-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI BCB Preview - October 2021: Altering The Flight Path

Brazil Central Bank

Executive Summary:

- Recent events in Brazil have prompted a sharp adjustment in market pricing as well as a wider range of Selic rate predictions for the Copom's October meeting.

- The perceived decline in fiscal credibility, alongside the persistent deterioration of inflation expectations has significantly increased the likelihood of more aggressive policy tightening.

- Surveys now show a 150 basis point hike as the most likely outcome with several analysts adjusting their forecasts upwards in recent days.

- Given the reaction function of the BCB seen earlier this year, even more aggressive action should not be ruled out in an attempt to anchor expectations.

Click to view the full preview: MNI Brazil Central Bank Preview - October 2021.pdf

Fiscal Credibility and Local Assets In Freefall

Local asset prices have been significantly affected by the recent fiscal announcements. The funding of the new 'Auxilio Brasil' program and the ongoing negotiations on precatorios have prompted the government to adjust the crucial spending limit, heavily impacting the government's credibility. Furthermore, multiple departures from the economy ministry team have not only been alarming but has exacerbated the decline of financial assets.

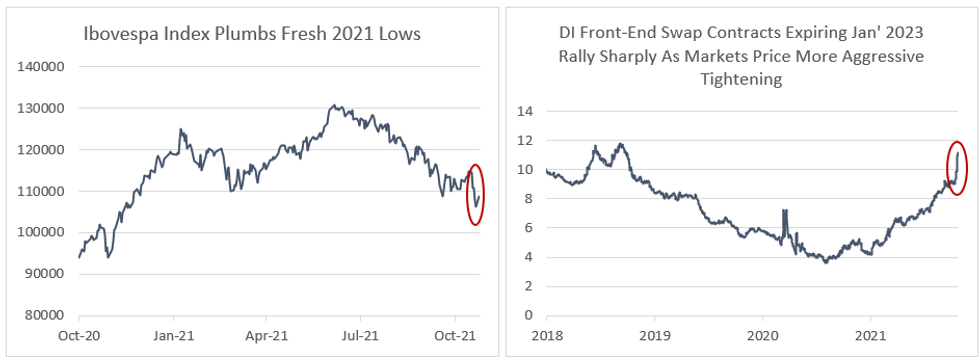

Brazilian equities have extended their downtrend in recent weeks with the news prompting fresh 2021 lows for the IBovespa Index. The DI curve has aggressively shifted higher with swap rate contracts expiring in January 2023 rising close to 225 basis points since the September meeting as shown below. USDBRL has risen roughly 5% from around 5.28 to 5.55 as of publication, after reaching 5.75 on Friday levels coinciding with the April '21 highs for the pair.

Late last week, Economy Minister Guedes attempted to calm markets by reiterating the nation's fiscal fundamentals remain solid and that the government are just slowing down the pace of fiscal adjustment. Additionally, Guedes went on to state the central bank should not risk falling behind the curve in relation to rising inflation. This potentially adds pressure to the Copom to act in line with market pricing and avoid further financial market volatility amid rising fiscal and policy risk premia. Especially considering the most recent survey of expectations point to them already being behind the curve.

MNI/Bloomberg

MNI/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.