-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Weekly Claims Upside Surprise

- MNI INTERVIEW: Fed Likely To Hike 50-100BPS More, Gagnon Says

- MNI INTERVIEW: Europe Faces Slow Growth- German Gov't Advisor

- MNI Claims Jump By Most In Single Week Since Jul'21, Ohio Sees Outsized Contributions

US

FED: Federal Reserve officials could take a breather from interest rate hikes at next week’s meeting, but that won’t stop them from tightening monetary policy by at least another half and possibly a full percentage point, Joseph Gagnon, a former senior economist at the Fed Board of Governors, told MNI Thursday.

- Inflation has been more stubborn than expected, and while it should let up enough by year-end to give policymakers comfort, recent strong data will keep the Fed on track for additional rate increases.

- “The data over the past few months has gradually pointed towards maybe a few more hikes, maybe 50 basis points or so, I wouldn’t rule out 100 basis points,” Gagnon told MNI’s FedSpeak podcast. For more see MNI Policy main wire at 1400ET.

EUROPE

EU: Germany and Europe face an extended period of sluggish growth as high interest rates choke investment, increase unemployment and sap consumer confidence even as inflation falls, a senior adviser to the German government told MNI.

- While success by the European Central Bank in “considerably” reducing inflation would help a revival in consumer confidence, the likely accompanying increase in unemployment would drag sentiment down again, said Lars Feld, personal economic adviser to Finance Minister Christian Lindner

- “The net result of reducing inflation rates, and then, perhaps, the negative outcome in the labor market is not clear to me,” Feld said in an interview. “I fear that consumer confidence will not come back quickly, at least not in Germany, and probably also not in Europe.” He added: “I expect stagnation in Germany and small growth for the EU, but actually the latter rather also is in a stag-flationary environment.” For more see MNI Policy main wire at 0803ET.

US TSYS: Weekly Claims Supports Tsys, Incoming Supply Weighs on Curve

- Treasury futures remain well supported in late trade after this morning's higher than expected weekly claims of 261k (largest since Dec '21) vs. 235k est, small up-revision to prior (233k vs. 232k). Little reaction to midmorning Wholesale Trade Sales/Inventories data.

- Curves have reversed early steepening, however, as support for short end rates recedes. Currently, 2s10s curve is -4.620 at -80.937 vs. -71.863 high.

- Short end move partially be due to markets expecting increased Treasury bill sales (size and breadth of durations), though latest announcement shows 13- and 26W bills steady at $65B and $58B respectively while 52W bill climbs $2B to $38B.

- As a result of this morning's post claims rally, projected rate hike chances over the next three meetings have cooled: Fed funds pricing in appr 28% chance of a 25bp hike next week vs. 38.8% earlier, July OR Sep has receded to 77.2% and 64.4% respectively vs. 91.2% and 80.0% earlier. Year end rate cut chances remain soft while Jan'24 has climbed back to fully pricing in a 25bp cut.

- Stocks, meanwhile, are trading near highs (SPX emini at 4296.5) lead by Consumer Discretionary and IT sector shares. Energy stocks have pared early week gains as crude trades lower (WTI -1.36 at 71.17)

OVERNIGHT DATA

- US JOBLESS CLAIMS +28K TO 261K IN JUN 03 WK

- US PREV JOBLESS CLAIMS REVISED TO 233K IN MAY 27 WK

- US CONTINUING CLAIMS -0.037M to 1.757M IN MAY 27 WK

US DATA: Initial jobless claims surprisingly increased 28k to 261k (cons 235k) in the week to Jun 3 after a minimally upward revised 233k (initial 232k) the prior week. It’s the largest single seasonally adjusted weekly increase since mid-Jul 2021 for the highest since Oct 2021.

- The four-week average increases 7k to 237k but remains off the 240k it most recently peaked at in late March/early April. The non-seasonally adjusted +10k increase to 219k pushes claims back towards the high end of typical non-pandemic years, although is a much smoother transition than the spike in the SA data.

- Looking by state, there aren’t any culprits the size of the recent Massachusetts fraud cases although Ohio does see an unusually sharp 6.3k increase on the same NSA basis from 10.4k to 16.7k, having also led the increases the prior week with +2.2k.

- Continuing claims take some of the edge off the higher initial figure though, surprisingly falling the prior week to 1757k (cons 1802k) from 1794k.

