-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Awaiting The Next Input After Monday's Shot

- Macro headline flow was light in Asia-Pac hours, with continued focus on President Trump's actions, while discussions surrounding the recent round of Chinese bond defaults remain evident.

- The latest Brexit headlines pointed to a deal next week, although Monday's headline flow on the matter was little more balanced on net.

- Core markets were happy to consolidate within recent ranges awaiting the next macro input.

BOND SUMMARY: ACGB Syndi Tap Weighs

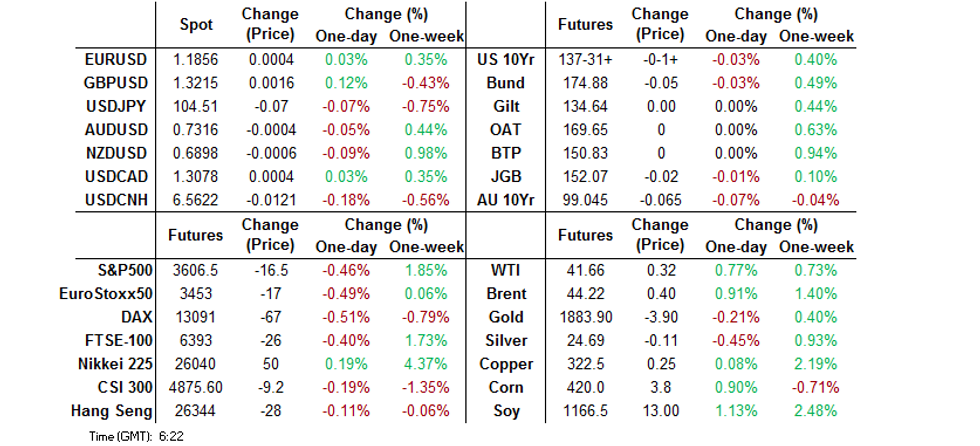

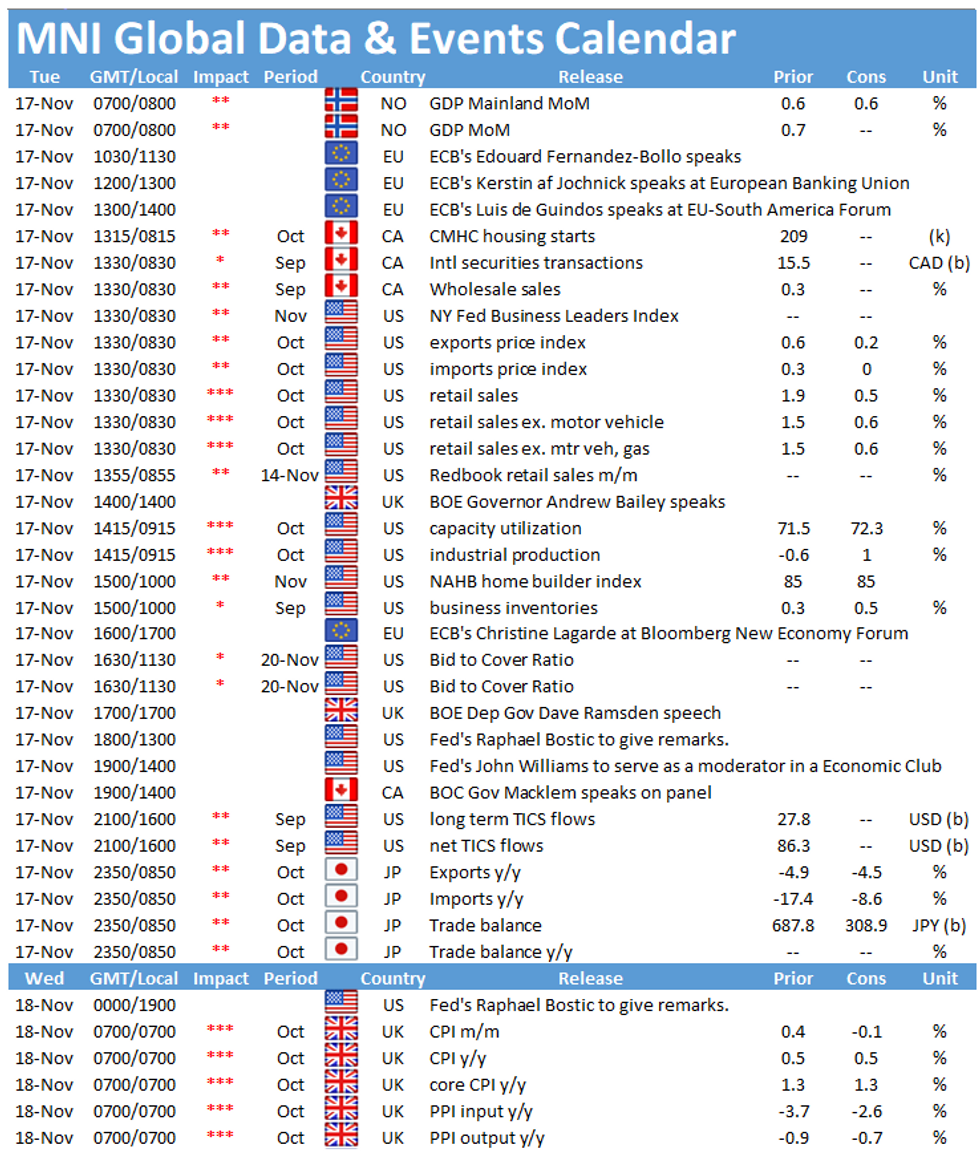

T-Notes trade -0-01+ at 137-31+ last, with the contract operating within a 0-05+ range in Asia-Pac hours. The cash curve has seen some light twist steepening on the ACGB pricing in Australia, while Saudi Aramco has started marketing a $ 5-part round of issuance. This comes after light bull flattening was seen on the relatively limited downtick in e-minis during early Asia dealing, with some focus also falling on a New York Times piece which noted that "President Trump asked senior advisers in an Oval Office meeting on Thursday whether he had options to take action against Iran's main nuclear site in the coming weeks." A reminder that the Moderna COVID vaccine trial news (which was flagged during Monday's Asia-Pac session) bettered last week's offering from Pfizer, resulting in further risk-on price action during Monday's early NY hours, although moves faded from extremes. T-Notes went out around mid-range, with the curve twist steepening. Fedspeak from Chair Powell & Barkin, as well as retail sales and industrial production data provide the local highlights on Tuesday.

- A tight Tokyo session for the JGB space, with little on the news flow front, outside of local reports that residents of Sapporo have been asked to stay at home and avoid going out as much as possible owing to the local COVID dynamic. Futures held a tight range, dealing either side of unchanged. Cash JGBs were generally richer at the margin, with some light underperformance for 5s and 10s. BoJ Rinban ops covering 1-10 Year paper saw purchase sizes left unchanged, with the following offer/cover ratios: 1-3 Year: 2.29x (prev. 2.62x), 3-5 Year: 2.85x (prev. 2.47x), 5-10 Year: 3.11x (prev. 2.34x). The uptick in the 5-10 Year bucket's cover ratio may have applied modest pressure to that zone of the curve in the Tokyo afternoon.

- The pricing of the A$6.0bn syndicated tap of ACGB May '41 in Australia applied some pressure to both U.S. Tsys and Aussie paper during Asia-Pac hours, with little in the way of broader macro headline flow evident. This left the Aussie futures curve steeper on the day, with YM -1.0 and XM -6.5 come the bell, after the latter moved through its SYCOM lows in late Sydney dealing. Cash trade saw underperformance for the 10-15 Year sector. There was little of note in the latest ABS payrolls data/minutes from the RBA's most recent monetary policy decision.

