-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Closing FI Analysis: Gilts Sold On Brexit Deal Talk

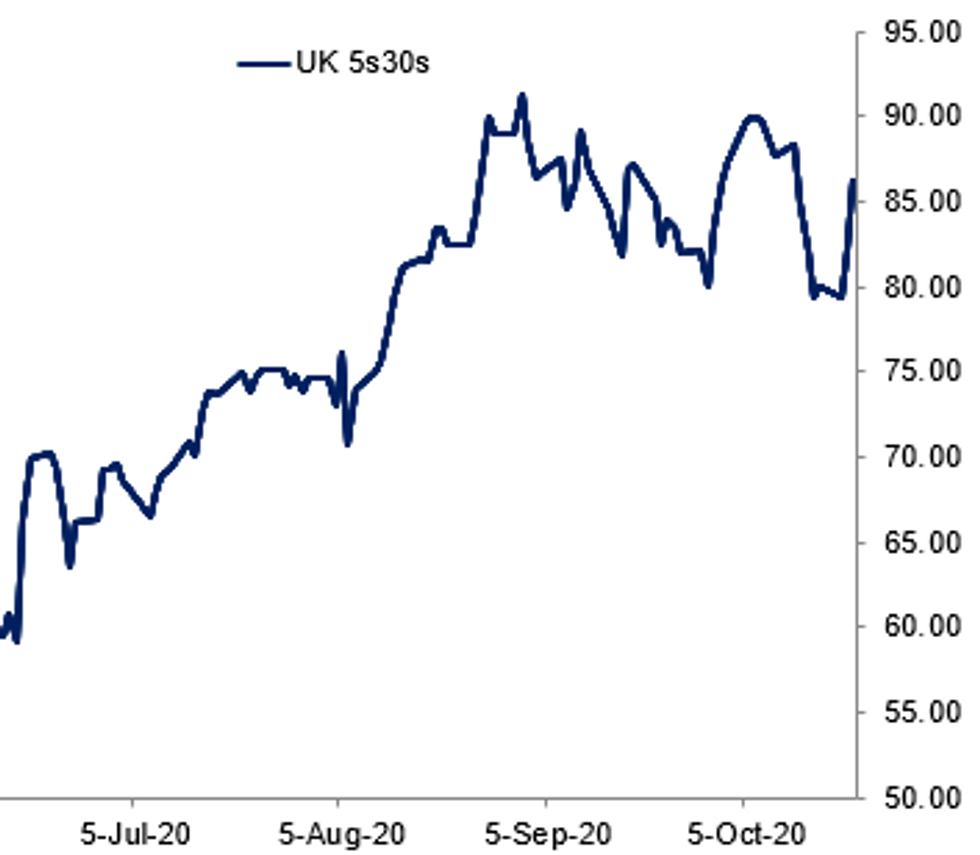

Fig. 1: UK Curve Steepens As Brexit Optimism Is Rekindled

BBG, MNI

BBG, MNI

EGB SUMMARY: BTP and GGB spreads wider on syndications

After selling off in the early part of the day, Bunds retraced most of their losses before starting to move lower again on headlines that Brexit talks were due to resume shortly, in the hope of a deal by mid-November.

- Most peripheral spreads are little changed on the day but GGB spreads are wider after the EUR2bln syndicated 15-year tap. BTP spreads are also wider after the MEF announced a syndication for a new 30-year BTP (along with simultaneous buybacks of four BTPs and a CCTeu).

- Bund futures are down -0.17 today at 175.64 with 10y Bund yields up 1.3bp at -0.594% and Schatz yields up 0.7bp at -0.779%.

- BTP futures are down -0.32 today at 148.83 with 10y yields up 4.3bp at 0.770% and 2y yields up 1.4bp at -0.323%.

- OAT futures are down -0.13 today at 169.66 with 10y yields up 1.1bp at -0.318% and 2y yields up 0.3bp at -0.708%.

GILT SUMMARY: Long-End Leading The Sell-Off

Gilts have sold off sharply through the day, with the curve bear steepening.

- Cash yields are 2-7bp higher and the 2s30s spread 6bp wider. Last yields: 2-year -0.0562%, 5-year -0.051%, 10-year 0.2381%, 30-year 0.8123%.

