-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Aussie Bonds Pressured, RBNZ Remit Tweaked

- Aussie bond sell off deepens on confluence of factors, even as RBA steps in to enforce 3-Year ACGB yield target.

- RBNZ remit tweaked to include considerations surrounding housing markets.

- Fed Vice Chair Clarida reiterates status quo.

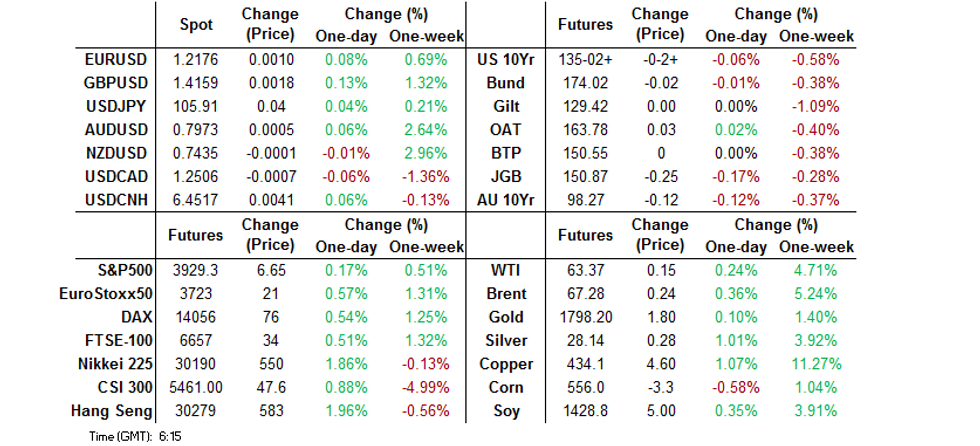

BOND SUMMARY: Aussie Bond Weakness Drives Broader Core FI In Asia

U.S. Tsys have largely been driven by the weakness in Aussie bonds during Asia-Pac hours, with little to go off on the broader macro headline flow front. 30s sit ~3.5bp cheaper on the day as the cash Tsy curve bear steepens. T-Notes last -0-02+ at 135-02+, 0-04+ off the lows after Aussie bonds regained some poise. Eurodollar futures run unchanged to 1.5 tick lower through the reds, with sizeable 2-way flow in EDM2 (at the same price, ~40K given, ~30K lifted) noted during Asia-Pac hours. Looking to Thursday, weekly jobless claims data, preliminary durable goods readings, 7-Year supply and Fedspeak from Williams, Quarles, Bostic, Bullard & George headline locally.

- While there was little in the way of headline flow to wet the whistle for JGB traders, the broader weakness witnessed in core FI markets dragged the space lower. Futures went out -25, just off worst levels of the day, with weakness evident into the close. Cash JGB trade saw some bear steepening, with 10-Year yields now at 0.140%. The JSCC/LCH spreads hold signs of foreign payers driving the moves in longer dated swaps. The BoJ left the size of its 1-10 Year Rinban operations as they were, with mixed offer/cover ratios, although the ratios didn't provide anything in the way of meaningful swings the uptick in the 3-5 Year metric may have applied some pressure during the afternoon. Tokyo CPI, the labour market report, retail sales and preliminary industrial production data headline the local docket on Friday. 2-Year JGB supply is also due.

- Aussie bond futures stabilised off of lows, with YM going out -4.0 and XM -12.0. There seemed to be several factors that intertwined to drive the latest leg of weakness during Sydney trade: The market being disappointed with the size of RBA purchases employed to enforce the Bank's 3-Year ACGB yield target (A$3.0bn today), stronger than expected local CapEx data & trans-Tasman impetus after the tweak to the RBNZ's remit, with the Bank now set to consider "the impact on housing when making monetary and financial policy decisions." Some also pointed to cross market AUD longs/received positions being washed out. AUD 1-Year/1-Year swap rates briefly printed through recent highs during the aforementioned vol., before easing back from best levels of the day. Private sector credit data and the weekly AOFM issuance slate headline tomorrow's local docket.

FOREX: Tight Asia Session, Kiwi Loses Shine After Jumping On RBNZ Remit Tweak

The Asia-Pac session didn't see much volatility, but saw NZD lose some ground after rallying in the U.S./Asia crossover. The upswing was a reaction to NZ FinMin's decision to double down on efforts to reign in house price inflation and amend the RBNZ's remit, forcing the MPC to consider "the impact on housing when making monetary and financial policy decisions." As regional players came in, the kiwi started the Asia-Pac session on a marginally firmer footing before faltering later in the day. Worth flagging that NZ$1.1bn of NZD/USD options with strikes at $0.7400 expire at today's NY cut, with the spot trading flat at $0.7434 as we type.

- JPY struggled from the off and Gotobi day flows may have played some role in the absence of market-moving headlines. USD/JPY accelerated gains into the Tokyo fix, but eased off after having a brief look above Wednesday's high.

