-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Bullish Impetus For Equities Moving Into The Year Of The Ox

- DXY looks through Tuesday's low in Asia, with equities broadly bid into the LNY break.

- PBoC conducts a net drain of market liquidity given perceptions surrounding much lower than usual LNY physical cash demand.

- Comments from Fed Chair Powell & U.S. CPI eyed on Wednesday.

BOND SUMMARY: TY Put Blocks Headline Narrow Asia-Pac Session For Core FI

Wednesday's pre-Lunar New Year Asia-Pacific session was devoid of any meaningful macro headline flow, with focus on the PBoC's latest net drain via OMOs as we move into the LNY break (physical cash demand is expected to be much lower than the holiday norm in China, given the COVID related travel restrictions that are in place in the country at present).

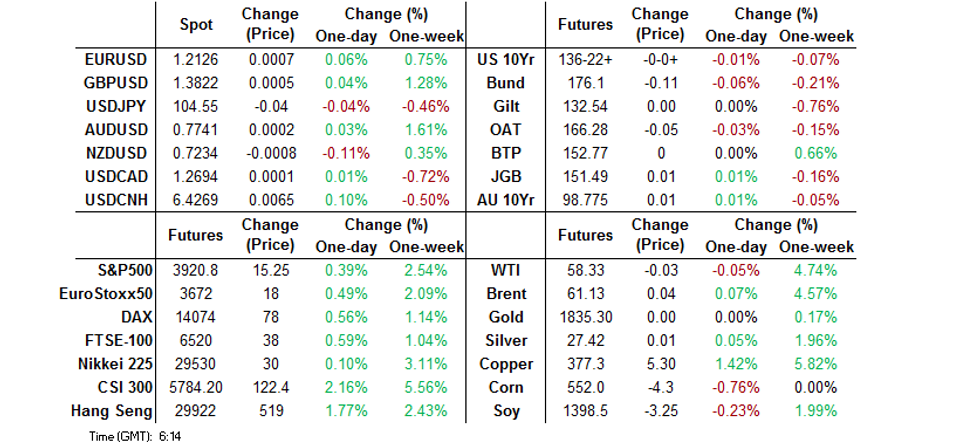

- That backdrop left T-Notes to operate within the confines of a 0-03 range, last -0-00+ at 136-22+, with cash Tsys little changed across the curve. The highlight came via a large TY options block, which initially looked like a 15.0K sale of the TYH1 136.25 puts & 30.0K sale of the TYH1 136.00 puts against buying 10.0K of the 3x1x2 TYJ1 134.50/133.50/133.00 put ladder. However, some have suggested that the block represented a 15.0K seller of the 1x2 TYH1 136.25/136.00 put spread against buying 10.0K of the TYJ1 134.50/133.50 put spread & 20.0K of the TYJ1 134.50/133.00 put spread. CPI and earnings data headline the local economic data docket on Wednesday. Elsewhere, 10-Year supply is on the slate, although it will be comments from Fed Chair Powell that garner the most attention.

- JGB futures added 1 tick on Wednesday, halting the longest stretch of daily losses since '03 in the process, with some swap spread widening and modest cheapening evident across most of the JGB curve, although the super-long end saw some incremental richening into the close, finishing a little firmer on the day. Local PPI data met broader market expectations, with the rate of the Y/Y decline slowing in January. Comments from BoJ's Nakamura did little to alter the view re: the broader monetary policy review which is ongoing at present, as he reaffirmed the notion that the current easing framework is "working appropriately," while noting that he would like to make adjustments to the scheme which promote sustainability.

- Wednesday provided a particularly narrow round of Sydney trade for the longer end of the Aussie curve, YM unch. and XM +1.0 at the close. ACGB Nov '31 supply was easily digested, while the uptick in the latest Australian Westpac consumer confidence reading took the metric back towards the multi-year highs witnessed in December's print. Swap spreads were generally flat to a touch wider across the curve. The latest round of RBA ACGB purchases are due on Thursday, with the potential for a particularly limited session given the widespread holidays that will be in play across the Asia-Pac timezone.

FOREX: Kiwi Falters, Asia-Pac Session Quiet Ahead Of LNY

NZD was the worst G10 performer, edging lower alongside NZGB yields, with BBG trader sources flagging the trimming/squaring of NZD/USD & AUD/USD long positions for short-term accounts. The Aussie was somewhat more resilient than its Antipodean cousin, as Australian Westpac Consumer Confidence improved this month. The news that China suspended imports from two NZ factories may have applied some mild pressure to NZD, with the reinstatement of LVR restrictions also grabbing attention locally. AUD/NZD is poised to extend its winning streak to five days in a row.

- The DXY ground lower, moving past yesterday's worst levels, ahead of a speech from the Fed chief & as e-minis advanced, with S&P futures printing fresh record highs. All in all, G10 crosses were rangebound as local players awaited Lunar New Year holidays.

