-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Risk Appetite Improves, ECB Hikes, BoJ up Next

- MNI INTERVIEW: Fed ‘Skip’ Heralds Premature Pause-Ex-Staffer

- MNI Fed Review - June 2023: Unconvinced By The Dots

- MNI INTERVIEW: Canada House Building Hit By Rates, Shortages

- MNI WATCH: ECB Signals More Hikes, Raises Inflation Projection

- MNI Initial Jobless Claims Surprisingly Confirm Prior Jump

US

FED: The Federal Reserve’s decision to forego another interest rate hike this week could make officials more reluctant to raise borrowing costs at future meetings, leading to a premature pause that will fail to bring inflation sustainably back to the central bank's 2% target, ex-New York Fed executive Rick Roberts told MNI Thursday.

- That’s because not raising rates in June despite recent hot economic data ranging from inflation to employment raises the bar for future increases, he said, adding that Fed Chair Powell’s press conference did little to clarify the outlook.

- “I don’t think they will hike in July,” he said. “With one more round of data before the next meeting, it’s hard to imagine what could be so different that you’ll come off the pause.” For more see MNI Policy main wire at 1335ET.

FED: The June FOMC meeting outcome was more hawkish than expected, with the Dot Plot guiding to a further 50 basis points of rate hikes this year, and Chair Powell clearly signaling that July is “live” for a hike.

- The reaction to the meeting was mixed, with many market participants asking why the Fed didn’t simply raise rates now, if they foresee at least two more hikes this year.

- Market hike pricing didn’t rise significantly, with analysts divided over whether June’s communications were merely a compromise to satisfy hawkish participants opposed to holding rates in June.

- The dovish market reaction in Powell’s press conference underscored how the “actual” current FOMC stance was seen as more nuanced, if not more dovish, than the Dots shock implied.

- In the end the FOMC will probably be satisfied with 2023 rate cuts being further priced out, with a July hike likely but still uncertain.

CANADA

CANADA: High interest rates and material costs are likely to constrain Canadian home construction activity for some time, with the government’s goal of doubling house building well out of reach as project completions face eight-week delays because of problems sourcing items like garage doors, the head of the national homebuilding group told MNI.

- The average eight-week delay has only nudged down from ten-week hold-ups at the height of the Covid pandemic, says Kevin Lee, CEO of the Canadian Home Builders’ Association in Ottawa. Even as global supply chains show improvement prices are also often much higher now, said Lee, whose group expects housing starts to fall 30% this year.

- “It’s getting better but there are still delays,” he said. “At the top of our list right now, still of things that are hard to get in terms of construction products, is garage doors.” For more see MNI Policy main wire at 1134ET.

EUROPE

ECB: The European Central Bank raised its deposit rate by 25bp to 3.5% on Thursday and signaled another quarter-point hike next month after revising higher its inflation forecasts.

- President Christine Lagarde repeated last month’s assertion that the ECB has more to do to bring inflation back to target in a timely fashion, with June’s Eurosystem staff macroeconomic projections adding 0.1 percentage point to headline inflation across the forecast horizon versus March, to 5.4% in 2023, 3.0% in 2024 and 2.2% in 2025.

- “Are we done? Have we finished the journey? No. We're not at the destination,” Lagarde said. “Do we still have ground to cover? Yes, we still have ground to cover. Barring a material change in our baseline scenario, it is very likely that we will continue to increase rates in July,” she added.

- Some of the tightening effect from previous decisions has been seen already, with financing conditions reacting “forcefully” to increases in interest rates, she said.

US TSYS: Risk Appetite Improved, Market Discounting Fed Forward Guidance

- Risk appetite improved in late trade, Treasury futures trading sideways but inching higher after the bell while equity indexes remain strong, SPX at the best levels since April 2022 as markets faded the hawkish forward guidance from Wednesday's FOMC.

- Tsy showed little reaction to an anticipated 25bp rate hike from the ECB, rallied sharply after another upside weekly jobless claims print (+262k vs. +245k est after last week's +261k), brief selling on stronger than expected retail sales print (+0.3% vs. -0.2% exp) evaporated as core comes out in-line.

- SOFR futures holding mildly weaker in the lead quarterly as Fed Chair Powell comment that "July is live" yesterday is taken seriously. Chances of a 25bp hike next at the July 26 FOMC is approximately 67% with Fed funds implied at 16.7bp. September cumulative at +20.7bp to 5.288%, November cumulative 19.7bp to 5.277%. while December cumulative recedes to 10.8bp to 5.190%. At the moment, Fed terminal at 5.280% in Oct'23.