- GBP outperformed at the margin, likely drawing continued support from familiar positives surrounding the UK's Covid-19 situation.

- The PBOC fixed its USD/CNY mid-point at CNY6.4522, broadly in line with sell side estimates.

- On the radar today: U.S. initial jobless claims, second GDP reading, flash durable goods, EZ & Italian confidence gauges as well as central bank speak from Fed's Williams, Quarles, Bullard, George & Bostic and ECB's de Guindos, Lane & de Cos.

FOREX OPTIONS: Expiries for Feb25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E863mln), $1.2095-1.2115(E906mln), $1.2130-50(E1.3bln)

- USD/JPY: Y104.25-30($775mln), Y105.00($623mln), Y105.40-50($551mln), Y106.65-80($718mln)

- EUR/GBP: Gbp0.8600(E891mln-EUR puts)

- AUD/USD: $0.7910(A$1.3bln), $0.7950(A$503mln)

- NZD/USD: $0.7400(N$1.1bln)

- USD/CAD: C$1.2624-25($1.0bln), C$1.2750-60($1.0bln)

- USD/CNY: Cny6.4685-00($575mln), Cny6.7295($1.25bln)

- USD/TRY: Try7.00($955mln-USD puts), 7.10($1.5bln-USD puts), Try7.25($1.0bln-USD puts)

- USD/MXN: Mxn20.00($522mln)

ASIA FX: Gains For Most

A risk on session saw most Asia FX gain, DXY dropped further after dovish testimony from Fed Chair Powell.

- CNH: Yuan is weaker, flows back into Hong Kong stocks are cited after a sharp sell off in Hong Kong stocks yesterday saw CNH gain.

- SGD: Singapore dollar is higher, USD/SGD dropped through 1.32 and has struggled to retake the level.

- TWD: Taiwan dollar is higher, earlier Moody's affirmed Taiwan's rating and upgraded its outlook to positive from stable.

- KRW: The won is stronger, but off best levels. The BoK kept rate on hold at 0.50% as expected and kept growth forecasts unchanged, but upgraded inflation estimates.

- INR: The rupee is slightly lower, USD/INR forwards rose after the RBI exempted some exposure to foreign sovereigns from Large Exposures Framework (LEF).

- IDR: Spot USD/IDR trades near neutral levels, last at IDR14,093, holding above the 50-DMA which gave way towards the back end of last week. S&P commented yesterday that BI's decision to ease lending rules is unlikely to boost loan growth as lenders are battling rising NPLs and collectability issues.

- MYR: Ringgitt is higher, it was reported Malaysia expects to get vaccines from Covax facility from March. Markets shrugged off data yesterday that showed Malaysian deflation decelerated more than expected in January.

- PHP: Markets in the Philippines were closed for a local holiday.

- THB: Baht is slightly stronger, but has moved in a narrow range ahead of a raft of data due later today. Market will digest trade balance, current account balance and foreign reserves.

ASIA RATES: Keep Your Eyes On The Ops

Central bank operations continue to exert influence over bond markets in the region with dovish Powell testimony and higher US yields obfuscating price action somewhat.

- CHINA: The PBOC matched injections with maturities today, this follows a net CNY 20bn injection so far this week. The overnight repo rate is higher at 1.7012% up around 47bps, while the 7-day repo rate is steady at 2.2096%. The cash curve has seen some bear flattening as equity markets in mainland China rebound from previous declines.

- SOUTH KOREA: 10-year bond futures initially hit lows as comments on the bond market were conspicuous in their absence at BoK Governor Lee's press conference. Futures came off lows when Lee said the central bank could release government bond buying plan in advance if needed, he caveated this by saying any measures undertaken would not be the same as QE in other nations.

- INDIA: Indian bonds were supported ahead of the RBI's operation twist which will take place today, the INR 100bn operation will see the RBI purchase INR 100bn of long end bonds and sell INR 100bn of short dated bonds. The bank has announced an INR 150bn operation twist on March 4. Market looks ahead to supply tomorrow as well as GDP data.

- INDONESIA: Cash yields are sharply higher, bear flattening seen, the sell off comes after two days of heavy buying after the government said it could reduce debt sales.

EQUITIES: Rebound

Asia-Pac equity markets are in the green today, taking cues from the US after markets staged an impressive rebound from pressure at the open. Chipmakers on several Asian bourses gained after US President Biden said would address a shortage in components have caused stoppages at some auto plants. The Hang Seng has reversed yesterday's losses after the announcement of a 0.03ppt hike in stamp duty to 0.13%.

- Futures in Europe and the US are higher, buoyed by testimony from Fed Chair Powell yesterday that the Fed would remain accommodative for some time with the economy still a long wat from employment and inflation targets.

GOLD: Range Respected

The yellow metal is a little softer over the last 24 hours or so, albeit back from Wednesday's cheaps, last trading just shy of $1,800/oz, with the well-defined technical boundaries remaining in play. The DXY is back from the highest levels witnessed over that time period, while U.S. real yields hold higher. ETF holdings of gold continue to edge away from all-time highs, but remain elevated from a historical standpoint.