- US APR WHOLESALE INV -0.1%; SALES 0.2%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 178.13 points (0.53%) at 33842.78

- S&P E-Mini Future up 21.5 points (0.5%) at 4295.75

- Nasdaq up 116.7 points (0.9%) at 13221.51

- US 10-Yr yield is down 8.1 bps at 3.7141%

- US Sep 10-Yr futures are up 15.5/32 at 113-22.5

- EURUSD up 0.0081 (0.76%) at 1.078

- USDJPY down 1.17 (-0.83%) at 138.96

- WTI Crude Oil (front-month) down $1.33 (-1.83%) at $71.20

- Gold is up $24.99 (1.29%) at $1964.93

- EuroStoxx 50 up 5.77 points (0.13%) at 4297.68

- FTSE 100 down 24.6 points (-0.32%) at 7599.74

- German DAX up 29.4 points (0.18%) at 15989.96

- French CAC 40 up 19.36 points (0.27%) at 7222.15

US TREASURY FUTURES CLOSE

- 3M10Y -2.905, -153.721 (L: -156.859 / H: -148.852)

- 2Y10Y -4.603, -80.92 (L: -81.339 / H: -71.863)

- 2Y30Y -3.047, -64.393 (L: -64.629 / H: -54.603)

- 5Y30Y +1.694, 1.969 (L: -1.177 / H: 6.904)

- Current futures levels:

- Sep 2-Yr futures up 1.125/32 at 102-18.625 (L: 102-14.5 / H: 102-21.75)

- Sep 5-Yr futures up 8/32 at 108-16.5 (L: 108-01.75 / H: 108-19.25)

- Sep 10-Yr futures up 15.5/32 at 113-22.5 (L: 112-30 / H: 113-24)

- Sep 30-Yr futures up 1-04/32 at 127-20 (L: 125-27 / H: 127-21)

- Sep Ultra futures up 1-10/32 at 136-1 (L: 133-26 / H: 136-02)

US 10YR FUTURE TECHS: (U3) Bounces Ahead of Key Support

- RES 4: 115-29+ High May 17

- RES 3: 115-19 High May 18

- RES 2: 115-00 High Jun 1 and a key resistance

- RES 1: 114-06+ / 114-30+ High Jun 6 / 50-day EMA

- PRICE: 113-18 @ 16:20 BST Jun 8

- SUP 1: 112-29+ Low May 26 / 30 and key support

- SUP 2: 112-16 76.4% retracement of the Mar 2 - May 4 rally

- SUP 3: 112-00 Low Mar 10

- SUP 4: 111-14+ Low Mar 9

Treasury futures bounced ahead of the week’s lows Thursday, leaving support at 112-29+ intact. Nonetheless, the broader outlook remains negative for now, following the bearish engulfing candle pattern on June 2. The candle highlights a reversal and attention remains on key support and the bear trigger at 112-29+, the May 26 / 30 low. Clearance of this level would resume the downtrend that started May 4 and open 112-16+, a Fibonacci retracement. Initial resistance has been defined at 114-06+, the Jun 6 high.

SOFR FUTURES CLOSE

- Jun 23 steady at 94.745

- Sep 23 +0.005 at 94.785

- Dec 23 +0.015 at 95.030

- Mar 24 +0.010 at 95.415

- Red Pack (Jun 24-Mar 25) +0.015 to +0.040

- Green Pack (Jun 25-Mar 26) +0.050 to +0.075

- Blue Pack (Jun 26-Mar 27) +0.080 to +0.085

- Gold Pack (Jun 27-Mar 28) +0.070 to +0.080

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01521 to 5.14638 (+.00521/wk)

- 3M +0.01251 to 5.25059 (+.02025/wk)

- 6M +0.01419 to 5.29207 (+.04660/wk)

- 12M +0.04239 to 5.14618 (+.11921/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00315 to 5.06929%

- 1M +0.04072 to 5.22243%

- 3M +0.02985 to 5.53971 */**

- 6M +0.01300 to 5.65657%

- 12M +0.04171 to 5.78800%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.53971% on 6/8/23

- Daily Effective Fed Funds Rate: 5.08% volume: $137B

- Daily Overnight Bank Funding Rate: 5.07% volume: $292B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.429T

- Broad General Collateral Rate (BGCR): 5.04%, $606B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $594B

- (rate, volume levels reflect prior session)

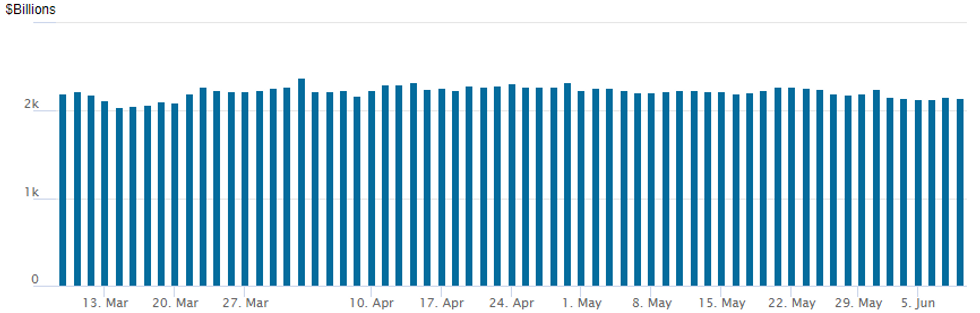

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,141.798B w/ 104 counterparties, compared to $2,161.556B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $2.2B Handelsbanken 3Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 06/08 $2.2B #Handelsbanken $700M 3Y +112.5, $500M 3Y SOFR+125, $1B 5Y +175

