-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Tsy Curve Steeper Ahead of Busy Day

MNI US OPEN - Lawmakers Move to Impeach South Korea President

MNI China Daily Summary: Wednesday, Dec 4

MNI EUROPEAN MARKETS ANALYSIS: Bonds Grind Higher In Asia

- Core FI extend gains overnight amid relatively thin news and data flow

- GBP lags G10 peers as more European countries halt vaccinations with AstraZeneca

- RBA says it is unlikely to meet its inflation target before 2024 based on current wage growth

BOND SUMMARY: Tsys Firm Ahead Of FOMC, ACGBs Shrug Off RBA Minutes

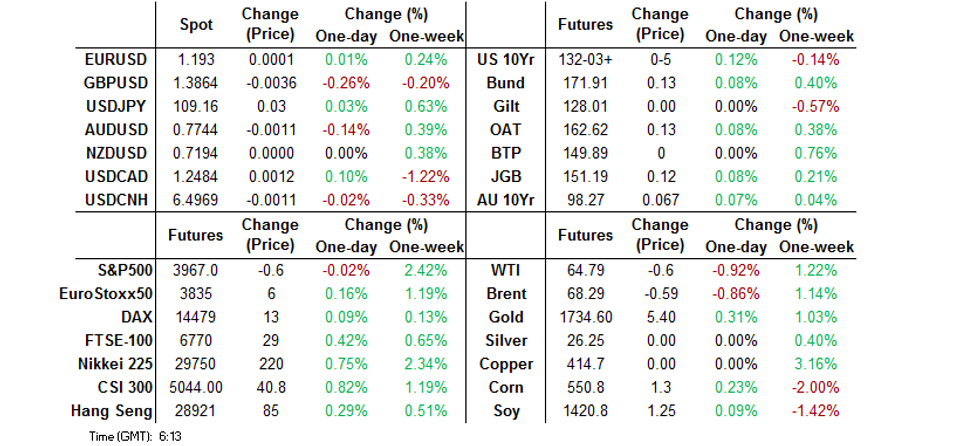

T-Notes extended yesterday's gains and trade +0-05 at 132-03+ as we type, amid little in the way of headline flow to drive the move. Cash curve bull flattened, though the 7-10 sector outperformed, while 10-year Tsy yield pulled back under 1.600%. Eurodollar futures run -0.5 to +1.0 tick through the reds. U.S. highlights today include industrial output & retail sales data, as well as 20-Year Tsy supply. The Fed is in its blackout period, with all eyes on Wednesday's MonPol decision.

- JGB futures took their cue from T-Notes and crept higher, printing best levels in a week. The contract sits at 151.16, 9 ticks above last settlement. Cash JGB yields trade lower across a slightly flatter curve. Final industrial output figures reported by Japan were revised marginally higher. The MoF conducted a liquidity enhancement auction for off-the-run 5-15.5 Year JGBs, with bid/cover ratio easing to 3.664x from 5.060x seen at the prev. auction. MoF off'ls revealed that there is Y3.8tn left in Japan's Covid-19 reserve fund, while FinMin Aso said that the cabinet has approved cash handouts for low income families. Aso added that the decision on U.S. beef imports has not been taken yet, after local media flagged an imminent tariff hike.

- Aussie bond futures firmed, YM last sits +3.5 & XM +9.4 ticks, in close proximity to session highs. Cash ACGB curve flattened, yields trade +0.1bp to -10.1bp at typing. Bills trade unch. to +3 ticks through the reds. The space showed little reaction to the latest RBA MonPol meeting minutes and local data, which included a beat in Q4 house price index & slight deterioration in the ANZ/Roy Morgan weekly consumer confidence gauge. Following the release of the RBA minutes, CBA said they now see the RBA keeping its YCC policy in place until the maturity of the Apr '24 bonds (without switching to Nov '24), while Westpac confirmed their call that the RBA will extend the YCC to the Nov '24 bond.

FOREX: RBA Minutes Sap Some Strength From Aussie, Sterling Underperforms

Price action across G10 FX space was relatively subdued in the lead up to Wednesday's FOMC decision. AUD went offered, extending losses to fresh session lows after the minutes from the RBA's latest MonPol meeting noted that "wages growth would be unlikely to be consistent with the inflation target earlier than 2024" and warned against potential hiccups related to the imminent termination of the JobKeeper wage subsidy scheme.

- Sterling lagged behind as more EU nations suspended vaccinations with the AstraZeneca jabs, while Brussels launched legal action against the UK over alleged breach of the Brexit deal.

- USD/JPY struggled to advance towards the fresh cycle high printed on Monday, even as a "golden cross" formation materialised on the daily chart.

- The PBOC fixed its USD/CNY mid-point at CNY6.5029, just 3 pips below sell side estimates.

