-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Worst 10Y Sale of Year; Stocks Gain Ahead CPI

EXECUTIVE SUMMARY

US

FED: The Federal Reserve will need to raise rates to at least 6% and as high as 8% because policymakers are underestimating the extent of an inflation problem that has already kicked off a wage-price spiral, former Richmond Fed President Jeffrey Lacker told MNI.

- Officials are still too sanguine about just how persistent and broad inflation pressures have become, causing them to misjudge the extent of additional monetary tightening needed to bring price growth back to the Fed’s 2% target, Lacker said.

- “I think they’re going to end up over 6%, they’re too optimistic about inflation coming down,” he said. “Six to 8% is the range to be thinking about in terms of restrictive policy.” For more see MNI Policy main wire at 1340ET.

FED: Federal Reserve officials are considering driving the fed funds rate to about 5% in the first half of 2023, as strong demand and healthy consumer balance sheets necessitate more tightening, former Fed officials told MNI.

- "The committee is aiming to get to a sufficiently restrictive position to ensure financial conditions overall are adequately tight to produce a clear trend of declining inflation. It's not hard to imagine a terminal rate above 5%," said former Atlanta Fed president Dennis Lockhart. "The committee wants to avoid a 'start and stop' pattern of policy in 2023 that would be credibility and confidence damaging. So, the bias is to push further until they feel very comfortable pausing to take stock and let the policy rate have its effect over time."

- William English, former director of the division of monetary affairs at the Fed Board, said the Fed will have to raise rates significantly above the 4.6% anticipated in September’s Summary of Economic Projections and probably stay with higher rates for longer. For more see MNI Policy main wire at 0958ET.

- OER and rents of primary residence could see a modest renewed uptick whilst we also watch for the ongoing core goods disinflation/deflation trend and notably core services excluding shelter after particular emphasis from Chair Powell.

- Landing on day one of the two-day FOMC meeting, the report would have to be wildly different to consensus to see something other than the 50bp hike viewed as locked in for Wed but with two-way risk to the Fed rate path further out.

- Whilst a beat or miss compared to expectations might be a logistical challenge to change SEP forecasts and dots, it could however shape the language of the statement and perhaps notably Powell’s presser.

UK

BOE: The Bank of England is widely expected to settle on a 50-basis-point hike at its December meeting, but the nine-member Monetary Policy Committee will split, with two of the external members leaning towards a smaller hike or no hike at all, and one or two votes possible for 75 basis points.

- When the MPC raised Bank Rate by 75 basis points to 3.0% in November seven members backed the move, with two dovish dissents from externals, as Swati Dhingra voted for 50bps and Silvana Tenreyro for 25bps. Dhingra has subsequently warned of the risks of over-tightening while Tenreyro has made clear that for her 3% could be the peak, suggesting that both will dissent dovishly in December. The majority, though, is centred on insiders, boosting the chances that the Committee will coalesce around 50bps. For more see MNI Policy main wire at 1139ET.

Canada

CANADA: Sentiment among exporters in Canada -- one of the most trade-dependent industrialized economies -- is dropping back to the lowest since Covid or the global financial crisis, the chief economist of the country's trade finance bank told MNI.

- Business leaders see rapid inflation persisting through 2023, dangers to global trade from war in Ukraine, and the potential for a global recession, according to Stuart Bergman at Export Development Canada.

- Firms across almost every industry are reporting more negative conditions, suggesting exports won't pull Canada out of a slump at a time when higher interest rates are shrinking domestic demand, he said. Many firms also see the global economy on the edge of a recession. For more see MNI Policy main wire at 0920ET.

US TSYS: Holding Lows After Large 10Y Auction Tail

Tsys weaker after the close, holding narrow range, near lows through the second half. Two significant periods where Tsys sold off/extended lows.- FI market support evaporated midmorning after domino effect of: surge in crude prices (WTI tapped 73.94 high) triggered fast sell-off in Bunds, Gilts and Tsys. Others, however, suggested midmorning sale was tied to WSJ economist Timiraos story suggesting the Fed is "divided" over path of monetary policy.

- Tsy 10Y auction reopen spurred the second sell-off in rates (10YY tapped 3.2620% high; 30YY 3.5939% high). Little react to in-line: $40B 3Y note auction (91282CGA3) 4.093% high yield vs. 4.092% WI; Tsys gapped lower after $32B 10Y note auction re-open (91282CFV8) tailed w/ 3.625% high yield vs. 3.590% WI - largest for the year, surpassing last month's 3.2bp tail.

- No data Monday, markets await Nov CPI release on Tuesday (MoM 0.3% est, 7.3% YoY), final FOMC of 2022 Wed afternoon.

