-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: About That RBNZ Hike

- Chinese regulatory burden, COVID and matters in the Middle East continue to dominate headline flow.

- The first new community COVID case seen in NZ in months weighed on the NZD and impacted RBNZ pricing.

- Comments from Fed Chair Powell and U.S. retail sales data headline on Tuesday.

BOND SUMMARY: Core FI A Touch Better Bid In Asia

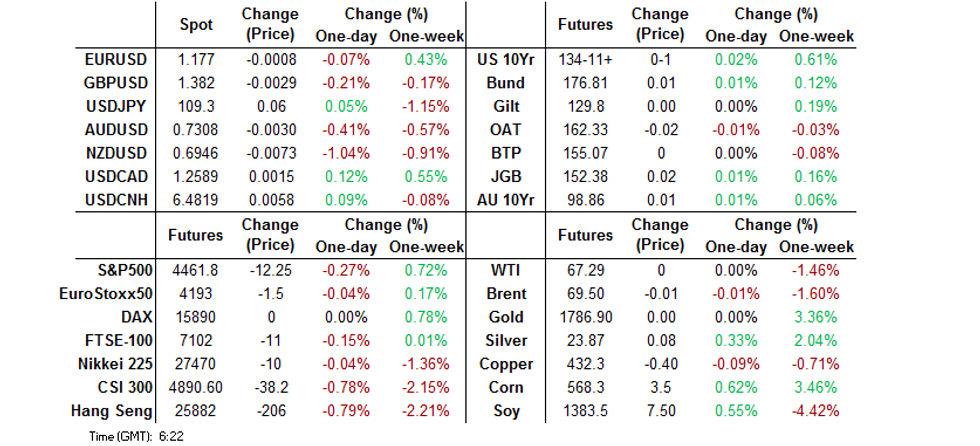

U.S. Tsys drew support from a modest downtick in e-minis during Asia-Pac hours (after the S&P 500 lodged a fresh record high on Monday), with geopolitical tension centring on the Middle East, broader COVID worry and regulatory matters in China all presenting relatively familiar topics of headline flow. That allowed T-Notes to unwind their post settlement losses lodged late in the NY day, with that contract last dealing +0-01 at 134-11+, while cash Tsys across the curve sit little changed to ~1.5bp richer on the day into European hours.

- JGB futures unwound their overnight losses to last trade +2, with Japanese COVID chief Nishimura outlining the touted longer and wider state of emergency that the government is looking to implement. Cash JGBs trade little changed to ~1.5bp richer on the day.

- Aussie bond futures also received some incremental support from the previously outlined risk-negative factors, although the space traded in a fairly limited fashion, YM +1.0, XM +0.5 last. The uncertainty created by the latest local outbreak of COVID seemed to be much more of an issue in the RBA meeting minutes (released today) than it was in text and communique that immediately followed the August decision, with the Bank ultimately stressing that "the bond purchase program will continue to be reviewed in light of economic conditions and the health situation, and their implications for the expected progress towards full employment and the inflation target. The Board would be prepared to act in response to further bad news on the health front should that lead to a more significant setback for the economic recovery." Still, the minutes underscored the Bank's thought process that fiscal support would be timelier, although the optionality that the RBA has clearly defined will become more of a discussion point the longer the lockdowns in Australia last. Elsewhere, the detection of a COVID case in the Auckland community supported the NZ rates space and impacted pricing re: RBNZ tightening, which may have provided some incremental support for ACGBs.

FOREX: Kiwi Capitulates After Covid Case In Auckland Community Puts NZ On Alert

The kiwi tumbled after New Zealand health officials reported a positive Covid-19 case in Auckland community. The news came after it emerged that the Delta variant spread among people staying in a managed isolation facility after their doors were simultaneously opened for just a few seconds, although there is no known link between the two events as of yet. The impact of these headlines was amplified by the proximity of RBNZ monetary policy meeting, which had been widely expected to mark the beginning of the tightening cycle. The OIS strip now prices 19bp worth of tightening come the end of tomorrow's meeting, which puts implied odds of a full 25bp hike at 76%.

