-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI European Closing FI Analysis: US Election, BoE Eyed

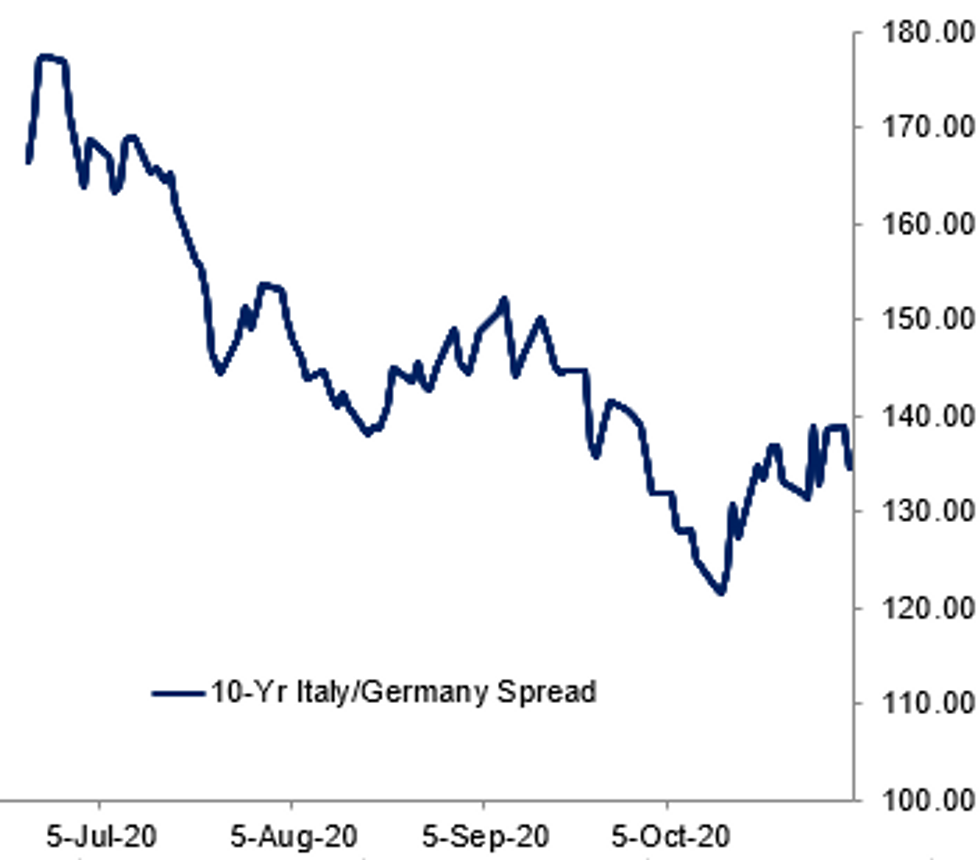

Fig. 1: BTP Spreads Narrow Amid Risk-On Atmosphere

BBG, MNI

BBG, MNI

EGB SUMMARY: All about Equities

EGBs have have stayed within the morning session ranges, and better offered, with all the action seen in Equities today.

- Equity screens are flashing green, as investors positions ahead of the US election.

- German curve has traded flat, leaning bear flatter on the margin, with 5/30s hovering near the low of the session.

- Peripheral have outperformed core bond and trade tighter on the day, with Greece leading at 4.8bps.

- All eyes turns to the US election, with Polling results throughout the night.

- Dec Bund futures (RX) down 17 ticks at 176.07 (L: 175.82 / H: 176.37)

- Germany: The 2-Yr yield is up 1bps at -0.795%, 5-Yr is up 1.4bps at -0.811%, 10-Yr is up 1.8bps at -0.622%, and 30-Yr is up 1bps at -0.22%.

- Dec BTP futures (IK) up 29 ticks at 149.79 (L: 149.29 / H: 150)Italy / German 10-Yr spread 3.7bps tighter at 135.1bps

- Dec OAT futures (OA) down 1 ticks at 170.14 (L: 169.82 / H: 170.25)10-Yr Periphery EGB Spreads:

- Spanish bond spread down 2.4bps at 73.7bps

- Portuguese PGB spread down 2.8bps at 70.6bps

- Greek bond spread down 4.7bps at 152bps

GILT SUMMARY: BoE Still A Focus Alongside US Election

Gilts have traded weaker and the curve has bear steepened as markets adopt a risk-on posture ahead of the US election.