- FOMC will step down the pace of rate hikes to 50bp at the December meeting. But it will likely signal via the Dot Plot that it intends to tighten by a further 75bp to a terminal rate above 5% in 2023.

OVERNIGHT DATA

US TREASURY NOV BUDGET DEFICIT $248.5B VS $191.3B YR-AGO MONTH

MARKETS SNAPSHOT

Key late session market levels:

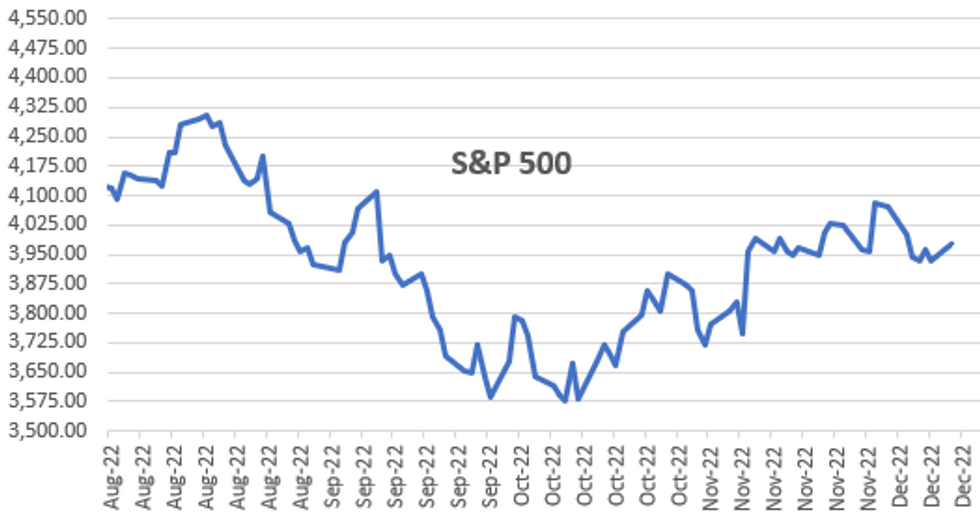

- DJIA up 389.18 points (1.16%) at 33864.2

- S&P E-Mini Future up 39.5 points (1%) at 4007.5

- Nasdaq up 91.8 points (0.8%) at 11095.83

- US 10-Yr yield is up 3.7 bps at 3.615%

- US Mar 10Y are down 10/32 at 113-25

- EURUSD down 0.0015 (-0.14%) at 1.0525

- USDJPY up 1.18 (0.86%) at 137.75

- WTI Crude Oil (front-month) up $2.15 (3.03%) at $73.18

- Gold is down $16.08 (-0.89%) at $1781.13

- EuroStoxx 50 down 20.8 points (-0.53%) at 3921.82

- FTSE 100 down 30.66 points (-0.41%) at 7445.97

- German DAX down 64.09 points (-0.45%) at 14306.63

- French CAC 40 down 27.09 points (-0.41%) at 6650.55

US TSY FUTURES CLOSE

- 3M10Y +5.083, -67.028 (L: -79.909 / H: -63.889)

- 2Y10Y -1.727, -78.953 (L: -81.216 / H: -76.548)

- 2Y30Y -3.509, -82.669 (L: -84.438 / H: -78.486)

- 5Y30Y -1.421, -22.737 (L: -23.985 / H: -20.106)

- Current futures levels:

- Mar 2Y down 4/32 at 102-21 (L: 102-20 / H: 102-25.75)

- Mar 5Y down 6.75/32 at 108-21 (L: 108-19 / H: 109-01.25)

- Mar 10Y down 10/32 at 113-25 (L: 113-22.5 / H: 114-12.5)

- Mar 30Y down 10/32 at 129-19 (L: 129-11 / H: 130-30)

- Mar Ultra 30Y down 13/32 at 142-10 (L: 141-26 / H: 144-08)

(H3) Remains Above Support

- RES 4: 116-12 2.0% 10-dma envelope

- RES 3: 115-26 2.00 proj of the Oct 21 - 27 - Nov 3 price swing

- RES 2: 115-14 50% Aug - Oct Downleg

- RES 1: 115-06+ High Dec 7 and the bull trigger

- PRICE: 114-05 @ 1430ET Dec 12

- SUP 1: 113-21+/113-00 Low Dec 2 / 50-day EMA

- SUP 2: 112-11+ Low Nov 21 and a key short-term support

- SUP 3: 112-05+ Low Nov 14

- SUP 4: 110-22 Low Nov 10

Treasury futures traded lower Friday but the contract is finding support today. Price remains below 115-06+, Dec 7 high and the next bull trigger. The outlook remains bullish following recent gains that have confirmed an extension of the trend sequence of higher highs and higher lows. A break higher would open 115-14, 50% of the Aug - Oct downleg on the continuation contract. Support to watch is at the 50-day EMA, at 113-00.