- Treasury technicals, despite today's rally, futures remain in a downtrend and this week’s move lower confirmed a resumption of the trend. Support at 112-29+, May 26 / 30 low has been cleared. This signals scope for the 112-00 handle, the Mar 10 low. Further out, bearish price action suggests scope for a move towards 110-27+, the Mar 2 low and a key support. Gains are considered corrective - for now. Initial firm resistance is at 114-00, Tuesday’s high.

- Focus turns to Bank of Japan's policy announcement early Friday. Fed exits policy blackout tonight, Barkin, Bullard and Waller on tap tomorrow. Early NY data U. of Mich. Sentiment (59.2, 60.0) at 1000ET.

OVERNIGHT DATA

- US MAY RETAIL SALES +0.3%; EX-MOTOR VEH +0.1%

- US APR RETAIL SALES REVISED +0.4%; EX-MV +0.4%

- US MAY RET SALES EX GAS & MTR VEH & PARTS DEALERS +0.4% V APR +0.5%

- US MAY RET SALES EX MTR VEH & PARTS DEALERS +0.1% V US MAY +0.4%

- US MAY RET SALES EX AUTO, BLDG MATL & GAS +0.2% V APR +0.6%

- US MAY RETAIL SALES CONTROL GROUP +0.2% V APR +0.6%

- US MAY RET SALES EX AUTO, BLDG MATL & GAS +0.2% V APR +0.6%

- US MAY RETAIL SALES CONTROL GROUP +0.2% V APR +0.6%

- US JOBLESS CLAIMS +0K TO 262K IN JUN 10 WK

- US PREV JOBLESS CLAIMS REVISED TO 262K IN JUN 03 WK

- US CONTINUING CLAIMS +0.020M to 1.775M IN JUN 03 WK

US DATA: Initial jobless claims again surprised to the upside at 262k (cons 245k) in the week to Jun 10 after last week’s surprise jump to 261k was confirmed (revised up to 262k).

- The increase pushes back on the idea that last week’s seasonally adjusted increase could have been exaggerated by extra noise around holiday weeks and more heavily implies a genuine slowing in labor market momentum. The four-week average increased to 247k from 238k prior, pushing above the 240k in later March/early April to its highest since Nov’21.

- Non-seasonally adjusted claims support the increase, jumping from 220k to 249k to the high end of typical non-pandemic years. Continuing claims meanwhile saw a smaller upside surprise, rising to 1775k (cons 1768k) from 1755k

- US JUN PHILADELPHIA FED MFG INDEX -13.7

- US MAY IMPORT PRICES -0.6%

- MAY EXPORT PRICES -1.9%; NON-AG -1.8%; AGRICULTURE -2.1%

- US MAY INDUSTRIAL PROD -0.2%; CAP UTIL 79.6%

- US APR IP REV TO +0.5%; CAP UTIL REV 79.8%

- US MAY MFG OUTPUT +0.1%

- US NY FED EMPIRE STATE MFG INDEX 6.6 JUN

- US NY FED EMPIRE MFG NEW ORDERS 3.1 JUN

- US NY FED EMPIRE MFG EMPLOYMENT INDEX -3.6 JUN

- US NY FED EMPIRE MFG PRICES PAID INDEX 22.0 JUN

- US APR BUSINESS INVENTORIES +0.2%; SALES +0.1%

- US APR RETAIL INVENTORIES +0.1%

- CANADIAN APR MANUFACTURING SALES +0.3% MOM

- CANADA APR FACTORY INVENTORIES -0.0%; INVENTORY-SALES RATIO 1.71

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 462.66 points (1.36%) at 34438.48

- S&P E-Mini Future up 60.5 points (1.37%) at 4478.75

- Nasdaq up 184.9 points (1.4%) at 13809.8

- US 10-Yr yield is down 6.6 bps at 3.7204%

- US Sep 10-Yr futures are up 20/32 at 113-16

- EURUSD up 0.0119 (1.1%) at 1.0949

- USDJPY up 0.17 (0.12%) at 140.24

- WTI Crude Oil (front-month) up $2.33 (3.41%) at $70.61

- Gold is up $16.48 (0.85%) at $1959.14

- EuroStoxx 50 down 10.86 points (-0.25%) at 4365.12

- FTSE 100 up 25.52 points (0.34%) at 7628.26

- German DAX down 20.67 points (-0.13%) at 16290.12

- French CAC 40 down 37.62 points (-0.51%) at 7290.91

US TREASURY FUTURES CLOSE

- 3M10Y -2.591, -150.291 (L: -154.181 / H: -142.485)