- 06/08 $1.25B #NatWest 6.25NC5.25 +195

- 06/08 $1B #Finnerva PLC WNG 2028 SOFR+47

- 06/08 $500M #Santander 6NC5 +285a

EGBs-GILTS CASH CLOSE: Rally Into End-Of-Day

The UK short end outperformed Thursday with a sharp drop in BoE implied hike pricing, with bull steepening in the curve.

- Bund and Gilt futures hit the session's best levels just at the cash close alongside a sharp drop in oil prices on news of a potential US-Iran nuclear deal, though have faded a little since and remain well below Wednesday's pre-Bank of Canada hike levels.

- 5.5bp of hikes were removed from the BoE implied hiking path; 1.1bp for ECB's.

- German yields pared some of Wednesday's gains but didn't keep pace with Gilts; much of Europe was on holiday, thinning trade.

- Periphery spreads narrowed sharply following recent widening: the 4bp drop in Greek spreads was noticeable ahead of Friday's Fitch ratings review.

- Friday morning sees some Eurozone national industrial production readings.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 4.4bps at 2.894%, 5-Yr is down 5.4bps at 2.42%, 10-Yr is down 5.4bps at 2.402%, and 30-Yr is down 4.2bps at 2.562%.

- UK: The 2-Yr yield is down 7.2bps at 4.5%, 5-Yr is down 4.4bps at 4.212%, 10-Yr is down 1.8bps at 4.233%, and 30-Yr is down 1.3bps at 4.488%.

- Italian BTP spread down 4.3bps at 178.4bps / Greek down 3.9bps at 128.9bps

FOREX: Substantial Greenback Turnaround, Swiss Franc Surges

- The greenback has had a substantial turnaround on Thursday, with the USD index sinking to two-week lows and broad strength witnessed across the majority of G10 currencies. The Swiss Franc was the notable outperformer, amid hawkish comments from the Governor of the Swiss National Bank.

- USDCHF looks set to post an intra-day 1.10% decline as the pair consolidates around the 0.90 handle approaching the APAC crossover. The impressive CHF move comes following more hawkish remarks from SNB Governor Thomas Jordan. The central bank chief highlighted that “we have second-round effects, third-round effects, so inflation is more persistent than we initially thought”. Jordan also noted that Swiss interest rates are relatively low, so it doesn’t make sense to wait which have exacerbated the CHF rally.

- USD/CHF has significantly narrowed the gap with the 50-dma at 0.8993 - with the pair notably breaking the below the uptrendline drawn off the early May lows of 0.8820.

- The Canadian dollar has bucked the trend, underperforming its G10 counterparts despite the BOC’s hawkish surprise on Wednesday and some analysts bolstering their calls for a weaker USDCAD. TD see a break below 1.33 as the path of least resistance, with a best case from a benign US CPI and the Fed skipping a June hike next week helping CAD outperform most G10 crosses, Scotia see fundamental fair value settling closer to 1.32, and ING see quite elevated chances it hits 1.30 this summer.

- Elsewhere, the likes of the Euro, GBP, JPY, AUD and NZD are all rising between 0.75-0.90% amid the softer greenback, with the price action underpinned by the weaker US initial jobless claims data and moderately firmer global equity benchmarks. Of note, cable has made a break of key resistance at 1.2545. Progress and a close through here could begin to signal a bottoming out of prices, with 1.2592 next up, a Fibonacci retracement and 1.2680 remaining the key topside level.

- Chinese PPI/CPI data is due overnight on Friday, with Canada employment the key release to close the week. All eyes remain focused on the US CPI print next Tuesday, which precedes the June FOMC decision.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/06/2023 | 0130/0930 | *** |  | CN | CPI |

| 09/06/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 09/06/2023 | 0600/0800 | * |  | NO | CPI Norway |

| 09/06/2023 | 0600/0800 | ** |  | SE | Private Sector Production |

| 09/06/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 09/06/2023 | 0800/1000 |  | EU | ECB de Guindos in Capital Requirements Seminar at EU Parliament | |

| 09/06/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 09/06/2023 | 1400/1000 | * |  | US | Services Revenues |

| 09/06/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/06/2023 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.