-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI CHINA LIQUIDITY INDEX: Quarter-End Tightens; Economy Hopes

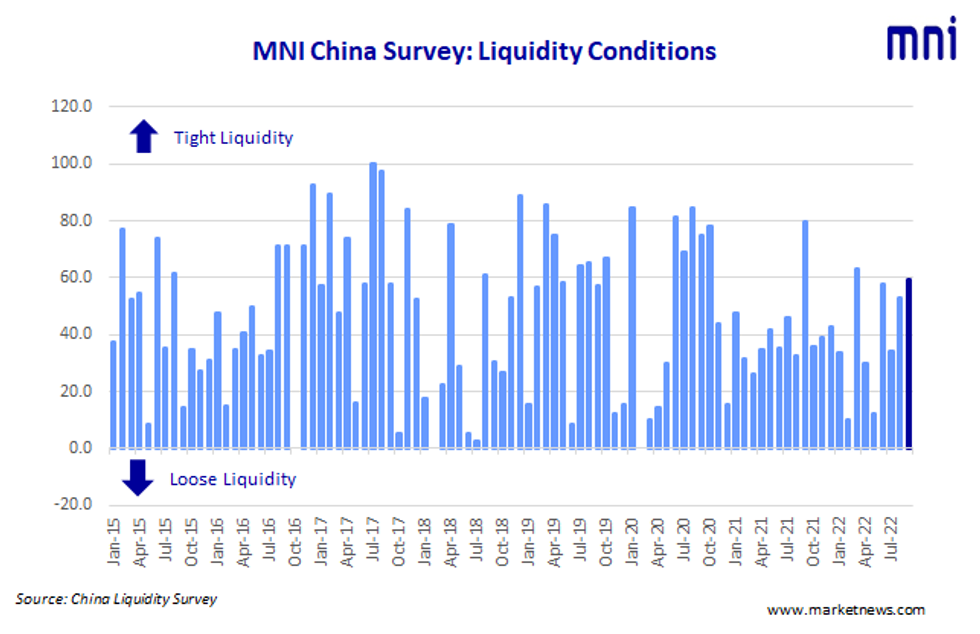

MNI Sep China Liquidity Conditions Index 59.4 Vs 53.1 Aug

Liquidity conditions across China’s interbank market tightened modestly into quarter-end, even as the People’s Bank of China injected more funds into the system, the latest MNI Liquidity Conditions Index shows.

The Liquidity Condition Index, rose to 59.4 in September from 53.1 previously, with 34.4% of the participants reporting marginally tighter liquidity condition towards the end of the month.

The higher the index reading, the tighter liquidity appears to survey participants.

“Cash demands will rise quickly before both the 7-day National Day holiday and the Macro Prudential Assessment (MPA) at the end of Q3. Liquidity usually gets tight in September, but the central bank is injecting funds to target ‘reasonable and ample’, liquidity” a Shenyang based trader told MNI.

“Though loans have picked up with the supporting policies and financing instruments, total liquidity is still ample due the continuing ‘asset-shortage’ across the interbank market,” a senior trader with a state-owned bank in Beijing commented.

The People’s Bank of China conducted CNY400 billion MLFs in September, draining CNY200 billion after offsetting CNY600 billion maturities. The central bank injected a net CNY90 billion via its open market operation as of September 27, MNI calculated.

ECONOMY GLIMMER

The Economy Condition Index climbed to 48.4 in September from 40.6 in August, with a quarter of traders seeing a solid recovery in the economic indicators.

“Industrial output grew 4.2% y/y in August, faster than the 3.8% y/y increase registered in July, driven by the manufacturing sector as well as the electricity production due to the high temperature,” a Zhejiang based trader said.

“Fixed asset investment growth is also better than expected despite the property market weakness – infrastructure and manufacturing investments made major contributions,” the trader added.

POLICY HOLD

The PBOC Policy Bias Index stood at 35.9 in September, after 40.6 in August, with 65.6% of participants seeing current policy on hold and a further 31.3% expecting a looser stance.

“Policy is likely to act to with stabilize the economy and improve employment,” a senior trader in Beijing commented.

The Guidance Clarity Index edged down to 54.7 in September from last 56.3. The high level of the reading underlines that the market still appears to understand the central bank’s action.

RATES DOWN

The 7-Day Repo Rate Index edged down to 35.9 from 45.3, with rates expected to fall back to the policy rate range guided by the central bank. The 7-day weighted average interbank repo rate for depository institutions (DR007) closed at 1.6931% Tuesday.

The 10-year CGB Yield Index edged lower in September, down from the previous 59.4 reading, with 31.3% predicting a rising yields in the coming three months.

MNI’s survey also picked up on expectations of a reserve requirement ratio (RRR) cut in Q4, thus added the special question to participants that “how do you think the likelihood of another reserve cut?” As many as 53.1% respondents predicted such a cut in Q4.

“A rough estimate of the maturity of CNY2.45 trillion MLF will bring a huge pressure to the liquidity pool, the reserve cut might be used to hedge the MLF or to reduce the pressure,” a Shanghai based trader told MNI.

The MNI survey collected the opinions of 32 traders with financial institutions operating in China's interbank market, the country's main platform for trading fixed income and currency instruments, and the main funding source for financial institutions. Interviews were conducted September 12 – September 23.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.