-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN:Strong ISM Services, Fed Collins Weighs on Rates

- MNI INTERVIEW: US Services Growth Has Room To Pick Up - ISM

- MNI Upside ISM Services Surprise Underlines Demand Resilience In Q3

- MNI BRIEF: Fed’s Beige Book Points To ‘Modest Growth’

- MNI MBA Purchase Mortgage Applications Back At Lows Since 1995

- MNI BOC WATCH: Hold at 5% And Signals Hike On Sticky Inflation

US

US: Institute for Supply Management chair Anthony Nieves told MNI Wednesday the ISM services index is likely to edge higher in coming months after climbing to a six-month high in August, a further sign that activity growth is holding up in the third quarter.

- "I anticipate them being around the same if not slightly higher," he said in an interview. "Overall, we'll have a little bit more build up going into the holiday season as long as things stay on track."

- The ISM services index increased 1.8pp to 54.5 in August, better than expectations of 52.4 and the highest since February. ISM services has held above 50 for eight months, which is the dividing line between expansion and contraction.

- Despite the increase, Nieves said the survey indicates the economy is consistent with below-trend GDP growth of around 1.6% and the Fed should not take it as a sign of an economy that is too hot. "I don't want to say we should get overly excited about that," he said. "It's within the realm of what we should be seeing." For more see MNI Policy main wire at 1225ET.

CANADA

BOC: The Bank of Canada left its key lending rate at the highest since 2001 at 5% Wednesday and signaled officials remain prepared to hike again because of the risk elevated price gains become entrenched amid slow progress wrestling down inflation.

- The one-page statement pointed to upside risks like elevated wages and core inflation even as growth stalls, while declining to return to past comments rates may be high enough or the risk of over-tightening. Economists surveyed by MNI expected a rate hold after two prior increases and a statement with hawkish notes.

- "Governing Council remains concerned about the persistence of underlying inflationary pressures, and is prepared to increase the policy interest rate further if needed," the group led by Governor Tiff Macklem said in a decision that will be followed Thursday with a speech and press conference. Officials held rates because of "recent evidence that excess demand in the economy is easing, and given the lagged effects of monetary policy." For more see MNI Policy main wire at 1001ET.

US TSYS Rates Hugging Lows After Strong ISM Services Data

- Treasury futures having been drifting sideways since marking session lows in the first half. Early data driven volatility as rates bounced following S&P Global US Services PMI comes out a little lower than expected (50.5 vs. 51.0 est), Composite PMI (50.2 vs. 50.4 est). Futures had pared gains prior to release. Markets also listening to UK Bailey comments on inflation - close to May forecast.

- Support was short lived, however, as futures gapped lower following higher than expected ISM Services Index (54.5 vs. 52.5), Prices Paid (58.9 vs. 56.8 prior). reacceleration to the highest reading since February after a dip in July added further evidence that the US economy has been resilient through Q3, with the ISM noting the 54.5 print is consistent with 1.6% Q/Q annualized real GDP growth (albeit that's lower than most current estimates).

- Dec'23 10Y futures breached initial support of 109-28.5 (Aug 29 low) on the way to 109-19.5 session low. An extension lower would signal scope for 109-09+, Aug 22 low and a bear trigger. A break of this level would strengthen a bearish theme.

- Little react to Bank of Canada leaving its key lending rate at the highest since 2001 at 5% Wednesday and signaled officials remain prepared to hike again because of the risk elevated price gains become entrenched amid slow progress wrestling down inflation.

- Focus turns to Thursday's weekly claims, ULC and flurry of Fed speakers Thursday, ahead late Friday's policy blackout at midnight

OVERNIGHT DATA

- US ISM AUG SERVICES COMPOSITE INDEX 54.5

- US ISM AUG SERVICES BUSINESS INDEX 57.3

- US ISM AUG SERVICES PRICES 58.9

- US ISM AUG SERVICES EMPLOYMENT INDEX 54.7

US: August's ISM Services reading came in strong at 54.5, beating expectations of a drop to 52.5 from July's 52.7, and above the high end of analyst expectations of 53.9.

- This reacceleration to the highest reading since February after a dip in July added further evidence that the US economy has been resilient through Q3, with the ISM noting the 54.5 print is consistent with 1.6% Q/Q annualized real GDP growth (albeit that's lower than most current estimates).

- The report showed strength across most key categories, including Production/Activity (+0.2 to 57.3), Employment (+4.0 to 54.7), New Orders (+2.5 to 57.5), New Export Orders (+1.0 to 62.1), and Prices (+2.1 to 58.9). The Employment reading was the highest since Nov 2021, New Orders highest since Feb, Prices Paid since April, and New Export Orders since September 2022.

