-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: World Bank Double Dip Recession Warning

EXECUTIVE SUMMARY

US

FED: The Federal Reserve's role in addressing climate change should be limited to requiring banks to understand and manage financial risks related to global warming, rather than using its monetary or supervisory tools without an explicit mandate from Congress, Fed Chair Jerome Powell said Tuesday.

- In remarks prepared for a Riksbank panel on central bank independence, Powell repeated his view that the Fed has "narrow" responsibilities on climate change, a stance for which he faced opposition from Democratic lawmakers during his renomination hearing last year.

- "The Fed does have narrow, but important, responsibilities regarding climate-related financial risks. These responsibilities are tightly linked to our responsibilities for bank supervision," he said. "The public reasonably expects supervisors to require that banks understand, and appropriately manage, their material risks, including the financial risks of climate change."

- The Fed chair made no comments on economic policy in his prepared remarks.

- "I expect the FOMC will continue raising interest rates to tighten monetary policy, as we stated after our December meeting," she said. "My views on the appropriate size of future rate increases and on the ultimate level of the federal funds rate will continue to be guided by the incoming data and its implications for the outlook for inflation and economic activity."

- The Fed has hiked its policy rate 425bps since last March and markets see a roughly 80% chance of another stepdown in February to a 25bp increase according to CME FedWatch. CPI figures due Thursday are expected to show core inflation easing to 5.7% and headline prices at 6.6% on the year.

EUROPE

EU: The European Commission’s uphill task in driving through its preferred reforms of the European Union’s fiscal rules has been made even tougher by the bloc’s new Swedish presidency, which sympathises with other member states opposing the proposals and has left the issue off the agenda for next week’s finance ministers’ meeting, EU officials told MNI.

- The lack of discussion next week of reforming the rules contained in the EU’s Stability and Growth Pact rules means progress on the matter is unlikely at the economy-focussed Feb. 9-10 EU summit, at which the subject had been expected to figure prominently, one official said.

- “I think there is a lot of pushback right now from member states and the Swedish presidency is absolutely not eager to discuss this issue or consider it a matter of urgency at all,” another said.

EU: Eurogroup President Paschal Donohoe has a “window of opportunity” in the first quarter to steer member states away from untargeted energy support packages adopted during last year’s gas price crisis, EU officials told MNI on Tuesday.

- The European Central Bank’s recent signal that rates will rise significantly through early 2023 to combat inflation and a welcome easing in energy prices are also putting pressure on states to rein in expansionary fiscal stances at odds with the hawkish monetary policy setting, officials said. (See MNI INTERVIEW: Need Strong ECB Hikes For Early CPI Win -Kazaks)

- “There is a monetary policy, which is independent, but we can’t be sending mixed signals. We can’t have a hawkish monetary policy sitting alongside very expansionary fiscal measures, it just doesn’t work," the official said.

Global

World Bank: The global economy may be one shock away from another recession following the one brought on by Covid, the first time in more than 80 years with two downturns in the same decade, the World Bank said Tuesday.

- Euro-area output will stall this year and the U.S. will grow just 0.5% for its weakest expansion outside of a recession since 1970 according to the Global Economics Prospects report. Both regions were marked down almost 2 percentage points from six months earlier. China's growth forecast was reduced almost a percentage point to 4.3%.

- Excluding China, growth in emerging market and developing economies is expected to slow from 3.8% in 2022 to 2.7% in 2023. Global growth for 2023 was slashed to 1.7% from 3%.

