-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN MARKETS ANALYSIS: A Sense Of Caution Overnight

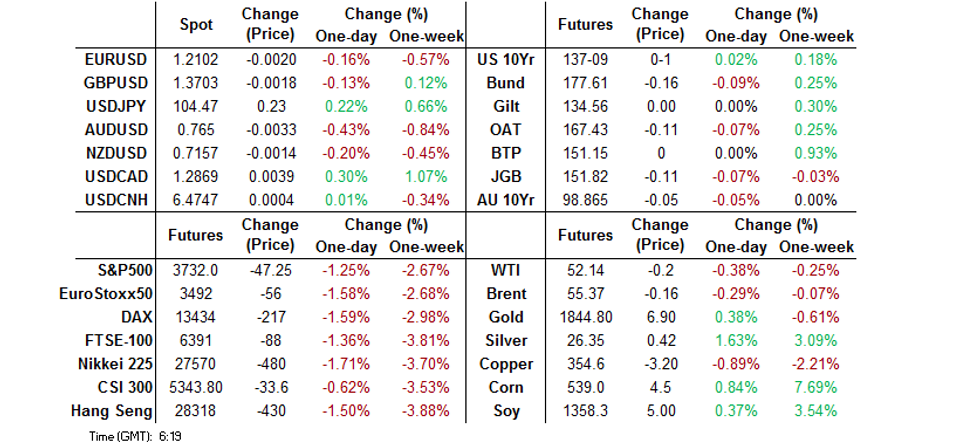

- U.S. retail trading matters and diminished Novavax vaccine efficacy vs. the South African COVID strain weigh on risk in Asia.

- DXY bid after yesterday's sell off.

- TYJ1 risk reversal plays continue to catch the eye in the Asia-Pac timezone.

BOND SUMMARY: Cross Currents Result In Mixed Markets

T-Notes stuck to a 0-04+ range overnight, last +0-01+ at 137-10, with cash Tsys sitting little changed to a touch richer across the curve, 30s print 1.0bp dearer into European hours. It would seem that some worry surrounding the Novavax COVID vaccine's efficacy re: the South African strain of the virus (which became evident in very late NY trade) limited the light steepening impetus that was initially seen after the re-open, before providing further support in Asia. A 3.0K screen buyer of TYH1 also helped to support the space. Still, flow was dominated by yet another 10K risk reversal block trade during Asia-Pac hours, this time in the TYJ1 137.00/135.00 strategy, buying the puts to sell the calls (60K worth of TYJ1 risk reversal strategies have crossed in Asia on block over the last week and a half). Eurodollar futures trade unchanged to +0.5 through the reds. An ~11K screen seller of EDH1 was seen at the re-open. Month-end flows and Fedspeak are set to dominate during Friday's NY session.

- JGB futures finished 11 ticks below settlement levels, with the cash curve a touch steeper, which came on the back of the light pressure seen in core FI during NY hours, while some continue to speculate re: the potential for adjustments to the BoJ's JGB purchase plan for the month of February (which will be released after hours today). Paying flows in swaps also seemed to aid the momentum, with longer dated swap spread widening seen during the morning. There was also some focus on the summary of opinions from the BoJ's January meeting, in which one member of the BoJ board stressed that more flexible management of the Bank's YCC scheme is vital, while one board member also said the same about the Bank's ETF purchases. These are of course assumed to be the central areas in the BoJ's ongoing monetary policy review, with the results set to be released in March. A reminder that local press reports recently suggested that the BoJ will tolerate a wider trading band around the 0% centre point re: 10-Year JGB yields. Elsewhere, the latest round of BoJ Rinban operations saw purchase sizes that were in line with the previous rounds for each respective bucket, while the offer/cover ratios didn't provide any real points of interest.