- As ISM Services chair Anthony Nieves told MNI at the start of August after the July report regarding New Orders, "I expect this to rebound a little bit as well and get more into the mid 50s on the composite [PMI] as we get into the tail end of of the third quarter and going into the fourth quarter", basing his optimism on seasonal factors.

- August's wasn't an unambiguously positive report. Inventories jumped (+7.3 to 57.7) but Inventory Sentiment rose (+4.9 to 61.5), the latter indicating that firms felt their inventories were too high vs activity levels.

- Backlogs fell the most in series history back to 1997 (-10.3 to 41.8) with some respondents citing the arrival of long-awaited shipments, but the ISM noted that 49% of respondents didn't measure backlogs.

US: S&P Global US Services PMI (Aug F) M/M 50.5 vs. Exp. 51.0 (Prev. 51.0); Composite PMI (Aug F) M/M 50.2 vs. Exp. 50.4 (Prev. 50.4)

- US MBA: MARKET COMPOSITE -2.9% SA THRU SEP 01 WK

- US MBA: REFIS -5% SA; PURCH INDEX -2% SA THRU SEP 1 WK

- US MBA: UNADJ PURCHASE INDEX -28% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 7.21% VS 7.31% PREV

US: MBA composite mortgage applications fell -2.9% (purchases -2%, refis -5%) in the week to Sep 1 as it reversed a +2.3% lift the prior week.

- It came despite the 30Y conforming mortgage rate pulling back 10bps to 7.21% after two weeks at joint highs since Dec 2000, although the rate is still more than 1pp higher than a year ago.

- The decline in purchase applications took the level back to that from Aug 18 for the lowest since 1995.

US: REDBOOK: AUG STORE SALES +4.1% V YR AGO MO; US REDBOOK: STORE SALES +4.1% WK ENDED SEP 02 V YR AGO WK

US: U.S. economic growth has been modest since mid-July while hiring and inflation have softened, the Federal Reserve’s Beige Book report published Wednesday showed.

- “Contacts from most Districts indicated economic growth was modest during July and August,” the report said. “Job growth was subdued across the nation. Though hiring slowed, most districts indicated imbalances persisted in the labor market as the availability of skilled workers and the number of applicants remained constrained.”

- The Fed said most of its districts reported price growth slowed overall and inflation decelerated faster in manufacturing and consumer goods sectors.

MARKETS SNAPHOT

Key late session market levels:- DJIA down 217.35 points (-0.63%) at 34424.04

- S&P E-Mini Future down 39.25 points (-0.87%) at 4463.5

- Nasdaq down 185 points (-1.3%) at 13835.91

- US 10-Yr yield is up 2.8 bps at 4.2876%

- US Dec 10-Yr futures are down 9/32 at 109-21.5

- EURUSD up 0.0003 (0.03%) at 1.0725

- USDJPY down 0 (0%) at 147.72

- WTI Crude Oil (front-month) up $0.95 (1.1%) at $87.65

- Gold is down $8.76 (-0.45%) at $1917.32

- EuroStoxx 50 down 30.9 points (-0.72%) at 4238.26

- FTSE 100 down 11.79 points (-0.16%) at 7426.14

- German DAX down 30.34 points (-0.19%) at 15741.37

- French CAC 40 down 60.63 points (-0.84%) at 7194.09

US TREASURY FUTURES CLOSE

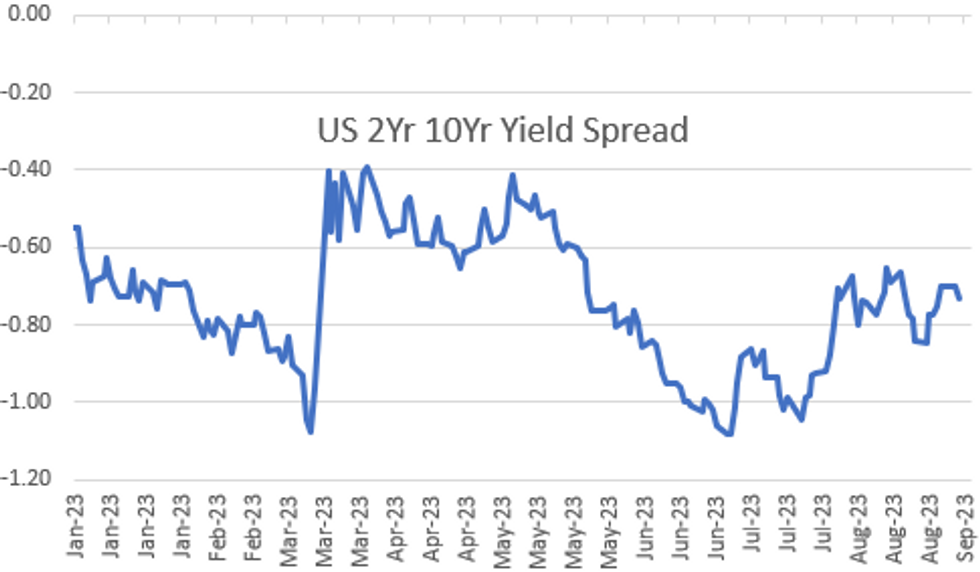

- 3M10Y -1.285, -119.74 (L: -127.291 / H: -117.826)

