-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Banxico Preview - Feb 2022: Core Inflation Points To 50bp Hike

Banxico Preview - Feb 2022

Executive Summary

- Markets expect Banxico to raise rates by a further 50bps to 6.00% this month, with core inflation dynamics keeping the board on track with their accelerated pace of tightening.

- Nonetheless, a newly appointed Governor and persistent weakness in the growth profile indicates the decision is by no means set in stone.

- As such, the potential for a smaller hike at this meeting should not be fully discounted.

Click to view the full preview: MNI Banxico Preview - February 2022.pdf

Concerns Linger Over Rodriguez’s Policy Approach

Following the departure of Governor Alejandro Diaz de Leon, Victoria Rodriguez has assumed command of the Banxico governing board. In her first remarks to Senators, she emphasised the autonomy of the central bank and the bank’s role in avoiding unintended effects from inflation, however, markets have received very little new information on the new Governor’s stance and comments from President AMLO have done little to alleviate concerns.

Indeed, some analysts have highlighted the 2022 annual program as potentially ringing some alarm bells, citing the sentence, “low inflation is a necessary but insufficient condition for economic development”. Furthermore, speaking at an event, president AMLO highlighted his desire to focus on growth. “One job of the bank is to control inflation and the other, which we would like very much to see, but we are only giving an opinion, is that it also helps to boost growth”, the President remarked. “Inflation can be controlled but if there isn’t growth we don’t make progress”, Lopez Obrador added.

Core Inflation Points to Need For Another 50bp Hike

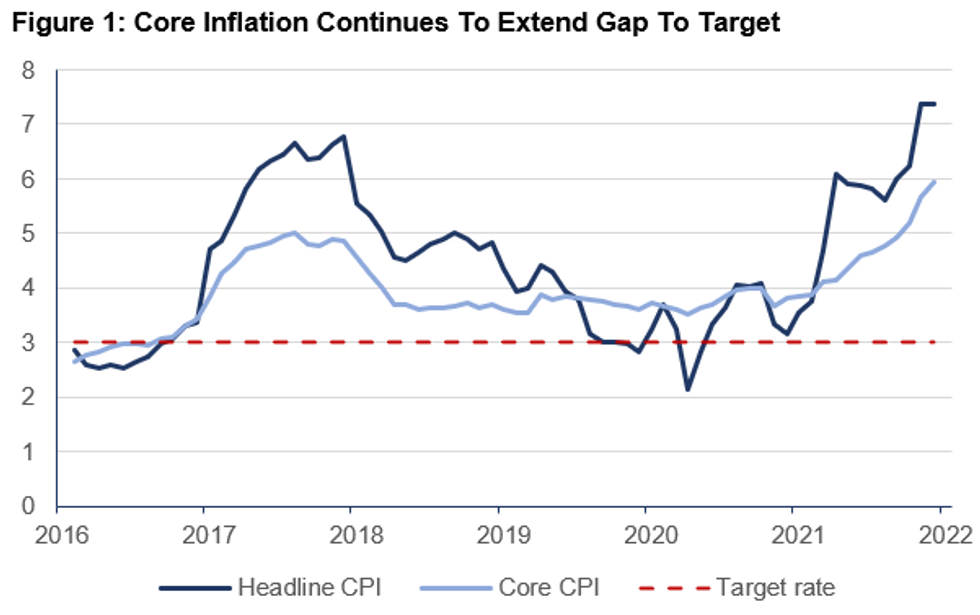

The latest bi-weekly inflation data indicated headline annual CPI had dipped to 7.13% from 7.45% one month ago. Additionally, this Wednesday’s data is expecting the headline rate to fall back below 7% Y/y. However, the more concerning dynamic for the central bank will be regarding core components. Core inflation exceeded 6% in the first half of January to hit 6.11%, more than double the central bank’s target rate of 3%. Deputy Governor, Jonathan Heath, took to Twitter to remark “Mexico’s core inflation is “still a very complicated scenario”. Source: MNI/Bloomberg

Source: MNI/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.