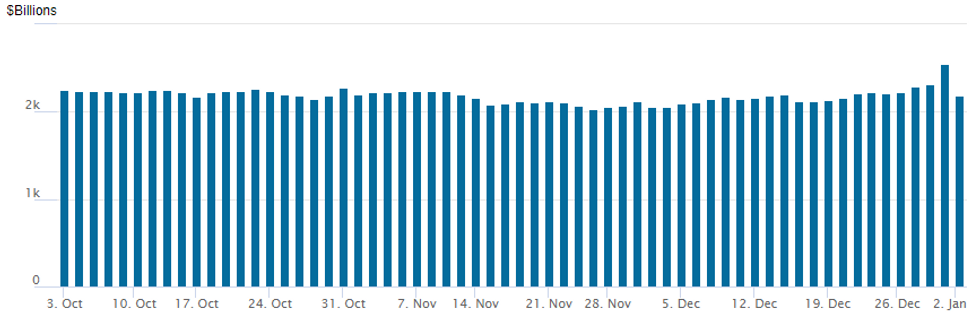

FED Reverse Repo Operation: Off Year-End Record High

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,188.272B w/ 99 counterparties vs. last Friday's record high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30).

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00086 to 4.31886% (+0.00129 total last wk)

- 1M +0.00972 to 4.40129% (+0.00471 total last wk)

- 3M +0.01457 to 4.78186% (+0.04176 total last wk)*/**

- 6M -0.00272 to 5.13614% (-0.01428 total last wk)

- 12M -0.03528 to 5.44686% (+0.03828 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.78186% on 1/3/23

- Daily Effective Fed Funds Rate: 4.33% volume: $67B

- Daily Overnight Bank Funding Rate: 4.33% volume: $126B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.004T

- Broad General Collateral Rate (BGCR): 4.26%, $354B

- Tri-Party General Collateral Rate (TGCR): 4.26%, $325B

- (rate, volume levels reflect prior session)

PIPELINE: Late Corporate Bond Issuance Roundup

$28.425B launched on day - still waiting for SocGen 4pt and TD 2pt - should push total issuance over $30B. 75% of the estimated $40B for week as accts rush to secure funding after plying sidelines for all of December (worst month on record w/ under $8B).

- Date $MM Issuer (Priced *, Launch #)

- 1/03 $5.8B #SMFG $1.5B 3Y +130, $300M 3Y SOFR+143, $1.5B 5Y +160, $1B 7Y +185, $.5B 10Y +200

- 1/03 $4B #United Mexican States $1.25B 5Y +150, $2.75B 12Y +260

- 1/03 $4B #UBS $1.75B 4NC3 +155, $2.25B 11NC10 +220

- 1/03 $2.3B #John Deere $1.2B 3Y +65, $1.1B 3Y SOFR, 5Y +85

- 1/03 $2.15B #MetLife $650M 3Y +83, $500M 5Y +113, $1B 31Y +140

- 1/03 $1.8B #Duke Energy Carolinas $900M each: 10Y +120, 30Y +145

- 1/03 $1.75B #Enterprise Products Op $750M 3Y +90, $1B 10Y +160

- 1/03 $1.75B #Targa Resources $900M 10Y +235, $850M 30Y +275

- 1/03 $1.5B #Santander UK 6NC5 +260

- 1/03 $1.5B #Com Bank of Australia (CBA) $1.2B 2Y +68, $300M 2Y SOFR+63

- 1/03 $975M #ComEdison $400M 10Y +115, $575M 30Y +140

- 1/03 $900M #Caterpillar 3Y +63

- 1/03 $Benchmark SocGen 4NC3 +230, 6NC5 +255, 11NC10 +295, 30Y +350

- 1/03 $Benchmark TD 3Y +95, 3Y SOFR, 5Y +125

- Expected Wednesday:

- 1/04 $Benchmark EIB 5Y SOFR+41a

EGBs-GILTS CASH CLOSE: Early Gains Fade

European bond yields closed mostly lower Tuesday, though well off session lows. Germany's curve bull flattened, with the UK's twist flattening, and periphery EGB spreads tightened modestly.

- Weaker-than-expected German inflation data initially drove EGB and Gilt yields lower, in the first full trading session of 2023 (Gilts were closed Monday).

- But bonds pared gains later in the session, with short-end and intermediate Gilt yields fully round-tripping.

- The afternoon session's weakness is not easily explained by any particular catalyst, though the UK move appeared to match a rebound in the GBP vs USD, with a bit of a lag.

- Though there was no sovereign bond supply today, Austria and Slovenia announced mandates, and there was a fairly busy EUR corporate issuance slate. Weds sees Germany sell E5bln of Schatz.

- French flash Dec inflation features early Wednesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.9bps at 2.67%, 5-Yr is down 5.8bps at 2.418%, 10-Yr is down 5.5bps at 2.389%, and 30-Yr is down 8.7bps at 2.313%.

- UK: The 2-Yr yield is up 2bps at 3.595%, 5-Yr is unchanged at 3.618%, 10-Yr is down 2.1bps at 3.651%, and 30-Yr is down 0.2bps at 3.954%.

- Italian BTP spread down 0.7bps at 211.3bps / Spanish down 0.4bps at 106.6bps

FOREX: Greenback Consolidates Solid Gains To Start New Year

- Despite a firm start for major equity index futures and the EuroStoxx50 topping its mid-December resistance, the greenback was the strongest currency across G10 in early trade on Tuesday. The USD index has since consolidated these gains amid renewed equity weakness and looks set to post a 1% advance to start the year.

- Despite a strong wave of JPY buying in APAC trade, which saw USDJPY slip to near seven-month lows of 129.52, the subsequent greenback strength has seen EUR, CHF AUD and NZD leading the weakness in G10.

- Weaker than expected German CPI data was the key contributor to the single currency weakness ahead of key Eurozone releases later this week. EURUSD has traded sharply lower and in the process has breached support at the 20-day EMA at 1.0587 and briefly traded below 1.0528, the Dec 13 low. Continued weakness may expose a key short-term support at 1.0443, the Dec 7 low.

- AUD/USD had breached the Dec29 low to near the 50-dma of 0.6662. Weakness through the moving average would open 0.6629 and levels not seen since mid-November. Similarly, NZD/USD did trade through the 200-dma of 0.6232 with the focus on first support at 0.6156.

- On Wednesday the ISM Manufacturing PMI and JOLTS job openings are main data points before the release of the FOMC December meeting minutes. Focus then quickly turns to Friday’s US employment report.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/01/2023 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 04/01/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 04/01/2023 | 0730/0830 | *** |  | CH | CPI |

| 04/01/2023 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 04/01/2023 | 0745/0845 | *** |  | FR | HICP (p) |

| 04/01/2023 | 0815/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 04/01/2023 | 0845/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 04/01/2023 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 04/01/2023 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 04/01/2023 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 04/01/2023 | 0930/0930 | ** |  | UK | BOE M4 |

| 04/01/2023 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 04/01/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 04/01/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 04/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 04/01/2023 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 04/01/2023 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 04/01/2023 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 05/01/2023 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.