-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Vaccine Euphoria Losing Luster

EXECUTIVE SUMMARY

- MNI INTERVIEW: ECB To Up PEPP, Cut TLTRO Rate-Ex Markets Chief

- MNI DATA IMPACT: Most Americans Unlikely to Travel for Holidays

- MNI DATA IMPACT: 1/3 US Shoppers to Cut Holiday Spending: Gallup

- MNI BRIEF: U.S. Senate May Approve Trump Fed Nominees Next Week

- MNI POLICY: BOC: Canada Faces Pandemic 'Still in Full Throttle'

- TRUMP ADMIN SAID TO BE STEPPING BACK FROM STIMULUS NEGOTIATIONS, Bbg

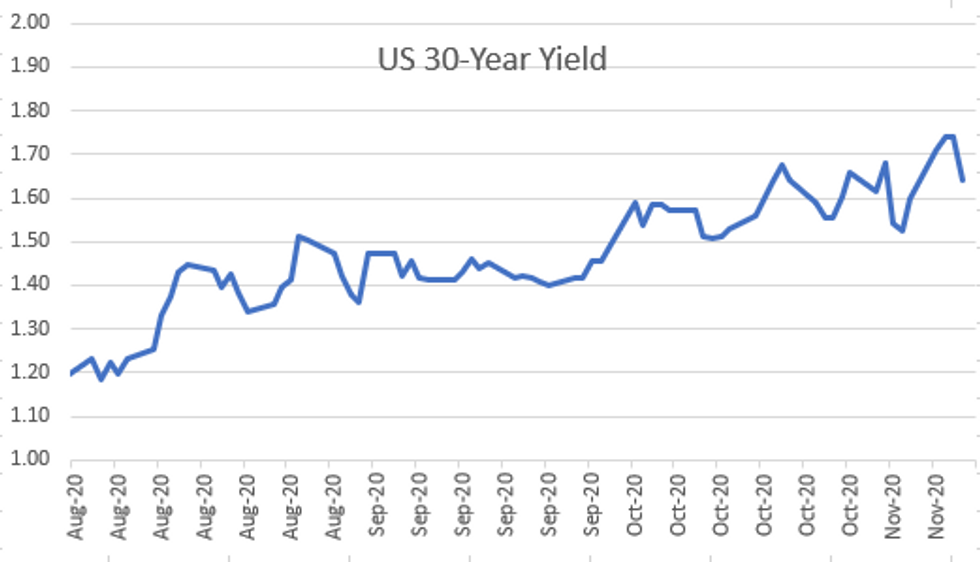

Late Week Pressure For 30YY

US

US: Nearly three-fourths of Americans are unlikely to travel for Thanksgiving this month, and even fewer are expected to travel during Christmastime, the American Hotel and Lodging Association said Thursday. For more, see 11/12 main wire at 1502ET.

US: Americans are more likely to spend less this holiday season compared to last year if another round of federal stimulus checks aren't sent out before the end of the year, according to data published Thursday by public opinion research group Gallup. For more, see 11/12 main wire at 1405ET.

US: The U.S. Senate as soon as next week could vote to confirm President Donald Trump's controversial Federal Reserve nominee Judy Shelton to a seat on the board of governors.

- Senate Majority Leader Mitch McConnell on Thursday set up procedural votes for Shelton that could lead for final up or down votes next week that would require a simple majority for her confirmation. Shelton's nomination was put up at the same time as that of Christopher Waller, a St. Louis Fed economist. Waller's confirmation has been far less controversial.

- The makeup of the Fed board of governors could change further once the Biden administration is inaugurated. Lael Brainard, currently the board's only Democrat, is also a top contender for Biden's Treasury Secretary.

