-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: StL Fed Bullard Peak Rate 5-5.25%

EXECUTIVE SUMMARY

US

FED: The Federal Reserve can cool the economy without putting millions out of work because the overwhelming majority of post-pandemic job openings aim to poach workers rather than hire from the pool of jobless, so even a large overall decline in vacancies as interest rates increase would add only modestly to unemployment, St. Louis Fed economist Paulina Restrepo-Echavarria told MNI.

- In new research with co-author Dallas Fed economist Anton Cheremukhin, Restrepo-Echavarria argues the response of unemployment to a slowdown in demand for workers has likely decreased in recent years, because poaching vacancies have outpaced job openings with the potential to determine the unemployment rate.

- Vacancies for the employed have risen steadily since 2015 and accelerated since Covid-19 to more than three-quarters of all posted openings from roughly half in the decade prior, they estimate, while monetary policy is thought to have an equal effect on both.

- "There's a good probability based on my read that we're at a turning point right now in terms of where the inflation numbers are going and where the economy is headed. We're not seeing it at all in the labor market but we know from past experience that the labor market can just turn on a dime," he said in an interview.

- While stressing current "indicators are all showing that inflation is still high," Shapiro said that despite some remaining kinks supply chain bottlenecks have come down a lot. "It certainly looks like the supply chain pressures that were very, very strong last year are behind us now," he said. For more see MNI Policy main wire at 1235ET

- “Five to 5.25% that’s a minimum level according to this analysis that would at least get us in the zone” of restrictive policy Bullard told reporters following a presentation in which he noted Taylor rules suggest rates must climb to between 5% and 7% in order to get U.S. inflation back down toward the Fed’s 2% target.

- Richmond Fed President Thomas Barkin told MNI in a recent interview persistent inflation may force interest rates to peak higher than previously expected. Bullard said it’s too soon to get optimistic about the inflation picture despite a better-than-expected October CPI. “We’re really not looking at a good inflation situation for the U.S. We’ve been burned already two years in a row.”

US TSYS: Take The Fed, Seriously, Please

Tsys weaker after the bell, off early session lows as early volatility subsided in the second half.

- Hawkish comments by StL Fed Bullard that rates are not restrictive and belong above 5%, perhaps well above -- kicked off the session while Tsys bounced off early session lows following weaker than exp Philly Fed Mfg index of -19.4 vs. -6.0 exp. Housing Starts and Permits little stronger than expected (1.425m vs. 1.411m est; 1.526M vs. 1.515M est).

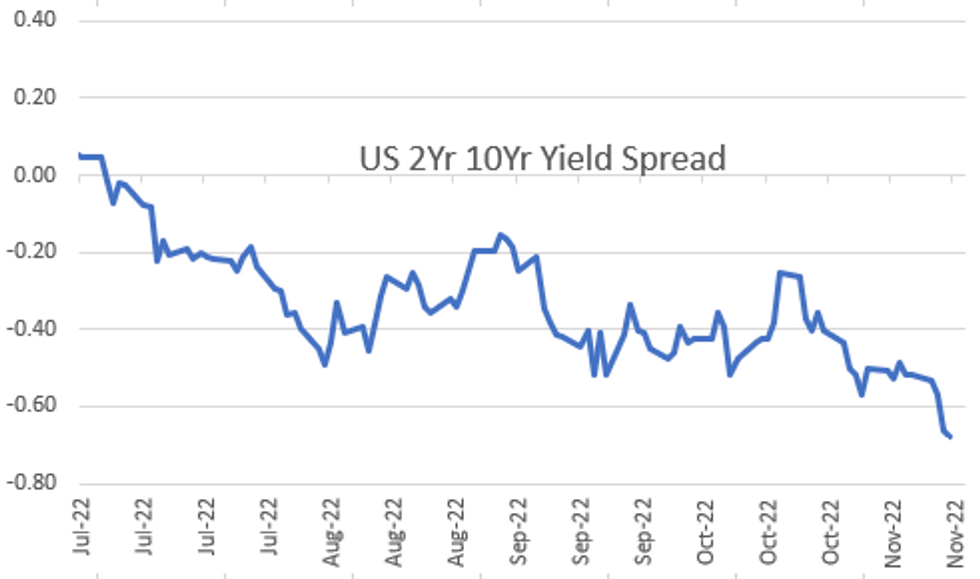

- Key move - continued sell-off in 2s10s curve to new all-time inverted low of -71.249, a measure of market expectations of a coming recession as the Fed moves to stem the rise in inflation. The 2s10s curve off lows after the bell at -68.608 (-1.680).

- Eurodollar/SOFR 2023 futures levels under considerable pressure as Fed terminal rate has climbed to 4.90% from 4.93% in Jun'23 earlier (5.08% pre-CPI). Fed funds implied hike for Dec'22 back to 50.9bp, Feb'23 cumulative +1.5bp to 86.4bps (84.9bp earlier) to 4.713%.

