-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Thursday, December 12

MNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI ASIA OPEN: When Is Higher for Longer Too Far?

EXECUTIVE SUMMARY

US

FED: The beginning of peak pandemic-era inflation is likely to arrive in the first half of 2023, while five or six months of data on falling inflation are needed before the Fed can say with any certainty how quickly price growth will moderate, St. Louis Fed research director Carlos Garriga told MNI.

- "We want to have not just a turning point but solid declines in inflation to start thinking about making adjustments to the policy, and Chair Powell has said that consistently," he said in an interview. "Right now we have not even changed the trend from increasing to flat or decreasing to assess which way things will decline in 2023."

- With wage pressures pushing up the price of services and rising housing costs hitting CPI with a lag, inflation is likely to remain elevated through the end of the year, Garriga said. Former Fed officials told MNI this week rates are likely to top 5% next year after CPI rose 8.2% in the year to September and core CPI accelerated to a new 40-year high of 6.6%. For more see MNI Policy main wire at 1458ET.

FED: Philadelphia Fed President Patrick Harker on Thursday said he expects overnight interest rates to be well above 4% by December and the central bank to keep raising rates "for a while" to combat soaring inflation.

- "Given our frankly disappointing lack of progress on curtailing inflation, I expect we will be well above 4% by the end of the year," he said in remarks prepared for the Greater Vineland Chamber of Commerce in New Jersey. "We are going to keep raising rates for a while."

- Annualized consumer inflation came in at 8.2% in September, way above the Fed's 2% target, he noted. Inflation is "widespread throughout the economy" and health care premiums are set for a hefty rise next year after providers suffered large losses this year. For more, see MNI Policy main wire at 1200ET.

FED: Federal Reserve officials are at increasing risk of tightening monetary policy too far and causing an unduly deep recession because they fail to see how much inflation is still supply driven and underestimate the lagged effects of rate hikes, former Boston Fed executive Jeff Fuhrer told MNI.

- “I think this is one of the biggest risks at the moment,” said Fuhrer, a former senior policy advisor at the Boston Fed, now a fellow at the Eastern Bank Foundation, on MNI's FedSpeak podcast.

- The Fed has raised interest rates by 300 basis points this year, including three consecutive 75-basis-point increases, with another expected in November. Stronger-than-expected CPI data has ratcheted up expectations for a higher terminal rate. (See MNI: Ex-Officials Now See Fed Rate Peak At 5% Or Higher).

- "In the current situation with risks to inflation skewed to the upside, policy must be based on whether we see inflation actually falling in the data rather than just in forecasts," she said. "Policy should remain focused on on restoring price stability, which will also set the foundation for a sustainably strong labor market. With inflation running well above our 2% goal, this likely will require ongoing rate hikes and then keeping policy restrictive for some time."

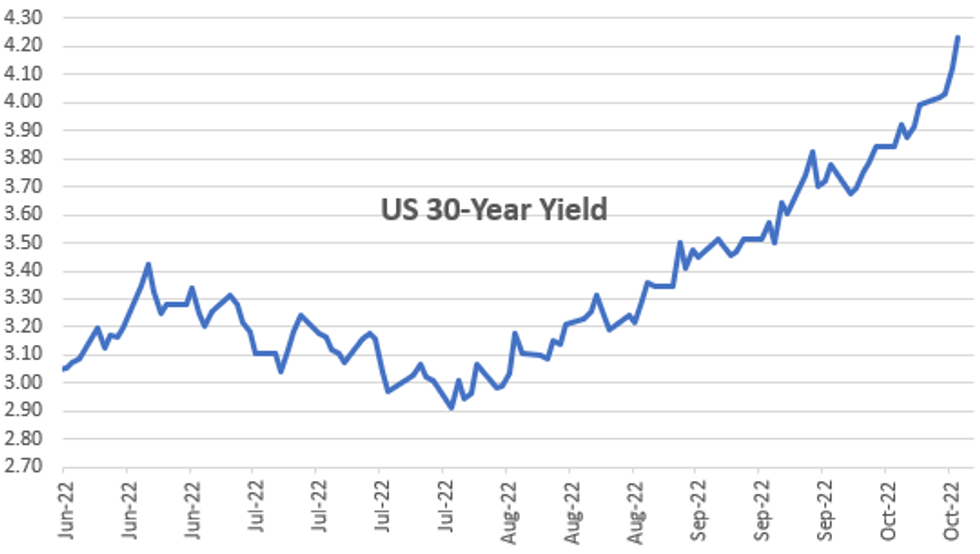

US TSYS: Ylds Continue to Extend Cycle Highs Into the Close

Tsy futures gradually extended session lows since briefly extended early session highs post-data: weekly claims -12k to 214k, continuing claims +.021M to 1.385M, Pilly Fed Mfg index little weaker than expected at -8.7.

