-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: ACGBs Firm Ahead Of Bond Redemptions, Equities Recover

- Aussie bonds catch a light bid with A$26bn in ACGB May '21 due to mature on Saturday

- E-minis & Asia-Pac equity benchmarks move higher, remain in recovery mode

- G10 FX pairs are rangebound, set for a calm end to the week in Asia

BOND SUMMARY: Reinvestment Flows Support ACGBs, JGBs Gain Despite Firmer Equities

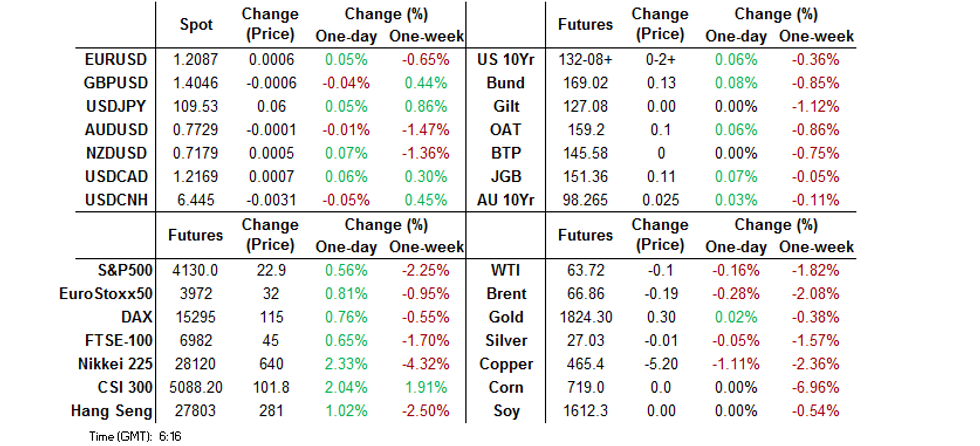

Limited news and data flow translated kept T-Notes rangebound overnight. The contract inched higher at some point, but was capped by Thursday's high of 132-10. It last changes hands +0-02+ at 132-08+, just above the mid-point of the Asia-Pac session's range. Cash curve flattened at the margin, with yields last seen +0.2bp to -1.2bp, even as e-minis remain elevated. Eurodollar futures trade unch. to +1.0 tick through the reds. Going forward, focus in the U.S. turns to retail sales, industrial output, U. of Mich. Survey & comments form Fed's Kaplan.

- JGB futures jumped at the re-open and remained afloat thereafter, even as local equity benchmarks registered healthy gains. The contract trades at 151.36, 11 ticks above last settlement & hitting session highs. Cash JGB yields sit lower, curve runs a tad flatter with 40s outperforming. The BoJ offered to buy 1-10 Year JGBs, leaving purchase sizes unch. across all baskets. Breakdown data revealed downticks in offer/cover ratios in today's Rinban ops. Japan's Covid-19 response czar said that the island of Hokkaido as well as Hiroshima and Okayama prefectures will be added to the declaration of Covid-19 emergency through the end of the month. PM Suga holds a presser on the matter at 8pm JST.

- ACGB space likely drew some support from reinvestment flows, ahead of Saturday's redemption of A$26bn in ACGB May '21. Cash ACGB curve bull flattened, albeit 10-year yield rose the most and last sits at 1.784%. YM trades +0.5, with XM +2.5 at typing, after sticking to tight ranges in Sydney trade. Bills last seen -1 to +1 tick through the reds. The AOFM auctioned A$1.0bn of ACGB 21 Apr '26 and bid/cover ratio fell to 3.96x from 5.92x, although the previous auction of the bond was held in Jun 2020. The space looked through the issuance slate for next week.

FOREX: Yen Under Light Pressure In Pre-Weekend Trade

Markets cruised towards the weekend, with lacklustre headline and data flow providing little in the way of meaningful catalysts. The yen lagged the G10 pack as e-minis and regional equity benchmarks ground higher. USD/JPY clawed back most of Thursday's losses as a result.

- The likes of GBP, CAD & AUD struggled for any impetus, while CHF & the Scandies fared relatively well in a largely directionless trade. Tight ranges were respected.

- The PBOC set the central USD/CNY mid-point at CNY6.4525, 7 pips above sell-side estimates. A third marginally weaker than expected fixing in a row suggests that China's central bank is satisfied with the redback's trajectory, after Monday & Tuesday saw considerably wider fix-vs-estimate spreads.

- Today's data docket is rather U.S.-centric, with retail sales, industrial output & U. of Mich. Sentiment due. Central bank speaker slate features Fed's Kaplan, while the ECB will release the account of its latest MonPol meeting.