- NZD/USD tanked to its lowest point since Aug 2 amid panic selling of the Kiwi dollar, while NZD/USD overnight implied volatility surged to 19.44%, its highest level since March 17. AUD/NZD surged off multi-month lows in tandem with an aggressive bounce in Australia/New Zealand 2-Year swap spread.

- The Antipodean cross advanced even as AUD went offered in reaction to the minutes from the RBA's latest monetary policy meeting, which noted that the Board "considered the case for delaying the tapering of bond purchases to A$4bn a week currently scheduled for September 2021". The post-minutes downswing in AUD/USD was boosted by a technical break of $0.7316, which represents the low print of Aug 10. AUD was the second-worst G10 performer.

- Participants retreated into safe havens as Covid-19 angst and China's continued regulatory crackdown soured risk appetite.

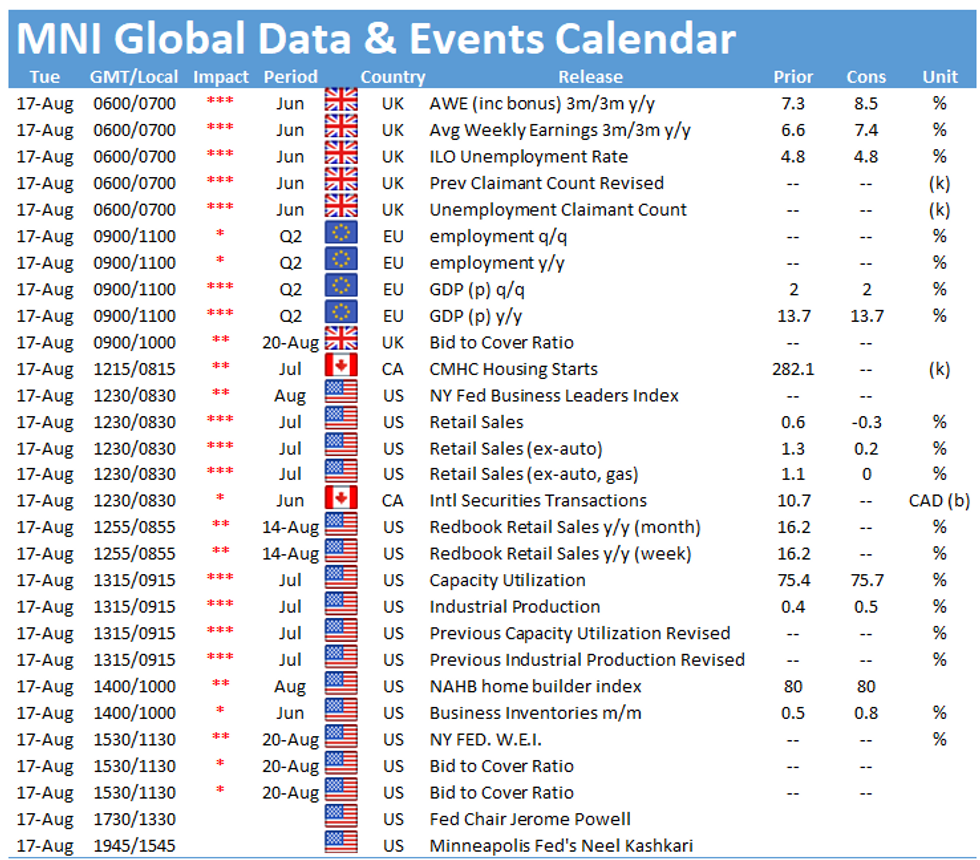

- Looking ahead, comments from Fed's Powell & Kashkari will grab attention today, while the data docket features U.S. retail sales & industrial output, UK jobs data and flash EZ GDP.

