-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI BRIEF: RBA Details Hypothetical Monetary Policy Paths

MNI EUROPEAN MARKETS ANALYSIS: Busy Data Docket To Round Out The Week

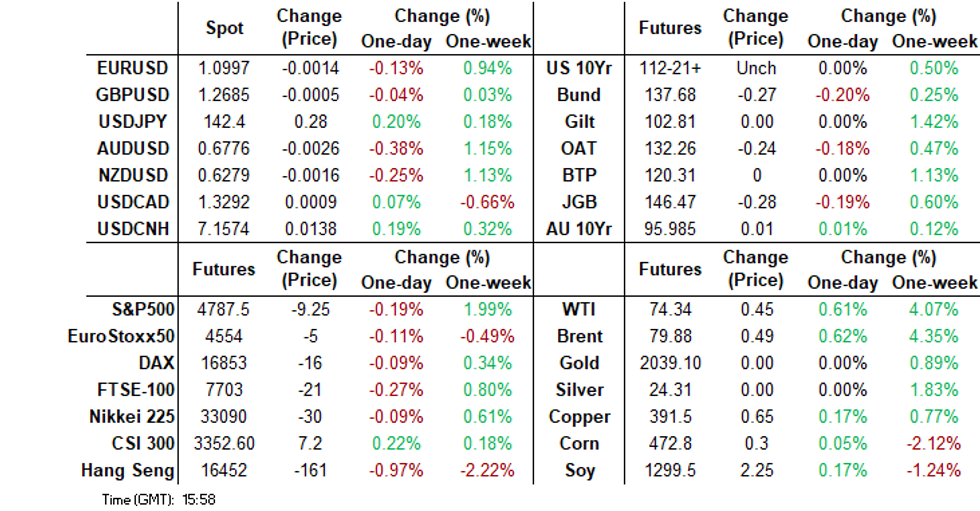

- Slumping China tech equities, post fresh gaming curbs, has weighed on regional risk appetite. The Hang Seng Tech Index is back close to YTD lows. The fallout for CNH has been fairly limited at this stage. AUD/USD is the weakest performer in the G10 FX space, while the USD has stabilized against other majors as well.

- US Tsys have observed a narrow range, with little follow through on moves in today's Asian session. The post lunch break tone to JGB futures has been skewed lower, although we are up from session lows. Gold and oil are close to recent highs and tracking up firmly for the week.

- In Europe today UK Retail Sales and GDP provides the highlight, further out we have US personal income and spending, new home sales, durable goods and UofMich consumer sentiment.

MARKETS

US TSYS: Muted Asian Session, Busy Docket To Round Off Week.

TYH4 deals at 112-20, -0-01+, a 0-06+ range has been observed on volume of ~38k.

- Cash tsys sit ~1bps cheaper across the major benchmarks.

- Tsys have observed a narrow range, with little follow through on moves in today's Asian session. A downtick from session highs was observed alongside a marginal bid in the USD and pressure on equities however the move lower didn't follow through and Tsys observed narrow ranges for the most part.

- FOMC dated OIS are stable pricing ~130bps of cuts by November 2024.

- In Europe today UK Retail Sales and GDP provides the highlight, further out we have US personal income and spending, new home sales, durable goods and UofMich consumer sentiment.

- A reminder that there are no Fed speakers currently scheduled on Friday.

JGBS: Offered, But Up From Session Lows

The post lunch break tone to JGB futures has been skewed lower, although we are up from session lows. JBH4 was last 146.46, -.29, session lows coming in at 146.36.

- There has been spill over from weaker US Tsys, TYH4 close to Thursday lows at the time of writing.

- Lower bid to cover ratios at the 3m bill sale and the enhanced liquidity auction may have also contributed to the offered tone post the break.

- As noted earlier, we had Nov National CPI on expectations, but the detail showed some underlying pressures. The MUFG CEO also stated earlier that there's a "fair chance" the BoJ ends negative rates in Jan (Asahi, see this link).

- In the cash JGB space, the 10yr yield sits near 0.63% slightly below session highs. Yield gains remain firmer in the 20-40yr tenors. The 10yr swap rate is above 0.83% in latest dealings.

- A reminder that BoJ Governor Ueda speaks on Christmas day (next Monday) at the Keidanren meeting in Tokyo (no time is given for the speech at this stage).

JAPAN DATA: Headline CPI Measures As Expected, Ex All Food & Energy Sticky At 2.7%Y/Y

The National CPI print for Nov was in line with estimates. The headline at 2.8% y/y, ex fresh-food 2.5%, excluding fresh food and energy 3.8%. All measures also showed slowed y/y momentum versus Oct.

- The core measure which excludes all food and energy was steady at 2.7% y/y, where it has been in recent months.

- In m/m terms, headline was down -0.1%, driven by -0.3% good prices, although services prices rose 0.2% m/m, versus flat in Oct.

- Food, utilities, transport and entertainment were all down in m/m terms. The most notable rises were in clothing and medical care.