- U.S. existing home sales fell for an eighth straight month in September to a seasonally adjusted annual rate of 4.71 million, 1.5% lower than the previous month and down 24% compared to 2021 and a ten-year low as mortgage rates climbed, the National Association of Realtors said Thursday.

- Decent total volumes on the day (TYZ2>1.4M), Yield curves bear steepening (2s10s +4.315 at -38.606) as yields continue to extend cycle highs (10YY 4.2304%).

- Modest tail for US Tsy $21B 5Y TIPS auction (91282CFR7): 1.732% high yield vs. 1.725% WI.

- Eurodollar futures remain under heavy pressure, Reds through Golds (EDZ3-EDU7) -0.135-0.150 as markets price in two more 75bp hikes by year end, at least another 50bp to kick off 2023 w/ Fed terminal rate just over 5%.

- Reminder, Fed enters media blackout midnight Friday - yet only NY Fed Williams making open remarks at a careers event at 0910ET is scheduled.

OVERNIGHT DATA

- US JOBLESS CLAIMS -12K TO 214K IN OCT 15 WK

- US PREV JOBLESS CLAIMS REVISED TO 226K IN OCT 08 WK

- US CONTINUING CLAIMS +0.021M to 1.385M IN OCT 08 WK

- US OCT PHILADELPHIA FED MFG INDEX -8.7

- NAR: SEPT EXISTING HOME SALES -1.5% TO 4.71M SAAR; 10-YR LOW

- NAR'S YUN: SEPT SALES REFLECT LOWER MORTGAGE RATES OF 5%-6%

- NAR'S YUN: EXISTING HOME SALES PACE COULD DECLINE TO 4.5M

- Sales in September reflected mortgage rates of 5% to 6% from the summer months, NAR chief economist Lawrence Yun said on a call with reporters. With rates now near 7%, the monthly pace of sales could fall to 4.5 million soon, Yun said.

- Low inventory should continue to support sales, Yun said. The median sales price fell for a third straight month to USD384,800 in September from a record high of USD413,800 in June, following usual seasonal trends. Properties remained on the market for 19 days, up from 16 days in August and 17 days a year ago.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 68.31 points (-0.22%) at 30345.72

- S&P E-Mini Future down 29.25 points (-0.79%) at 3676.25

- Nasdaq down 67.8 points (-0.6%) at 10608.54

- US 10-Yr yield is up 9.9 bps at 4.2325%

- US Dec 10Y are down 22/32 at 109-10

- EURUSD up 0.0006 (0.06%) at 0.9779

- USDJPY up 0.35 (0.23%) at 150.25

- WTI Crude Oil (front-month) up $0.43 (0.5%) at $85.98

- Gold is down $2.98 (-0.18%) at $1626.35

- EuroStoxx 50 up 21.61 points (0.62%) at 3492.85

- FTSE 100 up 18.92 points (0.27%) at 6943.91

- German DAX up 26 points (0.2%) at 12767.41

- French CAC 40 up 46.18 points (0.76%) at 6086.9

US TSY FUTURES CLOSE

- 3M10Y +9.684, 22.905 (L: 7.384 / H: 23.327)

- 2Y10Y +4.315, -38.606 (L: -46.495 / H: -38.171)

- 2Y30Y +4.816, -38.969 (L: -45.429 / H: -38.234)

- 5Y30Y +1.265, -22.285 (L: -24.801 / H: -19.441)

- Current futures levels:

- Dec 2Y down 4.625/32 at 101-29.25 (L: 101-28.875 / H: 102-02.125)

- Dec 5Y down 14/32 at 105-20.5 (L: 105-19.25 / H: 106-06)

- Dec 10Y down 22/32 at 109-10 (L: 109-08.5 / H: 110-07)

- Dec 30Y down 1-20/32 at 120-09 (L: 120-07 / H: 122-06)

- Dec Ultra 30Y down 2-03/32 at 127-01 (L: 126-31 / H: 129-11)

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.045 at 94.830

- Mar 23 -0.050 at 94.705

- Jun 23 -0.075 at 94.730

- Sep 23 -0.110 at 94.840

- Red Pack (Dec 23-Sep 24) -0.145 to -0.13

- Green Pack (Dec 24-Sep 25) -0.145 to -0.145

- Blue Pack (Dec 25-Sep 26) -0.15 to -0.14

- Gold Pack (Dec 26-Sep 27) -0.14 to -0.13

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00057 to 3.06114% (-0.00500/wk)

