-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Used Car Component Key to June CPI

- MNI US CPI Preview: Core Seen Softer On Used Cars Drag

- MNI: EC Call For Prudent ‘24 Fiscal Policies To Support ECB

- MNI INTERVIEW: Real Wage Growth Boost In Coming Months For UK

- MNI: Little Sign Of Credit Crunch For Small Businesses

US

US DATA: Consensus puts core CPI inflation at 0.3% M/M in June as it slowed from a modest beat of 0.44% in May. It’s seen almost entirely coming from used car prices pulling back after two rapid 4.4% increases. Analysts look for declines of circa -1% although yesterday’s Manheim prices sliding -4.2% caught markets attention.

- Elsewhere, non-housing core services could have eased a touch (with the usual pitfalls vs its PCE equivalent) and we also watch non-used car core goods after its exactly unchanged May print.

- There is no evidence that the downside miss in nonfarm payroll gains last Friday has deterred FOMC participants from signalling their preference to raise rates twice more this year. An above-expected print and/or a report with strong details in ex-shelter services would reinforce the "higher for longer" theme; a miss most impactful for September pricing.

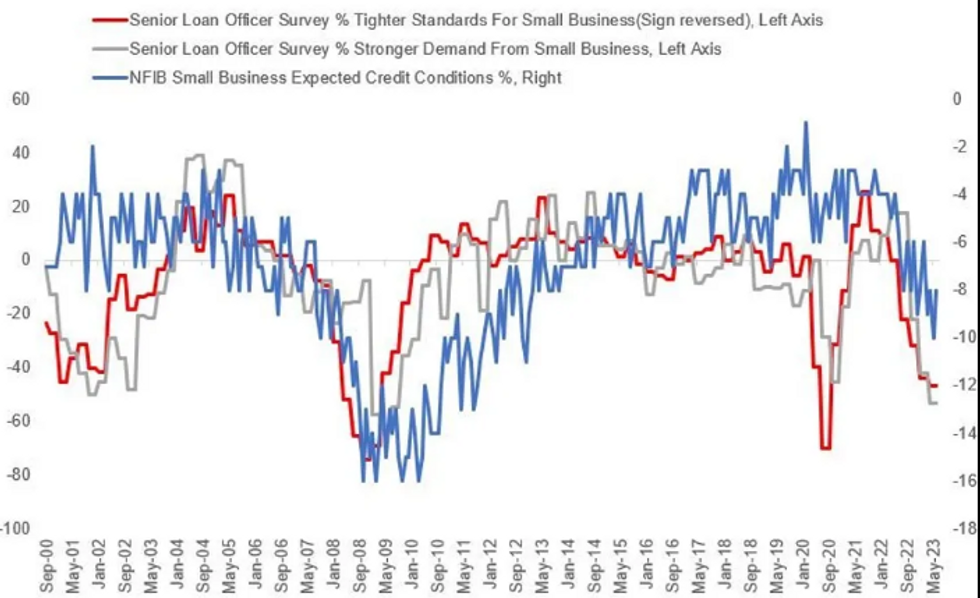

US: June's NFIB survey showed little sign of an incipient credit crunch among small businesses.

- Just 2% of small business owners reported that "all their borrowing needs were not satisfied", and the same percentage reported that financing was their "biggest problem" - a 2 point drop from May.

- 87% had no problems on the lending front (27% reported all credit needs met and 60% were not interested in a loan). And just 6% reported that their last loan was harder to get than in previous attempts.

- The net credit conditions expectation remained around the same level (-8%) as it has been since last August, a 2pp improvement from May's -10%.

- The NFIB report sums up the financing situation with "credit remains available but the price is rising as the Federal Reserve raises its policy rate". Indeed, the Fed's Senior Loan Officer Survey has tightened sharply, with the demand reading at -53.3% in the latest survey, below the pandemic lows and around levels that prevailed in the 2008-09 global financial crisis.

- In short, despite a clear tightening of credit conditions alongside the Fed's hiking cycle, financing does not appear to be a problem for small businesses.

- Conditions will probably worsen in line with the Senior Loan Officer Survey, but the majority of the tightening so far appears to have come via higher rates and not balance sheet constrained/risk averse banks.

EUROPE

ECB: The European Commission will call on member states to implement prudent fiscal policies next year to support the European Central Bank in bringing down inflation, a senior EU official said Tuesday.

