-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: S&P Global US PMIs Surprise

- MNI INTERVIEW: Canada Budget To Offer Housing 'Base Hits'-Page

- MNI ECB WATCH: ECB Set For First Rates Pause Since July 2022

- MNI Flash PMIs Offer Soft Landing Evidence

US TSYS Flash PMIs Gains Weigh on Short Rates

- Tsy futures holding mildly mixed after the bell, curves extending lows (2Y10Y -7.253 at -27.614) as Bonds inched higher early in the second half. Still off overnight highs, 30Y futures are +6 at 110-05, 10Y futures briefly trade -3 at 106-12.5 -- still well within technical levels: resistance: 107-05+ 20-day EMA, support: 105-10+ Low Oct 19.

- Futures traded soft after early China headlines of raising Yuan sovereign bond issuance an extra 1T, while raising fiscal deficit ratio to appr 3.8% from 3.0%. Tsy futures extend session lows after S&P Global US PMIs come out higher than expected:

- S&P Global US Manufacturing PMI (50.0 vs. 49.5 est, 49.8 prior)

- S&P Global US Services PMI (50.9 vs. 49.9 est, 50.1 prior)

- S&P Global US Composite PMI (51.0 vs. 50.0 est, 50.2 prior)

- Little reaction from Tsy futures after the $51B 2Y note auction (91282CJE2) trades on the screws: 5.055% high yield vs. 5.055% WI; 2.64x bid-to-cover vs. 2.73x prior.

- Stocks gained after early deluge of positive Q4 earnings announcements from PacWest Bancorp, Dow, GE, GM, Verizon and Xerox to name a few, S&P Eminis currently +34.0 at 4275.75. After market announcements include: Alphabet, Microsoft, Visa and Waste Management.

CANADA

CANADA: Canada's pending fiscal update will be limited to "base hits" of incremental measures rather than a home run that fully addresses the housing crunch as a weaker economy and other spending files burden government finances, former parliamentary budget officer Kevin Page told MNI.

- Higher bond yields, slower economic growth and rising unemployment mean the budget profile will weaken by a few billion dollars to CAD45 billion in the fiscal year that began April 1 according to Page. Chrystia Freeland still has the relative luxury of a budget shortfall of just 1.5% of GDP, a pittance versus red ink being spilled in countries like the United States, Page said on the MNI FedSpeak podcast.

- “The government does feel squeeze, from the point of view of just political pressure, and the bond market is providing a bit of pressure,” said Page, now President of the Institute of Fiscal Studies and Democracy at the University of Ottawa. “A series of base hits is really what they are trying to do. This is a long term challenge with respect to getting housing supply in a better place” as well as "over the next couple of elections." For more see MNI Policy main wire at 0901ET.

EU

ECB: The European Central Bank is set to leave interest rates on hold for the first time since July 2022 when it meets in Athens on Thursday, though upside risks to inflation from energy and wages might prompt some Governing Council members to push for a 25-basis-point hike in December.

- Still, with October’s euro area Bank Lending Survey showing continued strong tightening of financial conditions, many members will be wary of overtightening, after 10 consecutive hikes boosted the deposit rate by 400 basis points to 4% in September. (See MNI INTERVIEW: ECB Growth Assumptions Over-Optimistic).

- At its last meeting, the ECB said rates had reached levels that would contribute to a timely reduction of inflation to the 2% target, and officials are likely to follow Chief Economist Philip Lane in indicating that the Bank is likely to remain “on guard for an extended period". (See MNI SOURCES: ECB Doves Wary Of December Push For Hike). For more see MNI Policy main wire at 0704ET.

OVERNIGHT DATA

US DATA: S&P Global composite PMI surprisingly increased to 51.0 (cons 50.0) from 50.2 in the preliminary October report.

- The positive surprise and increase was led by services at a three-month high (50.9 vs cons 49.9 after 50.1), whilst manufacturing also firmed to a six-month high (50.0 vs cons 49.5 after 49.8).

- The press release does however note some further progress on inflation metrics: "Meanwhile, inflationary pressures softened. Cost burdens rose at the slowest pace for three years, with firms moderating hikes in selling prices at the same time. The rate of charge inflation eased to the weakest since June 2020 and was slower than the long-run series average. Firms were reportedly keen to pass through any cost savings made to customers in a bid to drive sales."

- Further: “The survey’s selling price gauge is now close to its pre-pandemic long-run average and consistent with headline inflation dropping close to the Fed’s 2% target in the coming months, something which looks likely to be achieved without output falling into contraction.”

- The surprisingly large market reaction has been geared more towards the beat in activity metrics and less so the inflationary measures.