- 2Y10Y -0.9, -91.502 (L: -95.859 / H: -90.205)

- 2Y30Y +1.817, -78.962 (L: -88.476 / H: -78.719)

- 5Y30Y +4.107, -6.756 (L: -17.034 / H: -6.585)

- Current futures levels:

- Sep 2-Yr futures up 4.125/32 at 102-9.625 (L: 102-00.375 / H: 102-10.5)

- Sep 5-Yr futures up 13/32 at 108-5.25 (L: 107-14.5 / H: 108-06)

- Sep 10-Yr futures up 20/32 at 113-16 (L: 112-16 / H: 113-18)

- Sep 30-Yr futures up 27/32 at 127-27 (L: 126-08 / H: 128-10)

- Sep Ultra futures up 26/32 at 136-28 (L: 135-06 / H: 137-30)

US 10YR FUTURES TECHS: (U3) Bounce Considered Corrective - For Now

- RES 4: 115-19 High May 18

- RES 3: 115-00 High Jun 1 and a key resistance

- RES 2: 114-06+ / 114-23 High Jun 6 / 50-day EMA

- RES 1: 114-00 High Jun 13

- PRICE: 113-14+ @ 18:19 BST Jun 15

- SUP 1: 112-12+ Low Jun 14

- SUP 2: 112-00 Low Mar 10

- SUP 3: 111-14+ Low Mar 9

- SUP 4: 110-27+ Low Mar 2 and key support

Treasury futures remain in a downtrend and this week’s move lower confirmed a resumption of the trend. Support at 112-29+, May 26 / 30 low has been cleared. This signals scope for the 112-00 handle, the Mar 10 low. Further out, bearish price action suggests scope for a move towards 110-27+, the Mar 2 low and a key support. Gains are considered corrective - for now. Initial firm resistance is at 114-00, Tuesday’s high.

SOFR FUTURES CLOSE

- Jun 23 -0.005 at 94.795

- Sep 23 +0.015 at 94.715

- Dec 23 +0.045 at 94.850

- Mar 24 +0.070 at 95.195

- Red Pack (Jun 24-Mar 25) +0.085 to +0.095

- Green Pack (Jun 25-Mar 26) +0.105 to +0.110

- Blue Pack (Jun 26-Mar 27) +0.085 to +0.10

- Gold Pack (Jun 27-Mar 28) +0.070 to +0.085

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.01129 to 5.09059 (-.04811/wk)

- 3M -0.00194 to 5.21617 (-.03321/wk)

- 6M +0.02158 to 5.28853 (+.00242/wk)

- 12M +0.06656 to 5.21940 (+.07123/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.01071 to 5.07614%

- 1M -0.01185 to 5.14629%

- 3M +0.00528 to 5.51371 */**

- 6M -0.02300 to 5.62843%

- 12M +0.06000 to 5.87886%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.54443% on 6/9/23

- Daily Effective Fed Funds Rate: 5.08% volume: $128B

- Daily Overnight Bank Funding Rate: 5.06% volume: $290B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.397T

- Broad General Collateral Rate (BGCR): 5.03%, $634B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $611B

- (rate, volume levels reflect prior session)

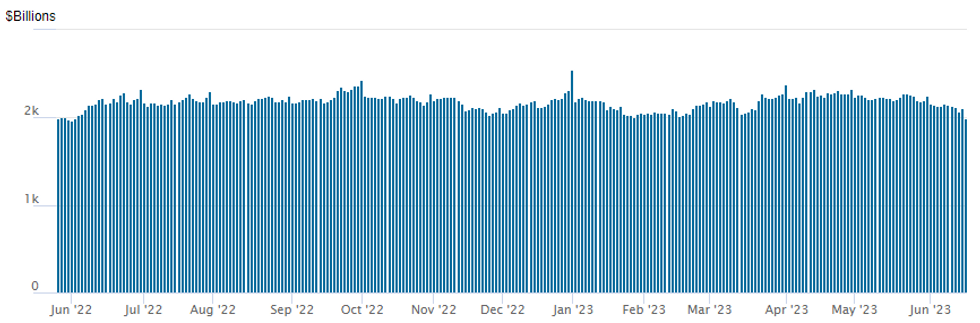

FED Reverse Repo Operation: Usage Below $2T First Time Since June '22

NY Federal Reserve/MNI

NY Fed reverse repo usage falls below $2T for first time since June 2, 2022 to $1,992.140B w/ 103 counterparties, compared to $2,109.105B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $500M Bank of China NY 3Y Priced