- “The inflation outlook calls for strong fiscal policy coordination and prudent fiscal policies in order to ensure a consistent fiscal and monetary policy mix and facilitate the task of monetary policy,” a Commission paper to be discussed by Euro Area finance ministers on Thursday states.

- High and persistent inflation, a tight labour market and an economy running close to potential all supported the case for tighter fiscal policies, the official said. (MNI POLICY: EU Agree Tighter '24 Fiscal Stance, Debating Scale) “There is quite broad agreement among member states that the fiscal stance should be restrictive,” the official said. For more see MNI Policy main wire at 1310ET.

UK: Real wages are set to turn positive in the coming months as inflation is likely to fall, offering a boost to consumer confidence and spending, although evidence is growing that the jobs market is cooling, Grant Fitzner, chief economist at the Office for National Statistics, told MNI.

- “With nominal wage growth at these levels and headline inflation likely to fall in coming months, real earnings (using the ONS’s preferred CPIH measure of inflation) are close to turning positive,” Fitzner said, noting that it would be the first time that real pay growth is in the black since mid-2021.

- That will be a boost for consumer confidence and spending in coming quarters, Fitzner added, a bright spot if the wider UK economy did start to slow. For more see MNI Policy main wire at 0706ET.

US TYSY Markets Roundup: Curves Flatten Ahead June CPI

- Generally quiet trade Tuesday, carry-over support in intermediate (TYU3 +5.5 at 111-10, 3.976% yield) to long-end rates from Monday while curves scaled back a portion of steepening (2s10s -3.704 at -90.719) over the last week ahead tomorrow's CPI inflation metric.

- Consensus puts core CPI inflation at 0.3% M/M in June as it slowed from a modest beat of 0.44% in May. There is no evidence that the downside miss in nonfarm payroll gains last Friday has deterred FOMC participants from signaling their preference to raise rates twice more this year.

- An above-expected print and/or a report with strong details in ex-shelter services would reinforce the "higher for longer" theme; a miss most impactful for September pricing.

- Fed Funds implied rates remain unchanged for the Jul 26 decision (+22bp) but beyond that have edged higher on the day after reversing an overnight decline that continued from yesterday’s second half softer trading.

- Cumulative change from 5.08% effective: +22bp Jul (unch), +28.5bp Sep (unch), +35bp Nov (+1bp), +30bp Dec (+1bp), +21.5bp Jan (+1bp). Rates are first seen lower than they are today with the May meeting (-8bps, +0.5bp on the day). Cuts from Nov terminal: 5bp Dec’23, 63bp Jun’24 and 135bp Dec’24.

- Fed speaker schedule for tomorrow includes: Richmond Fed Barkin (0830ET), MN Fed Kashkari (0945ET), Atlanta Fed Bostic (1300ET) and Cleveland Fed Mester (1600ET)

OVERNIGHT DATA

- US REDBOOK: JUL STORE SALES -0.4% V YR AGO MO

- US REDBOOK: STORE SALES -0.4% WK ENDED JUL 08 V YR AGO WK

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 244.25 points (0.72%) at 34189.55

- S&P E-Mini Future up 19.75 points (0.44%) at 4464

- Nasdaq up 40.6 points (0.3%) at 13725.89

- US 10-Yr yield is down 1.4 bps at 3.98%

- US Sep 10-Yr futures are up 3.5/32 at 111-8

- EURUSD up 0.0005 (0.05%) at 1.1006

- USDJPY down 0.88 (-0.62%) at 140.43

- WTI Crude Oil (front-month) up $1.88 (2.58%) at $74.87

- Gold is up $6.83 (0.35%) at $1932.18

- EuroStoxx 50 up 30.05 points (0.71%) at 4286.56

- FTSE 100 up 8.73 points (0.12%) at 7282.52

- German DAX up 117.18 points (0.75%) at 15790.34

- French CAC 40 up 76.32 points (1.07%) at 7220.01

US TREASURY FUTURES CLOSE

- 3M10Y -3.337, -143.011 (L: -153.369 / H: -141.279)

- 2Y10Y -3.729, -90.744 (L: -91.825 / H: -86.114)

- 2Y30Y -3.866, -87.061 (L: -88.16 / H: -82.19)