- Little to pen for the Aussie bond space outside of the earlier flagged hedging flow surrounding QTC's A$3.0bn Aug '32 issuance, with a subsequent unwind after the AOFM failed to announce the syndication of a new ACGB Nov '32 within next week's issuance schedule. That left the space steeper, drifting after the two aforementioned swings. YM unch. and XM -5.0 at the close, with the latter 1.0 off of worst levels. Swap spreads narrowed across most of the curve. Next week brings a heavy RBA schedule with the first decision of '21 due on Tuesday, addresses from Governor Lowe slated for Wednesday & Friday, as well as the release of the latest SoMP, also on Friday.

FOREX: Greenback Firms Up On Month-End Flows, Questions Surrounding Vaccine Effectiveness

USD & CHF gained on safe haven demand, with DXY edging higher amid month-end flows. Concerns over the spread of new strains of the coronavirus and the effectiveness of some Covid-19 vaccines continued to linger, following reports that the Novavax product is less effective against the South African variant of the pathogen & Germany's decision not to administer the AstraZeneca jab to people over 65 years old.

- JPY struggled for any momentum again, despite broader risk aversion. USD/JPY climbed past its 100-DMA, it may have drawn some support from flows ahead of the next Gotobi Day, which falls on a Saturday. Worth noting that $1.3bn worth of options with strikes at Y104.35-45 expire at today's NY cut.

- AUD faltered as iron ore prices remained heavy, while BBG trader source flagged AUD/NZD sales by short-term accounts in reaction to the aforementioned reports re: German doubts over AstraZeneca jab for the elderly. Australia secured 1.2mn doses of the vaccine for Feb, with exp. of 1.6mn more. AUD/NZD dipped under its 100-DMA, with bears hoping for a close below that moving average.

- The kiwi held up relatively well after ANZ Consumer Confidence improved a tad, NZ Tsys financial statements showed narrower deficit than forecast, the RBNZ announced its second QE taper this month, while NZ health officials said they see no evidence of community transmission of Covid-19 in the country.

- The PBOC fixed USD/CNY at CNY6.4709, 38 pips above the CNY6.4671 estimate. The sell side estimates could have been skewed today given the large trading range for the yuan, which has strengthened heading into month-end. The bank injected a net CNY98bn via OMOs after draining around CNY325bn so far this week.

