-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Commodity Weekly: Oil Markets Assess Trump Impact

MNI Gas Weekly: Winter Weather Takes the Driver's Seat

MNI ASIA OPEN: The Final Debate

EXECUTIVE SUMMARY:

- MNI INTERVIEW: US Slump Worsens On No Fiscal Aid: Ex-BLS Head

- MNI EXCLUSIVE: China May Ease Debt Caps On Property Developers

- MNI BRIEF: UK Economy Already Hit By Brexit Effect: Moody's

- BIDEN TO 60 MINUTES: THERE ARE ALTERNATIVES TO COURT PACKING, Bbg

- FRANCE REPORTS 41,622 NEW CORONAVIRUS CASES IN 24 HOURS, Bbg

- ITALY REPORTS 16,079 NEW CORONAVIRUS CASES VS 15,199 ON WED, Bbg

- PELOSI SEES PROGRESS IN STIMULUS TALKS, Bbg

US

US: The U.S. economy faces an even deeper downturn with a lack of fiscal stimulus cutting into consumer and business sentiment, ex-BLS Commissioner Erica Groshen told MNI. "The recessionary dynamic is now taking hold--the business cycle is actually getting worse right now," Groshen, who is also a former New York Fed staffer, said in an interview. For more see 10/22 main wire at 1420ET.

US: Final Presidential Debate Briefing Tonight sees the second and final presidential election debate take place between Republican incumbent President Donald Trump and Democratic nominee former vice-president Joe Biden. The debate takes place at Belmont University in Nashville, Tennessee.

- What topics will be debated?: Moderator Kristen Welker of NBC News has chosen the following six topics that will be discussed in 15-minute segments totaling a 90 min debate: Fighting Covid-19, American Families, Race in America, Climate Change, National Security, and Leadership. To avoid the interruptions that marred the first debate, while a candidate is delivering their two-minute statement at the start of each segment the other candidate will have their microphone cut off.

- Will the debate have an impact?: A recent poll from Ipsos/Reuters found that just 8% of voters had yet to make up their minds on their preference for president, but winning over that 8% could prove crucial for either candidate if it gives them a boost in key swing states. The expectations remain similar to the first debate in that Trump needs to pull a rabbit out of his hat to reverse the polls that continue to show him trailing, while Biden simply needs to avoid any notable gaffes and his campaign can view the debate as a relative success.

US: Pelosi: Bill Can Happen Before Election; No Agreement On State/Local Funding House Speaker Pelosi's press conference ends. She took a few Q's, some items of note (paraphrasing here to some degree):

- Re state and local funding / liability provisions: Pelosi says no agreement on those topics yet.

- When asked about optimism on getting a deal given election only 12 days out and Senate seemingly opposed, Pelosi says: "If we were not making progress I would not spend five seconds in these conversations... This is nothing other than a serious attempt. I believe both sides want to make an agreement. Can't explain disarray on Senate side. Not up to me to [psych?] out Mitch McConnell, it's about the President of the United States to engage in a discussion and to deliver what can happen on the Senate side."

- "I'm used to negotiations and the end is the hardest part, but we've sent more paper over...we will have to compromise, neither side can swallow a poison pill, but we are narrowing those differences."

- "I think White House comes to the table with some level of confidence" that they can get Senate Republicans on board.

- "Hypothetically if we can get an agreement before the election - I think that we can... It's not just about what we can agree in a room, it's about the CBO, putting it in legislative order, it takes time...it can happen, it's really up to them. I'm pleased where we are now and if we can resolve some of these things inthe next few days it will take a while to write the bill, hope we could start writing now on certain parts of the bill...it's close, and where will the President be at any given moment, he's been all over the place".

EUROPE

UK: The UK economy has already suffered "significant" damage from the Brexit process even before the end of the current transition period, Moody's Investor Services said in a report published Thursday, saying the loss of economic activity was already weighing on the country's creditworthiness.

- * According to Moody's, UK economy is at least 2.5% smaller than it would have been without the Brexit process. "Households have less spending power after inflation as a consequence of weaker real GDP, affecting the credit performance of asset-backed securities linked to household borrowing," the report said. For more see 10/22 main wire at 1148ET.

ASIA

CHINA: The Chinese government is expected to fine tune recently-introduced caps on property developers' borrowing next year, to avoid widespread bankruptcies among smaller firms or sapping local government land sales, policy advisors told MNI. While the so-called "three red lines" rule, which sets debt thresholds and was first mentioned in media reports in September, remains informal, some developers have already been asked to submit plans to cut debt under a pilot program.

