-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - AUD/JPY Finds Bottom on China News

MNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

MNI Banxico Review - November 2021: Maintaining The Pace

Banxico Review - November 2021

Executive Summary

- Banxico's governing board decided to hike the overnight rate by 25bps to 5.0%, in line with the majority of surveyed analysts, but less than market pricing ahead of the decision.

- The board voted 4-1 in favour of the 25 basis point hike, with Deputy Governor Esquivel the sole dissenter once more, voting to keep the key rate on hold at 4.75%.

- With some analysts forecasting an acceleration in the hiking pace, and others highlighting significant risks to more aggressive tightening, markets immediately interpreted the decision as dovish.

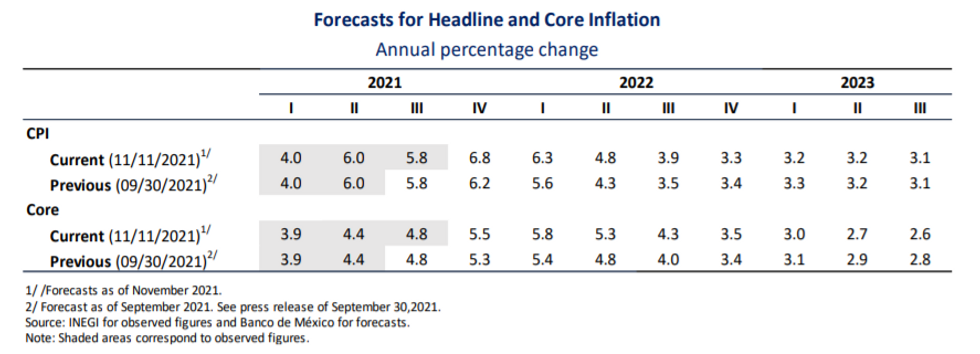

- However, inflation forecasts were revised higher and hawkish messaging remains throughout the statement and some analysts have factored in further hikes in 2022 to their base case scenarios.

Click to view the full review: MNI Banxico Review - November 2021.pdf

The statement describes the shocks that have increased inflation "are largely considered to be transitory". This compares to the September statement where the same shocks were "expected to be transitory". Additionally, the board describe the transitory horizon as "unknown" and the shocks "of considerable magnitude" which are both new.

Despite pointing towards the increasing pressures and potentially alluding to there being no plans to pause the current policy tightening schedule, the 25bp hike with Esquivel's dissention were interpreted as dovish to market pricing, causing a relief rally in the front end of the curve and some immediate pressure on the currency. USDMXN rose from 20.50 to 20.65 and gradually closed in on the daily highs of 20.6888.

Analysts have however, interpreted the statement/forward guidance as more hawkish with some adjusting their calls for extended tightening in 2022 to anchor expectations with one analyst pointing out there is not a zero probability of a 50bp hike in December given the huge uncertainties surrounding price formation.The complete set of revised inflation forecasts were set out in the following table within the statement:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.