-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsy Curve Nears 40Y Inverted Lows

- MNI Leading Indices Signal Recession That Is Yet To Materialize

- MNI INTERVIEW: Higher-For-Longer Rates Risk Volatility

- MNI: BOE Surprises With 50bps Hike, Cites Persistent Inflation

- MNI NORGES BANK WATCH: Hikes 50 BPS To 3.75%, Foresees 4.25% Peak

- MNI WATCH: SNB Hikes 25bps, More Likely Coming

US TSYS: Rates Hug Lows After Surprise BOE, Norges Bank 50Bp Hikes

- Treasury futures settling in around late session lows (TYU3 112-24 -18, yield 3.7946%) after some early policy and data driven volatility. Treasury futures inexplicably bounced off initial lows following this morning's surprise 50Bp hike from the BoE (Norges Bank hiked same overnight).Gist of rebound making the rounds is the larger than anticipated hike to stem inflation brings forward timing of a rate cut.

- The MPC said nothing to push back directly against market rate expectations for a near 6% peak in Bank Rate, instead sticking to its previous line that if there was evidence of more persistent inflation pressures, further tightening would be required.

- Meanwhile, Treasury futures marked session highs after weekly claims comes out strong for the third consecutive read (+264k vs. +259k est, +262 prior revised to +264k). Front month 10Y futures tap 113-14 (+4) high post data, scaling back to 112-21 low after midday. Curves bending steeper, 2s10s +1.021 at -99.255 after falling to -101.103 low earlier (nearing March's 40+ year inverted low of -110.0).

- Little reaction to Fed Chairman Powell's second day of policy testimony to Congress and lengthy Q&A that followed. Chair Powell said the "FED VERY AWARE, CONCERNED ABOUT COMMERCIAL REAL ESTATE, and may raise capital requirements for large banks (>100B) by as much as 20%.

- Friday focus: S&P PMIs, KC Fed Services and additional Fed Speakers.

US

US: The Conference Board's Leading Economic Index fell for a 14th consecutive month in May, at -0.7% M/M, vs -0.6% in April albeit slightly better than the -0.8% expected.

- The LEI has been seen as a historically reliable recession indicator, with the long period spent in deeply negative territory seen as consistent with a recession starting soon - with the moving average contraction accelerating in the past 6 months (-4.3%) vs the prior 6 (-3.8%).

- In May, several categories weighed on the headline index, including ISM new orders, consumer expectations, rate spreads, and the leading credit index - more positive were building permits, jobless claims, and stock prices, with the average workweek neither contributing or subtracting.

- In other words, "soft" sentiment indicators dragged while housing activity and the labor market offset that weakness.

- The LEI continues to signal a recession in the next 12 months - but the contraction that has been flagged for the past several months is yet to materialize, including an upwardly revised Q1 GDP growth reading, and incoming data suggesting a decent Q2 outturn.

US/UK: Keeping interest rates at high levels for an extended period of time risks further episodes of financial instability and could undermine policymakers’ aims of achieving macro-economic stability, a former head of international research at the New York Fed told MNI.

- Gianluca Benigno, who with Fed colleagues has developed the concept of R double star, the level of rates at which financial stresses trigger self-reinforcing fire sales, said the dilemma for policymakers comes when this point has fallen below the more established R star measure, the rate compatible with macro-economic stability. That would mean that even hiking even to neutral means moving into the financial instability zone, he said, noting how the U.S. has already seen bank failures and the UK gilt market turmoil against a backdrop of tighter monetary policy.

- "The R double star concept can be interpreted as a sort of ceiling or maximum level that you can have in terms of interest rates," which makes it policy sensitive, Benigno said, without giving an estimate of where it lies. He and his colleagues have attempted to locate it using credit spreads but he hopes that further research will develop better measures by, for example, combining leverage and safe assets. For more see MNI Policy main wire at 1159ET.

UK

BOE: The Bank of England Monetary Policy Committee sprung a surprise Thursday in hiking more aggressively than widely expected, with seven of the nine members backing a 50 basis point hike in June.

- The move lifted Bank Rate to 5.0% with the majority justifying the decision with reference to the persistence of inflation, with second round effects taking longer to unwind. The MPC said nothing to push back directly against market rate expectations for a near 6% peak in Bank Rate, instead sticking to its previous line that if there was evidence of more persistent inflation pressures, further tightening would be required.