OVERNIGHT DATA:

- US JOBLESS CLAIMS -55K TO 787K IN OCT 17 WK

- US PREV JOBLESS CLAIMS REVISED TO 842K IN OCT 10 WK

- US CONTINUING CLAIMS -1.024M to 8.373M IN OCT 10 WK

US DATA: September Existing Home Sales +9.4% to 6.54M SAAR, Beats Expectations

- "Another spectacular month for sales and prices" as September existing home sales beat expectations, rising 9.4% to 6.54m SAAR vs 6.3m expected.

- Sales +20.9% yoy, "well surpassed" pre-pandemic housing conditions, says NAR economist Lawrence Yun.

- Median home price +14.8% yoy to record USD311,800, due to insufficient supply, strong demand, and higher sales of larger, more expensive homes (many of which are being sold to homeowners trading up).

- Average 21 days on market is another record low (a year ago was 32 days).

- 2.7 months supply is lowest inventory count for the month of September since 1982 when NAR started tracking the data (a year ago was 4.0 months supply)

- Working from home trend driving home sales for those who can afford it, while fast rising prices will present challenges for future first-time homebuyers, Yun said.

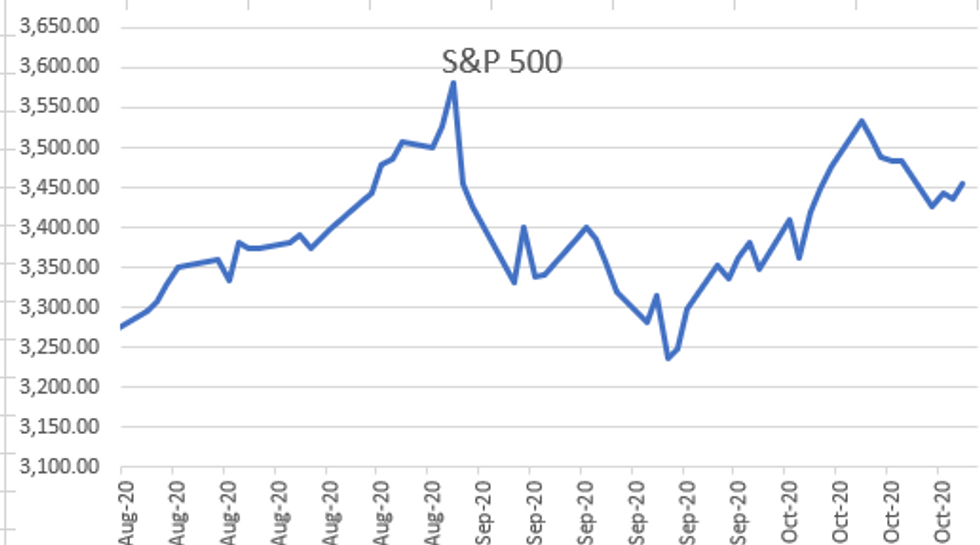

MARKETS SNAPSHOT

- DJIA up 150.3 points (0.53%) at 28403.59

- S&P E-Mini Future up 10.75 points (0.31%) at 3448.25

- Nasdaq up 9.8 points (0.1%) at 11511.41

- US 10-Yr yield is up 2.7 bps at 0.8495%

- US Dec 10Y are down 8.5/32 at 138-10

- EURUSD down 0.0043 (-0.36%) at 1.1821

- USDJPY up 0.29 (0.28%) at 104.84

- WTI Crude Oil (front-month) up $0.62 (1.55%) at $40.66

- Gold is down $21.41 (-1.11%) at $1904.07

- European bourses closing levels:

- EuroStoxx 50 down 9.29 points (-0.29%) at 3171.41

- FTSE 100 up 9.15 points (0.16%) at 5785.65

- German DAX down 14.58 points (-0.12%) at 12543.06

- French CAC 40 down 2.57 points (-0.05%) at 4851.38

US TSY SUMMARY: Tsys Extend Lows Late

Focus on massive fiscal stimulus/covid-related relief continued Thursday, but the steady drip of headlines through the session did not induce the see-saw action like they did earlier in the week.

- "Just about there" House Sp Pelosi is still "hopeful they will be able to reach an agreement" on a fiscal stimulus package. While "both sides" of the aisle want to come to an "aid agreement" Pelosi adds, there are "larger policy differences" that remain said WH adv Kudlow.

- Mkts are becoming partially inured to the prospect a deal may be done but likely after the presidential election. Despite the moderately decent volumes (TYZ0> 1.17M) market participants plied the sidelines ahead of tonight's final Presidential debate at 2100ET.