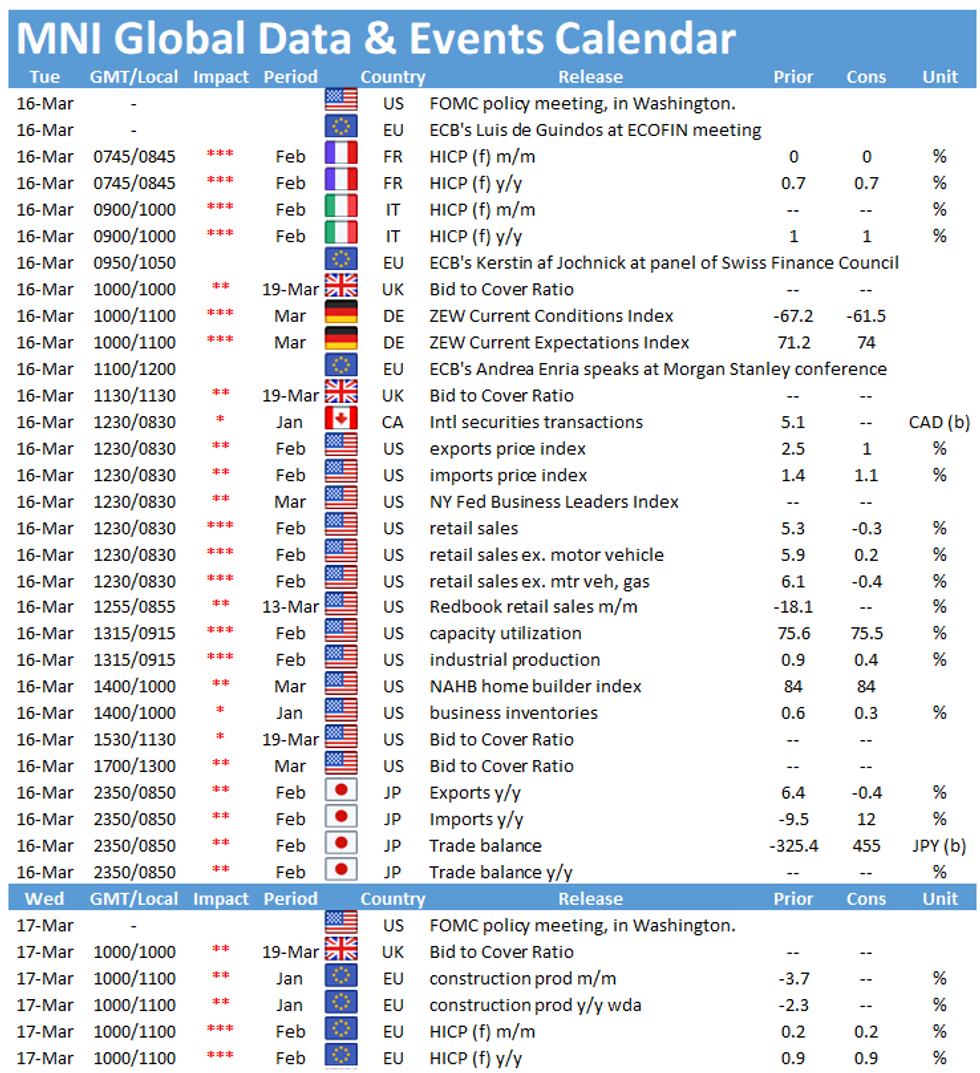

- Today's data docket features German ZEW Survey, final French & Italian CPIs as well as U.S. retail sales & industrial output. Riksbank's Ingves & Jansson take part in an open hearing, while ECB's Elderson holds a Q&A session.

FOREX OPTIONS: Expiries for Mar16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1885-1.1900(E1.1bln-EUR puts), $1.2050(E662mln), $1.2175(E652mln)

- USD/JPY: Y106.00($1.6bln), Y107.00($1.45bln), Y107.85-00($996mln), Y109.00-15($1.1bln-USD puts)

- GBP/USD: $1.3650(Gbp432mln), $1.3750(Gbp797mln-GBP puts)

- EUR/GBP: Gbp0.8545-50(E621mln)

- USD/CHF: Chf0.9220($720mln)

- AUD/USD: $0.7500(A$1.2bln), $0.7650(A$1.4bln), $0.7670(A$532mln), $0.7695-00(A$649mln), $0.7770(A$755mln), $0.7800-05(A$518mln), $0.7825-30(A$617mln)

- AUD/JPY: Y82.50(A$650mln)

- USD/CAD: C$1.2530-50($970mln), C$1.2800($1.15bln)

- USD/ZAR: Zar14.85($512mln-USD puts)

ASIA FX: Mixed As Greenback Holds Gains

The greenback held its gains while moving a narrow range ahead of the FOMC later this week, which saw some regional dynamics come into play.

- CNH: Offshore yuan is stronger. The PBOC fixed USD/CNY at 6.5029, 3 pips below sell side estimates. USD/CNH having a see-saw session, moving between minor gains and losses, last down 44 pips at 6.4935, having bounced off session lows at 6.4950, but is off session highs of 6.5040.

