-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RBA Feb Cut Nearly Fully Priced Post Q4 CPI

MNI: More Data Needed Before Hike - BOJ Minutes

MNI EUROPEAN MARKETS ANALYSIS: GBP The Outperformer As Brexit Deal Nears

- A Brexit deal is set to be outlined this morning after yet another Johnson-von der Leyen call, GBP the outperformer among G10.

- Little seen in the way of fiscal progress in DC.

BOND SUMMARY: Winding Into Christmas

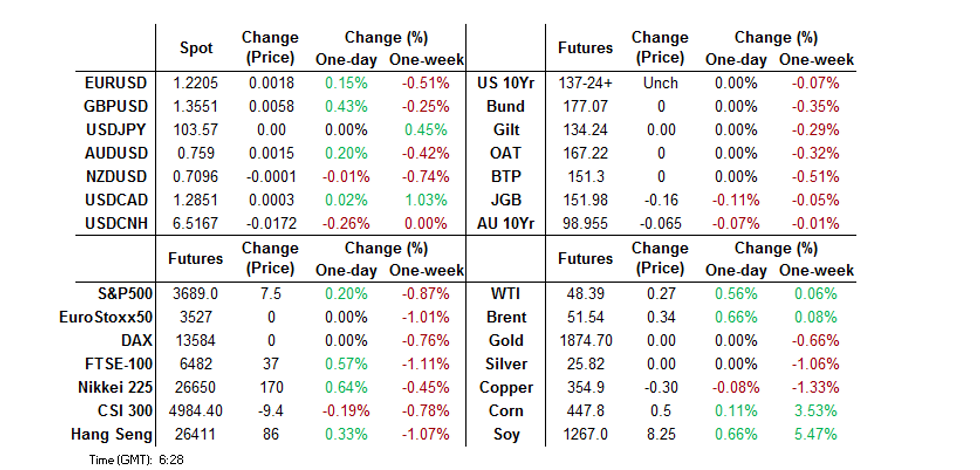

A very limited Asia-Pac session for U.S. Tsys, with the cash market little changed at typing, while T-Notes sit +0-00+ at 137-25, sticking to a 0-02+ range. Trade was non-committal as we moved towards the Christmas break, with continued focus on Brexit and the fiscal situation in DC.

- Little in the way of consistent movement was seen across the JGB curve, with yields marginally mixed for most of the day, while futures extended on their overnight losses, closing 16 ticks below yesterday's settlement levels, at worst levels of the day and sub-152.00. News flow has generally been light, with continued focus on the situation surrounding former PM Abe that we flagged earlier (although there has been little spill over for markets on that front). Elsewhere, BoJ Governor Kuroda spoke, noting that the BoJ policy review will focus on making the Bank's policy settings more sustainable as simply maintaining QQE with YCC will not be enough. Kuroda also noted that the review will not look at reducing the side effects of the Bank's ultra-loose policy stings. He also tipped his hat to the downside risks for the Japanese economy, once again. A firm enough 2-Year JGB auction was seen, with the low price topping dealer expectations at the margin (BBG survey pointed to 100.450), while the cover ratio moved back towards more normal levels and the tail narrowed, although we must stress that last month's 2-Year offering was poorly received, which muddies the usual comparative benchmarking. Real yield dynamics and collateral matters likely helped takedown.

- The overnight bear steepening for Aussie bond futures ultimately held/extended in a holiday shortened Sydney session, with little in the way of notable macro headline flow evident. That left YM -1.0 at the close, with XM -6.5, as the latter ticked to fresh lows into the closing bell. The move wasn't all offshore driven, with the AU/U.S. 10-Year yield spread widening by ~2bp. The cash curve ran steeper, with swaps tightening across the curve in the main. Bills finished unchanged to -1 through the reds, with 3-Month BBSW fixing unchanged, at all-time lows of 0.010%.

FOREX: Final Stretch

GBP easily outperformed is G10 peers in thin, pre-holiday trade on the back of reports that the Brexit deal is down to the short strokes, with negotiators rushing to finalise the text of the agreement before its expected announcement in the London morning. Cable added ~50 pips in the Asia-Pac session, building on the solid gains posted Wednesday, albeit neither GBP/USD nor EUR/GBP managed to push through the prior day's extremes. Upside in cable is tempered as EUR/GBP struggles to break through 0.90

- For the most part, major crosses were happy to hug tight ranges with activity sapped by market closures in the likes of Indonesia and the Philippines. Macro flow was few and far between, providing little to move the needle.

- Brexit positivity supported broader sentiment, applying pressure to USD & JPY, which were among the worst performers in G10 FX space, although the DXY ticked away from lows in the second half of the session. NZD also struggled, unlike AUD, which allowed AUD/NZD to resume gains after snapping its four-day winning streak yesterday.

- The PBOC fixed USD/CNY at 6.5361, 197 pips lower than yesterday's fix as the greenback recedes and the redback advances alongside Asia FX.