- Lower than exp weekly claims (787k vs. 870k est; continuing claims lower at 8.373M vs. 9.625M est) actually saw futures inch higher for a few minutes before reversing, trading lower through the balance of the session. (Tsy futures extended lows after the bell as equities posted new highs)

- The 2-Yr yield is up 0.6bps at 0.1533%, 5-Yr is up 1.8bps at 0.3731%, 10-Yr is up 2.9bps at 0.8512%, and 30-Yr is up 2.9bps at 1.6644%.

US TSY FUTURES CLOSE: Session Lows

Weaker after the bell, near low end narrow session range since midmorning. Generally quiet session on average volumes (TYZ0 1.15M), accts sidelines ahead tonight's final Presidential debate. Yld curves started off mildly flatter but reversed to steeper soon after as bonds sold off, update:

- 3M10Y +3.539, 75.654 (L: 70.185 / H: 75.99)

- 2Y10Y +2.117, 69.25 (L: 65.326 / H: 69.789)

- 2Y30Y +1.951, 150.566 (L: 145.594 / H: 151.053)

- 5Y30Y +0.791, 128.628 (L: 125.566 / H: 128.954)

- Current futures levels:

- Dec 2Y down 0.37/32 at 110-13.125 (L: 110-12.8 / H: 110-13.75)

- Dec 5Y down 3.25/32 at 125-18.25 (L: 125-17.25 / H: 125-22.5)

- Dec 10Y down 8.5/32 at 138-10 (L: 138-08.5 / H: 138-20)

- Dec 30Y down 25/32 at 172-10 (L: 172-06 / H: 173-15)

- Dec Ultra 30Y down 1-15/32 at 213-18 (L: 213-10 / H: 215-29)

US EURODLR FUTURES CLOSE: At/Near Session Lows

At/near session lows across the strip, long end underperforming; lead quarterly EDZ0 holding steady since 3M LIBOR set' +0.00562 to 0.21475% (-0.00363/wk).

- Dec 20 steady at 99.760

- Mar 21 -0.005 at 99.790

- Jun 21 -0.005 at 99.800

- Sep 21 steady at 99.805

- Red Pack (Dec 21-Sep 22) -0.015 to -0.005

- Green Pack (Dec 22-Sep 23) -0.025 to -0.015

- Blue Pack (Dec 23-Sep 24) -0.035 to -0.025

- Gold Pack (Dec 24-Sep 25) -0.04

US DOLLAR LIBOR: Latest settles

- O/N +0.00350 at 0.08413% (+0.00300/wk)

- 1 Month +0.00137 to 0.14925% (-0.00213/wk)

- 3 Month +0.00562 to 0.21475% (-0.00363/wk)

- 6 Month +0.00000 to 0.24600% (-0.01150/wk)

- 1 Year +0.00025 to 0.33513% (+0.00013/wk)

US TSY: Short Term Rates

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $59B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $166B

- Secured Overnight Financing Rate (SOFR): 0.07%, $943B

- Broad General Collateral Rate (BGCR): 0.05%, $347B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $321B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $4.240B submission

- Next scheduled purchase:

- Fri 10/23 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

PIPELINE: No New Issuance Thursday

- PIPELINE: No New Issuance Thursday

- Date $MM Issuer (Priced *, Launch #)

- 10/22 $Benchmark Galaxy Pipeline multi-tranche investor call

- -

- $15.35B Priced Wednesday; $30.85B/wk

- 10/21 $6B *World Bank (IBRD) 5Y +10

- 10/21 $2.25B *RBC $1.25B 3Y +33, $1B 3Y FRN SOFR+45

- 10/21 $2B *Sultanate of Oman $1.25B 7Y 6.75%, $750M 12Y 7.375%

- 10/21 $2B *Meituan $750M 5Y +180, $1.25B 10Y +225

- 10/21 $1B *FHLBanks 2Y global +4

- 10/21 $750M *Arab National Bank 10NC5 Sukuk +290

- 10/21 $750M *Qatar Islamic Bank 5Y Sukuk +155

- 10/21 $600M *Inv Corp Dubai (ICD) +5.5Y +275

FOREX: Greenback Claws Back Lost Ground

After being heavily weighed upon earlier in the week, the greenback clawed back some lost ground Thursday prompting the USD index to bounce further from Wednesday's multi-week low. In sympathy, GBP moderated after the currency enjoyed one of the best sessions in months as EU and UK negotiators met again in London to progress trade talks. GBP was one of the poorest performers in G10 as markets took profit, but steered well clear of revisiting the week's lows.

- Equities were non-directional Thursday, with markets still awaiting any progress (or lack thereof) on fiscal aid in the US. House Speaker Pelosi continued to suggest a deal is possible before the election, but gaps clearly remain on state aid and liability provisions.

