-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Brazil Central Bank Preview – Aug 2022: Optionality Going Forward

MNI BCB Preview - August 2022

Executive Summary

- The BCB are widely expected to hike the Selic rate by 50bps from 13.25% to 13.75%. This would be in line with prior guidance of a hike “of the same or lower magnitude” compared to the June meeting where the Copom hiked by 50bps.

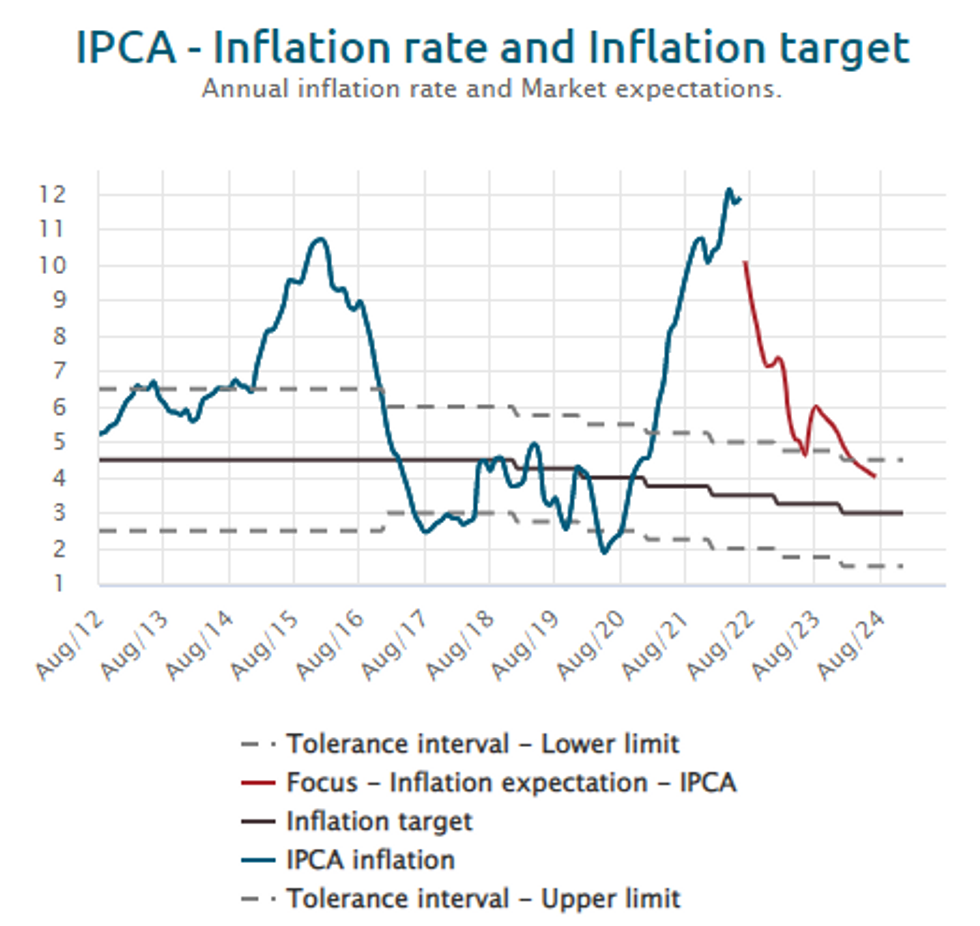

- Despite headline inflation edging lower since the last meeting, inflation expectations for year-end 2023 have continued to creep higher which is likely to affirm the need for further tightening at this juncture.

- However, the focus for market participants will be on whether the BCB provide any guidance surrounding future action or whether they provide themselves with complete optionality ahead of the September meeting.

Click to view the full preview: MNI Brazil Central Bank Preview - August 2022.pdf

Central Bank Confirm Higher For Longer

Shortly after the June Copom meeting it became evident that Brazilian policy makers’ strategy is to keep the benchmark Selic at a higher level for longer to ensure that inflation falls back around the target. This was confirmed by central bank Economic Policy Director Diogo Guillen, talking at an online press conference on June 23 alongside the central bank governor and will likely be affirmed in the central bank’s upcoming communication.

Governor Campos Neto said board members are focused on next year’s target, moving to a strategy to bring 2023 inflation around their target of 3.25%, adding that 2024 has not yet been considered in their policy horizon. With this said, it is important to scrutinise the most recent surveys that highlight the ongoing deterioration of medium-term expectations which confirm that another 50bp Selic rate hike is the most likely outcome on Wednesday.

Medium Term Inflation Expectations Continue To Drift Higher

Despite July inflation ticking back up to 11.89% Y/y, the most recent reading of mid-month IPCA saw a notable decline to 11.39%, marginally below the surveyed median estimate of 11.41%. Furthermore, the past two Focus surveys have seen the median economist forecast downgraded, with year-end 2022 estimates now sitting at 7.15%. This is substantially lower than the 8.89% prediction before the June meeting. While these developments will be welcomed by central bank directors, perhaps more concerning is that year-end 2023 expectations have continued to deteriorate, rising from 4.39% to 5.33%, suggesting that price pressures continue to prove more persistent than initially thought.

Following the thesis of higher rates for longer, the Focus survey now suggests the Selic rate will end 2023 at 11%. This compares to a 9.75% prediction before the June meeting and affirms some sell-side views that any loosening of monetary policy may appear further down the pipeline.

Source: Brazil Central Bank

Source: Brazil Central Bank

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.