- Modest corporate debt issuance resumes

- Date $MM Issuer (Priced *, Launch #)

- 06/15 $575M #Peco Energy WNG 10Y +120

- 06/15 $500M *Bank of China NY 3Y +45

EGBs-GILTS CASH CLOSE: Short End Underperforms As ECB Eyes July Hike

The German curve twist flattened Thursday as the ECB hiked by the expected 25bp and Pres Lagarde cemented expectations for a further raise in July. Gilts outperformed Bunds slightly, but the UK curve likewise twist flattened.

- Schatz sold off on the ECB decision, which included an unexpected upgrade to the 2025 inflation forecast.

- While Lagarde underpinned hike pricing for the next meeting ("very likely we will continue to increase rates in July"), unexpectedly weak US jobless claims figures helped drag global yields back down and ultimately yields finished off their session highs.

- Periphery spreads tightened with the exception of Greece, which saw widening for the 4th consecutive session following last Friday's lack of a positive ratings action from Fitch.

- Friday's morning's focus will be the final, detailed Eurozone readings, along with several ECB speakers including Holzmann, Rehn, Muller, Centeno, and Villeroy.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 11bps at 3.126%, 5-Yr is up 9.8bps at 2.605%, 10-Yr is up 5.2bps at 2.504%, and 30-Yr is down 0.4bps at 2.58%.

- UK: The 2-Yr yield is up 8.5bps at 4.907%, 5-Yr is up 6.3bps at 4.535%, 10-Yr is down 0.8bps at 4.384%, and 30-Yr is down 5.7bps at 4.502%.

- Italian BTP spread down 1bps at 162.6bps / Greek up 4.4bps at 135.7bps

FOREX: EURUSD Closing On The Highs, Rises 1.1% As ECB Dust Settles

- EURUSD rallied sharply higher Thursday, extending the bull cycle that started at 1.0635 on May 31. A number of important retracement points have been cleared, reinforcing bullish conditions and this signals scope for an extension higher. The European Central Bank raised its deposit rate by 25bp to 3.5% on Thursday and signalled another quarter-point hike next month after revising higher its inflation forecasts.

- The renewed strength for the single currency suddenly brings the April highs of 1.1095 back into focus for EURUSD. Between here and there, 1.0986, the 76.4% retracement of the Apr 26 - May 31 swing may provide the first resistance.

- The pair has soared 1.25% on Thursday, and trades at its highest level since 2008, reaching the next objective for the rally at 153.62, a Fibonacci projection. The next topside level of note is 154.62, another projection level before 155.00, psychological round number resistance.

- The USD index has fallen 0.80% amid a strong rally for major equity benchmarks. Landing with the deluge of US data at, import prices offered a mildly weaker than expected take which may have assisted the broad greenback weakness.

- The weaker dollar and risk on tone has benefitted the likes of AUD (+1.37%), the strongest performer across G10 bar the Norwegian Krone. GBPUSD (+0.92%) also extended on its recent surge, with the pair closing in on the 1.28 handle.

- Friday will see the June BOJ decision where the broad consensus looks for no change at this meeting. Market expectations have moved away from a potential YCC tweak this week, with July now seen as a more likely window for an adjustment. The European morning's focus will be the final, detailed Eurozone readings of CPI, along with several ECB speakers including Holzmann, Rehn, Muller, Centeno, and Villeroy.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/06/2023 | 0200/1100 | *** |  | JP | BOJ policy announcement |

| 16/06/2023 | 0700/0300 |  | US | St. Louis Fed's James Bullard | |

| 16/06/2023 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 16/06/2023 | 0830/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 16/06/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 16/06/2023 | 1145/0745 |  | US | Fed Governor Christopher Waller | |

| 16/06/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 16/06/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 16/06/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 16/06/2023 | 1300/0900 |  | US | Richmond Fed's Tom Barkin | |

| 16/06/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.