-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

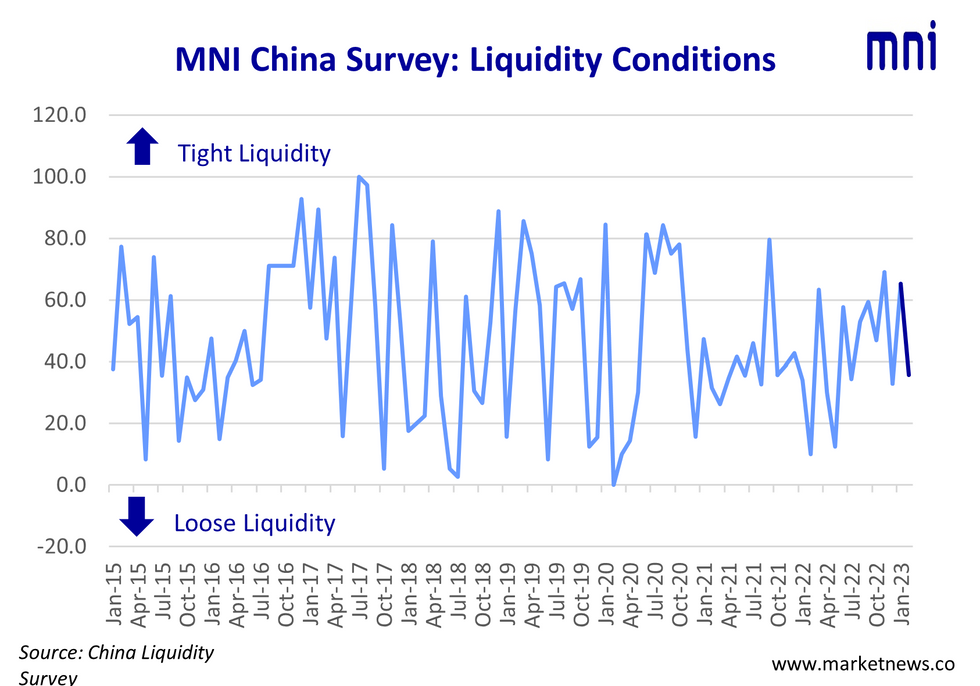

Free AccessMNI CHINA LIQUIDITY INDEX: China Liquidity Eases Sharply

China’s interbank liquidity relaxed sharply in February, producing the second-easiest conditions in seven months, as the PBOC moved to support economic recovery and deal with higher-than-expected demand for loans, the latest MNI Liquidity Conditions Index showed.

The liquidity index eased to 35.7 points in February from the previous 65.3, showing a clear loosening of conditions for local traders after the lunar new year. Only in December, when it touched 32.9, has the index been lower since July.

The People's Bank of China increased liquidity through its Medium-term Lending Facility and open market operations after new yuan loans surged to a record high CNY4.9 trillion, forcing lenders to set aside more capital to satisfy reserve requirements, market participants told MNI. (See MNI PBOC WATCH: China’s LPR Seen Steady On Economic Recovery - Bonds & Currency News | Market News)

The central bank has provided a net CNY199 billion one-year MLF this month, the third consecutive month of net injection, with the rate unchanged at 2.75% for a seventh month.

“Though the authorities drained some excess liquidity shortly after the Chinese New Year, liquidity has remained reasonable and ample,” said a senior fund manager in Shanghai.

MNI’s PBOC Policy Bias Index showed 88.6% of local traders believe Beijing will maintain its easing stance, with recent subdued inflationary data giving more space for loose conditions.

“The PBOC will want liquidity to be maintained at ample levels to help lower financing costs for the real economy during the recovery period,” a senior trader based in Beijing told MNI.

Additionally, China’s policy banks may soon enter a new round of recapitalisation, issuing bonds that could be used as collateral for central bank liquidity instruments. (See MNI: China’s Policy Banks Need Capital Boost In Growth Push - Bonds & Currency News | Market News)

REBOUND

The Economic Conditions Index increased to 78.6, following last month's 61.1, the most positive since June, when the economy was rebounding following the end of the Shanghai lockdown.

Recent data on credit expansion and property prices has highlighted signs of recovery as policy takes effect, prompting the PBOC to keep the benchmark Loan Prime Rate unchanged this month.

However, the PBOC stands ready to adjust the over-five-year LPR if the rebound proves unsustainable, economists and analysts told MNI.

RATES UP

The MNI 7-Day Repo Rate Index rose to 57.1 from 40.3, indicating traders believe the rate will appreciate moderately over the next two weeks.

MNI’s 10-year CGB Yield Index was 54.3 in February, up from 44.1, the highest in six months, with 31.4% of traders predicting yields would rise moderately as the economy improves

“Yields will be reasonably flexible without any big fluctuations over the next three months, as current rates will provide solid support for the economy,” a Beijing trader told MNI.

Foreign investors decreased holdings of Chinese government bonds in January, according to data released by Bond Connect. Offshore investors' net position decreased by CNY106 billion in the first month of the year, put off by the relatively low interest rates on offer.

The yield on Chinese government 10-year bond stood at 2.93%, lower than the equivalent 3.82% on a 10-year US treasury note.

The MNI survey collected opinions of 35 local traders with financial institutions operating in China's interbank market, the country's main platform for trading fixed income and currency instruments, and the main funding source for financial institutions. Interviews were conducted Feb 6 – Feb 17.Click below for the full press release:

Click below for the full report:

MNI China Liquidity Index February 2023.pdf

For full database history and full report on the MNI China Liquidity Index™, please contact:sales@marketnews.comFor full database history and full report on the MNI China Liquidity Index™, please contact:sales@marketnews.com

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.