FOREX OPTIONS: Expiries for May14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E715mln)

- USD/JPY: Y109.45-50($975mln), Y110.00($680mln)

- GBP/USD: $1.3990-05(Gbp539mln)

- AUD/USD: $0.7750(A$981mln)

- USD/CAD: C$1.2125-40($555mln), C$1.2280-85(C$575mln)

ASIA FX: Most Asia EM FX See Small Gains As Risk Sentiment Rebounds

The greenback gave up early gains, but stayed within yesterday's range. Positive risk sentiment supported most Asia EM FX, though coronavirus concerns were a drag for some.

- CNH: Offshore yuan is stronger, retracing earlier declines after the PBOC set a fix above sell-side estimates for the sixth straight day. The cumulative miss in this period is 133 pips.

- SGD: Singapore dollar is weaker, the number of virus cases in Singapore has risen to a 10-month high. Officials have closed Changi Airport terminals and a linked shopping mall to the public for two weeks.

- TWD: Taiwan dollar has risen, retracing some this week's decline. After plunging a total of 9.5% in the first four trading sessions of this week the Taiex is up 1.5%.

- KRW: The won is weaker, on track for a fourth decline. South Korea reported 747 daily new coronavirus cases, above 700 for the second day.

- PHP: Peso is weaker. The gov't took the initiative after an underwhelming Q1 GDP report and said that mobility curbs in the NCR+ bubble will be eased. The region will be moved to "General Community Quarantine," the second-lowest level of restrictions, until the end of the month. The Presidential Palace clarified that some of the heightened restrictions will remain in place, despite lowering the overall level of curbs.

- THB: Baht has risen. Gov't spokesman said that the parliament will debate a THB3.1tn budget outlay from May 31 to Jun 2. The budget is expected to receive royal endorsement and become law by Sep.

ASIA RATES: Auctions In Focus

Futures rise in South Korea and China even as equity markets rise, focus in India falls on today's auction.

- INDIA: Yields higher in early trade with some flattening seen. Markets will digest industrial production and CPI data released late on Wednesday before a holiday yesterday. The near term outlook remains clouded by the current surge in COVID-19 cases and lockdowns in several states. Bloomberg estimates that around 60% of the country's GDP is in full lockdown with much of the remaining in partial lockdown. Wholesale price inflation is due later in the session while bond traders will focus on the results of the INR 260bn bond auction today.

- SOUTH KOREA: Futures in South Korea are higher in sympathy with the US tsy move yesterday. Data earlier showed South Korea's export price index rose 10.6% in April from 5.9% in March, the import price index rose 15.0% from 9.0% in March. The MOF sold KRW 400bn of 50-year bonds, a 13bps yield concession and reduced auction size helped support demand.

- CHINA: Futures higher but off best levels, the PBOC has said it can use tools other than monetary policy to moderate commodity prices after another jump in PPI earlier this week. The PBOC matched maturities with injections today, repo rates have declined; overnight repo rate down 1bp at 1.7893%, the seven-day repo rate is down 6.15bps at 1.9962%. Elsewhere corporate bond spreads have tightened after Huarong asserted its preparedness for upcoming bond repayments and said support from the Chinese government remains in place. The comments are intended to assuage concerns after media reports that regulators were concerned over the restructuring plan.

EQUITIES: Recovering After Sell Off

Most markets in the Asia time zone, recovering after heavy selling earlier this week as US stocks provided a positive lead. Gains are robust across bourses, but China leads the way higher with gains of over 2% on the CSI 300. Markets in Japan are seeing robust gains, up around 1.8% despite reports of a state of emergency in Hokkaido and Hiroshima. After plunging a total of 9.5% in the first four trading sessions of this week the Taiex is up 1.5%. The ASX 200 has also seen gains of around 1% despite further heavy losses in iron ore. Futures in the US are higher, the Nasdaq leading the way with gains of around 0.7%.

GOLD: Retracing Some Of Yesterday's Gain

Gold has pulled ack after rising on Thursday, but is still holding on to a chunk of yesterday's gains. The yellow metal last trades at $1822.63/oz, down $4.09, but still above lows around $1810 yesterday. Gold declined earlier in the week as the greenback firmed following above expectations CPI report, since then Fed speakers have posited that price pressures are expected to be transitory, Fed's Bullard said yesterday that it's a judgement call on whether inflation is transitory, a departure from previous Fed comments.

OIL: Crude Futures Headed For Weekly Loss

Oil is modestly lower in Asia on Friday, but is still within yesterday's range after plunging on Thursday and seeing a small bounce into the close. WTI is own $0.18 from settlement levels at $63.64/bbl, while Brent is down $0.25 at $66.80. The benchmarks are on track for a weekly decline of almost 2%, which would be the worst week since early April. The fall this week comes despite a positive assessment of demand from the IEA with markets focusing on elevated inflation globally and the possibility of policy tightening, while also considering a surge in coronavirus cases in many countries including India where new cases are still at over 300k per day. As reported yesterday the Colonial Pipeline is back online but it is expected to take a few days for supply to return to normal, the Biden administration allowed a foreign tanker to transport gasoline to a Valero Energy refinery to allow it to keep operating. Other waivers are being considered.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.