- SGD: Singapore dollar has strengthened, the jobless rate fell to 3.2% from 3.3% which has added fuel to the fire that the central bank may tighten later this year.

- TWD: Taiwan dollar is stronger, but USD/TWD still off yesterday's session lows around 28.12, and has weakened through the session.US President Biden will meet with Chinese counterparts later this week, one of the issues on the agenda is expected to be Taiwan. According to reports in Politico US officials are warning with increasing urgency that China could in the next few years invade Taiwan.

- KRW: The won strengthened through the session, the gain comes as new coronavirus cases drop. South Korea reported 382 daily new infections, in the 300s for the second day, as health authorities plan to unveil another set of restrictions in the greater Seoul area to sharply flatten the virus curve.

- INR: Rupee higher from the open, data yesterday showed the trade deficit narrowed more than expected. The trade deficit dropped to $12.62bn, the lowest since December thanks to a sharp drop in imports.

- IDR: Rupiah is flat, Bank Indonesia will deliver their MonPol decision on Thursday and virtually all analysts expect policymakers to leave the benchmark interest rate unchanged.

- MYR: Ringgit is weaker, Malaysia's daily count of new Covid-19 cases fell to the lowest level in three months on Monday, as the nation reported 1,208 infections. Health Min Adham Baba said that the statistic could fall to 500 by May if people comply with existing restrictions.

- PHP: Peso is marginally weaker, the Philippines has seen a fresh wave of Covid-19 infections, which prompted officials to reinstate some targeted restrictions.

- THB: Baht has strengthened, PM Prayuth has just received the first dose of the AstraZeneca Covid-19 vaccine in a launch of the vaccine rollout, after a local panel of experts said that the shot is safe.

ASIA RATES: Broad Bid

Bonds supported in general as US tsys extend yesterday's move higher.

- CHINA: The PBOC refrained from large OMO injections again, matching maturities for a seventh straight day, there has been no liquidity added to the system since Feb 25. Overnight repo rates have risen again in response, the overnight repo rate las up 38bps at 2.1401%, though lower then yesterday's high of 2.2634%. The 7-day repo rate briefly popped to 2.30%, but is last at 2.2212%. The higher repo rates have seen equities struggle. Futures are higher as equities slip, 10-year future up 0.155 at 96.85.

- INDONESIA: Yields mixed across the curve. Indonesia said to have received IDR 40tn bids at its IDR 30tn auction, after missing the target for the last three weeks. The recent greenshoe option by Indonesia suggests yields are nearing levels the market is comfortable with.

- SOUTH KOREA: Futures are higher, the move is on the back of reports that the Bank of Korea are considering purchasing government bonds above the KRW 5tn-KRW 7tn previously proposed. The bank will also reportedly reduce the size of the scheduled KRW 2.2tn 2-year auction tomorrow.

- INDIA: Yields lower across the curve in India, bonds advancing for a third day on expectations healthy advance-tax revenues could lead the RBI to reduce the amount of debt supply bought to market. Yields in the 10-year sector remain stubbornly high though, 10-year yield is down 0.6bps, while 7-year yields are down 4.3bps. Meanwhile, participants look ahead to state auctions later today, last week discount margins at auction fell.

EQUITIES: Tech Rallies

Equities are higher in Asia-Pac on Tuesday, having overcome an earlier mid-session drop. Chinese markets ventured into negative territory after the PBOC refrained from injecting liquidity for the seventh straight day, which saw repo rates jump and sapped equity markets. This negative sentiment spilled over into other Asia-Pac markets, before a rally in tech stocks helped markets regain footing. Markets in Australia are the biggest gainer today, led higher by a 3% rally in the tech sector. Futures in Europe and the US are mixed, the tech rally is supporting a move higher in Nasdaq futures, while e-mini Dow Jones has slipped around 0.125% at time of writing. Elsewhere, the VIX has returned to its pre-pandemic levels as equity markets in the US hover around record highs.

GOLD: Creeps Towards Resistance

The yellow metal is higher in Asia-Pac trade, creeping towards last week's high at $1,740 which also held earlier in March. Gold is on track for two straight days of gains with markets looking ahead to the FOMC meeting later this week, where markets appear to expect Fed Chair Powell to affirm the board's dovish stance. Also helping underpin gold is the prospect of higher taxes from the Biden administration, which historically sees shifts into bullion.

OIL: Slips For Third Day

Crude futures are lower in Asia, on track for a third day of loses. WTI is $0.50 lower than settlement at $64.89/bbl, Brent is down $0.54 at $68.34/bbl. A stronger greenback is hurting oil prices, as is over supply, which has seen WTI's front time spread drop to the deepest levels of contango since early January. Markets look ahead to API data later in the day for indications as to the extent of oversupply, with analysts estimating headline US crude stocks are around 6.5% above five-year averages.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.