-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY216 Bln via OMO Monday

MNI European Closing FI Analysis: Decent Moves, But Back To Flat ***TEST****

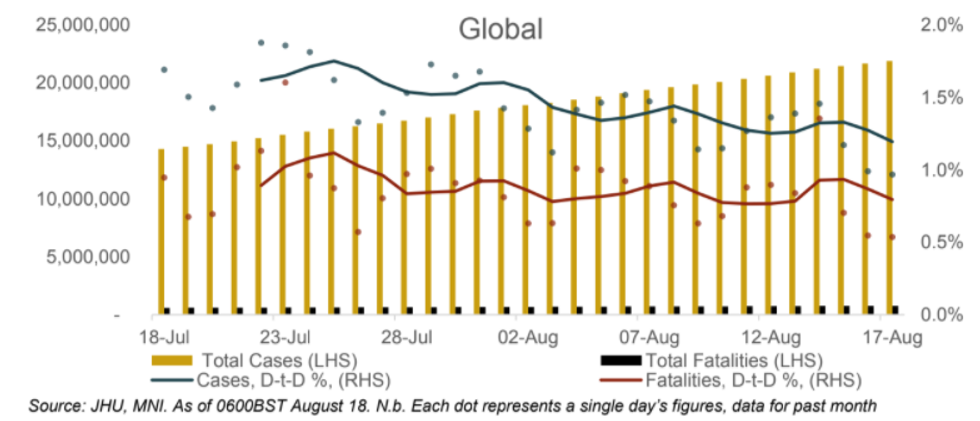

Fig 1: COVID Case Growth Becoming A Bit Less Of A Market Driver

Source: MNI Global COVID Tracker

EGB SUMMARY: Bunds Flat Despite A Few Big Intraday Moves

For the first two hours from the Bund open, it was one-way traffic higher, with a drift lower followed by a sharp fall to session lows a little before US housing data was released in the European afternoon. Bunds have clawed back though, and are near flat on the day.

- BTP spreads round-tripped as well, 10-Yrs rising to just about 140bps to Bunds, before falling back to flat (a bit above 138bps).

- A total dearth of triggers, whether data (none), supply (Bunds a little weaker after 2027 auction but 0c tail and decent cover suggesting a solid enough sale), or speakers (ECB's de Guindos spoke on eurozone banking sector consolidation).

- Looking ahead, few action points on Weds: German 30-Yr supply eyed.

** Latest levels:

- Sep Bund futures (RX) down 3 ticks at 176.18 (L: 176.03 / H: 176.51)

- Sep BTP futures (IK) down 14 ticks at 147.69 (L: 147.48 / H: 147.9)

- Sep OAT futures (OA) down 5 ticks at 168.16 (L: 168.01 / H: 168.47)

- Italy / German 10-Yr spread 0.8bps wider at 138.9bps

GILT SUMMARY: Leicester Lockdown Released

- Gilts have underperformed both Bunds and Treasuries today despite some decent gilt auctions this morning.

- The auctions of the 0.125% Jan-23 gilt and the 0.625% Oct-50 gilts both saw tighter tails and stronger bid-to-covers than their previous sales. And this afternoon both saw the PAOF taken up in large size.

- The UK government has confirmed today that the extra lockdown measures in Leicester can now be reversed and has also stated that the "Eat Out to Help Out" scheme had been used 35 million times in its first two weeks.

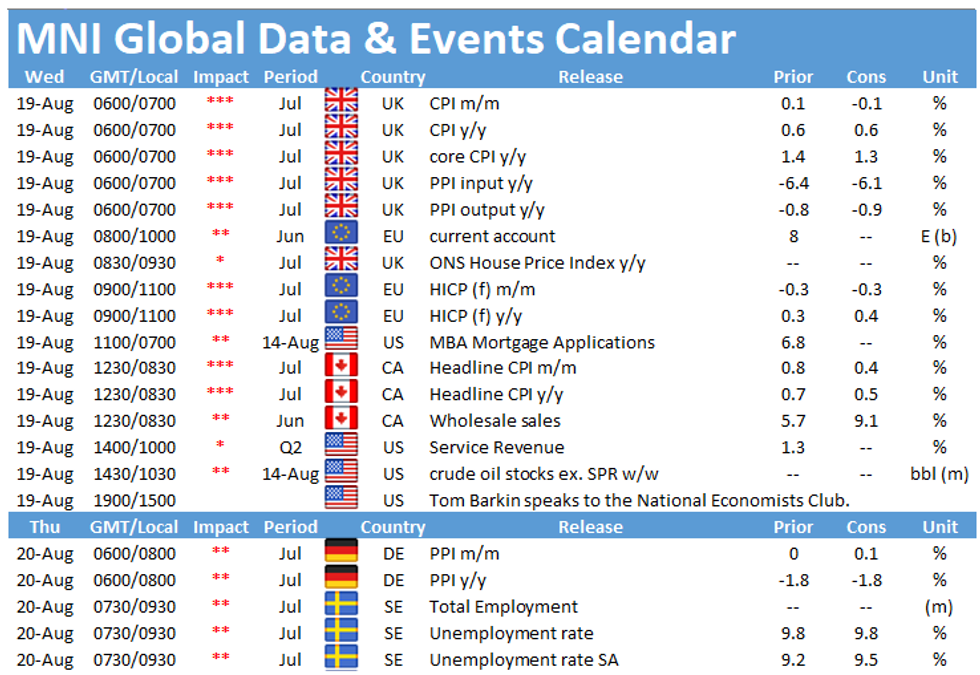

- Looking ahead to tomorrow the highlight will be CPI but with the Bank of England unlikely to change its policy course on near-term CPI surprises, Friday's data will be more important. This includes retail sales, public sector finances and the August PMIs.

- Gilt futures are down -0.13 today at 136.90 with 10y yields up 1.5bp at 0.230% and 2y yields up 1.5bp at -0.32%.

DEBT FUTURES/OPTIONS:

- RXX0 177.00/179.00/181.00 call fly bought for 11 in 1k

- DUU0 112.00/112.10/112.20/112.30 call condor sold at 3.75 in 10k

- RXU0 177.00/177.50 1x2 call spread bought for 3 in 2k

- 2RZ0 100.625 call v 2RH1 100.75 call sold at flat in 3k total (in terms of the Dec)

- 2RZ0 100.50/100.375 combo sold at flat in 1.5k (v 100.44) - (sold the put)

- ERU0 100.37/100.50/100.625 call fly sold at 9 in 1k

- ERU0 100.25 put bought for 0.25 in 3k

- 0RX0 100.50 straddle sold at 8 in 0.5k

- LM1 100.00/100.125/100.25/100.375 call condor bought for up to 2.5 in 19k (15k and 4k clips)

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.