-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI Colombia Central Bank Preview - June 2021: Unanimous Hold

Banco de la Republica

Executive Summary

- The Monetary Policy Committee are likely to keep the overnight lending rate unchanged at 1.75%.

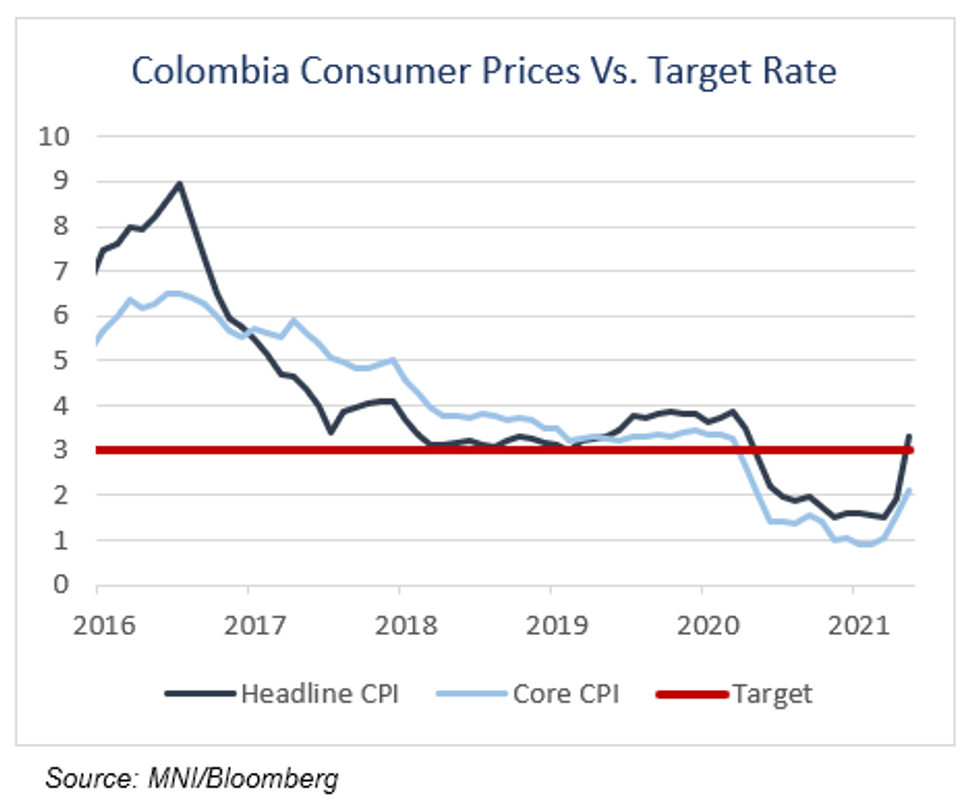

- Despite a sharp rise in headline inflation, core prints remain below the target rate and inflation expectations remain well anchored, in line with the central bank's target.

- However, pre-emptive policy action being taken by other emerging market central banks as well as increasing uncertainty about U.S. monetary policy has the potential to fast track the discussion regarding a path to normalisation.

The full preview with analyst views can be found here:

MNI BanRep Preview - June 2021.pdf

State of Play – At the April meeting, the central bank left policy unchanged in a split decision, with one board member voting for a 25bp rate cut. Since the previous MPC meeting, May headline CPI bounced from April coming in above surveyed estimates at 1.00% m/m and 3.30% y/y. Core CPI actually dipped in May, printing 0.15% vs 0.30% prior, however, the annual reading rose to 2.11%.

Colombia's fiscal and monetary policies from the pandemic's beginning have allowed for a well-paced recovery in the second half of 2020 and the first quarter of 2021, surprising the central bank staff, according to Governor Leonardo Villar at an OECD event in late May. However, GDP growth estimates for 2021 including the bank's 6% and the OECD's 7.5% will be difficult to materialise amid the ongoing economic damage caused by social demonstrations and protests following the recently withdrawn tax reforms.

According to the central bank's most recent survey, analysts now expect an increase in Colombia's benchmark interest rate of 25bps to 2% in October as inflation expectations increase, according to the median estimate. This was brought forward from an initial rate hike in December in the May survey.

Markets – COP has remained broadly unchanged since the April meeting despite volatile swings. More notably, the IBR swap curve has shifted higher once again. The front-end and the belly of the curve have risen between 60-100 basis points between the April meeting and current pricing.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.