- 5Y30Y -1.704, -22.236 (L: -23.002 / H: -19.561)

- Current futures levels:

- Sep 2-Yr futures down 1.5/32 at 101-19.875 (L: 101-19 / H: 101-23.625)

- Sep 5-Yr futures steady at at 106-21.5 (L: 106-19 / H: 106-28.5)

- Sep 10-Yr futures up 3.5/32 at 111-8 (L: 111-03.5 / H: 111-16)

- Sep 30-Yr futures up 8/32 at 124-10 (L: 123-31 / H: 124-24)

- Sep Ultra futures up 16/32 at 132-13 (L: 131-28 / H: 132-29)

US 10YR FUTURE TECHS: (U3) Corrective Bounce

- RES 4: 113-16 50-day EMA

- RES 3: 112-17+ High Jul 3

- RES 2: 112-12+ Low Jun 14 and the 20-day EMA

- RES 1: 112-04 High Jul 5

- PRICE: 111-08 @ 11:16 BST Jul 11

- SUP 1: 110-05 Low Jul 6

- SUP 2: 110-00 Low Nov 9 2022 (cont)

- SUP 3: 109-14 Low Nov 8 2022 (cont)

- SUP 4: 109-10+ Low Nov 4 2022 (cont)

Treasury futures remain above last week’s low of 110-05 (Jun 6). The trend outlook is bearish and short-term gains are considered corrective. The break lower last week confirmed a resumption of the downtrend. Note that moving average studies are in a bear mode position, highlighting current conditions. The focus is on the 110-00 handle next. Initial firm resistance is seen at 112-12+, the Jun 14 low.

SOFR FUTURES CLOSE

- Sep 23 -0.015 at 94.570

- Dec 23 -0.030 at 94.605

- Mar 24 -0.035 at 94.850

- Jun 24 -0.025 at 95.230

- Red Pack (Sep 24-Jun 25) -0.02 to steadysteady0

- Green Pack (Sep 25-Jun 26) +0.010 to +0.035

- Blue Pack (Sep 26-Jun 27) +0.040 to +0.050

- Gold Pack (Sep 27-Jun 28) +0.050 to +0.060

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00257 to 5.19643 (+.01942/wk)

- 3M +0.00159 to 5.30109 (+.00262/wk)

- 6M -0.00096 to 5.40243 (-.01257/wk)

- 12M -0.02333 to 5.38527 (-.06915/wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $125B

- Daily Overnight Bank Funding Rate: 5.07% volume: $270B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.506T

- Broad General Collateral Rate (BGCR): 5.04%, $597B

- Tri-Party General Collateral Rate (TGCR): 5.04%, $586B

- (rate, volume levels reflect prior session)

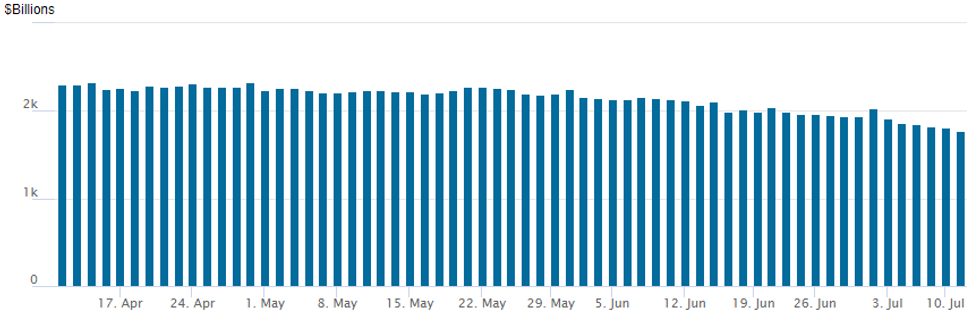

FED Reverse Repo Operation

NY Federal Reserve/MNI

Latest operation falls to $1,775.796B, lowest since early May'22, w/ 101 counterparties, compared to $1,811.981B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: John Deere, Rabobank Debt Launched Late

$9.75B Corporate debt to Price Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 07/11 $4B *KFW 10Y SOFR+45

- 07/11 $1.5B #John Deere 5Y +75

- $1.5B #Cooperative Rabobank $850M 2Y +65, $650M 2Y SOFR+70

- 07/11 $1.5B #JBIC (Japanese Bank for Int Cooperation) 5Y +69

- 07/11 $750M #Abu Dhabi Islamic Bank NC5.5 Sukuk +165

- 07/11 $500M #Korea Hydro/Nuclear Power 5Y +90

EGBs-GILTS CASH CLOSE: Weakness Resumes Post-UK Jobs, Pre-US CPI

Core European curves bear flattened Tuesday, with Gilts underperforming Bunds following May's UK labour market data.