OVERNIGHT DATA

- US NOV PHILADELPHIA FED MFG INDEX -19.4 (-6.0 est)

- US OCT HOUSING STARTS 1.425M; PERMITS 1.526M

- US SEP STARTS REVISED TO 1.488M; PERMITS 1.564M

- US OCT HOUSING COMPLETIONS 1.339M; SEP 1.431M (REV)

- US JOBLESS CLAIMS -4K TO 222K IN NOV 12 WK

- US PREV JOBLESS CLAIMS REVISED TO 226K IN NOV 05 WK

- US CONTINUING CLAIMS +0.013M to 1.507M IN NOV 05 WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 49.07 points (-0.15%) at 33500.78

- S&P E-Mini Future down 19.75 points (-0.5%) at 3948

- Nasdaq down 54.6 points (-0.5%) at 11128.52

- US 10-Yr yield is up 8.1 bps at 3.7713%

- US Dec 10Y are down 18.5/32 at 112-20

- EURUSD down 0.0028 (-0.27%) at 1.0367

- USDJPY up 0.66 (0.47%) at 140.16

- WTI Crude Oil (front-month) down $3.67 (-4.29%) at $81.93

- Gold is down $12.74 (-0.72%) at $1761.09

- EuroStoxx 50 down 4.36 points (-0.11%) at 3878.42

- FTSE 100 down 4.65 points (-0.06%) at 7346.54

- German DAX up 32.35 points (0.23%) at 14266.38

- French CAC 40 down 31.1 points (-0.47%) at 6576.12

US TSY FUTURES CLOSE

- 3M10Y +7.743, -46.423 (L: -59.304 / H: -44.303)

- 2Y10Y -1.334, -68.262 (L: -71.249 / H: -62.993)

- 2Y30Y -4.504, -56.469 (L: -60.254 / H: -48.419)

- 5Y30Y -3.553, -4.974 (L: -7.331 / H: 0.159)

- Current futures levels:

- Dec 2Y down 5.125/32 at 102-8.75 (L: 102-06.75 / H: 102-14.75)

- Dec 5Y down 13/32 at 107-28.25 (L: 107-24 / H: 108-11.5)

- Dec 10Y down 18/32 at 112-20.5 (L: 112-13 / H: 113-09.5)

- Dec 30Y down 17/32 at 125-28 (L: 125-06 / H: 126-27)

- Dec Ultra 30Y down 24/32 at 133-29 (L: 133-02 / H: 135-14)

US 10YR FUTURE TECH: (Z2) Fades, But Broader Trend Intact

- RES 4: 115-14+ 50.0% retracement of the Aug 2 - Oct 21 downleg

- RES 3: 114-17 High Sep 20

- RES 2: 113-30 High Oct 4 and a key resistance

- RES 1: 113-11 High Nov 16

- PRICE: 112-21 @ 15:30 GMT Nov 17

- SUP 1: 111-14/110-12+ 20-day EMA / Low Nov 10

- SUP 2: 109+10+ Low Nov 04

- SUP 3: 108-26+ Low Oct 21 and the bear trigger

- SUP 4: 108-06+ Low Oct 2007 (cont)

Treasury futures faded into the Thursday close, but remain pointed higher after the recovery off the Monday lows. The contract has cleared resistance at 112-13+, the 50-day EMA. A clear break of this EMA would strengthen the case for short-term bulls and open 113-30, the Oct 4 high and a key resistance. On the downside, initial firm support is seen at 111-14, the 20-day EMA. A break of this average would expose key support at 108-26+, the Oct 21.

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.008 at 95.013

- Mar 23 -0.030 at 94.790

- Jun 23 -0.045 at 94.765

- Sep 23 -0.10 at 94.970

- Red Pack (Dec 23-Sep 24) -0.15 to -0.135

- Green Pack (Dec 24-Sep 25) -0.12 to -0.08

- Blue Pack (Dec 25-Sep 26) -0.075 to -0.06

- Gold Pack (Dec 26-Sep 27) -0.055 to -0.05

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00458 to 3.81271% (-0.00215/wk)

- 1M +0.02786 to 3.93857% (+0.06328/wk)

- 3M +0.00114 to 4.67543% (+0.06929/wk) * / **

- 6M +0.04043 to 5.12243% (+0.03843/wk)

- 12M -0.00700 to 5.45786% (+0.00657/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.67543% on 11/17/22

- Daily Effective Fed Funds Rate: 3.83% volume: $98B

- Daily Overnight Bank Funding Rate: 3.82% volume: $281B

- Secured Overnight Financing Rate (SOFR): 3.81%, $1.096T

- Broad General Collateral Rate (BGCR): 3.77%, $423B

- Tri-Party General Collateral Rate (TGCR): 3.77%, $408B

- (rate, volume levels reflect prior session)