- The majority view was that recent data "indicated more persistence in the inflation process" against a backdrop of a tight labour market and resilient demand, according to the June minutes. "The scale of the recent upside surprises in official estimates of wage growth and services CPI inflation suggested a 0.5 percentage point increase in interest rates was required," the minutes said. For more, see MNI Policy main wire at 0701ET.

EUROPE

NORGES: Norges Bank increased its policy rate by 50 basis points to 3.75% at its June meeting, at the top end of expectations, and said it was likely to hike again in August.

- The Norwegian central bank said it now expects to lift the policy rate to 4.25% by the autumn, up from the projected rate peak of 3.6% in its previous forecast, suggesting 25bp hikes are likely at each of the next two meetings The Monetary Policy and Financial Stability Committee then expects the policy rate to hold close to peak until an only very gradual reversal starting in 2024.

- The detailed rate projections showed the policy rate close to 4.0% by the fourth quarter of 2024, 3.45% in Q4 2025 and 2.88% at the end of the three-year forecast. Governor Ida Wolden Bache justified the 50bp hike by warning of the dangers of higher inflation becoming entrenched with strong earnings growth and krone weakness.

SNB: The Swiss National Bank raised its policy rate by 25bps to 1.75% on Thursday, with chair Thomas Jordan arguing that further rate rises cannot be ruled out despite a more “gradual approach” being appropriate compared with the previous meeting’s half-point hike.

- Headline inflation stood at 2.2% in May, and is now expected to average the same amount this year before dipping to 2.1% - above the SNB’s target range of 0-2% - in both 2024 and 2025, reflecting upward pressure in measures of underlying inflation.

- “We cannot at this stage rule out the necessity of further monetary policy tightening to achieve this objective,” Jordan said. Jordan conceded that the Bank is in an easier position compared with some of its counterparts - with eurozone and U.S. inflation several percentage points higher than in Switzerland. But he asserted the SNB’s commitment to delivering on its mandate in a timely fashion.

OVERNIGHT DATA

- US JOBLESS CLAIMS +0K TO 264K IN JUN 17 WK

- US PREV JOBLESS CLAIMS REVISED TO 264K IN JUN 10 WK

- US CONTINUING CLAIMS -0.013M to 1.759M IN JUN 10 WK

- US Q1 CURRENT ACCOUNT GAP -$219.3B

- US Q4 CURRENT ACCOUNT REVISED TO -$216.2B

- US NAR: MAY EXISTING HOME SALES +0.2% TO 4.30M SAAR

- US NAR: MAY EXISTING HOME SALES DOWN 20.4% FROM YEAR AGO

- US NAR: MEDIAN HOME PRICE -3.1% YOY TO $396,100

- US NAR: MAY SAW LARGEST HOME PRICE DECLINE SINCE DECEMBER 2011

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 1.16 points (0%) at 33959.52

- S&P E-Mini Future up 11 points (0.25%) at 4421

- Nasdaq up 105.4 points (0.8%) at 13610.3

- US 10-Yr yield is up 6.8 bps at 3.7869%

- US Sep 10-Yr futures are down 17/32 at 112-25

- EURUSD down 0.0026 (-0.24%) at 1.096

- USDJPY up 1.17 (0.82%) at 143.05

- Gold is down $17.46 (-0.9%) at $1915.08

- EuroStoxx 50 down 18.28 points (-0.42%) at 4304.47

- FTSE 100 down 57.15 points (-0.76%) at 7502.03

- German DAX down 34.97 points (-0.22%) at 15988.16

- French CAC 40 down 57.69 points (-0.79%) at 7203.28

US TREASURY FUTURES CLOSE

- 3M10Y +8.113, -151.01 (L: -161.674 / H: -149.451)

- 2Y10Y +0.064, -100.212 (L: -101.103 / H: -97.983)

- 2Y30Y -1.219, -92.688 (L: -93.459 / H: -89.078)

- 5Y30Y -1.944, -17.085 (L: -17.801 / H: -12.939)

- Current futures levels:

- Sep 2-Yr futures down 5.375/32 at 101-31.625 (L: 101-30.625 / H: 102-06.375)