US: COVID Advisory

Unwelcome but necessary news for Chicagoans. Mayor Lori Lightfoot issues stay at home advisory today. "Chicago has reached a critical point in the second surge of COVID-19, demanding that we undertake this multi-faceted and comprehensive effort to stop the virus in its tracks," Bloomberg headlines:

- CHICAGO ADVISORY TO STAY IN PLACE FOR 30 DAYS UNLESS CHANGED, Bbg

- CHICAGO RECOMMENDS CALLING OFF THANKSGIVING GATHERINGS, Bbg

- CHICAGO ADVISORY ALLOWS LEAVING HOME FOR WORK, SCHOOL, Bbg

EUROPE

ECB: The European Central Bank may boost its Pandemic Emergency Purchase Programme and cut the rate of TLTRO loans to banks at its Dec. 10 meeting, but needs new policies to push inflation to target, former ECB market operations director general Francesco Papadia told MNI. For more, see 11/12 main wire at 1137ET.

CANADA

BOC: The Covid-19 pandemic is still raging and policy makers must find new ways to boost long-term productivity that offsets scarring to laid-off workers and struggling businesses owners, Bank of Canada Senior Deputy Governor Carolyn Wilkins said Thursday.

OVERNIGHT DATA

U.S. INITIAL STATE JOBLESS CLAIMS AT 709K LAST WEEK; EST. 731K

U.S. STATE CONTINUING CLAIMS AT 6.79M; EST. 6.83M

October CPI Unchanged; Core Unchanged

U.S. CPI was flat in October following a 0.2% gain in September, below market forecasts for a 0.2% increase, according to figures released Thursday by the Bureau of Labor Statistics. CPI was up 1.2% from a year earlier.

- Food prices rose 0.2% in October after a flat reading in September, with the cost of dining out up 0.3%.

- Energy prices were up 0.1% following a 0.8% increase in September, mainly driven by a 1.2% increase in electricity prices. Gas prices fell 0.5% in October.

- Excluding food and energy prices, core CPI was also flat in October after a 0.2% increase in September. From a year earlier, core CPI was up 1.6%.

- Apparel prices fell 1.2% in October after dropping 0.5% in September.

- New vehicle prices rose 0.4% while the cost of a used vehicle fell 0.1% following a 6.7% increase in September.

- The relatively large owners' equivalent rent category, accounting for 25% of the total CPI basket, was up 0.2% in October following a 0.1% increase in September.

- Airline fares rose 6.3% through the month after dropping 2.0% in September.

US TREASURY OCT BUDGET DEFICIT $284B VS DEFICIT $134B YR EARLIER

FISCAL YEAR-T0-DATE 2021 BUDGET BALANCE -$284B VS FYTD20 -$134B

MARKETS SNAPSHOT

- DJIA down 317.46 points (-1.08%) at 29397.63

- S&P E-Mini Future down 26.5 points (-0.74%) at 3565

- Nasdaq down 76.8 points (-0.7%) at 11786.43

- US 10-Yr yield is down 9.4 bps at 0.8815%

- US Dec 10Y are up 18.5/32 at 138-6

- EURUSD up 0.003 (0.25%) at 1.1812

- USDJPY down 0.32 (-0.3%) at 105.32

- WTI Crude Oil (front-month) down $0.49 (-1.18%) at $41.55

- Gold is up $10.68 (0.57%) at $1870.97

- European bourses closing levels:

- EuroStoxx 50 down 39.1 points (-1.13%) at 3445.43

- FTSE 100 down 43.16 points (-0.68%) at 6361.79

- German DAX down 163.23 points (-1.24%) at 13107.77

- French CAC 40 down 82.64 points (-1.52%) at 5399.04

US TSY SUMMARY: Early Week Vaccine Euphoria Fading

Rates trade broadly higher after the bell, just off late session highs as concerns over spread of COVID-19 likely to trigger lock-downs/closings with holidays a couple weeks away. Equities ground lower (ESZ0 -50.0). Heavier volumes heavy again, TYZ>1.5M. Long end lead rally, yield curves consistently flatter.

