-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI CHINA LIQUIDITY INDEX: Liquidity Eases; Economy Rebounds

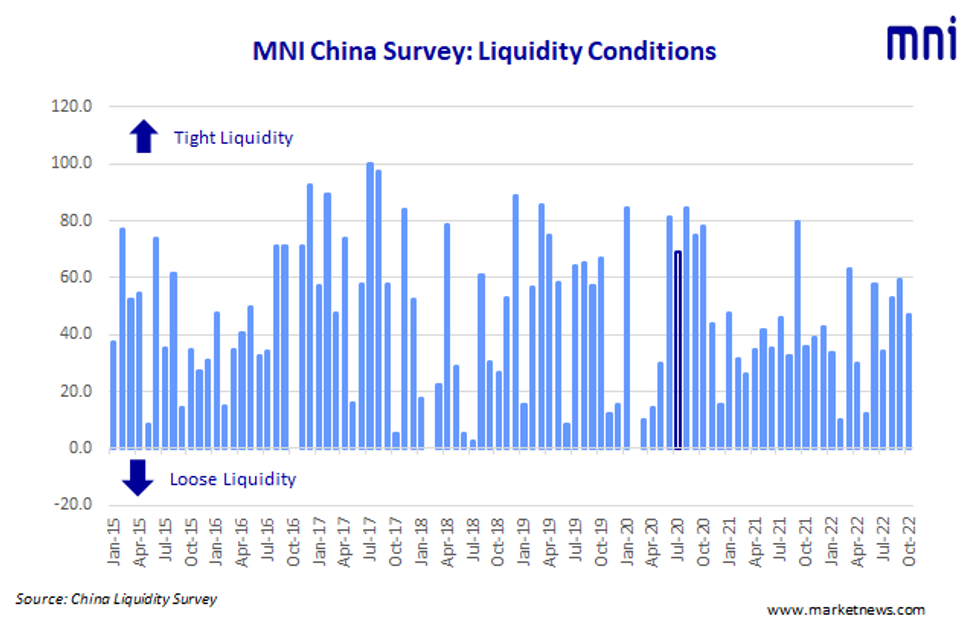

MNI Oct China Liquidity Conditions Index 46.9 Vs 59.4 Sep

Liquidity conditions across China’s interbank market eased in October, as end-quarter MPA stress and Golden week sash needs fell away. The outlook for the economy picked up, helped by the mood music from the 20th Party Congress, the latest MNI liquidity conditions survey showed.

The Liquidity Condition Index, slid to 46.9 from September’s 59.4, with one quarter of the participants reporting a marginal loosening of liquidity conditions.

The higher the index reading, the tighter liquidity appears to survey participants.

“As the quarterly MPA and the golden week holiday passed, demands for short term liquidity has fallen and financial institutions now feeling able to lend cash as they have sufficient in the pool – all pushing rates lower,” a Shenzhen based trader told MNI, pointing to the huge drain of CNY594 billion on Oct 8, the record high since Feb 17, 2020.

The People’s Bank of China conducted CNY500 billion MLF in October, hedging the equivalent maturities to maintain ‘reasonable and ample’ liquidity, the first time in three months that the central bank didn’t drain money via MLF operations. The PBOC drained net CNY722 billion via its open market operation as of October 25, MNI calculated.

ECONOMY REBOUND

The Economy Condition Index jumped to 53.1 in October, up from 48.4, with 81.2% of traders holding a positive view of the economy. The reading has marked the first time above breakeven 50 mark in recent three months.

“Exports were performing well – registered a 12.5% y/y growth in the first three quarters despite of a very high base, industrial output also kicked off a good start in Q4,” the Beijing based trader commented the indicators after the release.

China’s GDP recorded a 3.9% y/y growth in the third quarter, much faster than the 0.4% y/y increase in Q2, leading the economy increasing 3.0% y/y so far this year.

POLICY STEADY AND TRANSPARENT

The PBOC Policy Bias Index edged up to 37.5 in October from 35.9, with 75.0% of the participants seeing current policy on hold.

“The PBOC will implement the prudent monetary policy, strengthen inter- and counter-cyclical adjustments, and create a favourable monetary and financial environment for promoting economic growth, expanding employment, stabilizing prices, and maintaining the balance of payments.” Pan Gongsheng, vice governor of the central bank said on the speech introducing the financial work in the next stage.

The Guidance Clarity Index stood at 59.4 in October, up from 54.7 last month. The high level of the reading underlines the market’s satisfaction in understanding the central bank’s action.

“Either the small conduction of the open market operation to drain the excess liquidity, or the equivalent conduction of the MLF to meet reasonable demands, expressed clear signal that the central bank is carefully managing the liquidity,” a Shanghai based fund manager said, adding that the PBOC will make use of variety of monetary tools to maintain the ample liquidity.

RATES DIVERGING

The 7-Day Repo Rate Index edged up to 39.1, compared with last 35.9 reading, with vast majority seeing the rate is likely to stay or slide slightly.

The 7-day weighted average interbank repo rate for depository institutions (DR007) closed at 1.9195% Tuesday.

The 10-year CGB Yield Index stood at 46.9 in October, down from the 50.0, with 31.3% predicting lower yields three months ahead.

The MNI survey collected the opinions of 32 traders with financial institutions operating in China's interbank market, the country's main platform for trading fixed income and currency instruments, and the main funding source for financial institutions. Interviews were conducted October 10 – October 21.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.