US OCT. RICHMOND FED FACTORY INDEX 3; EST. 3

US OCT. RICHMOND FED REGIONAL BUSINESS CONDITIONS -15

MARKETS SNAPSHOT

- Key late session market levels

- DJIA up 240.34 points (0.73%) at 33178.73

- S&P E-Mini Future up 28 points (0.66%) at 4270

- Nasdaq up 101.7 points (0.8%) at 13120.79

- US 10-Yr yield is down 1 bps at 4.8399%

- US Dec 10-Yr futures are down 4.5/32 at 106-11

- EURUSD down 0.0081 (-0.76%) at 1.0589

- USDJPY up 0.19 (0.13%) at 149.9

- WTI Crude Oil (front-month) down $1.65 (-1.93%) at $83.84

- Gold is up $0.61 (0.03%) at $1973.46

- Prior European bourses closing levels:

- EuroStoxx 50 up 23.62 points (0.58%) at 4065.37

- FTSE 100 up 14.87 points (0.2%) at 7389.7

- German DAX up 79.22 points (0.54%) at 14879.94

- French CAC 40 up 43.18 points (0.63%) at 6893.65

US TREASURY FUTURES CLOSE

- 3M10Y +0.229, -61.536 (L: -66.538 / H: -57.606)

- 2Y10Y -6.196, -26.557 (L: -27.199 / H: -19.946)

- 2Y30Y -8.854, -14.284 (L: -14.937 / H: -4.947)

- 5Y30Y -6.049, 13.864 (L: 13.279 / H: 20.137)

- Current futures levels:

- Dec 2-Yr futures down 2.625/32 at 101-7.375 (L: 101-05.75 / H: 101-10.875)

- Dec 5-Yr futures down 4.75/32 at 104-15 (L: 104-10.25 / H: 104-23.25)

- Dec 10-Yr futures down 4/32 at 106-11.5 (L: 106-02.5 / H: 106-22)

- Dec 30-Yr futures steady at 109-31 (L: 109-08 / H: 110-16)

- Dec Ultra futures up 18/32 at 113-17 (L: 112-09 / H: 113-25)

US 10Y FUTURE TECHS: (Z3) Trend Signals Remain Bearish

- RES 4: 109-20 High Sep 19

- RES 3: 108-20 50-day EMA

- RES 2: 108-16 High Oct 12

- RES 1: 107-05+ 20-day EMA

- PRICE: 106-12 @ 1420 ET Oct 24

- SUP 1: 105-10+ Low Oct 19

- SUP 2: 104-20+ 2.0% 10-dma envelope

- SUP 3: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 4: 104-17+ Low Jul’07

Treasuries have recovered from their recent lows. The trend condition remains bearish and gains are likely part of a correction. Last week’s move lower resulted in a break of 106-03+, the Oct 4 low, confirming a resumption of the downtrend. The move down has exposed the 2.0% 10-dma envelope support of 104-20+. Key short-term trend resistance is at 108-16, the Oct 12 high. Initial firm resistance is at 107-05+, the 20-day EMA.

SOFR FUTURES CLOSE

- Dec 23 -0.005 at 94.560

- Mar 24 -0.015 at 94.635

- Jun 24 -0.030 at 94.845

- Sep 24 -0.045 at 95.105

- Red Pack (Dec 24-Sep 25) -0.085 to -0.055

- Green Pack (Dec 25-Sep 26) -0.065 to -0.03

- Blue Pack (Dec 26-Sep 27) -0.02 to steady

- Gold Pack (Dec 27-Sep 28) -0.005 to +0.005

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00047 to 5.32491 (-0.00674/wk)

- 3M +0.00138 to 5.37960 (-0.01887/wk)

- 6M +0.00643 to 5.44552 (-0.02396/wk)

- 12M +0.00400 to 5.38411 (-0.05424/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $88B

- Daily Overnight Bank Funding Rate: 5.32% volume: $237B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.330T

- Broad General Collateral Rate (BGCR): 5.30%, $554B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $545B

- (rate, volume levels reflect prior session)

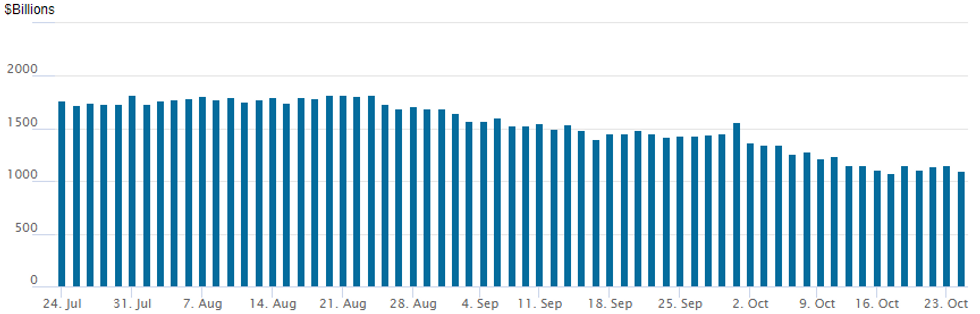

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage falls to $1,097.875B w/97 counterparties vs. $1,157.976B in the prior session. Very close to last Tuesday's $1,082.399B - the lowest level since mid-September 2021. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE $2.5B American Express 3Pt Debt Issuance Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/24 $2.5B #American Express $1.2B 3NC2 +125, $300M 3NC2 SOFR+135, $1B 8NC7 +165