- USD/JPY climbed into the Tokyo fix, perhaps on the back of Gotobi Day flows, but faded the move thereafter. The rate sits marginally shy of neutral levels as we type, struggling to punch through yesterday's low.

- USD/CNH saw a brief spell of slightly increased volatility in reaction to a miss in Chinese CPI. The PBOC fixed USD/CNY at CNY6.4391, 13 pips above sell side estimates.

- KRW soared despite a decent, above-forecast increase in South Korean unemployment, amid speculation that traders were existing short positions ahead of LNY. USD/KRW dived to worst levels in two weeks.

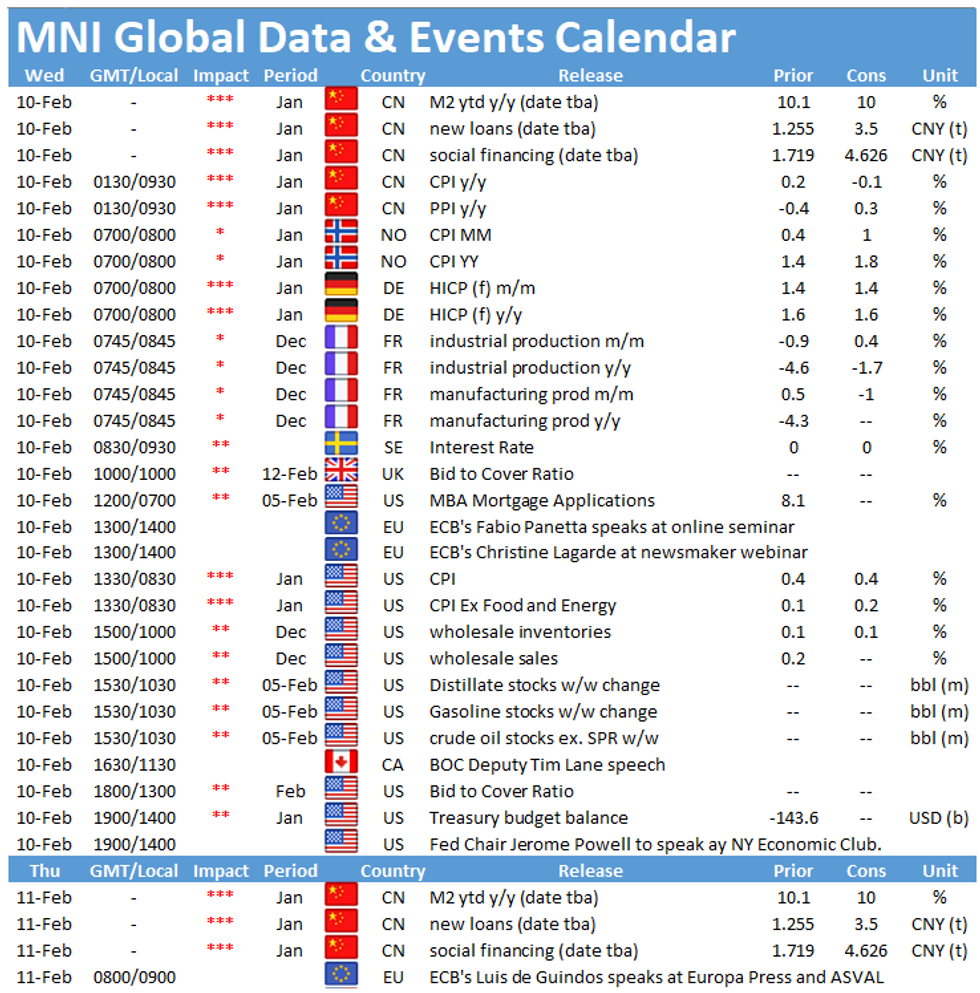

- On the radar today: U.S., German & Norwegian CPIs, French industrial output, Riksbank MonPol decision & comments from Fed Powell, ECB's Lagarde, de Cos, Visco & Panetta, BoC's Lane & BoE's Bailey.

FOREX OPTIONS: Expiries for Feb10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1905-30(E1.8bln), $1.2020-25(E1.0bln), $1.2065(E1.1bln), $1.2090-10(E928mln), $1.2115-25(E818mln), $1.2300(E1.1bln)

- USD/JPY: Y104.50($550mln), Y104.95-105.10($610mln), Y105.35-50($681mln)

- AUD/USD: $0.7550(A$1.4bln-AUD puts), $0.7650(A$759mln), $0.7750(A$591mln-AUD puts), $0.7780-00(A$671mln)

- USD/CAD: C$1.2700-05($656mln)

- USD/CNY: Cny6.40($648mln), Cny6.4050($670mln), Cny6.42($650mln), Cny6.4350($1.0bln), Cny6.44($680mln)

ASIA FX: Mixed Session Ahead Of LNY

Thin volumes and limited news flow ahead of LNY, with Taiwanese markets already closed for the holiday. The greenback attempted to stage a recovery early on, but the move quickly ran out of steam.