- 1M +0.07172 to 3.57243% (+0.12943/wk)

- 3M +0.04700 to 4.32457% (+0.13086/wk) * / **

- 6M +0.09443 to 4.83186% (+0.14657/wk)

- 12M +0.08171 to 5.42114% (+0.13800/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.32457% on 10/20/22

- Daily Effective Fed Funds Rate: 3.08% volume: $104B

- Daily Overnight Bank Funding Rate: 3.07% volume: $272B

- Secured Overnight Financing Rate (SOFR): 3.04%, $919B

- Broad General Collateral Rate (BGCR): 3.00%, $385B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $375B

- (rate, volume levels reflect prior session)

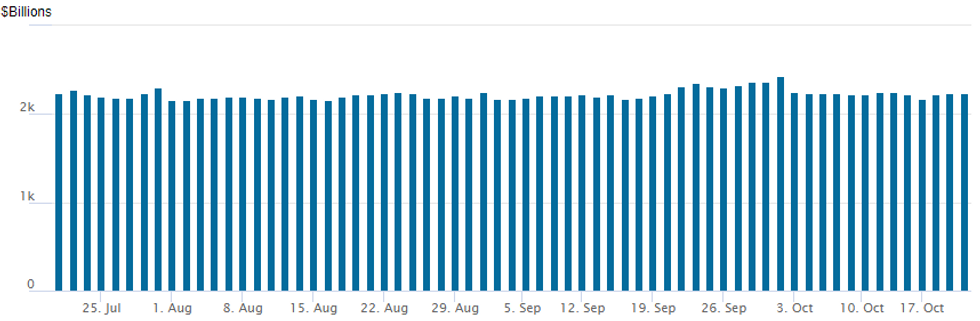

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage receded to $2,234.071B w/ 99 counterparties vs. $2,241.835B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: $2.5B RBC 2Pt, $1B Uruguay Launched Late

RBC dropped the 2Y SOFR leg for total of $2.5B between 2s and 5s

- Date $MM Issuer (Priced *, Launch #)

- 10/20 $2.5B #RBC $1.15B 2Y +105, $1.35B5Y +160

- 10/20 $1B #Uruguay 12Y +170

- 10/20 $850M #National Rural Utilities $500M 3Y +85, $350M +10Y +158

- 10/20 $600M #Citizens Bank 3NC2 +145

EGBs-GILTS CASH CLOSE: PM Truss Quits, So Does Gilt Rally

Gilts rallied into UK PM Truss's 1330UK resignation announcement, but weakened thereafter as political risks were weighed up and global core FI pulled back. The UK curve twist flattened, and in Germany, the belly underperformed.

- After selling off on the open (China potentially easing Covid quarantine requirements for inbound travelers helped boost risk appetite), European yields headed lower over the course of the morning.

- Gilts in particular were boosted by BoE's Broadbent who said risks to market hike pricing were more to the downside. This depressed terminal rate expectations, and the Gilt rally gained steam as it became clear Truss would resign.

- But Bund and Gilt yields headed higher in the afternoon, no specific catalysts seen - largely regarded as fading the rally.

- MNI's Politics Team looks at what's next for the UK; attention after hours turns to the BoE's announcement for the pace and timing of active gilt sales in Q4 (see our expectations here).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: 2-Yr yield is up 2.6bps at 2.121%, 5-Yr is up 3.2bps at 2.245%, 10-Yr is up 2.8bps at 2.404%, and 30-Yr is up 2bps at 2.367%.

- UK: 2-Yr yield is up 8.2bps at 3.588%, 5-Yr is up 9.5bps at 3.967%, 10-Yr is up 3.5bps at 3.913%, and 30-Yr is down 2.9bps at 3.96%.

- Italian BTP spread down 4.7bps at 235bps / Spanish down 2.1bps at 112.9bps

FOREX

- USDJPY Clears 150 With Latest Push Higher From US Yields

- Rising US yields see USDJPY belatedly move higher, hitting new cycle highs of 150.248 in a firm clearance of 150 in the past half an hour, before a minor retreat to 150.17 latest.

- Next resistance seen 150.45 (3.618 proj of the Aug 2-8-11 price swing) having made light work of the psychological 150.

- The US 10YY is +8.0bp at 4.214% with real yields also climbing of late, +3.4bps on the day and with the associated drag on equities with ESA at session lows.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/10/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 21/10/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 21/10/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 21/10/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 21/10/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 21/10/2022 | 1310/0910 |  | US | New York Fed's John Williams | |

| 21/10/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 21/10/2022 | 1600/1200 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.