- Long end lead continued to climb higher after brief dip on weak 30Y Bond auction tailed 8bp: $27B 30Y bond auction (912810SS8) yields 1.680% (1.578% last month) vs. 1.672% WI; w/ 2.29 bid/cover (2.29 prior).

- Off early week pave corporate issuance remained robust, $5.75B JP Morgan 3pt lead better issuance from banks, insurers; supra-sovereigns: Italy looking to issue 5Y and 30Y bonds in near term.

- Equity performance, particularly large banks has boosted GSIB (global systemically important banks) scores, easing year-end funding expectations in theory -- and spurring heavy selling in short end Eurodollar futures this week.

- The 2-Yr yield is down 0.6bps at 0.1748%, 5-Yr is down 5.9bps at 0.3948%, 10-Yr is down 9.5bps at 0.8799%, and 30-Yr is down 9.6bps at 1.6455%.

US TSY FUTURES CLOSE: Fading Monday's Vaccine Euphoria

Futures higher across the strip, long end outperforming. Whites-Reds lagging move, partially due to opinion that year end funding concerns for Global Systemically Important Banks (GSIBs) has eased with equities back near all-time highs. Lead quarterly EDZ0 held gain despite 3M LIBOR continued rebound off Monday's all-time low: +0.00037 to 0.22100% (+0.01512/wk). Latest levels:

- Dec 20 +0.010 at 99.750

- Mar 21 +0.005 at 99.780

- Jun 21 +0.005 at 99.785

- Sep 21 +0.005 at 99.785

- Red Pack (Dec 21-Sep 22) +0.005 to +0.015

- Green Pack (Dec 22-Sep 23) +0.025 to +0.045

- Blue Pack (Dec 23-Sep 24) +0.060 to +0.085

- Gold Pack (Dec 24-Sep 25) +0.090 to +0.110

US DOLLAR LIBOR

Latest settles

- O/N -0.00338 at 0.08150% (-0.00113/wk)

- 1 Month -0.00050 to 0.14088% (+0.01313/wk)

- 3 Month +0.00037 to 0.22100% (+0.01512/wk)

- 6 Month +0.00525 to 0.25138% (+0.00800/wk)

- 1 Year -0.00138 to 0.34050% (+0.00717/wk)

FED: NY Fed operational purchase

- Tsy 7Y-20Y, $3.601B accepted vs. $8.611B submission

- Next scheduled purchase:

- Fri 11/13 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Fri 11/13 Next forward schedule release at 1500ET

PIPELINE: JPM Launched

JPM leads list of issuers:

- Date $MM Issuer (Priced *, Launch #

- 11/12 $5.75B #JP Morgan fix-FRN: $2.75B 6NC5 +65, $1.4B 11NC10 +90, $1.6B 21NC20 +87.5

- 11/12 $1.5B #Societe Generale PNC10 5.375%

- 11/12 $1.45B *Pacific Gas & Electric 1Y FRN 3M LIBOR +137.5

- 11/12 $800M #Equitable Financial Life $500M 3Y +32, $300M 10Y +90

- 11/12 $500M *Inner Mongolia Yili 5Y Reg S +125

- 11/12 $Benchmark Rep of Italy investor call (1030ET) re: 5Y and 30Y US$ issuance

- 11/?? $Benchmark BNG Bank 5Y Reg S

FOREX: Havens on Front Foot as Vaccine Trades Unwind

Markets continue to unwind the vaccine-induced reflation trades put on earlier in the week, with equities inching lower across Europe and the US - the tech sector's been recovering, while profit-taking in cyclical stocks proves a drag on most indices.

- As a result, haven currencies were the strongest performers Thursday. JPY and CHF outperformed, but EUR buying was evident throughout, as markets price out the chances of any imminent ECB rate cut after Lagarde's speech Wednesday.

- GBP started, and finished, the session poorly with UK representatives stressing that significant gaps remain between EU and UK negotiators as meetings drag into the end of the week. GBP traded lower against all others in G10, with GBP/USD reverting back below 1.3150 ahead of the London close.