- The Turkish central bank surprised markets by keeping policy unchanged against widespread expectations of a broad rate hike. The TRY responded by selling off sharply, hitting new all-time lows against the USD.

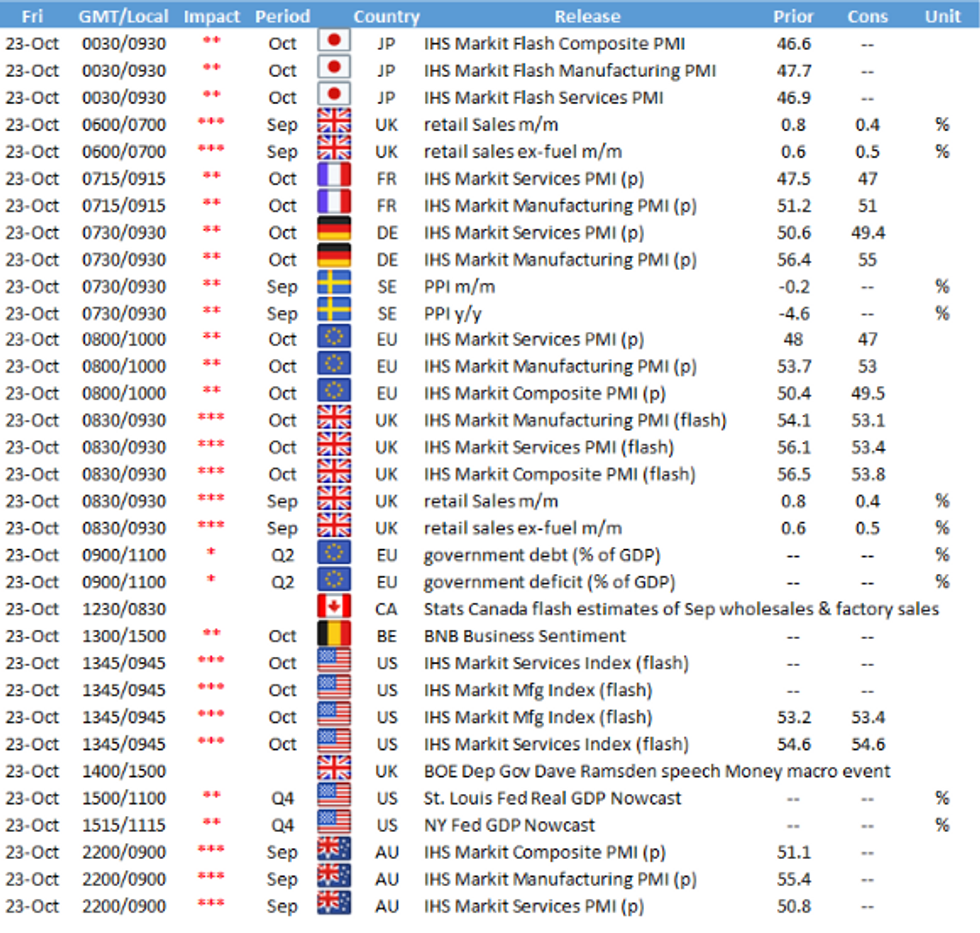

- Focus Friday turns to global PMI data. The prelim October data is expected to a further slowing in the Eurozone services sector, while US data is seen showing the economy grew at a similar pace in October. BoE's Ramsden is due to speak.

EGBs-GILTS CASH CLOSE: Bunds/Gilts Steepen; Periphery Spreads Flat

The UK and German curves bear steepened Thursday as equities came back from session lows (mainly on optimism of a US fiscal stimulus deal). Italian spreads stayed fairly flat throughout the session, with issuance of new 30-Yr via syndication offset by buyback of shorter-term BTPs in swap operation.

- On Friday, focus will be on UK Sep retail sales, German IFO, and European flash October PMIs.

Closing Levels / 10-Yr Periphery EGB Spreads: - Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 0.8bps at -0.765%, 5-Yr is up 1.5bps at -0.773%, 10-Yr is up 2.2bps at -0.566%, and 30-Yr is up 2.9bps at -0.145%.

- UK: The 2-Yr yield is up 2.1bps at -0.027%, 5-Yr is up 2.5bps at -0.025%, 10-Yr is up 4.2bps at 0.284%, and 30-Yr is up 4.3bps at 0.853%.

- Italian BTP spread down 0.1bps at 136.9bps

- Spanish bond spread down 0.3bps at 78.9bps

- Portuguese PGB spread down 0.5bps at 76.7bps

- Greek bond spread down 0.3bps at 150.2bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.