- CNH: The yuan has weakened since the fix, USD/CNH taking back a handful of pips from the sharp decline seen yesterday. The PBOC fixed USD/CNY at 6.4391, 13 pips above sell side estimates. Data earlier showed CPI fell while PPI eked out some small gains.

- SGD: Spot USD/SGD punched through the 1.33 handle yesterday, the pair has held closing levels in Asia amid lack of news flow. 1-month implied volatility rose after the 100 pip move lower yesterday.

- KRW: Won is higher for a third session, there is speculation that traders are exiting short positions ahead of LNY. Data earlier in the session was weak, unemployment rose to 5.4% from 4.5% expected.

- INR: Rupee is flat again on Wednesday after an inside day yesterday, market participants will look to the RBI OMO operations today for direction.

- IDR: Rupiah hit its best levels in a month after Indonesia eases travel restrictions, and palm oil soars.

- MYR: Ringgitt strengthened, Malaysia will start easing its movement restrictions today. Retail businesses will be allowed to re-open and restaurant dine-ins will be permitted, subject to certain limits.

- PHP: Peso hovered around neutral levels for the session. Markets participants are in wait and see mode as the government considers relaxing coronavirus measures, while tomorrows rate announcement is also in focus.

- THB: Baht is stronger, holding yesterday's gains. Late doors on Tuesday the Thai Cabinet gave a nod to an infrastructure spending package.

ASIA RATES: Mixed Session Ahead Of LNY

Thin volumes and limited news flow ahead of LNY, with Taiwanese markets already closed for the holiday. The greenback attempted to stage a recovery early on, but the move quickly ran out of steam.

- CNH: The yuan has weakened since the fix, USD/CNH taking back a handful of pips from the sharp decline seen yesterday. The PBOC fixed USD/CNY at 6.4391, 13 pips above sell side estimates. Data earlier showed CPI fell while PPI eked out some small gains.

- SGD: Spot USD/SGD punched through the 1.33 handle yesterday, the pair has held closing levels in Asia amid lack of news flow. 1-month implied volatility rose after the 100 pip move lower yesterday.

- KRW: Won is higher for a third session, there is speculation that traders are exiting short positions ahead of LNY. Data earlier in the session was weak, unemployment rose to 5.4% from 4.5% expected.

- INR: Rupee is flat again on Wednesday after an inside day yesterday, market participants will look to the RBI OMO operations today for direction.

- IDR: Rupiah hit its best levels in a month after Indonesia eases travel restrictions, and palm oil soars.

- MYR: Ringgitt strengthened, Malaysia will start easing its movement restrictions today. Retail businesses will be allowed to re-open and restaurant dine-ins will be permitted, subject to certain limits.

- PHP: Peso hovered around neutral levels for the session. Markets participants are in wait and see mode as the government considers relaxing coronavirus measures, while tomorrows rate announcement is also in focus.

- THB: Baht is stronger, holding yesterday's gains. Late doors on Tuesday the Thai Cabinet gave a nod to an infrastructure spending package.

ASIA: Lunar New Year Holiday Regional Exchange Schedules

Selected Asia-Pac exchange Lunar New Year holiday schedules can be viewed below:

EQUITIES: Mixed Picture In Asia-Pac

It is a mixed picture in Asia-Pac equity markets; US markets failed to sustain their rally on Tuesday, the S&P 500 snapped a six day winning streak to decline around 0.1% at the close.

- Most equity markets in the region are in negative territory, but shares in mainland China and Hong Kong are soaring. The Hang Seng briefly popped above 30,000 after surrendering the level in January, the upside is impressive considering the trading link to mainland investors is shut for LNY. Mainland China's markets are up around 1.5%, data earlier showed that Chinese CPI fell, while PPI squeezed out a small gain, and aggregate financing and FDI both rose.

- In the US futures are in positive territory, helped by some positive aftermarket earnings from Twitter and Cisco.

GOLD: Consolidating

The softer DXY and lack of net movement in U.S. real yields witnessed over the last 24 hours or so have combined to leave bullion little changed over that horizon, with spot last dealing just above $1,840/oz, consolidating the gains witnessed in recent sessions. Bulls now look to the 50-day EMA as the next point of technical resistance.

OIL: Rally Pauses

Crude futures are little changed ahead of London hours.

- API inventory data after market yesterday showed a draw in headline crude stocks of 3.5m/bbls, above the 2.7m/bbl decline estimated. The market will look to the US DOE weekly inventory report due later later for further clarity on price direction.

- Some supply concerns evident in downstream products, gasoline stockpiles rose by 4.81m/bbls, if DOE data matches this it would be the biggest build since April.

- There were some concerns over supply, the in its short term energy outlook the EIA said oil explorers are set to boost drilling and production from the second half of this year, with crude prices above breakeven levels. The agency did note that US consumption is unlikely to reach pre-pandemic levels before the end of 2022.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.