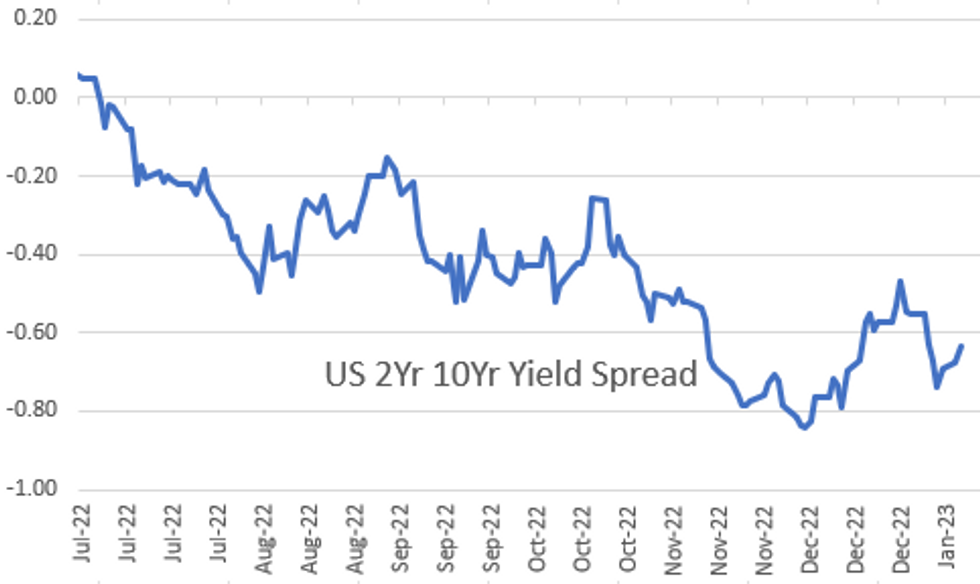

US Tsys: Fed Chair at Riksbank Central Bank Conf a Non-Event

Tsys broadly weaker after the bell, off midday lows after 30YY tapped 3.7726% (+.1127), yield curves bear steepening off deeper inverted levels since Fri's NFP (2s10s +4.184 at -64.002).- No relevant data on the day (in-line Wholesale Inventories at1.0%) markets were more focused on Fed Chairman Powell remarks at a Riksbank panel on central bank independence. Non-event as Powell repeated his view that the Fed has "narrow" responsibilities on climate change, a stance for which he faced opposition from Democratic lawmakers during his renomination hearing last year.

- Another strong session for corporate issuance, rate locks tied to a $10B Saudi Arabia three-tranche debt issuance weighed.

- Treasury futures saw modest bounce off lows after decent $40B 3Y note auction (91282CGE5) stopped through: 3.977% high yield vs. 4.000% WI; 2.84x bid-to-cover vs. 2.55x last month. Indirect take-up to 69.54% vs. 61.71% prior; direct bidder take-up at 13.18% vs. 20.44% prior; primary dealer take-up 17.28% vs. 17.85%.

- Focus turns to Thursday's CPI MoM (0.1%, -0.1%); YoY (7.1%, 6.5%).

OVERNIGHT DATA

- US REDBOOK: JAN STORE SALES +5.3% V YR AGO MO

- US REDBOOK: STORE SALES +5.3% WK ENDED JAN 07 V YR AGO WK

- US NOV. WHOLESALE INVENTORIES RISE 1.0%; EST. 1.0%

- US DEC IBD/TIPP ECON OPTIMISM INDEX 42.3

- US DEC IBD/TIPP ECON OPTIMISM INDEX 6-MO FORECAST 36.2

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 99.44 points (0.3%) at 33616.72

- S&P E-Mini Future up 16.5 points (0.42%) at 3930

- Nasdaq up 71.4 points (0.7%) at 10706.95

- US 10-Yr yield is up 8.9 bps at 3.6207%

- US Mar 10-Yr futures are down 21/32 at 113-31

- EURUSD up 0.001 (0.09%) at 1.074

- USDJPY up 0.36 (0.27%) at 132.24

- WTI Crude Oil (front-month) up $0.49 (0.66%) at $75.11

- Gold is up $4.68 (0.25%) at $1876.49

- EuroStoxx 50 down 11.16 points (-0.27%) at 4057.46

- FTSE 100 down 30.45 points (-0.39%) at 7694.49

- German DAX down 18.23 points (-0.12%) at 14774.6

- French CAC 40 down 38.22 points (-0.55%) at 6869.14

US TSY FUTURES CLOSE

- 3M10Y +3.058, -105.977 (L: -117.769 / H: -102.861)

- 2Y10Y +4.068, -64.118 (L: -69.097 / H: -63.097)

- 2Y30Y +4.696, -50.708 (L: -57.99 / H: -50.135)

- 5Y30Y +3.195, 1.724 (L: -3.591 / H: 2.302)

- Current futures levels:

- Mar 2-Yr futures down 3.875/32 at 102-27 (L: 102-25.75 / H: 102-30.625)

- Mar 5-Yr futures down 11.75/32 at 108-29.75 (L: 108-26.25 / H: 109-08.75)

- Mar 10-Yr futures down 21/32 at 113-31 (L: 113-26.5 / H: 114-19.5)

- Mar 30-Yr futures down 1-24/32 at 128-5 (L: 127-30 / H: 129-27)

- Mar Ultra futures down 2-17/32 at 138-20 (L: 138-08 / H: 141-05)

US 10YR FUTURE TECHS: (H3) Bullish Extension

- RES 4: 115-26 2.00 proj of the Oct 21 - 27 - Nov 3 low

- RES 3: 115-11+ High Dec13 and bull trigger

- RES 2: 115-08+ 2.0% 10-dma envelope

- RES 1: 114-23+ High Jan 9

- PRICE: 114-02 @ 1520ET Jan 10

- SUP 1: 113-11 50-day EMA

- SUP 2: 112-18+/111-28 Low Jan 5 / Low Dec 30 and the bear trigger

- SUP 3: 111-27+ 61.8% retracement of the Nov 3 - Dec 13 rally

- SUP 4: 111-01 76.4% retracement of the Nov 3 - Dec 13 rally

Treasury futures traded sharply higher Monday and the contract is holding on to its recent gains. Price has cleared the 100-dma to strengthen the short-term bullish condition. Potential is seen for a climb towards 115-11+, the Dec 13 high and a bull trigger. On the downside, initial support lies at 113-11, the 50-day EMA. A move below this average would expose support at 112-18+, Jan 5 low and the bear trigger at 111-28, the Dec 30 low.

US EURODOLLAR FUTURES CLOSE

- Mar 23 -0.020 at 94.915

- Jun 23 -0.025 at 94.860

- Sep 23 -0.040 at 94.995

- Dec 23 -0.050 at 95.355

- Red Pack (Mar 24-Dec 24) -0.09 to -0.06

- Green Pack (Mar 25-Dec 25) -0.10 to -0.095

- Blue Pack (Mar 26-Dec 26) -0.11 to -0.10

- Gold Pack (Mar 27-Dec 27) -0.12 to -0.105

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00358 to 4.30871% (-0.00472/wk)

- 1M +0.02557 to 4.42986% (+0.02829/wk)

- 3M +0.02329 to 4.80586% (-0.00400/wk)*/**

- 6M +0.00086 to 5.14186% (-0.05514/wk)

- 12M -0.02815 to 5.43371% (-0.12526/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.81171% on 1/5/23

- Daily Effective Fed Funds Rate: 4.33% volume: $106B

- Daily Overnight Bank Funding Rate: 4.32% volume: $287B

- Secured Overnight Financing Rate (SOFR): 4.31%, $1.127T

- Broad General Collateral Rate (BGCR): 4.27%, $437B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $401B

- (rate, volume levels reflect prior session)

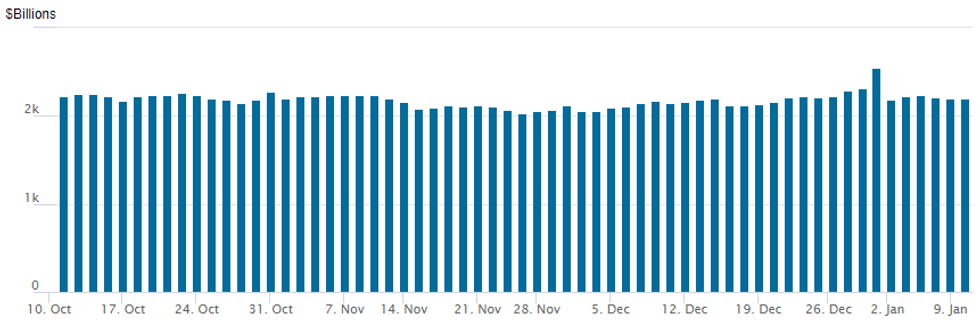

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,192.942B w/ 102 counterparties vs. prior session's $2.199.121B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $10B Saudi Arabia 3Pt Launch

Saudi Arabia 3pt jumbo largest of the year so far at $10B:

- Date $MM Issuer (Priced *, Launch #)

- 01/10 $10B #Saudi Arabia $3.25B 5Y +110, $3.5B 10.5Y +140, $3.25B 30Y 5.5%

- 01/10 $4B *KFW 5Y SOFR+40

- 01/10 $2B *AIIB 5Y SOFR+64

- 01/10 $2B #Israel 10Y +95

- 01/10 $2.5B #SK Hynix $750M 3Y +240, $1B 5Y +275, $750M 10Y +310

- 01/10 $1.5B #Deutsche Bank 6NC5 +300

- 01/10 $1.25B #CaixaBank 6NC5 +250

- 01/10 $1B #Macquarie Bank 10Y +320

- 01/10 $1B #Export Bank of India 10Y +190

- 01/10 $1B CDC (Caisse des Depots) 3Y SOFR+46a

- 01/10 $1B Venture Global 7NC 6.375%

- 01/10 $Benchmark American Honda 3Y +80, 3Y SOFR+92, 5Y +103

- 01/10 $Benchmark BPCE 5Y +145, 4NC3 +200

- 01/10 $Benchmark Mongolia 5Y 8.95%a

EGBs-GILTS CASH CLOSE: Supply Weighs

European core FI weakened Tuesday as extremely heavy corporate and sovereign supply weighed.

- Bunds sold off steadily throughout the session and underperformed Gilts. The German curve bear steepened, with the UK's mixed.

- With Bunds selling off, periphery EGB spreads compressed, with 10Y BTP/Bund dipping below 190bp for the first time since Dec 13.

- Central bank speakers at a Riksbank symposium delivering little impactful communication (Fed Chair Powell's absence of pushback against the recent easing of financial conditions sparked a brief modest rally)

- Attention was on heavy supply, with E39bln of sales including corporates (2nd biggest volume day ever, per BBG).

- Wednesday sees several ECB speakers including Holzmann, Villeroy, Rehn and de Cos; the week's major event remains US CPI Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 4.2bps at 2.654%, 5-Yr is up 7.8bps at 2.344%, 10-Yr is up 8bps at 2.308%, and 30-Yr is up 6.9bps at 2.249%.

- UK: The 2-Yr yield is up 3.3bps at 3.478%, 5-Yr is up 1.9bps at 3.465%, 10-Yr is up 3.1bps at 3.557%, and 30-Yr is down 3.8bps at 3.907%.

- Italian BTP spread down 4.4bps at 191.4bps / Spanish down 1.8bps at 102.7bps

FOREX: Currency Markets Consolidating Ahead Of Key US Data

- Tuesday did little to alter the narrative across currency markets with the greenback trading in slightly firmer territory but largely consolidating following the renewed weakness seen since Friday’s data.

- The greenback did have a small move lower after the release of Fed Chair Powell’s speech where some potential outside expectations that he might push back against some of the recent dovish re-pricing failed to come to fruition.

- While most of those moves largely reverted to prior levels, EURUSD does sit a little higher on the day, showing clear and relative outperformance to its G10 counterparts.

- A strong recovery extended Monday in EURUSD, confirming the end of the recent corrective pullback. The bull trigger at the Dec 15 high at 1.0735, has been cleared and this confirms a resumption of the uptrend. The break higher maintains the bullish price sequence of higher highs and higher lows and note that MA studies are in a bull-mode position. The focus is on 1.0787, the May 30, 2022 high.

- CNH sits slightly lower on an intraday basis, but USD/CNH did manage a lower low during Asia-Pac hours. This put the pair at new multi-month lows of 6.7589. 6.7359 sits as next support, the Aug 15 2022 low.

- In emerging markets, it is worth noting some outperformance for LatAm currencies where USDMXN is hovering at near 3-year lows and the Brazilian Real continues to bounce back following the weekend’s heightened social unrest.

- Aussie CPI & Retail Sales data is due overnight, however, markets will quickly turn their focus to the key release of US CPI on Thursday.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/01/2023 | 0030/1130 | ** |  | AU | Retail Trade |

| 11/01/2023 | 0900/1000 | * |  | IT | Retail Sales |

| 11/01/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 11/01/2023 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 11/01/2023 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.