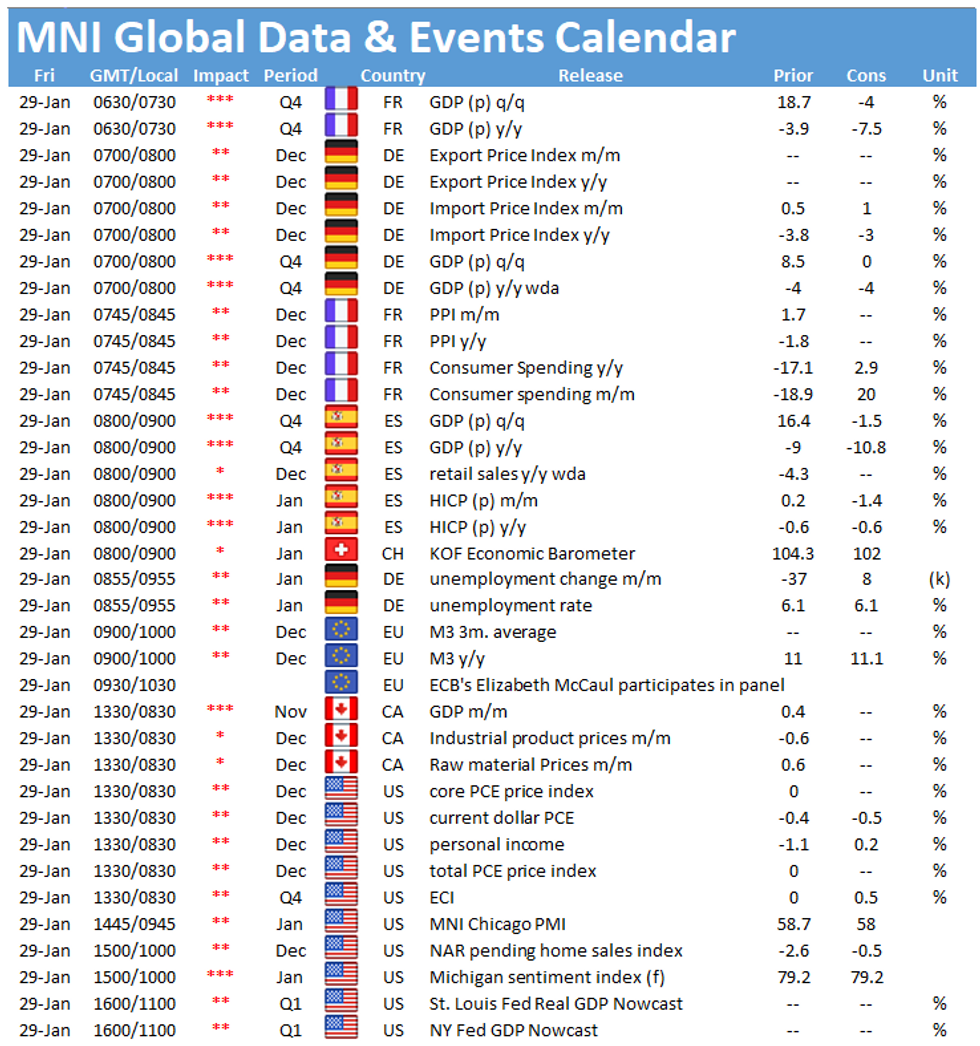

- Personal income/spending, final U. of Mich. Survey & MNI Chicago PMI out of the U.S., German & Norwegian jobless rates as well as German, French & Canadian GDPs take focus on the data front. Central bank speaker slate features Fed's Kaplan & Daly.

FOREX OPTIONS: Expiries for Jan29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E562mln), $1.2050-60(E826mln-EUR puts), $1.2070-75(E1.0bln), $1.2100(E697mln), $1.2200(E801mln), $1.2300(E953mln)

- USD/JPY: Y103.80-85($593mln), Y104.35-45($1.3bln)

- EUR/GBP: Gbp0.8800(E661mln-EUR puts), Gbp0.8845-60(E1.1bln-EUR puts)

- USD/CHF: Chf0.8800($1.46bln-USD puts)

- AUD/USD: $0.7400(A$541mln), $0.7610-30(A$778mln-AUD puts), $0.7650(A$866mln), $0.7725-35(A$1.0bln-AUD puts), $0.7750-55(A$503mln), $0.7880(A$812mln)

- USD/CAD: C$1.2750-60($830mln-USD puts)

- USD/MXN: Mxn19.80($1.2bln), Mxn20.00($1.4bln)

- USD/CNY: Cny6.45($740mln), Cny6.47($1.1bln), Cny6.50($1.5bln-USD puts), Cny6.55($782mln)

ASIA FX: Mixed Into Month-End; Risk Off Mood

A mixed session for Asia FX as the greenback strengthens, with flows distorted heading into month end. The general tone was risk off, exacerbated by some COVID-19 concerns; the South African strain of coronavirus has now been found in the US, while Germany recommended the AstraZeneca jab not be given to over 65's, and there were reports that the Novavax vaccine is less effective against the new variants.

- CNH: The yuan originally built on its Thursday strength, but reversed fortunes midway through the session, USD/CNH last up 41 pips at 6.4784. The PBOC fixed USD/CNY at 6.4709, 38 pips above the 6.4671 estimate. The bank injected a net CNY 98bn via OMOs after draining around CNY 325bn so far this week, money market rates still rose to multi-year highs despite the injection.

