-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI CNB Preview - August 2023: Wrestling With Market Pricing

Executive Summary:

- The CNB is widely expected to keep interest rates unchanged this week.

- Governor Michl may push back against dovish market bets, echoing recent communications.

- Forward guidance and the new macroeconomic forecast will be in the spotlight.

Full preview including summary of sell-side views here:

MNI CNB Preview - August 2023.pdf

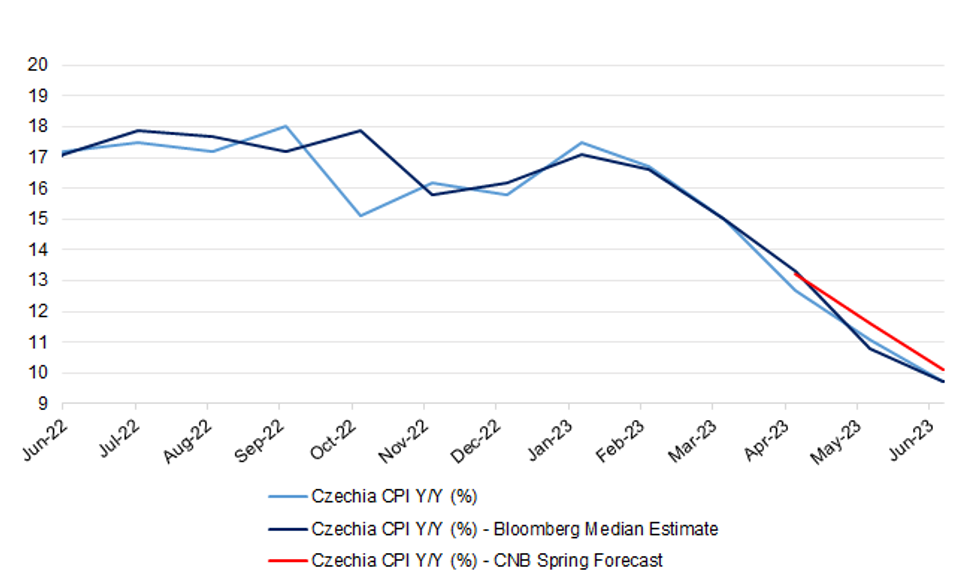

The Czech National Bank is widely expected to keep the two-week repo rate unchanged at 7.00%, potentially in a unanimous decision, as disinflationary macroeconomic data outturns keep challenging the Bank Board’s hawkish rhetoric. Despite these data signals, a flurry of comments from policymakers just before the start of the media blackout pointed to their continued intention to push back against dovish market bets. We expect Governor Ales Michl to reaffirm a familiar rhetoric during his press conference, even if the updated macro forecast shows a lower inflation path and implies a faster inauguration of the rate-cut cycle. While there is scope for moderation in the tone of the statement, the CNB will not deliver any sharp dovish pivot.

Source: MNI - Market News/Bloomberg/CNB

Source: MNI - Market News/Bloomberg/CNB

There has been little in Czech data outturns since the Bank Board’s most recent monetary policy meeting in June that would justify a resumption of the tightening cycle. However, this week’s monetary policy meeting was preceded by a media offensive from multiple Bank Board members. Eva Zamrazilova played down “excessive” market rate-cut bets, which in her view “will not materialise.” Jan Prochazka said that these bets are “too optimistic,” adding that he “can’t imagine” that the Bank Board could reach consensus to cut rates this year. Jan Frait said that actual easing will be “slower than market pricing,” but otherwise spoke in a more dovish tone than Prochazka, suggesting that the CNB could discuss rate cuts this autumn and flagging the option of making forward guidance symmetric. Any such tweak to the statement would merely put on paper what is already baked into the money markets.

Revisions to the main parameters of the CNB’s macroeconomic projections may fall to the dovish side amid signs of a faster-than-expected economic cooling. A recent interview with Deputy Director of the CNB’s Monetary Department offered a glimpse into the new estimates, with the official suggesting that headline inflation could reach the +2% Y/Y target as soon as in January 2024. The new forecast may thus imply a lower rate path, although it does not necessarily have to have much influence on the policymaking process. The Bank Board has not hesitated to ignore staff advice when it saw an alternative strategy fit for purpose and there is no reason to think that this pattern of behaviour could not be replicated in the future. Therefore, we expect the CNB to stick with messaging pouring cold water on overdone rate-cut bets, even if it would be at odds with staff projections.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.