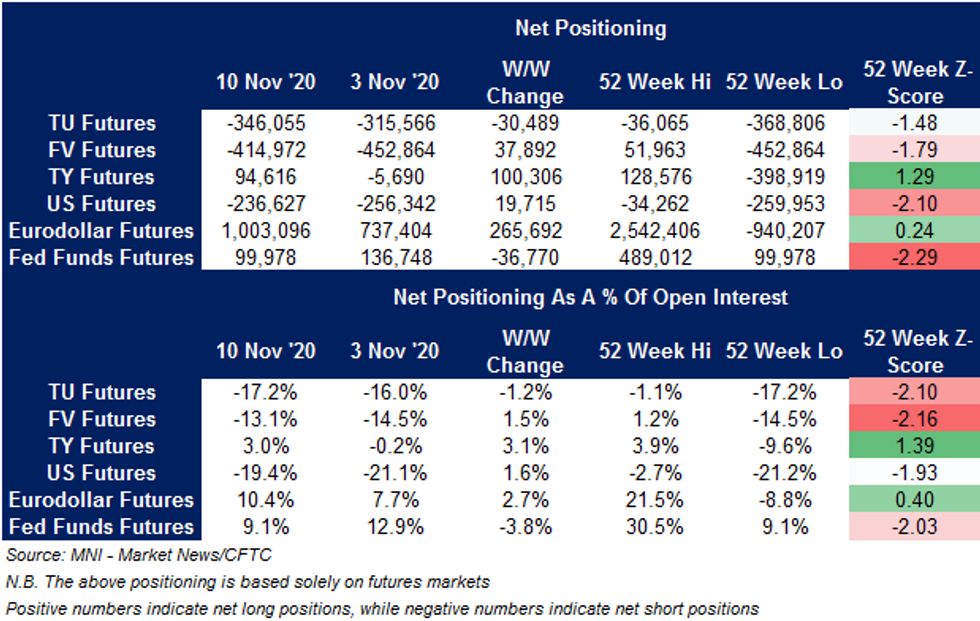

US TSYS: TY & Eurodollar Positions See Largest swings In CFTC COT

The latest weekly CFTC COT report revealed a chunky swing in TY futures positioning, which saw net longs established in cumulative terms.

- There was also a notable net lengthening of Eurodollar positions.

FOREX: GBP Strengthens Amid Brexit Optimism, USD/Asia Catch Up With Vaccine News

Sterling eked out gains in Asia after the Sun reported without attribution that the UK and EU may be close to a breakthrough in their Brexit talks. The article noted that the UK's chief Brexit envoy Frost told PM Johnson to expect a deal next week, possibly as soon as next Tuesday, although the negotiations may still collapse over familiar sticking points. Cable popped higher in reaction to the story, but failed to test yesterday's highs, waiting for London traders to get in.

- Other than that, price action across G10 FX space was muted amid sparse headline/data flow. JPY held up well, while NOK brought up the rear. NZD posted a short-lived downtick as NZ Trade Min O'Connor said that a strong exchange rate is "always a concern". USD struggled for any topside impetus and the DXY tested yesterday's trough.

- USD/Asia generally traded on a softer footing as regional currencies reacted to encouraging results of Moderna's latest Covid-19 vaccine trial. USD/CNH slipped, narrowing in on its recent cycle lows. Losses in USD/KRW were limited by South Korea's recent messaging re: readiness to take stabilising measures.

- Focus turns to U.S. retail sales & industrial output, Canadian housing starts, Norwegian GDP & consumer confidence and comments from RBA's Debelle, BoE's Bailey & Ramsden, ECB's Lagarde, BoC's Macklem and Fed's Powell & Barkin.

FOREX OPTIONS: Expiries for Nov17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-20(E1.4bln), $1.1830(E1.0bln),

- $1.1850(E2.1bln-EUR calls), $1.1895-1.1905(E1.3bln)

- USD/JPY: Y104.00-09($516mln), Y105.00($636mln)

- EUR/GBP: Gbp0.8900(E923mln), Gbp0.9050(E804mln)

- AUD/JPY: Y76.05(A$552mln), Y76.25(A$604mln)

GOLD: Well Defined Technical Lines Remain Untouched

Gyrations in the yellow metal continue to be driven by a combination of the broader USD and U.S. real yield dynamics, with Monday's sharp pullback retracing. Bulls still need to force a break above the psychological $1,900/oz level, with spot last dealing little changed around the $1,890/oz mark. The key technical lines in the sand are much further away and remain untouched.

OIL: Edging Higher After Monday's Rally

WTI & Brent have added $0.30-0.40 since settlement, sticking to tight ranges in Asia-Pac hours.

- This comes after the benchmarks benefitted from the broader boost for risk appetite on Monday, which stemmed from the developments surrounding Moderna's COVID-19 vaccine trial. Both metrics added over $1.00 come Monday's settlement, after futures eased back from best levels as we moved through NY trade.

- Back to crude-specific matters, the OPEC+ JMMC is set to convene today. A reminder that the gathering comes after source reports pointed to the OPEC+ JTC coming to a consensus of recommending a 3-6 month extension of current oil supply cuts from participating nations (a reminder that OPEC+ production is currently set to ramp up in January).

- The latest round of weekly API inventory estimates will hit after hours on Tuesday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.