-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Closing FI Analysis: Periphery Spreads Widen

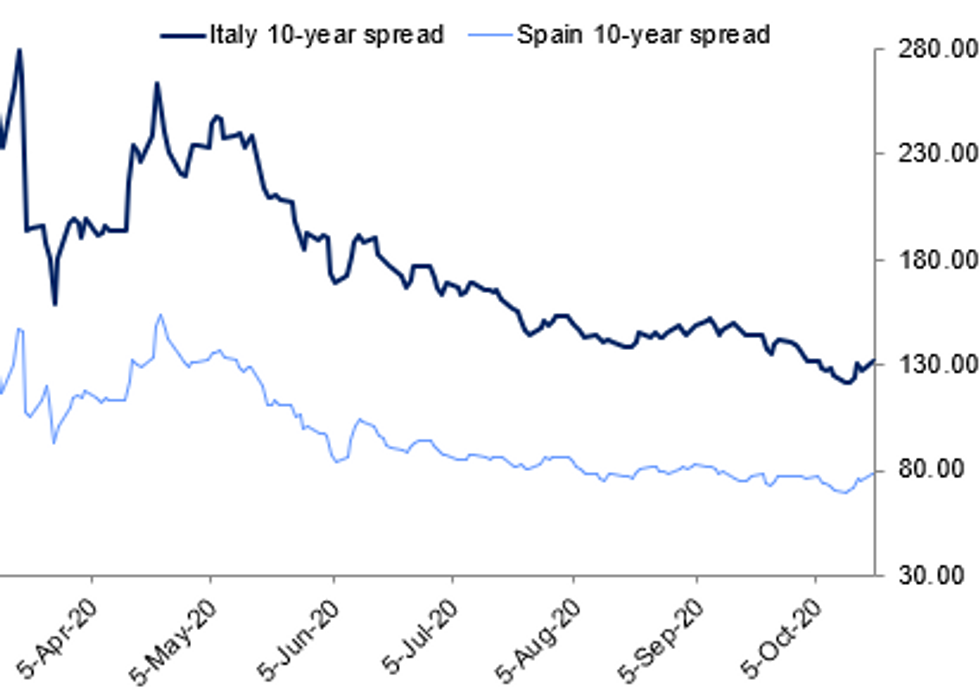

Fig 1: Periphery Spreads Widen As Risk Appetite Fades

Source: Bloomberg, MNI

Source: Bloomberg, MNI

EGB SUMMARY: Bunds reverse earlier losses, peripheral spreads widen

It has been a mixed day for European equity markets which were higher in the morning but have largely given up their gains. Bunds have also retraced some of their losses and yields are unchanged on the day.

- However, peripheral spreads which were already wider earlier today in contrast to the moves seen in equities have continued to widen throughout the afternoon session. BTP-Bund spreads in particular have widened today, with the 10-year spreads around 6bp wider on the day at the time of writing. The peripheral underperformance is largely due to continued Covid-19 concerns.

- Bund futures are down -0.03 today at 176.04 with 10y Bund yields unch at -0.622% and Schatz yields down -0.6bp at -0.785%.

- BTP futures are down -0.74 today at 149.48 with 10y yields up 6.1bp at 0.711% and 2y yields up 3.3bp at -0.333%.

- OAT futures are down -0.25 today at 169.89 with 10y yields up 1.3bp at -0.334% and 2y yields down -0.2bp at -0.715%.

GILT SUMMARY: Back To Flat

Having traded weaker earlier in the session, gilts have rallied this afternoon and now trade close to unch on the day and the curve flat overall.

- Last yields: 2-year -0.0658%, 5-year -0.0773%, 10-year 0.1824%, 30-year 0.7274%.

- The Dec-20 gilt future is trading toward the top end of the day's range (L:136.28 / H: 136.58) and 4 ticks off the high.

- Citing official insiders, Bloomberg earlier reported that the UK government could decide to rewrite the contentious Internal Markets Bill in a bid to get a Brexit deal over the line. However, Downing St continues to stress that Brussels needs to fundamentally alter its position in order for negotiations to progress.

- Looking ahead, the DMO will tomorrow offer GBP600mn of the 1.25% Nov-32 linker.

- There are no further significant data releases until Wednesday when CPI data for August and public sector finance data for September will be published.

DEBT FUTURES/OPTIONS:

- 0LZ0 100.125/100.25cs, bought for 2 in 1k

- LH1 99.875/100/100.12c fly 1x3x2, bought for 1.75 in 3k

- LM1 100.00/100.12/100.25, bought for 1.75 in 8.5k all dayRXZ0 174.50p, bought for 39 in 3k (ref 175.91)

- 2RX0 100.50/100.37ps, bought for 0.75 in 5k (ref 100.565, 16 del)

- RXZ0 175/173/169 broken put fly, bought for 24/26 in 1k

- RXX0 175.00/174.50ps, bought for 5 in 3k

- RXZ0 173.50/178.00^^, sold at 42 in 1k

- RXZ0 174.50p, bought for 39 in 3k (ref 175.91)

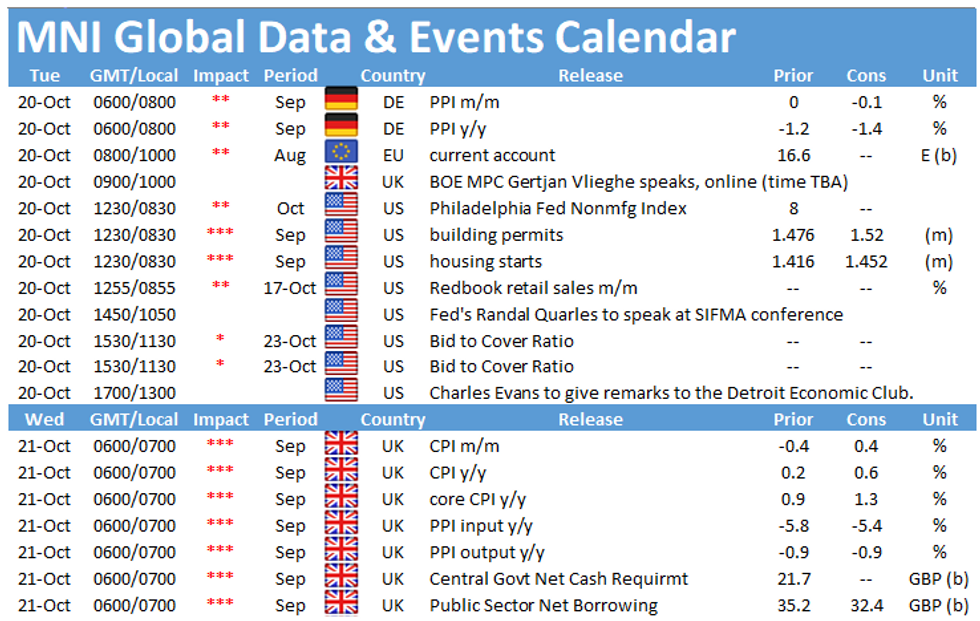

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.