- The Dec-20 gilt future trades at 135.90, 10 ticks off the day's low.

- Data published earlier today showed a slightly weaker than expected September CPI print (0.5% Y/Y vs 0.6% survey) and a higher than expected public sector net borrowing requirement for the same month (GBP35.4bn vs GBP32.4bn consensus).

- Deputy BoE Governor Dave Ramsden today stressed that there remains plenty of headroom to expand asset purchases.

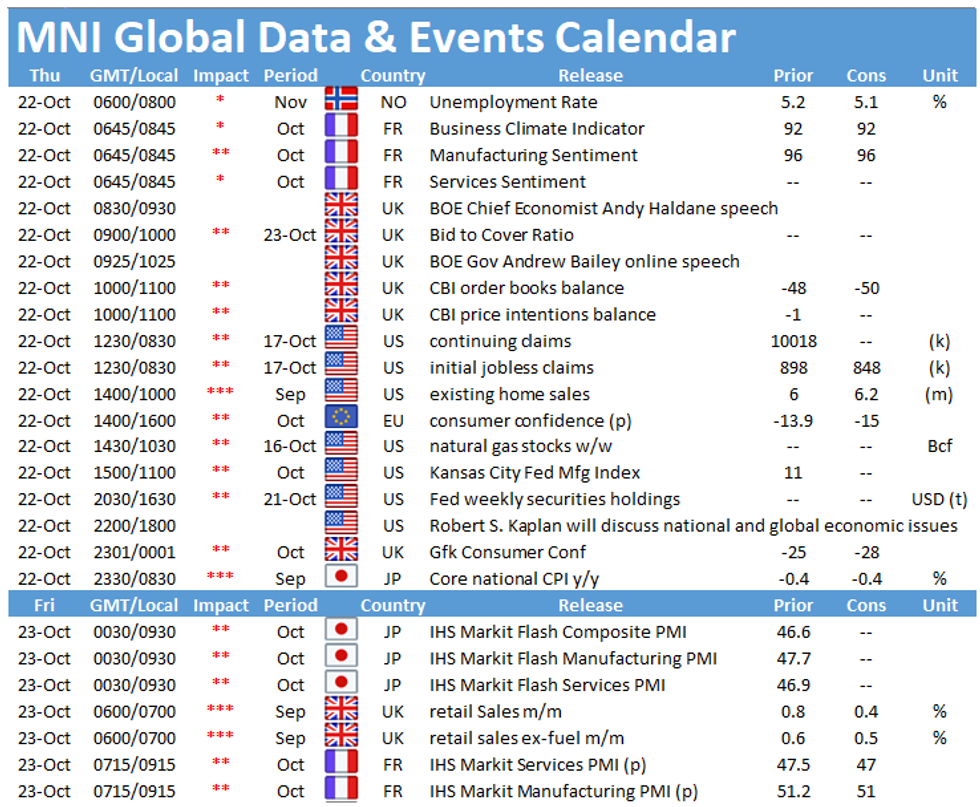

- CBI Trends data for October will be published tomorrow at 1100BST.

- Looking further ahead, GfK Consumer Confidence data for October, retail sales for September and the preliminary October PMI prints will be published on Friday.

DEBT FUTURES/OPTIONS:

- LG1 100.25c, bought for 0.75 in 25.5k

- LG1 100.25c, bought again for 0.75 in 2k (27.5k total)

- LG1 99.87/100^^, sold at 5.5 in 4k

- LH1 99.875p/100.00c strangle, sold at 6.5 in 4k

- LH1 99.875/100.00/100.125 call fly bought for 4.75 in 4k

- LH1 100.00/100.12cs 1x2 trades again for 1 in 1.5k (3k total bought).

- LM1 100.00^ vs 100.125/100.25cs, sold the straddle and receives 13.5. in 5k (adding position)

- LM1 100.12/100.37cs 1x1.5, bought for 3.5 in 10k (ref: 100.025)

- 0LF1 with 0LG! 100.12/100.37c strip, bought for 6.5 in 5k

- 0LG1 100.00/100.25cs 1x2, bought for 4.5 in 5.5k

- RXX0 176.0/176.5/177 c ladder, bought for 6 in 1.2k

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.