FOREX OPTIONS: Expiries for Aug17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1775(E556mln), $1.1815-25(E1.6bln), $1.1850-55(E900mln)

- USD/JPY: Y109.05-10($586mln), Y110.00($723mln)

- GBP/USD: $1.3810-25(Gbp535mln)

- AUD/USD: $0.7200(A$800mln), $0.7325-30(A$1.1bln), $0.7450(A$546mln)

- NZD/USD: $0.7050(N$597mln), $0.7080(N$593mln)

- USD/CNY: Cny6.4900($1.1bln)

ASIA FX: Won Knocked Down On Return From Holidays

The won tanked in a delayed reaction to yesterday's flight to safety, as trading resumed in South Korea after a local holiday. Concerns over the continued spread of the Delta coronavirus variant in Asia continued to linger.

- CNH: Offshore yuan lost some ground as China continued its regulatory crackdown, while an in-line PBOC fix provided little in the way of fresh impetus.

- KRW: The won was easily the worst performer in the Asia EM basket, with spot USD/KRW surging past key resistance from Sep 28, 2020 high of KRW1,174.80. The move occurred as onshore South Korean markets reopened after a long weekend, digesting the pent-up risk-off impulse.

- THB: The baht traded on a slightly softer footing amid lingering concern over yesterday's decision by Thailand's chief economic planning agency to cut 2021 growth outlook.

- MYR: Spot USD/MYR edged higher but respected a narrow range. Political uncertainty is elevated after PM Muhyiddin's resignation opened a period of horse trading before his successor gets picked. The King invited several party leaders to the Royal Palace today.

- PHP: Spot USD/PHP pulled back from its 15-month high as BSP Governor Diokno's comments for BBG grabbed attention. The official reiterated that RRR cuts are off the table now and suggested that the Philippines could still meet the 2021 growth target of +6%-7% Y/Y.

- SGD: SGD softened at the margin, even as Singapore's non-oil domestic exports beat expectations.

- TWD: Spot USD/TWD traded sideways. Taiwan's Premier said that the island would not collapse like Afghanistan if attacked by a "foreign force".

- Indonesian markets were closed in observance of the Independence Day.

EQUITIES: E-Minis A Touch Lower After S&P 500 Hits Record, Asia Mixed

Chinese & Hong Kong equity indices moved lower, with the driving force coming in the form of China's market regulator issuing draft rules aimed at stopping unfair competition in the internet space. The rules within the draft, published by the State Administration for Market Regulation (SAMR), were seemingly focused on a relatively wide variety of areas, from prohibiting the way that firms can use the data that they collect, all the way out to the removal of fake product reviews.

- U.S. e-mini futures have been biased a little lower vs. settlement levels after the S&P 500 registered fresh all-time highs on Monday (with the index doubling from its COVID-19 induced '20 low). Broader macro headline flow has been lacking since the NY closing bell, with the familiar themes of the geopolitical situation in the Middle East and broader COVID developments eyed.

GOLD: Holding Pattern After Last Week’s Sell Off & Recovery

Gold has stabilised over the last 24 hours or so, with little in the way of fresh macro impulses to drive the space since the early part of Monday's session. That leaves spot little changed during Asia-Pac hours, just shy of the $1,790/oz mark. Familiar technical boundaries remain in play.

OIL: Little Changed After Recovering From Lows On Monday

WTI & Brent have stuck to confined ranges during Asia-Pac hours and are virtually unchanged at typing. This comes after the crude oil benchmarks bounced from their intraday lows alongside equities on Monday, but still settled over $1.00 below Friday's levels. Monday's recovery from lows was further aided by RTRS sources reports suggesting that "OPEC and its allies, including Russia, believe oil markets do not need more oil than they plan to release in the coming months, despite U.S. pressure to add supplies to check an oil price rise." More broadly, COVID worries in China and general headwinds for the reflation/re-opening narratives are limiting the upside for crude at present.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.