- In y/y terms, the main drags were from utilities (-11.4% y/y). Most goods components saw slower y/y momentum, but services areas either were steady or saw y/y gains.

AUSSIE BONDS: Muted Pre-Christmas Session; Closed Monday, Tuesday

ACGBs sit 1bp richer to 2bps cheaper across the major benchmarks, the curve has twist steepened pivoting on 10s. The space observed a muted pre-Christmas session with ranges narrow and activity limited.

- Futures are little changed from opening levels, XM sits at 95.95 (-0.02) and YM at 96.37 (+0.01).

- November Private Sector Credit was in line with expectations and there was little reaction in the space.

- RBA dated futures have been steady in recent trade, there are ~60bps of cuts priced by Dec 24.

- A reminder that Australian markets are closed Monday and Tuesday and will reopen on Wednesday.

NZGBS: Narrow Ranges In Muted Pre-Christmas Dealing

NZGBs observed narrow ranges on Friday in muted pre-Christmas dealing, finishing 1bp richer to 3bps cheaper across the major benchmarks as the curve twist steepened. The space ticked away from early session lows, however the recovery did not follow through.

- 10-Year NZ US Swaps are stable and sit at +56bps. RBNZ dated OIS remain stable, there are ~80bps of cuts priced by Nov 24.

- Domestic newsflow has been light on Friday, and a reminder that there was no local data today.

- Looking ahead, markets in New Zealand are closed on Monday and Tuesday and will re-open on Wednesday.

HONG KONG EQUITIES: Weakness Extends On Large Tech Losses, Post Gaming Curbs

Hong Kong equities continue to track lower post the lunch break. The aggregate HSI is off over 1%, while the tech sub index has slumped 3.3%, although this is up from session lows (-4.5%).

- This is close to YTD lows for the index. This follows headlines that the China regulator will aim to curb online gaming use (see this BBG link). NetEase dropped by a record 28%, while Tencent was down 16% at one stage, the most since 2008.

- After the break, mainland shares are paring earlier gains.

- The spill over to CNH has proven to be fairly limited at this stage. The pair got above 7.1600, but we now back at 7.1580.

EQUITIES: Hong Kong Markets Falter On China Gaming Curbs

Regional equity markets are mostly positive, although gains are below US moves seen in cash trade on Thursday. Hong Kong markets faltered into the break on headlines around China gaming restrictions. US futures have given back some of Thursday's gains, but are up from session lows. Eminis were last near 4790.50 (-0.13%), while Nasdaq futures are off 0.25% at this stage.

- At the break, the HSI sits down 0.43% and well off earlier highs. The tech sub index is down 1.52%.

- This follows headlines that the China regulator will aim to curb online gaming use (see this BBG link). Tencent and NetEase have dropped sharply.

- There has been less fallout for mainland indices at this stage. The CSI 300 is up 0.74%, while the Shanghai Composite Index is +0.50%, with both indices close to session highs at the break.

- Elsewhere, Japan indices have recovered some ground. The Topix +0.45%, the Nikkei 225 up 0.20%. GPIF's CIO has stated that the fund is open to raising its allocation to stocks (see this BBG link).

- In South Korea the Kospi is +0.35%, while the Taiex is up a more modest 0.20%. In Australia, the ASX 200 is close to flat.

- In SEA, Thailand and Malaysia stocks are down modestly, while elsewhere we are seeing mostly positive gains.

FOREX: Greenback Nudges Higher In Asia

The greenback has nudged higher in Asia, trimming some of yesterday's losses. BBDXY is up ~0.1%, the move higher has been seen alongside an uptick in US Tsys Yields and US Equities paring Thursday's gains.

- AUD is the weakest performer in the G-10 space at the margins, AUD/USD is down ~0.3%. Technically bullish trend conditions persist, resistance is at $0.6821 High Jul 27 and $0.6847 High Jul 20. Support comes in at $0.6655 Low Dec 14.

- Kiwi is ~0.2% lower however a ~20 pip range has persisted for the most part in NZD/USD. AUD/NZD has fallen below the $1.08 handle however the cross remains well within recent ranges.

- Yen is softer as the marginally firmer US Tsy Yields weigh, USD/JPY sits at ¥142.45/50. National CPI for November was on the wires this morning and was in line with estimates. Support in the pair comes in at ¥140.97/71 Low Dec 14 / 76.4% of the Jul 14 - Nov 13 bull run. Resistance is at ¥144.96/145.26 High Dec 19 / 76.4% of the Dec 11 - 14 sell-off.

- Elsewhere in G-10 EUR is down ~0.1% and the Scandies are both ~0.2% lower however liquidity is generally poor in Asia.

- In Europe today the docket is highlighted by the UK Retail Sales and GDP prints.