OIL: Oil Gains Even As Stocks Build

Crude futures have managed to squeeze out some small gains, but seem reluctant to go higher and have moved in tight ranges for the majority of the Asia-Pac session. WTI & Brent sit ~$0.15 higher vs. settlement.

- Inventory data from the US DOE released yesterday showed headline crude stocks increased 1.28m bbls. The build came contrary to analysts' expectations of a 4.8m bbl draw, and was attributable to power outages and extreme low temperatures in southern US, which shut up to 4.4m bpd of refinery capacity at its peak. The data also showed a 10,000 bbl increase in US gasoline inventories, with a sharp reduction in refinery production countered by a reduction in demand. Implied gasoline demand registered a 1.2m bbls barrel fall -- the biggest such decline since early April 2020. The market largely shrugged off the bearish elements and continued to focus on oil's robust demand outlook amid declining COVID-19 infection numbers. European stockpiles have fallen though as global markets look elsewhere for supply, Genscape ARA crude stocks fell to the lowest since September.

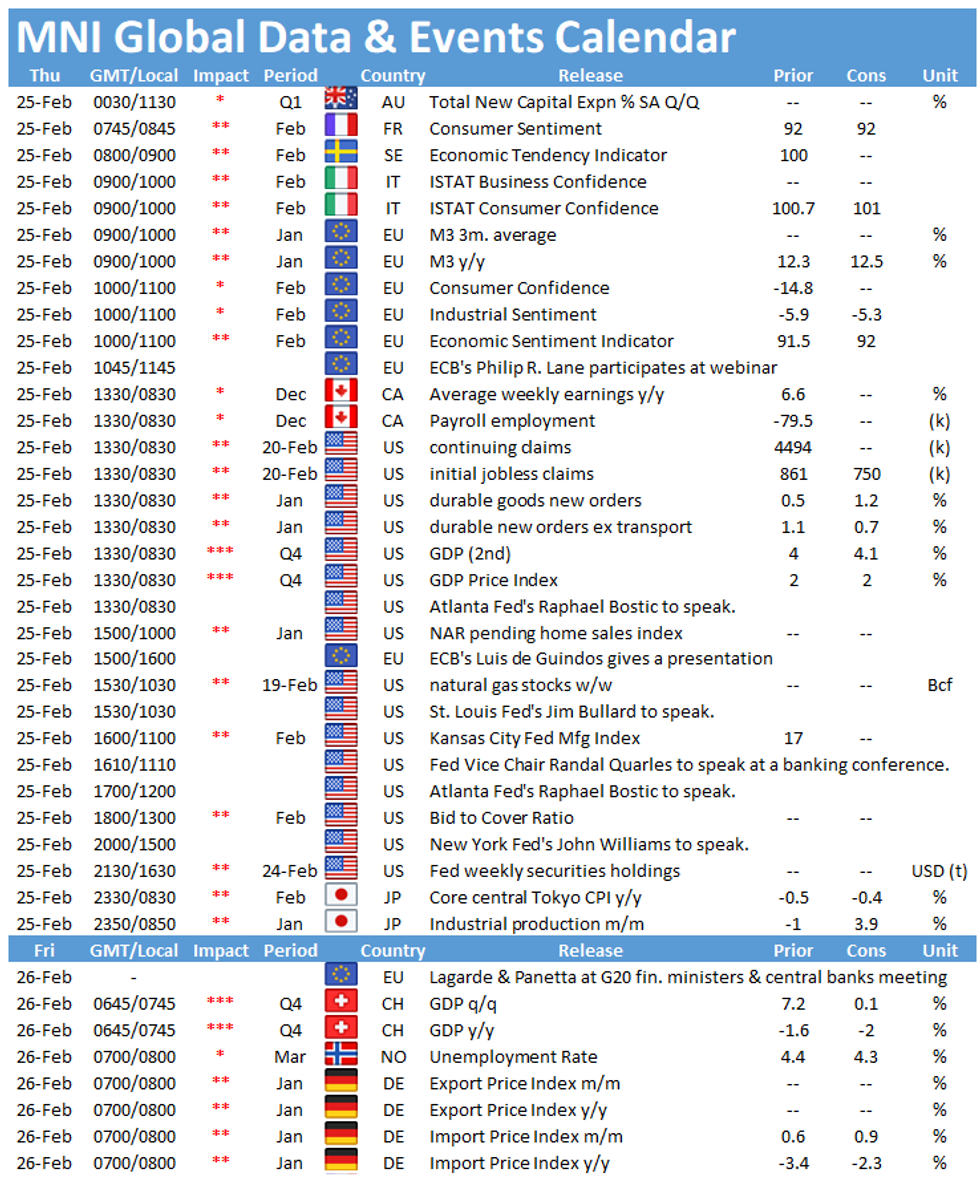

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.