-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI CHINA LIQUIDITY INDEX: Interbank Conditions Little Changed

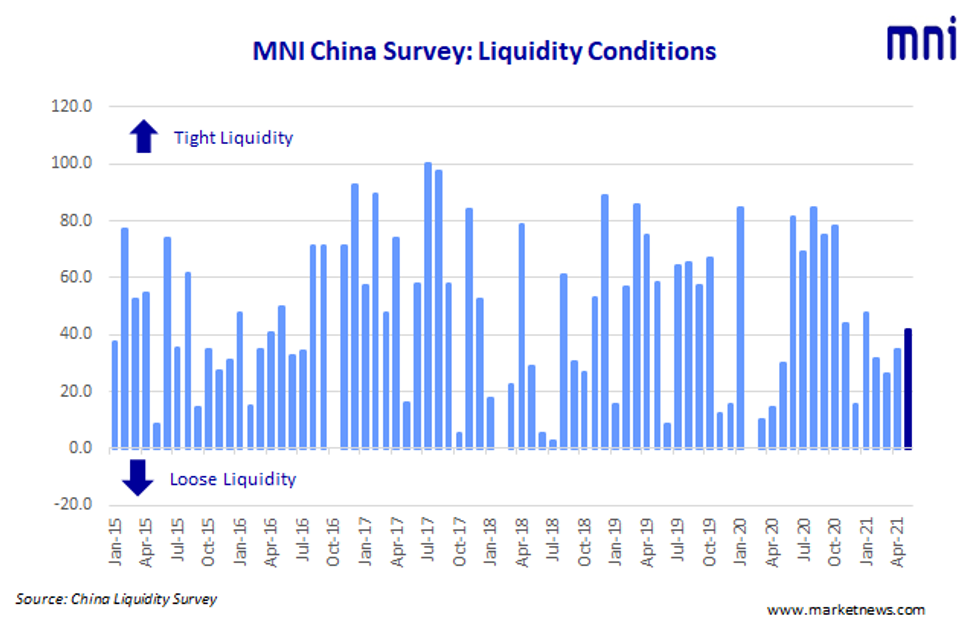

MNI May China Liquidity Conditions Index 41.7 Vs 34.8 Apr

Liquidity across China's interbank market remained relatively loose in May, with overnight and 7-day rates sitting close to official policy ones, signaling that the People's Bank of China will keep monetary policy stable, the latest MNI Liquidity Conditions Index shows.

The MNI China Liquidity Condition Index stood at 41.7 in May, up from 34.8 previously, with three quarters of traders surveyed saying conditions were "stable". The index was below 50 for a 7th consecutive month.

The higher the index reading, the tighter liquidity appears to survey participants.

Source: MNI China Liquidity Survey

The central bank is carefully watching the market "to avoid any possible liquidity risk," a bank trader in Henan said. Another based in Jiangsu said stable rates in money markets showed that the "PBOC does not need to inject extra liquidity."

The central bank conducted CNY100 billion MLF in the month to hedge the equivalent maturity of MLF with the rate unchanged at 2.95%, and drained CNY100 billion via open market operation as the end of May 24, MNI calculated.

SLOWER ECONOMY, POLICY UNCHANGED

The Economy Condition Index edged down to 58.3 in May from the previous 65.2, as most traders noted the modestly disappointing latest set of economic indicators, with lower retail sales and rising PPI both of concern.

The PBOC Policy Bias Index stood at 47.9 in May, up from April's 43.5, with more traders seeing policy at, and staying, neutral.

"PBOC will maintain the prudent monetary policy as well to prevent any speculation pushing up the prices," a Beijing based trader with the top state-owned bank commented.

"The central bank will closely track liquidity to stabilize market expectation -- current conditions are in line with its range, policy tools will be flexibly used to offset any short-term fluctuation," another trader at a state-owned bank told MNI. Following a regular meeting on May 21, China's financial committee said there will be no sharp turns in macro policy.

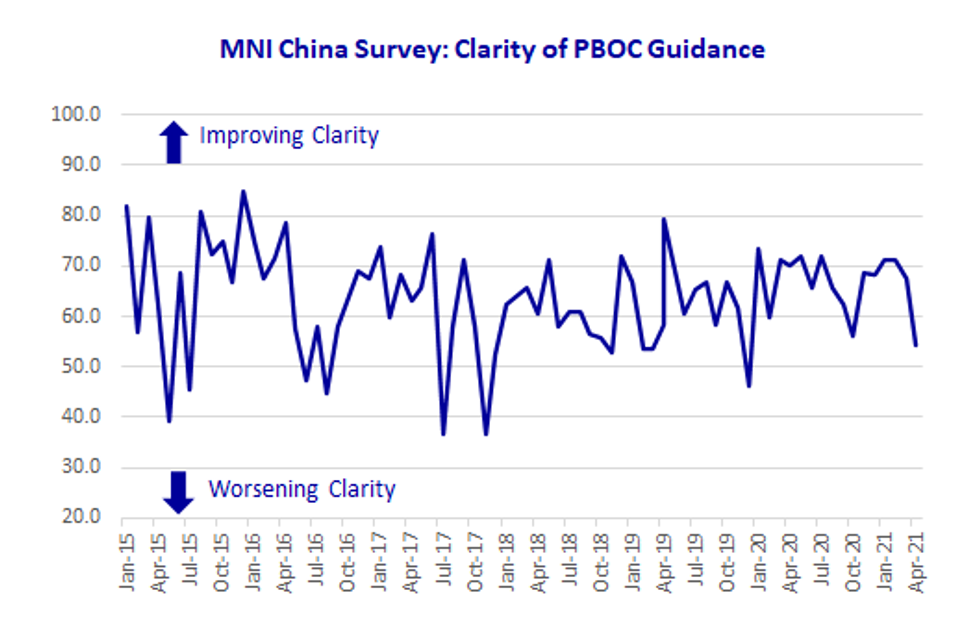

The Guidance Clarity Index was 54.2 in May, down from the 67.4 in April, with 83.3% traders seeing a well-executed guidance.

Source: MNI China Liquidity Survey

"The PBOC is managing liquidity precisely, directing market rates around the policy rates," a Shanghai-based trader explained the message he reads from central bank's move.

LONG END RATES TO FALL

The 7-Day Repo Rate Index was little changed at 56.3 from last 56.5 in April, with less respondents (25.0% VS 39.1%) seeing higher rates and more traders (62.5% VS 34.8%) seeing trade within a relatively small range.

The 7-day weighted average interbank repo rate for depository institutions (DR007) closed at 2.2579% Tuesday.

The 10-year CGB Yield Index, fell for a third month to 31.3 in May after the 43.5 reading in the previous month, with half of the traders predicting lower yields over the next three months.

There is little likelihood for higher rates or a tightening of policy as the 100th anniversary of the founding of China Communist Party approaches, a fund manager based in Shanghai said, while noting that "long end bonds yields have further room to go down,"

The MNI survey collected the opinions of 24 traders with financial institutions operating in China's interbank market, the country's main platform for trading fixed income and currency instruments, and the main funding source for financial institutions. Interviews were conducted May 10 – May 21.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.