- Sep 5-Yr futures down 11.75/32 at 107-19.25 (L: 107-16.75 / H: 108-02.75)

- Sep 10-Yr futures down 17/32 at 112-25 (L: 112-21 / H: 113-14)

- Sep 30-Yr futures down 1-2/32 at 127-3 (L: 126-27 / H: 128-10)

- Sep Ultra futures down 1-14/32 at 136-6 (L: 135-28 / H: 137-24)

US 10Y FUTURE TECHS: (U3) Trend Needle Points South

- RES 4: 115-19 High May 18

- RES 3: 115-00 High Jun 1 and a key resistance

- RES 2: 114-06+ / 114-14 High Jun 6 / 50-day EMA

- RES 1: 114-00 High Jun 13

- PRICE: 113-02+ @ 11:09 BST Jun 22

- SUP 1: 112-12+ Low Jun 14 and the bear trigger

- SUP 2: 112-00 Low Mar 10

- SUP 3: 111-14+ Low Mar 9

- SUP 4: 110-27+ Low Mar 2 and key support

Treasury futures remain in consolidation mode. The trend is down and last week’s move lower confirmed a continuation of the current bear cycle. Support at 112-29+, the May 26 / 30 low has been cleared. This signals scope for 112-00, the Mar 10 low. Further out, scope is seen for a move towards 110-27+, the Mar 2 low and a key support. Gains are considered corrective. Initial firm resistance is at 114-00, the Jun 13 high.

SOFR FUTURES CLOSE

- Jun 23 +0.008 at 94.778

- Sep 23 -0.010 at 94.650

- Dec 23 -0.045 at 94.745

- Mar 24 -0.085 at 95.030

- Red Pack (Jun 24-Mar 25) -0.14 to -0.12

- Green Pack (Jun 25-Mar 26) -0.105 to -0.08

- Blue Pack (Jun 26-Mar 27) -0.075 to -0.07

- Gold Pack (Jun 27-Mar 28) -0.07 to -0.07

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00676 to 5.08923 (+.01294/wk)

- 3M +0.01713 to 5.24626 (+.03942/wk)

- 6M +0.02277 to 5.33450 (+.04512/wk)

- 12M +0.02468 to 5.27445 (+.04413/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00629 to 5.06900%

- 1M +0.00286 to 5.15043%

- 3M +0.00229 to 5.54186% */**

- 6M +0.00014 to 5.68257%

- 12M +0.00257 to 5.90114%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.55743% on 6/12/23

- Daily Effective Fed Funds Rate: 5.07% volume: $130B

- Daily Overnight Bank Funding Rate: 5.06% volume: $297B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.387T

- Broad General Collateral Rate (BGCR): 5.03%, $610B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $598B

- (rate, volume levels reflect prior session)

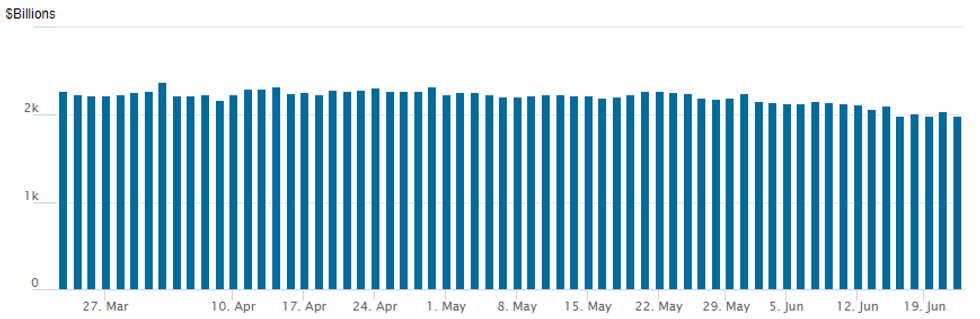

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,994.711B w/ 103 counterparties, compared to $2,037.102B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $1B BBVA Mexico 15NC10 Launched

- Date $MM Issuer (Priced *, Launch #)

- 06/22 $4.25B #Nasdaq $500M 2Y +90, $1B 5Y +135, $1.25B +10Y +175, $750M 30Y +210, $750M 40Y +225

- 06/22 $1B #BBVA Mexico 15NC10 8.45%

- 06/22 $550M #COSAN Luxembourg 2030 note, 7.5%

EGBs-GILTS CASH CLOSE: Surprise 50bp BoE Hike Further Inverts Curves

The UK curve twist flattened Thursday as the Bank of England surprised with a 50bp hike, though the German curve underperformed in a bear flattening move.