- SGD: Singapore dollar grinding lower through the session in cautious trade. A bid in the greenback has pushed USD/SGD to 1.3312. As we head into month end the pair has gained just shy of 0.7%, the biggest monthly gain since March 2020.

- TWD: USD/TWD has risen through the session on Friday, markets look ahead to GDP data at 0800GMT/1600HKT. The Taiwanese economy is expected to have grown 2.55% in 2020, outpacing China for the first time in 30 years.

- KRW: The won strengthened, recouping some of the decline this week. Data from South Korea was strong, headline industrial production rose 3.4% Y/Y vs estimates of a 0.6% decline.

- IDR: USD/IDR has moved away from its 50-DMA attacked yesterday, after the rate failed to consolidate above the moving average. It last sits -21 pips at IDR14,057. Bank Indonesia will offer 1-month domestic NDF at IDR14,111 in an auction.

- MYR: USD/MYR re-opened lower but has more than erased losses, with volatility increased as the pair digested the latest news flow after yesterday's public holiday in Malaysia. The rate last trades +85 pips at MYR4.0535. Moody's affirmed Malaysia at A3 (outlook stable) and said they expect Malaysia's medium-term growth prospects to "remain strong."

- PHP: USD/PHP showed above its 50-DMA yesterday and printed its , but failed to hold onto those gains and retreated. The rate last operates -4 pips at PHP48.075.PPI fell 2.4% Y/Y in Dec after sliding 3.2% in Nov.

- THB: USD/THB has been offered, catching up with overnight greenback sales, despite warnings re: Thailand's growth prospects from one of the FinMin depts. The rate last sits -5 pips at THB29.985.

EQUITIES: Equities Pressured

A mixed picture for stocks in the Asia-Pac time zone to end the week. Bourses in Japan, South Korea and Australia are all down between 1%-2%, but indices in Hong Kong and China are managing to squeeze out some gains.

- US futures are lower, breaching new session lows as we head into the European session after recovering from heavy selling yesterday. While markets initially rebounded after measures were imposed to limit retail traders speculation in meme stocks, the move gave back as some of the stocks in question saw sizeable after hours moves. RobinHood, one of the online brokers, has said it will ease some restrictions on the stocks in question.

- The phenomenon seems to be contagious. The market drama surrounding GameStop is spreading beyond the US as traders look to squeeze heavily shorted stocks. Rakuten and Pigeon Corp. both saw outsized moves in Japan.

- Risk off sentiment is exacerbated by some COVID-19 concerns, the South African strain of coronavirus has now been found in the US, while Germany recommended the AstraZeneca jab not be given to over 65's, and there were reports that the Novavax vaccine is less effective against the new variants.

GOLD: Familiar Levels In Play, Despite Thursday Swings

The yellow metal has stuck to familiar territory over the last 24 hours or so, leaving bullion little changed in Asia-Pac trade, with spot sitting a little above $1,840/oz.

- We should flag that the sharp push higher witnessed during Thursday's NY morning was potentially linked to a bid in silver, which in turn was linked to U.S. retail investors seemingly turning their attention to short sellers of the iShares Silver Trust (SLV).

- Bullion then unwound intraday gains during the NY afternoon, even as the dollar softened and U.S. real yields operated on the backfoot (albeit not in a straight line). The DXY is at similar levels vs. this time yesterday, while U.S. real yields sit a little lower in the main.

OIL: WTI Set For Weekly Loss

WTI & Brent are ~$0.20 below settlement levels. The commodity complex has come under some pressure as the greenback rises amid general risk off trade in Asia.

- The March brent contract, which expires on today, was up 0.2% to $55.64.

- Demand concerns also weigh with the South Africa strain of coronavirus now found in the US, while Germany recommended the AstraZeneca jab not be given to over 65's, and reports that the Novavax vaccine is less effective against the new variants.

- WTI is down around 0.2% this week, and on track for its second consecutive weekly decline after seeing positive returns for the majority of Q3.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.