- 10/24 $2.5B #IDA (Int Development Assn) 5Y SOFR+44

- 10/24 $1.5B Borr Drilling 5NC2, 7NC3

- 10/24 $500M Turk Eximbank 3.25Y 9.25%

EGBs-GILTS CASH CLOSE: Bellies Rally On Contractionary European PMIs

European yields continued to descend from Monday morning's highs on Tuesday, with both the German and UK bellies outperforming after soft preliminary October PMI data.

- The highlight of the session was the weak German services PMI (contractionary at 48.0 vs 50.0 expected), which combined with a poor French manufacturing print (1.9 point miss) saw Eurozone-wide PMI printing below expectations in both services and manufacturing.

- The UK's figures were largely in line (Services missed by 0.1pp, manufacturing beat by 0.5pp), while the details of the ONS's experimental labour market data evidenced some softening.

- The combined effect of the data was to marginally pull back on central bank hike expectations (still 1-2bp seen left in the ECB cycle, with BoE terminal down 2bp to just 9bp left) and pushed eventual cut pricing higher - helping curve bellies outperform.

- Despite the prospects of less monetary tightening and equity gains, periphery EGB spreads widened steadily throughout the session, led by Italy.

- Wednesday sees German IFO data, with the ECB communications Thursday the week's focus now that PMIs are out of the way.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 3.8bps at 3.096%, 5-Yr is down 5.6bps at 2.724%, 10-Yr is down 4.6bps at 2.828%, and 30-Yr is down 1.6bps at 3.052%.

- UK: The 2-Yr yield is down 4.3bps at 4.789%, 5-Yr is down 6.4bps at 4.515%, 10-Yr is down 6bps at 4.539%, and 30-Yr is down 4.7bps at 5.002%.

- Italian BTP spread up 3.3bps at 199.9bps / Spanish up 1.7bps at 111bps

FOREX EURUSD Reverses Lower Amid Divergent PMI Data

- In a direct reversal of Monday trade, the USD index looks set to close 0.7% in the green. Gains were underpinned by higher front-end yields, the softer Euro following the weaker-than-expected PMIs and the divergent above-estimate US PMI figures.

- Despite breaching both the 20- and 50-day EMAs, EURUSD corrected lower into the Tuesday close, consolidating back below 1.06 and defying any bullish signals that emanated from the week’s early strength. Any return higher would strengthen a short-term bull cycle and signal scope for a continuation higher.

- In similar vein, GBPUSD has declined 0.75% amid UK flash October PMIs all printing in contractionary territory once again (services has been <50 for 3-consecutive months, while manufacturing has remained in contraction since August 2022). The trend remains bearish, and a resumption of weakness would open 1.2037, Oct 4 low. A break of this level would resume the downtrend that started in July and open 1.1964, a Fibonacci projection.

- The Australian dollar has outperformed other majors which has prompted an impressive 1.10% move lower for EURAUD. The move matches some moderate strength for major equity indices on Tuesday and also comes ahead of tonight’s inflation data. Earlier, AUD/USD looked through a speech from RBA's Bullock, despite a step-up in rhetoric on inflation.

- USDCAD stands 0.3% in the green ahead of tomorrow’s Bank of Canada decision. The pair hasn’t yet tested resistance at a bull trigger of 1.3786 (Oct 5 high), clearance of which would confirm a resumption of the uptrend and open 1.3862 (Mar 10 high). The BoC tomorrow could have limited impact with heightened sensitivity to geopolitical risk, but could help steer subsequent trends.

WEDNESDAY DATA CALENNDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/10/2023 | 0030/1130 | *** |  | AU | CPI inflation |

| 25/10/2023 | 0030/1130 | *** |  | AU | CPI Inflation Monthly |

| 25/10/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Survey |

| 25/10/2023 | 0600/0800 | ** |  | SE | PPI |

| 25/10/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/10/2023 | 0800/1000 | ** |  | EU | M3 |

| 25/10/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/10/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 25/10/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 25/10/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/10/2023 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 25/10/2023 | 1400/1000 |  | CA | Bank of Canada Monetary Policy Report | |

| 25/10/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 25/10/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 25/10/2023 | 1500/1100 |  | CA | Bank of Canada Governor press conference | |

| 25/10/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 25/10/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 25/10/2023 | 2035/1635 |  | US | Fed Chair Jerome Powell |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.