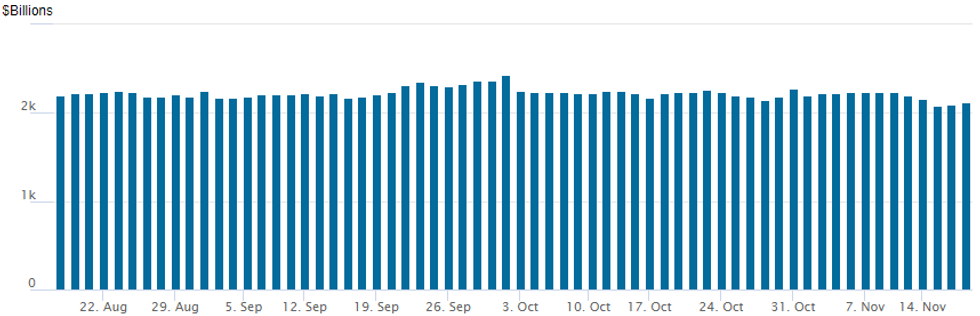

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,114.345B w/ 103 counterparties vs. $2,099.070B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: Primary Market Chills

No new issuance ThursdayDate $MM Issuer (Priced *, Launch #)

- 11/17 $Benchmark Discover Financial investor calls

- $5.35B Priced Wednesday (waiting for Kommuninvest)

- 11/16 $3B *NAB (National Australian Bank) $1.35B 2Y +80, $1.65B 5Y SOFR+105

- 11/16 $1B *Open Text 5Y 6.9%

- 11/16 $1B Kommuninvest 2Y SOFR +20

- 11/16 $850M *Dominion Energy 10Y +175

- 11/16 $500M *General Mills 3NC1 +110

EGBs-GILTS CASH CLOSE: Flatter As Hike Pricing Firms

Gilts underperformed Bunds as the UK government unveiled its budget plans Thursday, with both curves flattening.

- The UK autumn budget statement had relatively few surprises, though next year's expected Gilt remit exceeded consensus.

- ECB but particularly BoE hike pricing firmed (terminal rate up 10bp), fuelled by a US rate sell-off (Fed's Bullard contemplating rates as high as 7%).

- Curves bear flattened, with long-end yields weighed down by recession concerns (Brent fell below $90) and risk-off in equities.

- Periphery spreads narrowed from earlier wides; BTPs round-tripped from near 200bp to Bunds to close at 191.7bp, 2.3bp tighter on the session.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.9bps at 2.124%, 5-Yr is up 3.6bps at 1.991%, 10-Yr is up 2.4bps at 2.02%, and 30-Yr is down 0.9bps at 1.928%.

- UK: The 2-Yr yield is up 12.3bps at 3.116%, 5-Yr is up 6.5bps at 3.255%, 10-Yr is up 5.3bps at 3.202%, and 30-Yr is up 4bps at 3.353%.

- Italian BTP spread down 2.3bps at 191.7bps /Greek up 0.7bps at 226.2bps

FOREX: Broad Based USD Strength Moderates In Late US Trade

- The greenback made uniform gains across G10 Thursday, with the USD Index falling just shy of the Tuesday high in the early part of the NY session. However, a late bounce in equity markets helped moderate the greenback’s advance approaching the APAC crossover.

- While the timing does not exactly match with the immediate reaction across currency markets, USD optimism may have waned due to the November Philadelphia Fed manufacturing index coming in at -19.4 vs. Exp. -6.0, the lowest reading since the depths of pandemic lockdowns.

- Despite the trimming of gains, the greenback’s advance has been broad based on Thursday, with all G10’s in the red versus the dollar.

- A slightly larger move has been seen in AUD (-0.83%), brushing off a firmer employment report with a one percent decline in the Bloomberg commodity index likely weighing. This narrows the gap with initial AUDUSD support, which resides at 0.6578, the Nov 11 low.

- Concerns regarding crude demand from China came to the forefront, as Covid cases continue to rise, reducing the hope of any further near-term easing of restrictions. While oil futures recorded a one-month low, weakness was also seen in the Chinese Yuan, extending the bounce in USDCNH to roughly 2% from the week’s lows.

- UK retail sales and US existing home sales are the data points of note on Friday. Potential comments from ECB President Christine Lagarde, due to speak at the European Banking Congress in Frankfurt.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/11/2022 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 17/11/2022 | 0105/2005 |  | US | Fed Chair Jerome Powell | |

| 18/11/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 18/11/2022 | 0700/0800 | ** |  | SE | Unemployment |

| 18/11/2022 | 0700/0800 | ** |  | NO | Norway GDP |

| 18/11/2022 | 0830/0930 |  | EU | ECB Lagarde Speech at European Banking Congress | |

| 18/11/2022 | - |  | EU | COP 27 Ends | |

| 18/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 18/11/2022 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/11/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 18/11/2022 | 1500/1000 | * |  | US | Services Revenues |

| 18/11/2022 | 1715/1715 |  | UK | BOE Haskel Panels Ditchley Economics Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.