- Central banks set a generally hawkish tone overall, with Norges Bank hiking 50bp vs the 25bp expected (SNB's 25bp was in line), before the BoE raised a half point in a 7-2 vote that was not foreseen by any analyst.

- 10 year Gilt yields jumped to session highs (4.447%) then dived to session lows (4.327%) within the first 15 minutes after the decision as traders assessed the implications of the move, before settling slightly lower on the day. 2Ys gyrated similarly but resolved higher on the day.

- Interestingly though German yields ended higher than UK counterparts on the day, with the BoE's front-loaded tightening possibly seen as precipitating a UK recession.

- Greece easily outperformed with 10Y spreads 6+bp tighter ahead of the weekend's elections (our briefing is here).

- Friday's early highlights are UK retail sales and Europe flash June PMIs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 8.8bps at 3.221%, 5-Yr is up 8bps at 2.642%, 10-Yr is up 5.9bps at 2.494%, and 30-Yr is up 2.7bps at 2.509%.

- UK: The 2-Yr yield is up 3.1bps at 5.077%, 5-Yr is down 2.9bps at 4.562%, 10-Yr is down 3.8bps at 4.367%, and 30-Yr is down 2.8bps at 4.485%.

- Italian BTP spread up 2.1bps at 163.7bps / Greek down 6.6bps at 123.8bps

FOREX: Hawkish Central Banks Weigh Further On Japanese Yen

- Weakness for the Japanese Yen stands out on Thursday, with USDJPY rising 0.82% on the session and now back above the 143 mark for the first time since November last year. Central banks on Thursday set a fairly hawkish turn placing upward pressure on core yields. Up next on the topside for USDJPY is 143.77, the 2.0% 10-dma envelope.

- Helped by the soaring USDJPY, the greenback maintains its upward bias in late session with broad dollar indices hovering close to session highs as we approach the APAC crossover. The DXY is now up 0.30%, having reversed the majority of Wednesday’s decline.

- Interestingly, GBPUSD hovers just above session lows heading into the close, despite the hawkish surprise from the Bank of England. Markets continue to ponder the potential impact of a peak rate circa 6%, which explains GBP largely shrugging off the developments and trading on the heavy side heading into Friday. For cable, short-term support levels are well defined at 1.2680 (the May 10 high) and 1.2630 (the Jun 15 low).

- NOK remains an outperformer across G10, with a hawkish Norges bank briefly tipping EUR/NOK back toward the 100-dma support undercutting at 11.4405, however those declines have largely been pared throughout the session. A return lower to that level, which was last crossed in November last year, and a break below would mark a key medium-term momentum shift in the cross.

- Worth noting that in emerging markets, an underwhelming 650bps hike from the central bank placed the Turkish lira under severe selling pressure. USDTRY currently trades at fresh all time highs around 24.85, having appreciated 5.40% on the day.

- UK retail sales and Flash European PMIs headline a busy European docket on Friday.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/06/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 23/06/2023 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 23/06/2023 | 2330/0830 | *** |  | JP | CPI |

| 23/06/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 23/06/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 23/06/2023 | 0700/0900 | *** |  | ES | GDP (f) |

| 23/06/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 23/06/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 23/06/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 23/06/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 23/06/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 23/06/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 23/06/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 23/06/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 23/06/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 23/06/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 23/06/2023 | 0915/0515 |  | US | St. Louis Fed's James Bullard | |

| 23/06/2023 | 1200/0800 |  | US | Atlanta Fed's Raphael Bostic | |

| 23/06/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 23/06/2023 | 1245/1445 |  | EU | ECB Panetta in BIS Conference Discussion | |

| 23/06/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 23/06/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/06/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 23/06/2023 | 1530/1630 |  | UK | BOE Announces Q3-23 Active Gilt Sales Schedule | |

| 23/06/2023 | 1740/1340 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.