- 2Y10Y -3.697, -73.904 (L: -74.533 / H: -68.522)

- 2Y30Y -7.449, -66.594 (L: -67.899 / H: -56.685)

- 5Y30Y -7.145, -7.943 (L: -9.069 / H: 1.346)

- Current futures levels:

- Dec 2-Yr futures down 3.875/32 at 101-17.25 (L: 101-16.5 / H: 101-23.25)

- Dec 5-Yr futures down 9.25/32 at 106-1 (L: 106-00 / H: 106-15)

- Dec 10-Yr futures down 9/32 at 109-21.5 (L: 109-19.5 / H: 110-05)

- Dec 30-Yr futures up 2/32 at 119-5 (L: 118-25 / H: 119-19)

- Dec Ultra futures up 11/32 at 126-7 (L: 125-20 / H: 126-18)

US 10Y FUTURE TECHS: (Z3) Bearish Outlook

- RES 4: 112-24+ High Jul 27

- RES 3: 112-14 High Aug 10 and a key short-term resistance

- RES 2: 112-00 Round number resistance

- RES 1: 110-20/111-12+ 20-day EMA / High Sep 1

- PRICE: 109-21+ @ 1205 ET Sep 6

- SUP 1: 109-19+ Low Sep 6

- SUP 2: 109-18+/09+ Low Aug 25 / 22 and the bear trigger

- SUP 3: 108-20 1.000 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 4: 107.23 1.236 proj of the Jul 18 - Aug 4 - Aug 10 price swing

Treasury prices traded lower yesterday and the contract remains below 111-12+, the Sep 1 high. The latest move lower highlights a potential short-term reversal and 111-12+ marks a key short-term resistance. The medium-term trend direction is down and moving average studies reinforce this theme. An extension lower would signal scope for 109-09+, Aug 22 low and a bear trigger. A break of this level would strengthen a bearish theme.

SOFR FUTURES CLOSE

- Sep 23 steady00 at 94.580

- Dec 23 -0.010 at 94.545

- Mar 24 -0.025 at 94.675

- Jun 24 -0.055 at 94.920

- Red Pack (Sep 24-Jun 25) -0.095 to -0.08

- Green Pack (Sep 25-Jun 26) -0.09 to -0.085

- Blue Pack (Sep 26-Jun 27) -0.08 to -0.055

- Gold Pack (Sep 27-Jun 28) -0.045 to -0.015

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00078 to 5.32684 (-.00203/wk)

- 3M +0.00665 to 5.39773 (-0.00457/wk)

- 6M +0.02060 to 5.45272 (-0.00052/wk)

- 12M +0.06324 to 5.38895 (+0.02029/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $102B

- Daily Overnight Bank Funding Rate: 5.32% volume: $259B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.472T

- Broad General Collateral Rate (BGCR): 5.29%, $553B

- Tri-Party General Collateral Rate (TGCR): 5.29%, $546B

- (rate, volume levels reflect prior session)

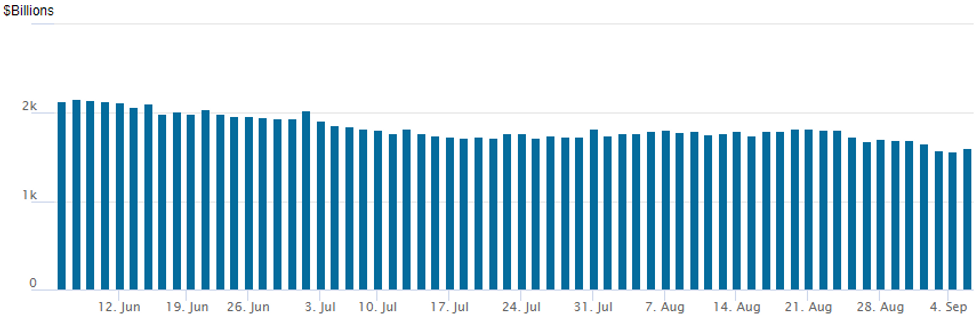

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation rebounds to $1,606.244B w/96 counterparties, compared to $1,568.490B in the prior session (lowest since early March 2022). The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE

EGBs-GILTS CASH CLOSE: US Services Data Sinks Bunds

Gilts easily outperformed Bunds Wednesday, with bear flattening in the German curve, and bull steepening in the UK's.