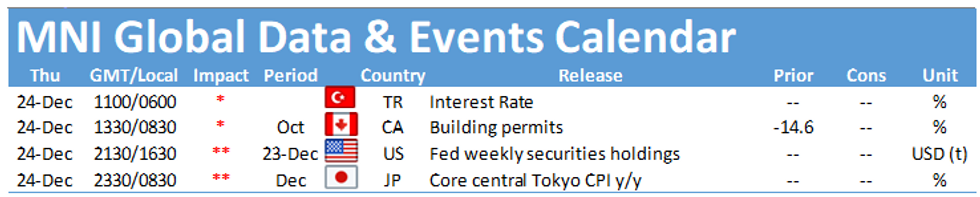

- Remaining points of note on today's thin calendar include Canadian building permits, ECB Economic Bulletin & the latest MonPol decision from the CBRT.

FOREX OPTIONS: Expiries for Dec24 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2100(E536mln), $1.2200-20(E1.4bln)

USD/JPY: Y100.20($1.3bln-USD puts), Y102.50($600mln), Y103.75-85($674mln)

GBP/USD: $1.3150(Gbp640mln)

USD/CNY: Cny6.5750($600mln)

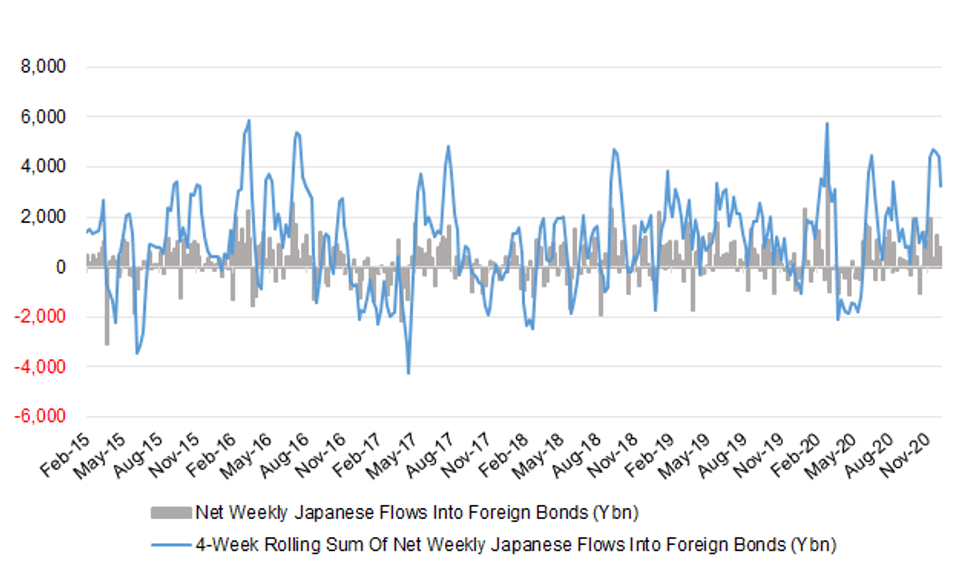

JAPAN: Little Of Note In Weekly International Security Flow Data

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 802.4 | 771.8 | 3203.8 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -771.8 | -585.2 | -2884.3 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 15.0 | 947.1 | 568.0 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -504.3 | 156.4 | 152.3 |

Source: MNI - Market News/Japanese Ministry Of Finance

Little in the way of any true stand-out flow in the latest round of weekly Japanese international security flow data.

- Japanese investors racked up an eighth consecutive week of net purchases of foreign bonds and a sixth straight week of net sales of foreign equities, but the net levels weren't anything outside of the recent norms (potential portfolio rebalancing into calendar year-end).

- Net weekly foreign flows into Japanese bonds pull backed to virtually neutral levels, while foreign investors shed Japanese equity holdings, breaking a streak of three consecutive weeks of purchases, unwinding most of the cumulative buying seen over that period in one sweep.

Source: MNI - Market News/Japanese Ministry Of Finance

EQUITIES: Equities Nudge Higher Overnight

The major e-mini contracts and regional Asia-Pac equity indices moved higher during a muted round of Christmas Eve trade, with focus on the positive Brexit developments.

- Macro headline flow was light, with participants lacking any sense of meaningful conviction ahead of the festive break.

- Deeper regulatory scrutiny out of China for tech giant Alibaba headlined regional matters, with the company's Hong Kong listing shedding 8% during the Hong Kong morning.

- Nikkei 225 +0.5%, Hang Seng +0.2%, CSI 300 -0.3%, ASX 200 +0.3%.

- S&P 500 futures +8, DJIA futures +64, NASDAQ 100 futures +17.

GOLD: Sticking Within The Lines

A slightly softer USD has provided some light support for bullion over the last 24 hours or so, although both the DXY and spot gold have continued to operate within the confines of the respective ranges established earlier in the week. This leaves a relatively stagnant technical picture, with spot last dealing around the $1,875/oz mark.

- Known ETF holdings of gold continue to flatline after the pullback from record highs for the metric, which were lodged back in October.

OIL: Nudging Higher

WTI & Brent sit $0.35-$0.40 above their respective settlement levels, with equities nudging higher during Asia-Pac hours.

- Crude has built on Wednesday's gains that were seemingly driven by Brexit developments and a sense of hope that existing vaccines can counter the recently discovered COVID mutation seen in the UK.

- In terms of crude specifics, Thursday's DoE inventory release saw headline crude stocks provide a shallower drawdown vs. exp., although that was at odds with the surprise build seen in the API equivalent late on Tuesday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.