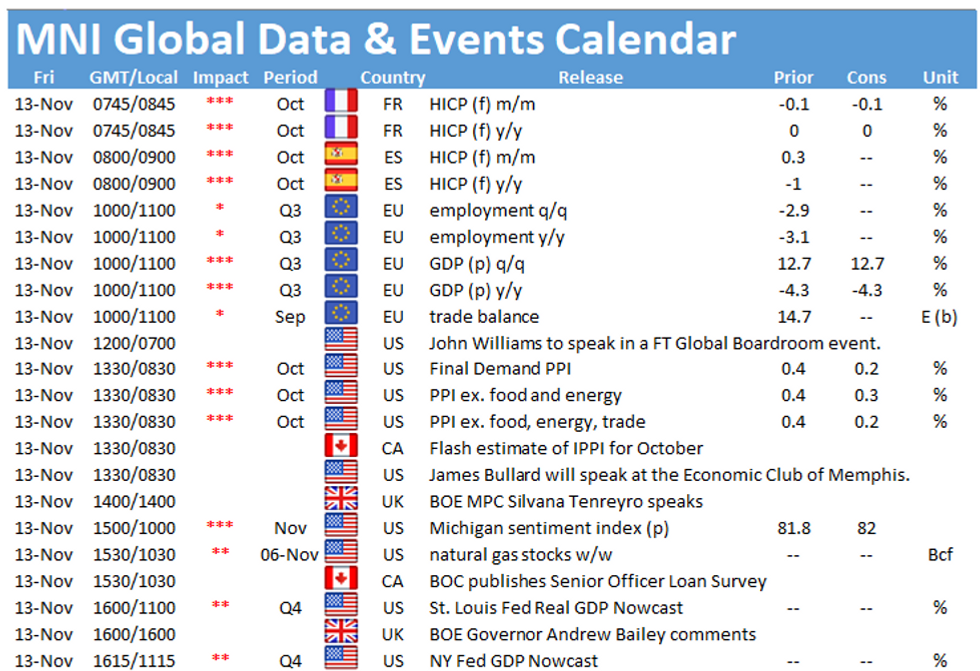

- Focus Friday turns to Eurozone GDP & trade balance data and PPI, Uni of Michigan numbers from the US. The speaker schedule will again draw focus, with speeches due from ECB's Rehn, de Cos, & Weidmann, BoE's Bailey, Tenreyro & Cunliffe and Fed's Williams & Bullard.

EGBs-GILTS CASH CLOSE: Gilts Bull Flatten Amid Mixed Brexit News

An impressive rally at the long-end in core FI, particularly in Gilts, with 30-Yr yields down over 8bps amid a strong bull flattening in the curve. Overall theme has been fading positive early week vaccine news.

- Gilts were boosted by continued mixed news on Brexit talk progress [BBC sources piece suggesting stalemate], helping push yields to session lows in the afternoon.

- Periphery EGB spreads closed mixed, BTPs very much outperforming; Greek short-end (2Yr) went into negative yield territory.

- On Friday, Eurozone Q3 prelim GDP highlights the data docket, while we get several BoE and ECB speakers.

- Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 0.8bps at -0.723%, 5-Yr is down 2bps at -0.73%, 10-Yr is down 2.9bps at -0.536%, and 30-Yr is down 3.9bps at -0.112%.

- UK: The 2-Yr yield is down 3.7bps at -0.036%, 5-Yr is down 4.4bps at 0.015%, 10-Yr is down 6.5bps at 0.348%, and 30-Yr is down 8.3bps at 0.932%.

- Italian BTP spread down 2.5bps at 122bps

- Spanish bond spread up 0.4bps at 66.8bps

- Portuguese PGB spread up 0.7bps at 64bps

- Greek bond spread up 1.3bps at 134.1bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.