-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI Banxico Preview - August 2021: Pressures Remain

MNI BANXICO PREVIEW

Executive Summary

- Banxico's governing board are widely expected to hike the overnight rate by another 25bps to 4.5%.

- Persistently high levels of headline inflation close to 6% Y/y highlight the need for further action to anchor expectations and bring CPI back to target.

- Markets will be watching the details included within the new communications strategy spelled out at this meeting and individual MPC members' views on pipeline policy tightening.

Click to view the full preview: MNI Banxico Preview - August 2021.pdf

Stubborn Inflation and Advancing Expectations

CPI for the month of July rose 0.59% versus an expectation of 0.56% and a 5.3% rise in June. Annual headline inflation for July fell to 5.81% Y/y from 5.88% in June. Despite the small decline, the reading was above estimates of 5.78% and remains well above the central bank's target of 3% +/- 1 percentage point.

Additionally, the latest central bank survey indicated Mexico analysts have raised their 2021 CPI estimate to 6.00% Vs. 5.80% in the prior survey. Within the biweekly report, 27 of the 28 analysts also pencilled in the next rate move to be a 25bps hike in August.

Additional Monetary Policy Communication Announced

In a statement released on August 5th, Banxico announced two new elements of communication to be included within the monetary policy statement:

- The central bank will now update CPI forecasts at each monetary policy decision, providing headline and core inflation forecasts for the next eight quarters.

- Additionally, Banxico will publish governing member's votes within the statements.

- Both changes are effective immediately and are designed to give greater clarity on the decision-making process of the Governing Board, improving transparency and communication. The updated guidance has been welcomed by analysts.

Marrkets

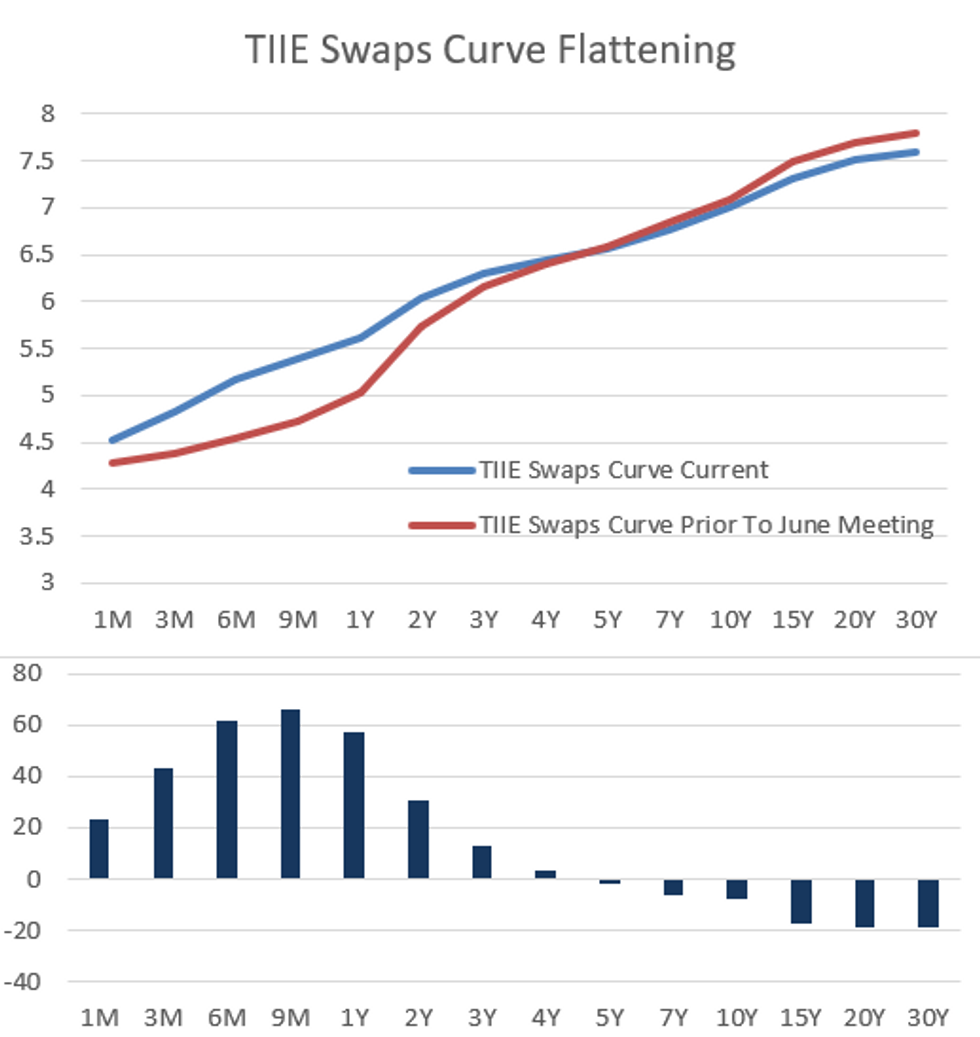

The front end of the TIIE swaps curve has shifted higher following the surprise hike in June. The persistence of inflationary pressures has kept upward pressure on the 3month-2year segment of the curve as markets price a greater amount of short-term tightening assuming the central bank will continue to act in an attempt to anchor expectations.

USDMXN has traded in a very narrow range since the June meeting as potential tailwinds from the pre-emptive hawkish manoeuvre have been offset by upside surprises in U.S. data contributing to the substantial progress goals of the Federal Reserve, resulting in a firmer greenback. Additionally, lingering anxieties relating to president AMLO's energy initiatives and favouring of the state-controlled utility companies underscore potential MXN headwinds. At the same time, it is worth pointing the Peso has proved resilient, outperforming regional peers since the June meeting.

MNI/Bloomberg

MNI/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.