OIL: Pushing Higher, Up Strongly For the Past Week

Oil prices have probed higher through the first part of Friday trade. Brent was last just above $80/bbl, comfortably above intra-session lows from Thursday (just under $78/bbl). Highs for the session rest at $80.30/bbl, while earlier in the week we got $80.60/bbl. At this stage, Brent is comfortably higher for the week, +4.6%. WTI is near $74.50/bbl in recent dealings, +4.4% firmer for the week.

- Focus for oil markets largely remains on developments in the Red Sea, where disruptions risk a key supply route.

- Tankers carrying crude oil and fuel entering the Bab al-Mandab strait fell to around 30 this week, down by over 40% from the daily average seen in the previous three weeks as more shipping companies pause routes in the Red Sea according to Bloomberg ship tracking.

- Working the other way is a potential more positive supply backdrop. Angola will exit OPEC, stated-owned Jornal de Angola reported. This is not expected to boost supply in the near term, but is symptomatic of tensions within the group.

- Elsewhere, US total oil and gas rig counts fell by 3 to 620, according to Baker Hughes Dec. 21.

- This has helped temper US supply optimism and has added positive sentiment in the space at the margin.

GOLD: Holding Close To $2050, Comfortably Higher For The Week

Gold has maintained a positive tone through the first part of Friday trade, despite a modest recovery in USD sentiment. The precious metal was last near $2049.6, slightly above Thursday closing levels. At this stage we are tracking +1.50% higher for the week.

- This is line with broader USD losses over this period (despite today's stabilization).

- The technical picture looks positive, with recent highs resting at $2055, which is above the 50% retracement of the Dec 4-13 bear leg. The 61.8% retracement rests near $2073.4.

ASIA FX: CNH Weakens On Tech Equity Slump, Lower Bond Yields

USD/Asia pairs are mixed. There have been some spot gains, largely reflective of catch up with USD weakness, but the 1 month NDF space has been more measured. The USD has stabilized against the majors, while slumping China tech shares has weighed on CNH and impacted broader equity market sentiment in the region.

- USD/CNH got to highs of 7.1636 on headlines around fresh gaming curbs. We have seen China tech stocks slump in Hong Kong, but fallout for CNH has proven limited. USD/CNH is back to 7.1550, while CNY is near 7.1480 onshore. Local government bond yields have mostly tracked lower post large onshore banks cutting deposits rates. This has been another yuan headwind, albeit at the margins.

- 1 month USD/KRW has mostly tracked higher against late Thursday lows in NY trade (1294). The pair is last near 1299. Onshore equities are away from earlier highs on negative spill over from China tech stocks. Another headwind for the won has been higher USD/JPY levels.

- Spot USD/IDR sits in the 15485/90 region, down versus yesterday closing levels, but well within recent ranges. The 1 month NDF sits higher versus NY closing levels on Thursday, last at 15481, as the equity tone in the region has tempered risk appetite. The BI decision to push back against early rate cuts for next year is likely helping at the margin from a rupiah standpoint.

- Broader pressure on the USD has weighed on USD/MYR in early dealing this morning as onshore participants digest Thursday's greenback downtick. USD/MYR sits at its lowest level since mid August, last printing at 4.6290/4.6355 ~0.5% lower than yesterday's closing levels. November CPI printed at 1.5% Y/Y softer than the expected 1.7%.

- The SGD NEER (per Goldman Sachs estimates) is steady this morning, we remain well within recent ranges. The measure sits ~0.4% below the top of the band. USD/SGD ticked lower on Thursday as broader greenback flows weighed on the cross. We sit a touch off post-FOMC levels and last print at $1.3260/65. A reminder that the local docket is empty today.

- USD/PHP sits above session lows, last at 55.42 (earlier lows were at 55.30). We weren't too far from earlier Dec lows at 55.24. USD/PHP has moved away from earlier Dec highs above 56.00, although is yet to make a concerted break lower. PHP has lagged somewhat the softer USD backdrop, although we have seen some catch up in the past week.Local equities sit off recent highs.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/12/2023 | 0700/0700 | *** |  | UK | Retail Sales |

| 22/12/2023 | 0700/0800 | ** |  | SE | Retail Sales |

| 22/12/2023 | 0700/0800 | ** |  | SE | PPI |

| 22/12/2023 | 0700/0700 | *** |  | UK | GDP Second Estimate |

| 22/12/2023 | 0700/0700 | * |  | UK | Quarterly current account balance |

| 22/12/2023 | 0700/0800 | ** |  | DE | Import/Export Prices |

| 22/12/2023 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 22/12/2023 | 0745/0845 | ** |  | FR | PPI |

| 22/12/2023 | 0800/0900 | *** |  | ES | GDP (f) |

| 22/12/2023 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 22/12/2023 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 22/12/2023 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 22/12/2023 | 1330/0830 | ** |  | US | Durable Goods New Orders |

| 22/12/2023 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 22/12/2023 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 22/12/2023 | 1500/1000 | *** |  | US | New Home Sales |

| 22/12/2023 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 22/12/2023 | 1530/1530 |  | UK | Publication of the Treasury Bill Calendar for January - March 2024 | |

| 22/12/2023 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.