- Core FI yields looked set for a fairly constructive by mid-afternoon European trade, with an early sell-off across Bunds and Gilts having faded. Very weak German factory orders had seen a brief bid in Bund futures on the open, but corporate and govvie supply applied some pressure early.

- Most of the early intrigue was ECB-speaker related, with yields higher as Knot sounded typically hawkish, and later Kazimir expressing a clear preference for another hike, as next week's decision approaches.

- Yields reversed higher a couple hours before the cash close as a stronger than expected US ISM Services reading saw Treasuries sell off sharply (a hawkish hold by the Bank of Canada may have contributed).

- A key exception was the UK short end which rallied throughout the session - the BoE TSC testimony was seen as not reinforcing a hawkish narrative, with Bailey sounding relatively constructive on the outlook.

- Greek instruments continued to trade in relatively volatile fashion, underperforming on the periphery despite little relevant catalyst in evidence.

- Thursday morning sees German IP data, several ECB speakers, Spanish/French bond supply, and the BoE Decision Maker Survey.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.7bps at 3.122%, 5-Yr is up 6.3bps at 2.659%, 10-Yr is up 4.1bps at 2.653%, and 30-Yr is up 1.6bps at 2.773%.

- UK: The 2-Yr yield is down 3.2bps at 5.239%, 5-Yr is up 0.7bps at 4.81%, 10-Yr is up 0.8bps at 4.533%, and 30-Yr is down 0.9bps at 4.784%.

- Italian BTP spread up 2.2bps at 175bps / Greek up 5.5bps at 137.1bps

FOREX Stronger US ISM Further Boosts Greenback, GBP Underperforms

- The US dollar continued to edge higher on Wednesday, boosted by an-above estimate US ISM Services index, with both prices paid and employment advancing from the prior read. Bank of America highlighted that “while the data flow last week showed some signs of moderation in the U.S., the theme of U.S. relative economic strength continues to dominate market narratives, particularly in the face of ongoing softness out of Europe and China.”

- GBP underperformed on the session, extending Tuesday’s weakness and reinforcing the bearish outlook. Support at 1.2548, the Aug 25 low, has been breached, confirming a resumption of the trend and cable has narrowed the gap with 1.2480, a Fibonacci projection, which has held for now. Below here, the most obvious targets are 1.2433 and 1.2369, lows from early June.

- USDJPY was pulled in both directions on Wednesday, as the nation’s top currency official said he won’t rule out any options if current moves in the exchange rate continue. The comments prompted downward pressure on the pair from the 147.82 highs down to 147.02 session lows. However, the firmer US data kept USDJPY weakness short-lived, with the pair trading back above 147.50 as we approach the APAC crossover.

- Weakness for global stocks continued to weigh on EMFX with the JPMorgan emerging market currency index registering a further 0.3% decline. Noteworthy pressure on the Polish Zloty stands out on Wednesday as the central bank significantly surprised the market by delivering a 75bp rate cut compared to the surveyed median estimate of a 25bp reduction. Strength for USDMXN (+1.00%) should also be highlighted, extending the most recent bounce to reach 3-month highs.

- Speeches from both RBA Governor Lowe and BOC Governor Macklem will be in focus on Thursday. Australian trade data, Swiss currency reserves and German industrial production highlight the data docket.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/09/2023 | 0130/1130 | ** |  | AU | Trade Balance |

| 07/09/2023 | 0300/1100 | *** |  | CN | Trade |

| 07/09/2023 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/09/2023 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 07/09/2023 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/09/2023 | 0800/1000 | * |  | IT | Retail Sales |

| 07/09/2023 | 0830/0930 |  | UK | BOE DMP Survey | |

| 07/09/2023 | 0830/1030 |  | EU | ECB's Elderson speaks at Event | |

| 07/09/2023 | 0900/1100 | *** |  | EU | GDP (final) |

| 07/09/2023 | 0900/1100 | * |  | EU | Employment |

| 07/09/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 07/09/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 07/09/2023 | 1230/0830 | * |  | CA | Building Permits |

| 07/09/2023 | 1230/0830 | ** |  | US | Non-Farm Productivity (f) |

| 07/09/2023 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/09/2023 | 1400/1000 | * |  | US | Services Revenues |

| 07/09/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 07/09/2023 | 1500/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 07/09/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 07/09/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 07/09/2023 | 1755/1355 |  | CA | BOC Governor Macklem gives "Economic Progress Report" speech in Calgary | |

| 07/09/2023 | 1930/1530 |  | US | New York Fed's John Williams | |

| 07/09/2023 | 1945/1545 |  | US | Atlanta Fed's Raphael Bostic | |

| 07/09/2023 | 2055/1655 |  | US | Fed Governor Michelle Bowman | |

| 07/09/2023 | 2300/1900 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.