- Gilt cash yields are 3-4bp lower with the curve 1bp steeper. Last yields: 2-year -0.054%, 5-year -0.0486%, 10-year 0.2556%, 30-year 0.8188%.

- The Dec-20 gilt future has traded down towards the lower end of the day's range (L: 135.65 / H: 136.09) and last printed 135.69.

- The DMO earlier sold GBP2.75bn of the 0.125% Jan-28 Gilt and GBP2.0bn of the 1.25% Oct-41 Gilt. A further GBP655.625mn and GBP499.999mln of each respective issue was taken up through the PAOF.

- The BoE purchased GBP1.473bn of long-dated gilts with offer-to-cover of 2.12x.

- While the US election takes centre stage this week, the BoE meeting is also a focus, particularly given the ECB's pre-commitment to providing additional stimulus in December.

- The data slate is light this week with the only releases of note being the final October PMI prints (Services/Composite on Wednesday, Construction on Thursday).

DEBT FUTURES/OPTIONS:

- RXZ0 174.50/173.50ps 1x1.5, bought for 18.5 in 1.5k (ref 176.11)

- RXZ0 174.50p, bought for 20 in 2k

- 0LX0 99.875/100.00/100.125c fly sold at 7 in 3k.

- BTP/Bund tightener via futures: IK 2,742 at 149.56 v RX 2,031 at 176.08

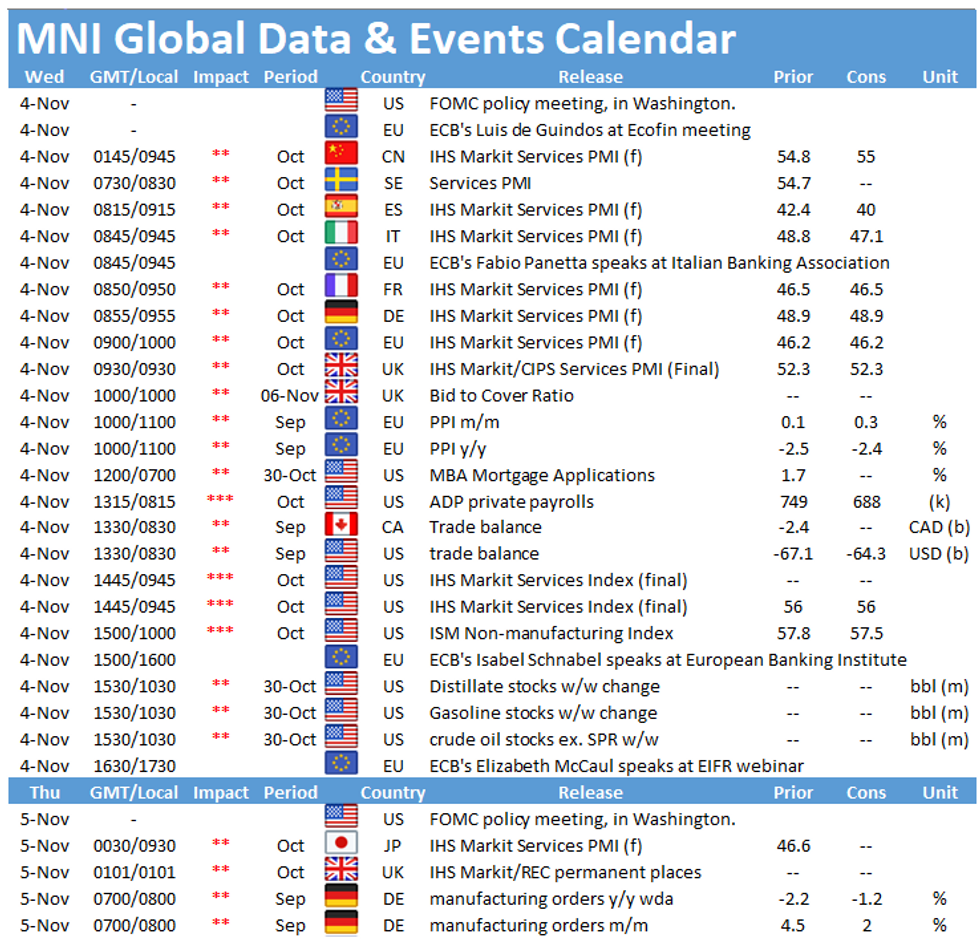

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.