- The UK jobs report was initially interpreted as mixed, with Gilts initially weakening on higher-than-expected wage numbers, then reversing higher on the higher unemployment rate signalling labour market slack.

- By session's end though Gilts had weakened with BoE hike pricing firming, as analysts focused on potential for further 50bp hikes on the robust wage data.

- Movements in Bunds followed suit, with global core FI weakening in the latter half of the session amid anticipation over Wednesday's US CPI print.

- BTPs underperformed on the periphery, with 10Y spreads to Germany closing at the widest level in over a month. GGBs steadied out after weakening sharply Monday on the announcement of the 15Y syndication held today.

- Wednesday has a busy docket with the release of the BoE's financial stability report and Spanish final CPI in the morning, with the main focus being US CPI in the afternoon.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.7bps at 3.316%, 5-Yr is up 1.2bps at 2.769%, 10-Yr is up 0.9bps at 2.649%, and 30-Yr is up 1.4bps at 2.66%.

- UK: The 2-Yr yield is up 5.6bps at 5.426%, 5-Yr is up 4.2bps at 4.886%, 10-Yr is up 2.3bps at 4.663%, and 30-Yr is up 2bps at 4.697%.

- Italian BTP spread up 2.3bps at 176.9bps / Spanish up 1.2bps at 106.7bps

FOREX: NZD Underperforms Ahead of RBNZ, USDJPY Extends Losing Streak

- The softer USD backdrop has persisted into a fourth session, with the USD Index edging to the lowest levels since mid-may. The pullback after nonfarm payrolls has extended and the DXY has printed as low 101.67, narrowing the gap with the next major support of 101.03. The New Zealand dollar screens as the weakest in G10, interesting given the RBNZ decision is due overnight. New Zealand’s central bank is likely to remain on hold for the first time since August 2021.

- USD/JPY typifies the soft USD theme, with the pair lower for a fourth consecutive session and attention firmly on support at the 50-day EMA that intersects around current levels at 140.34. A clear break of this average would strengthen bearish conditions, opening 139.85, the Jun 16 low and 139.18, the 38.2% retracement of the Mar 24 - Jun 30 bull leg.

- AUD and EUR are also among the poorest performers in G10, with AUD/JPY a stand out cross at these levels: AUD/JPY is now on a five session losing streak, with the 50-dma the next level to watch at 93.439.

- NOK tops the G10 FX table once more on Tuesday, extending Monday’s move following the higher-than-expected CPI for June and notable acceleration for core measures. USD/NOK has declined around 1.2% and has significantly narrowed the gap with the April lows of 10.2451.

- A busy Wednesday is headlined by US inflation data as well as RBNZ and BOC rate decisions. There may also be comments from both RBA Governor Lowe and BOE Governor Bailey.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/07/2023 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 12/07/2023 | 0600/0700 |  | UK | BOE FPC Summary and Record | |

| 12/07/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 12/07/2023 | 0800/0900 |  | UK | Financial Stability Report press conference | |

| 12/07/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 12/07/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 12/07/2023 | 1230/0830 | *** |  | US | CPI |

| 12/07/2023 | 1230/0830 |  | US | Richmond Fed's Tom Barkin | |

| 12/07/2023 | 1345/0945 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/07/2023 | 1345/1545 |  | EU | ECB Lane panels at NBER conference. | |

| 12/07/2023 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 12/07/2023 | 1400/1000 |  | CA | Bank of Canada Monetary Policy Report | |

| 12/07/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 12/07/2023 | 1500/1100 |  | CA | Bank of Canada Governor press conference | |

| 12/07/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/07/2023 | 1700/1300 |  | US | Atlanta Fed's Raphael Bostic | |

| 12/07/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/07/2023 | 1800/1400 |  | US | Fed Beige Book | |

| 12/07/2023 | 2000/1600 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.