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.023 at 95.225

- Mar 23 -0.035 at 94.840

- Jun 23 -0.050 at 94.790

- Sep 23 -0.045 at 94.930

- Red Pack (Dec 23-Sep 24) -0.09 to -0.065

- Green Pack (Dec 24-Sep 25) -0.085 to -0.065

- Blue Pack (Dec 25-Sep 26) -0.06 to -0.045

- Gold Pack (Dec 26-Sep 27) -0.045 to -0.035

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00614 to 3.81186% (+0.00527 total last wk)

- 1M +0.02185 to 4.29214% (+0.08543 total last wk)

- 3M +0.01957 to 4.75271% (+0.00057 total last wk)*/**

- 6M +0.02129 to 5.16100% (-0.00943 total last wk)

- 12M +0.02614 to 5.52557% (+0.07000 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 3.83% volume: $102B

- Daily Overnight Bank Funding Rate: 3.82% volume: $271B

- Secured Overnight Financing Rate (SOFR): 3.80%, $1.058T

- Broad General Collateral Rate (BGCR): 3.76%, $418B

- Tri-Party General Collateral Rate (TGCR): 3.76%, $398B

- (rate, volume levels reflect prior session)

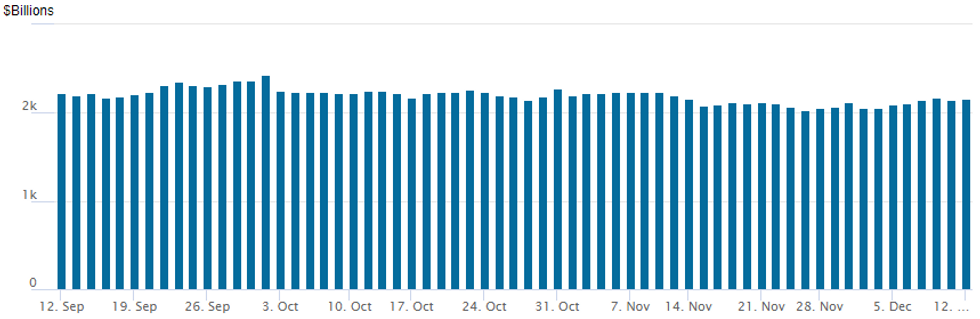

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,158.517B w/ 96 counterparties vs. $2,146.748B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

$3B JP Morgan 3NC2 Launched

First significant corporate issuance in a week:- Date $MM Issuer (Priced *, Launch #)

- 12/12 $3B #JP Morgan 3NC2 +115

FOREX: USDJPY Corrective Cycle Remains In Play, Rises 0.9%

- Despite a fairly lacklustre start to the week, in terms of data and newsflow, USDJPY has rallied 0.9% on Monday, extending the post-PPI bounce from Friday’s lows of 135.63 to trade within close proximity of the 138 handle.

- The short-term outlook is bullish and a corrective cycle remains in play, following the recovery from 133.63, the Dec 2 low. This phase has allowed an oversold trend condition to unwind. An extension higher would open 138.70, the 20-day EMA. This average marks the first key short-term resistance.

- Overall, the USD index has risen 0.35% with higher front-end US yields supporting the greenback throughout the session ahead of tomorrow’s critical US CPI release and Wednesday’s December Fed meeting.

- Weaker metals prices added some pressure on commodity-tied currencies, with the likes of AUD falling around 0.8% against the dollar. In similar vein, the south African Rand is the worst performer across emerging markets, plummeting 1.4% to start the week, while the Phala Phala saga surrounding the South African president remains front and centre.

- UK employment and German ZEW sentiment data headline the European docket on Tuesday before the much-anticipated US inflation figures are released. Focus then quickly shifts to policy decisions from the Fed, the BOE and the ECB.

Tuesday Economic Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/12/2022 | 0700/0800 | *** |  | DE | HICP (f) |

| 13/12/2022 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 13/12/2022 | 0700/0800 | ** |  | NO | Norway GDP |

| 13/12/2022 | 0900/1000 | * |  | IT | Industrial Production |

| 13/12/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/12/2022 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 13/12/2022 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 13/12/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 13/12/2022 | 1330/0830 | *** |  | US | CPI |

| 13/12/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 13/12/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 13/12/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.